Cantor's $3 Billion Crypto SPAC Deal: Tether And SoftBank Involved

Table of Contents

The Deal's Structure and Key Players

Cantor Fitzgerald's Role: Cantor Fitzgerald, a well-established financial services firm with a history spanning decades, is taking a bold step into the burgeoning crypto space by sponsoring this massive SPAC (Special Purpose Acquisition Company). This strategic move positions Cantor at the forefront of the crypto revolution, diversifying its portfolio and potentially tapping into a high-growth market. The benefits for Cantor include access to lucrative investment opportunities and the establishment of a strong foothold in the evolving digital asset landscape.

Tether's Participation: Tether's participation is arguably the most noteworthy aspect of this deal. As the issuer of USDT, one of the largest stablecoins by market capitalization, Tether's investment carries significant weight.

- The amount of investment from Tether: While the precise amount remains undisclosed, rumors suggest a substantial contribution, reflecting Tether's confidence in the long-term viability of the crypto market and the potential of the target company.

- The potential reasons behind Tether’s investment: Tether's investment could be driven by several factors, including a strategic move to diversify its holdings, gain exposure to promising crypto projects, and further solidify its position in the crypto ecosystem. It could also be a move to enhance its credibility and counter ongoing regulatory scrutiny.

- The impact on Tether’s reputation and future plans: The success or failure of this deal will directly impact Tether's reputation. A successful investment could bolster its standing, while a failure could raise further questions about its financial stability and reserves.

SoftBank's Investment: SoftBank's involvement adds another layer of significance. Known for its bold investments in technology and its vast portfolio of companies, SoftBank's participation signifies the growing acceptance of cryptocurrencies by major institutional investors.

- SoftBank’s investment amount: The exact investment amount remains confidential, but industry analysts predict a significant contribution from the Japanese conglomerate.

- SoftBank's strategic goals in the crypto market: SoftBank's strategic goals likely involve capitalizing on the potential growth of the crypto market, diversifying its investment portfolio, and exploring potential synergies with its existing portfolio companies in the fintech and technology sectors.

- Potential synergies between SoftBank's portfolio companies and the SPAC target: SoftBank’s vast network could prove invaluable in fostering collaborations and partnerships for the target company, accelerating its growth and market penetration.

Target Company and Industry Implications

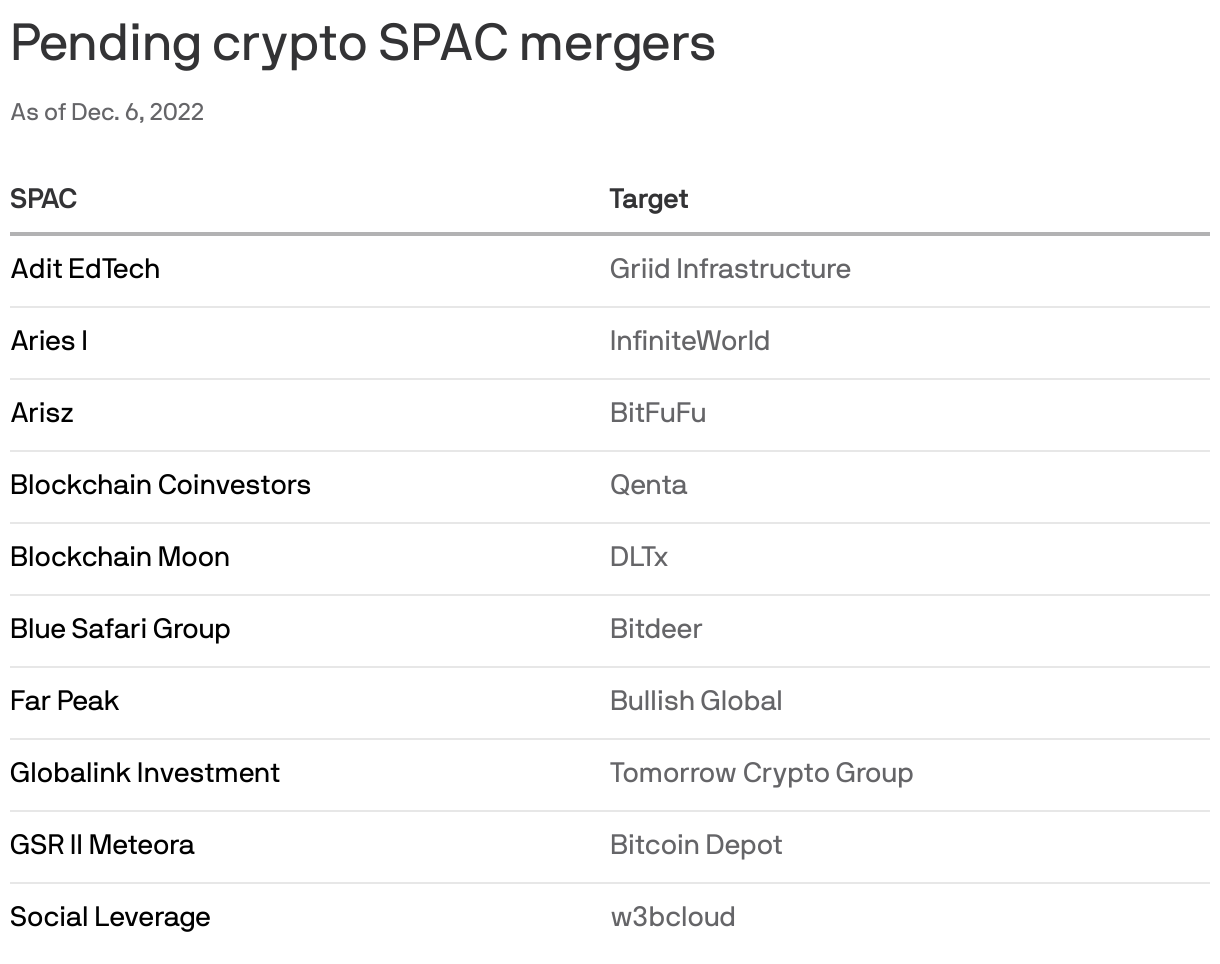

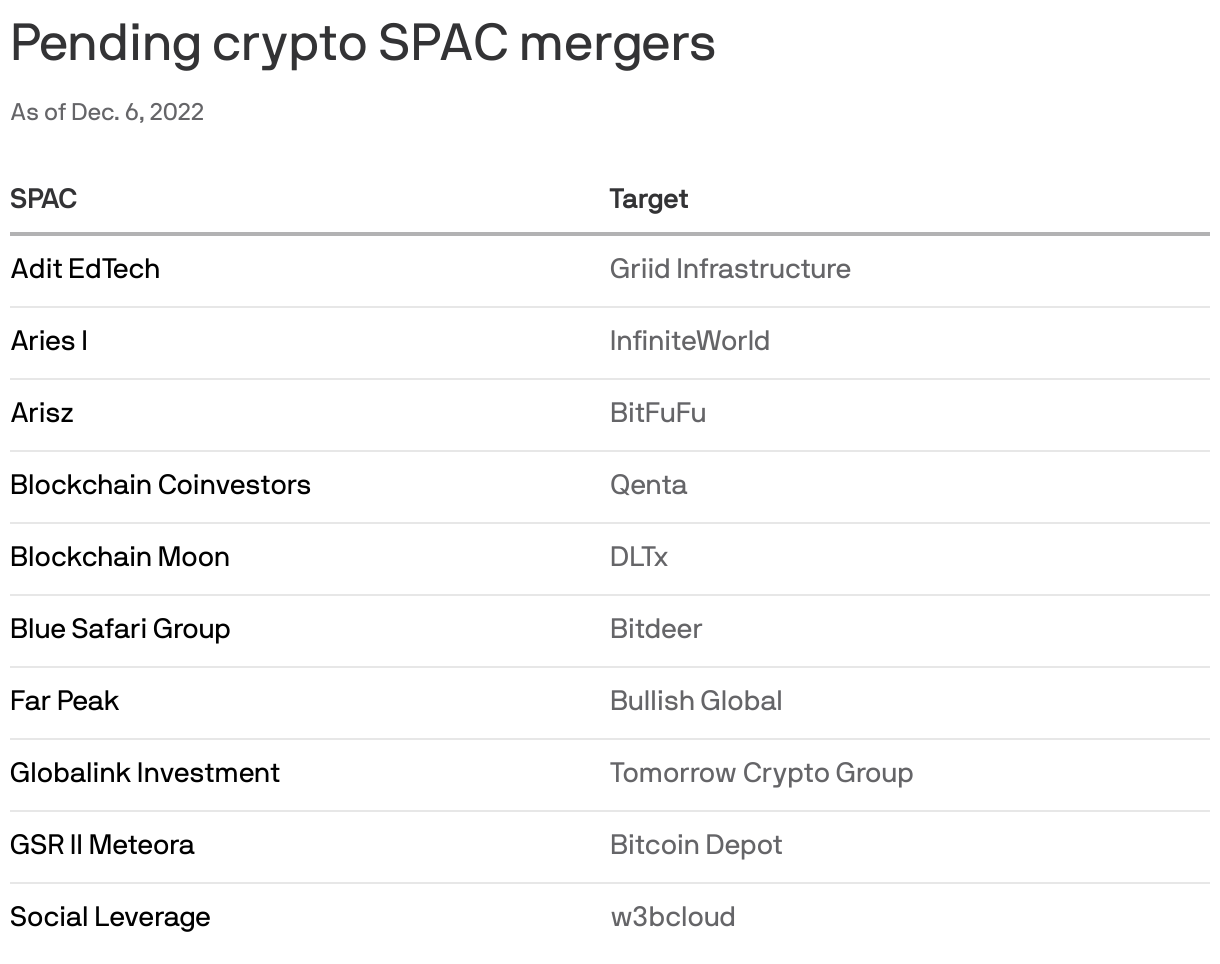

Identifying the Target Company (if known): At the time of writing, the target company for Cantor's SPAC remains undisclosed. However, speculation points towards a company operating in a high-growth area within the cryptocurrency ecosystem, potentially involving blockchain technology, decentralized finance (DeFi), or related innovative technologies.

Market Disruption and Future Growth: This deal signifies a significant shift in the cryptocurrency landscape.

- Potential for increased mainstream adoption of cryptocurrencies: The involvement of established financial giants like Cantor and SoftBank signals increased mainstream acceptance and legitimization of cryptocurrencies.

- Effect on cryptocurrency valuations: The deal could influence valuations across the cryptocurrency market, potentially leading to increased investment and price appreciation for promising crypto projects.

- Impact on the competitive landscape: The resulting merger could significantly alter the competitive landscape, potentially leading to consolidation and increased innovation within the targeted sector.

Regulatory Landscape and Potential Challenges

Regulatory Scrutiny of Crypto SPACs: The cryptocurrency market remains largely unregulated in many jurisdictions, creating uncertainty and potential regulatory hurdles for crypto SPACs. The deal will undoubtedly face scrutiny from regulatory bodies like the SEC.

Compliance and Legal Considerations: Navigating the legal and compliance aspects of this deal will be crucial.

- Potential regulatory hurdles for the target company: The target company will likely face rigorous due diligence and regulatory compliance checks, ensuring adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations.

- The due diligence process involved: A thorough due diligence process will be essential to assess the target company’s financials, technology, and legal compliance.

- Compliance requirements for Tether and SoftBank: Both Tether and SoftBank will need to comply with relevant regulations and reporting requirements related to their investments.

Conclusion:

Cantor's $3 billion crypto SPAC deal, with the substantial involvement of Tether and SoftBank, represents a watershed moment for the cryptocurrency market. This landmark deal signals a growing acceptance of cryptocurrencies by major financial institutions and suggests a significant shift toward increased mainstream adoption. The deal's success will depend largely on navigating regulatory hurdles and the strategic choices of the involved parties. The long-term impact on the crypto market and the broader financial landscape remains to be seen, but this deal undoubtedly marks a turning point. Follow us for updates on Cantor's Crypto SPAC Deal and further analysis of this significant development in the crypto space. Learn more about the impact of this landmark Cantor's Crypto SPAC Deal and its implications for the future of finance.

Featured Posts

-

The Paradox Of Pope Francis Global Reach Internal Divisions

Apr 24, 2025

The Paradox Of Pope Francis Global Reach Internal Divisions

Apr 24, 2025 -

Canada Election Conservatives Pledge Tax Cuts Fiscal Responsibility

Apr 24, 2025

Canada Election Conservatives Pledge Tax Cuts Fiscal Responsibility

Apr 24, 2025 -

Stock Market Today Dow Jumps 1000 Points Live Updates And Analysis

Apr 24, 2025

Stock Market Today Dow Jumps 1000 Points Live Updates And Analysis

Apr 24, 2025 -

Tyler Herros 3 Point Contest Triumph Defeating Buddy Hield

Apr 24, 2025

Tyler Herros 3 Point Contest Triumph Defeating Buddy Hield

Apr 24, 2025 -

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025