Analysis: Trump's Influence On US Stock Futures Prices

Table of Contents

Trump's Tweets and Market Reactions

The "Tweet Effect": An Analysis of Immediate Market Swings

Donald Trump's frequent use of Twitter became a defining characteristic of his presidency, and his tweets often triggered immediate and significant price swings in US stock futures. This "tweet effect" resulted from the unpredictable nature of his pronouncements and their potential to impact various sectors of the economy.

- Example 1: A tweet announcing new tariffs on imported goods could lead to immediate drops in futures contracts related to affected industries. For instance, a tweet targeting steel imports might cause a sharp decrease in the price of steel futures contracts, possibly resulting in a 2-5% drop within minutes of the tweet's release. Trading volume would also spike significantly during this period.

- Example 2: Conversely, a positive tweet regarding economic growth or a particular company could trigger a rapid rise in relevant futures contracts. A tweet praising a specific company's performance, for instance, could lead to a 1-3% increase in its stock futures contracts within hours, fueled by increased investor optimism.

The psychology behind the "tweet effect" is rooted in fear, uncertainty, and speculation. Investors, constantly monitoring social media and news for updates, react instantly to perceived positive or negative news, leading to rapid and sometimes irrational market movements.

Media Amplification and Market Sentiment

The media played a crucial role in amplifying the impact of Trump's tweets and statements on stock futures. The 24-hour news cycle, coupled with the rapid dissemination of information via social media, ensured that even seemingly minor pronouncements could rapidly impact investor confidence.

- Media's Role: News channels and online platforms constantly analyzed and interpreted Trump's statements, often adding their own commentary and speculation. This amplified the initial impact, creating a ripple effect that extended beyond the direct market consequences of the original tweet or statement.

- Speculation vs. Direct Impact: It's crucial to distinguish between the direct market impact of Trump's words and the impact of media-driven speculation. While some market moves directly reflected the substance of his announcements, many were fueled by media interpretations and subsequent investor sentiment.

Economic Policies and their Influence

Tax Cuts and Stock Futures: A Short-Term Boost?

Trump's 2017 tax cuts, significantly lowering corporate tax rates, initially led to a surge in corporate profits and a positive impact on stock futures prices. This was largely due to increased investor optimism about future corporate earnings.

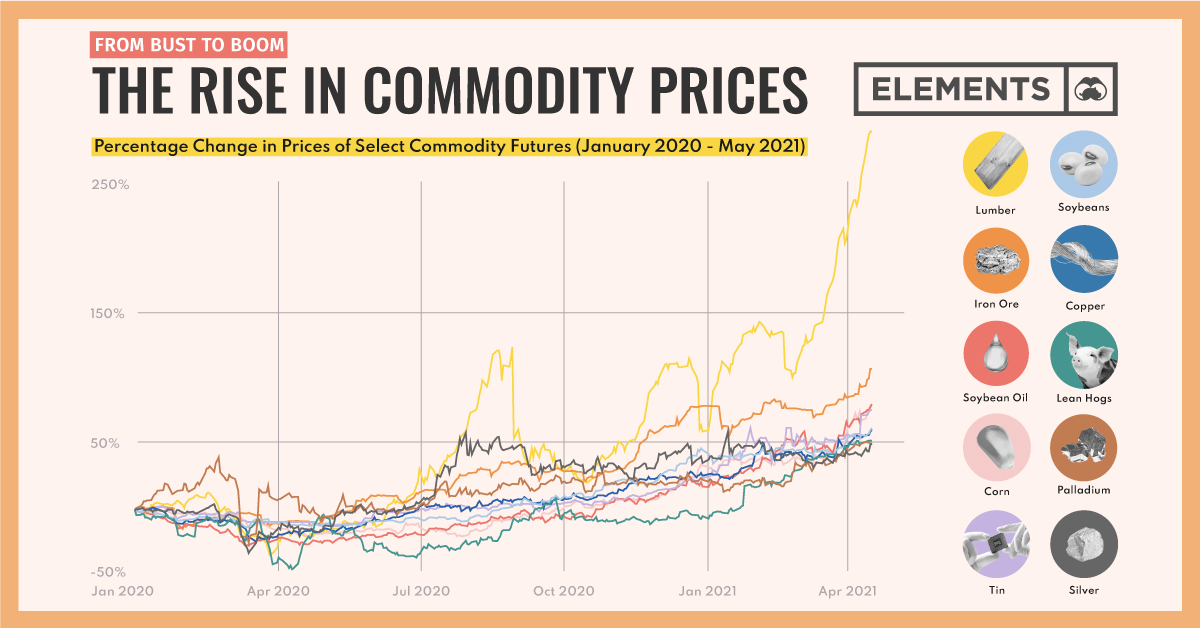

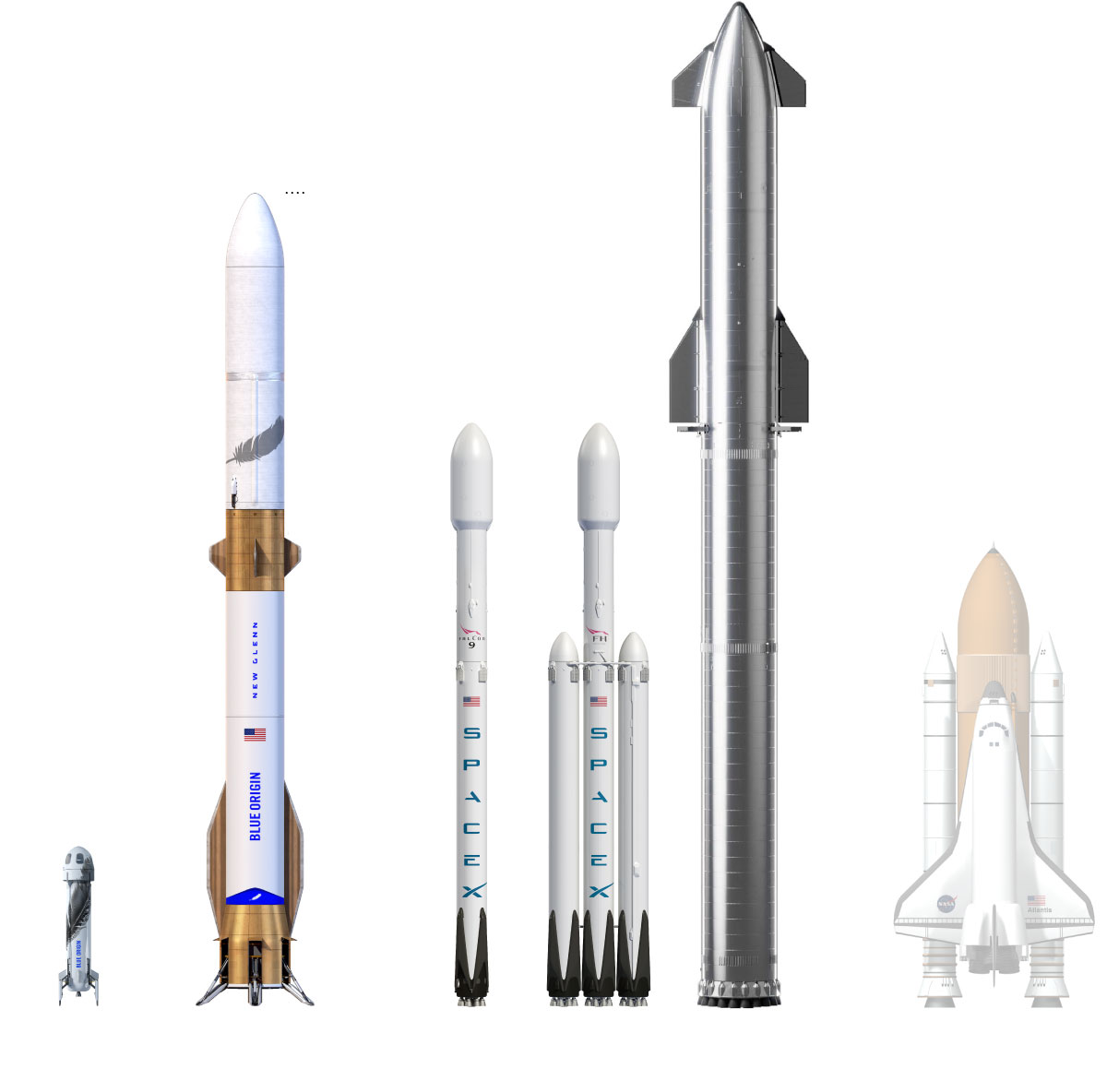

- Correlation: Charts and graphs illustrating the correlation between the tax cuts, increased corporate earnings announcements, and subsequent rises in stock futures prices would clearly demonstrate this short-term impact.

- Short-Term vs. Long-Term: While the initial effect was positive, the long-term effects of the tax cuts on market performance remain a subject of debate among economists. Some argue that it fueled short-term gains without generating sustained economic growth.

Trade Wars and Market Uncertainty: Navigating the Volatility

Trump's trade policies, characterized by the imposition of tariffs on imported goods, introduced significant uncertainty and volatility into the stock futures market. These trade wars created considerable challenges for investors.

- Sector-Specific Impacts: Tariffs on specific goods directly impacted the futures contracts of relevant sectors. For example, tariffs on steel imports directly affected the price of steel futures. Similarly, trade disputes with China impacted the futures contracts of companies heavily involved in trade with that nation.

- Hedging Strategies: In response to the uncertainty created by Trump's trade policies, investors increasingly relied on hedging strategies to mitigate potential losses. This involved using futures contracts to offset potential risks associated with price fluctuations.

Overall Market Performance Under Trump's Presidency

Comparison to Previous Administrations: A Holistic View

To accurately assess Trump's influence, it's necessary to compare the performance of US stock futures during his presidency to that of previous administrations. This comparison must control for other macroeconomic factors like interest rates, inflation, and global economic conditions.

- Comparative Analysis: Charts and graphs illustrating the performance of key stock futures indices under different administrations are necessary for a clear visual comparison. Careful consideration of confounding macroeconomic factors is essential to isolate the influence of Trump's policies.

- Contextual Factors: It's important to note that market performance is rarely attributable to a single factor. Economic conditions, global events, and investor sentiment all play crucial roles.

Long-Term vs. Short-Term Effects: A Lasting Legacy?

Determining the lasting impact of Trump's policies on the long-term trajectory of US stock futures requires careful analysis. While some policies may have generated short-term gains, their long-term consequences are still unfolding.

- Shifts in Market Sentiment: The era witnessed significant shifts in market sentiment, driven in part by the unpredictable nature of Trump's policies. This volatility itself became a defining feature of the market.

- Ongoing Implications: The economic and trade policies enacted during his presidency continue to shape market dynamics today. Analyzing these ongoing implications is crucial for understanding the lasting legacy of his time in office.

Conclusion: Understanding the Complexities

This analysis reveals that Donald Trump's presidency significantly impacted US stock futures prices. However, disentangling his influence from other macroeconomic factors remains a complex task. His tweets created short-term volatility, his economic policies had mixed effects, and his trade wars introduced significant uncertainty. While some policies initially boosted certain sectors, the long-term consequences are still being assessed. Further research is crucial to gain a complete understanding of the long-term impacts of his presidency on the US stock futures market. Understanding these past influences is crucial for informed decision-making in today's volatile markets. Investors and traders should continue to analyze the impact of political events on stock futures prices, utilizing advanced tools and resources to navigate this intricate landscape. Keywords: Trump’s impact on stock futures, future market analysis, political risk analysis, market volatility, investor sentiment.

Featured Posts

-

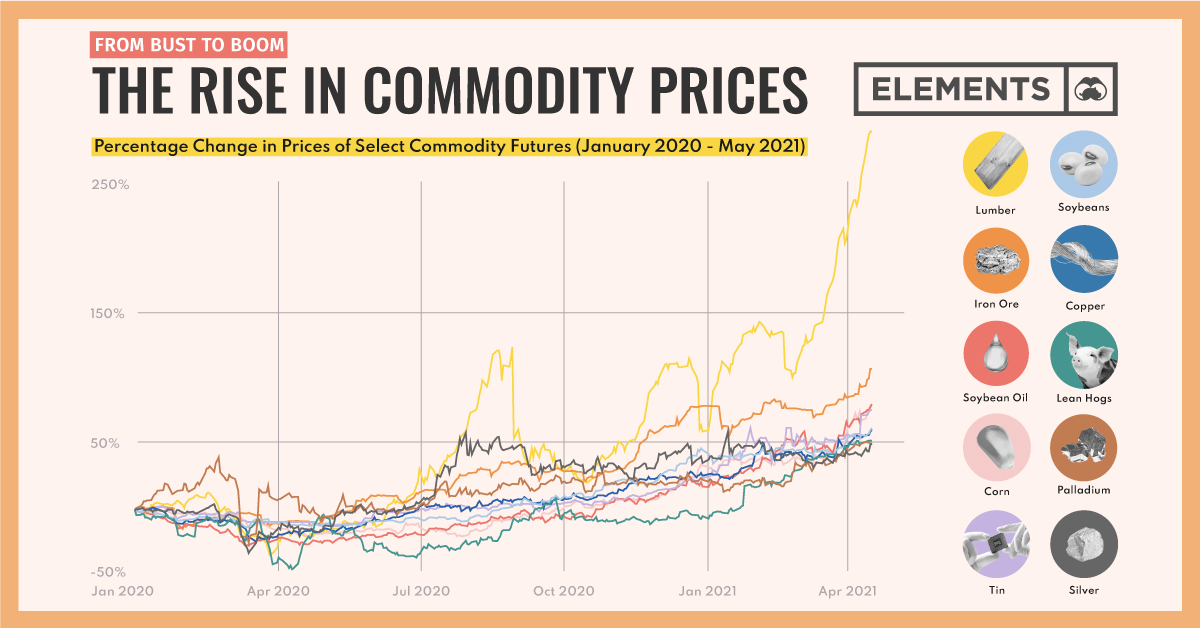

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Problem

Apr 24, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Problem

Apr 24, 2025 -

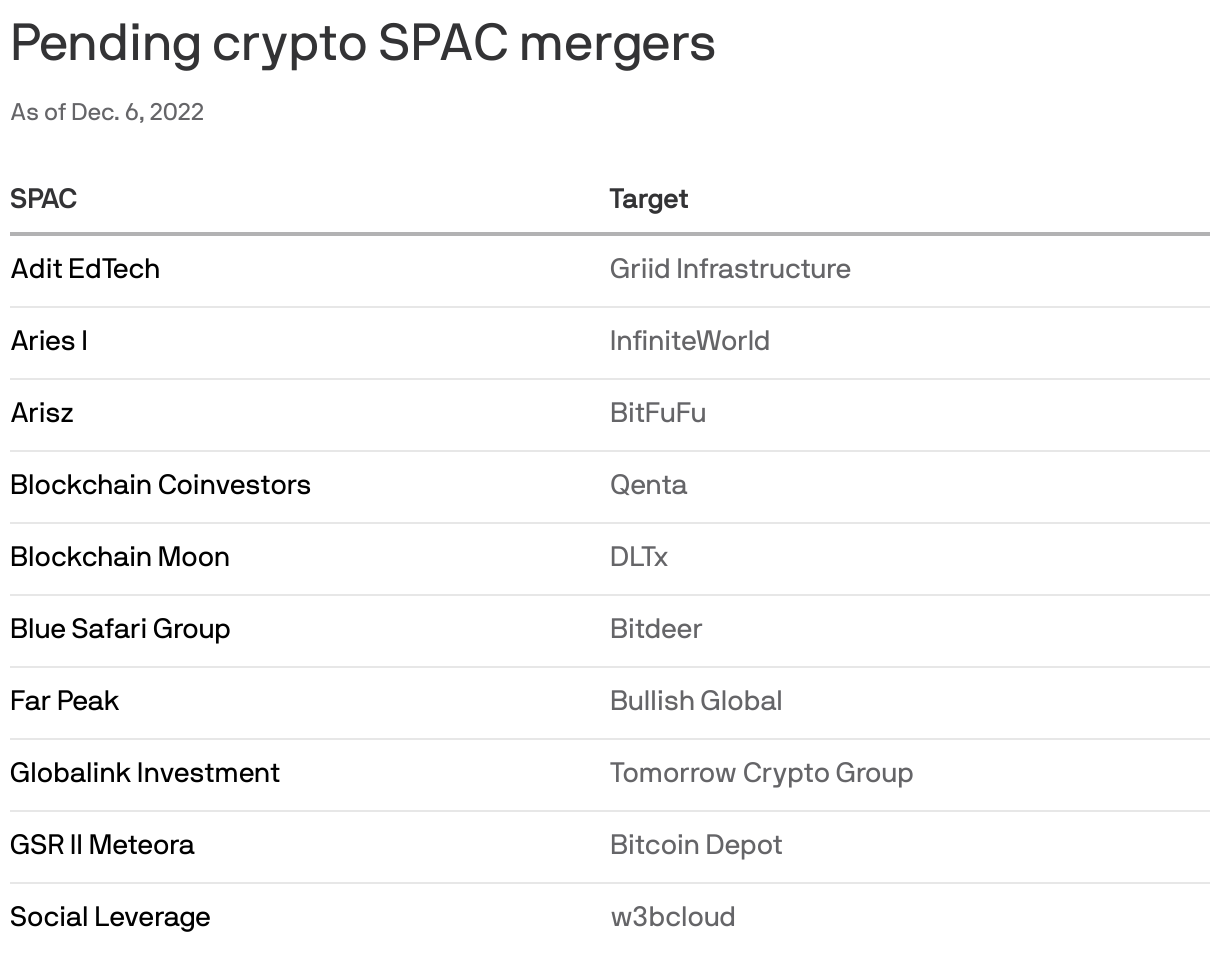

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involved

Apr 24, 2025

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involved

Apr 24, 2025 -

Bitcoin Price Climbs Amidst Trade And Federal Reserve Uncertainty

Apr 24, 2025

Bitcoin Price Climbs Amidst Trade And Federal Reserve Uncertainty

Apr 24, 2025 -

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025 -

I Sygkinitiki Anartisi Toy Travolta Gia Ton Thanato Toy Xakman

Apr 24, 2025

I Sygkinitiki Anartisi Toy Travolta Gia Ton Thanato Toy Xakman

Apr 24, 2025