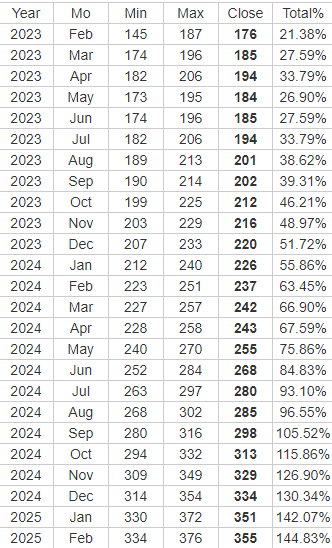

Analyst's $254 Apple Stock Prediction: Time To Buy?

Table of Contents

The Analyst's Rationale Behind the $254 Apple Stock Prediction

This ambitious $254 Apple stock price target isn't pulled from thin air. Several key factors contribute to this analyst's optimistic outlook.

Apple's Strong Financial Performance

Apple consistently delivers robust financial results, providing a solid foundation for the $254 Apple stock price target. Recent quarterly earnings reports paint a picture of continued growth and market dominance.

- Record Revenue: Apple's revenue consistently surpasses expectations, driven by strong sales across its product lines.

- iPhone Sales Remain Strong: Despite market saturation, iPhone sales continue to be a significant revenue driver, demonstrating the brand's enduring appeal.

- Services Segment Growth: The Services segment, encompassing Apple Music, iCloud, and the App Store, showcases impressive year-over-year growth, indicating a diversified and resilient revenue stream.

- Wearables, Home, and Accessories Growth: This category continues to expand, demonstrating Apple's success in expanding beyond its core products. The strong performance in this sector contributes positively to the overall Apple financial performance and the $254 Apple stock price target. This segment's earnings per share (EPS) are also noteworthy.

Future Growth Drivers

Beyond its current success, several factors point towards continued growth that supports the Analyst's $254 Apple Stock Prediction.

- Innovative Product Launches: Anticipated product launches, such as the highly anticipated AR/VR headset and the next generation of iPhones, promise to drive further revenue growth and bolster Apple's market share. These innovations are key drivers for the future growth prospects.

- Expansion into New Markets: Apple's continued expansion into emerging markets presents significant opportunities for growth and increased market penetration. This global market expansion is a significant element in the $254 Apple stock price target.

- Services Revenue Growth: The potential for further growth within the Services segment, including expansion into new services and subscription models, provides a sustainable revenue stream. This contributes significantly to the long-term revenue growth outlook.

Competitive Landscape and Market Analysis

Apple's dominant position in the tech industry is undeniable, but it's crucial to analyze the competitive landscape.

- Strong Brand Loyalty: Apple benefits from exceptional brand loyalty, a key differentiator against competitors.

- Intense Competition: However, intense competition from other tech giants requires ongoing innovation and adaptation to maintain its market leadership.

- Market Trends: The overall market outlook for consumer electronics remains positive, further supporting Apple's potential for continued growth. Analyzing these market trends is crucial to evaluating the Analyst's $254 Apple Stock Prediction.

Factors to Consider Before Investing in Apple Stock Based on the $254 Prediction

While the Analyst's $254 Apple Stock Prediction is enticing, it’s crucial to consider several factors before investing.

Market Volatility and Economic Uncertainty

The current market climate presents both opportunities and challenges.

- Inflation and Interest Rates: Rising inflation and interest rates pose risks to the stock market, impacting investor sentiment and potentially affecting Apple's stock price.

- Recessionary Fears: Concerns about a potential recession could dampen consumer spending, impacting demand for Apple products.

- Geopolitical Risks: Global geopolitical instability can create uncertainty and volatility in the market. These factors are significant contributors to the Apple stock risk.

Alternative Investment Opportunities

Diversification is key to a robust investment portfolio.

- Other Tech Stocks: Consider comparing Apple's potential return against other tech stocks or broader market indices.

- Investment Vehicles: Explore other investment vehicles like bonds or real estate to diversify your investment portfolio and manage risk. This portfolio diversification is crucial for managing investment risk.

Your Individual Investment Strategy

Before making any investment decisions, consider your personal circumstances.

- Risk Tolerance: Evaluate your own risk tolerance. Investing in Apple stock, even with a potential $254 Apple stock price target, carries inherent risk.

- Financial Goals: Align your investment strategy with your long-term financial goals.

- Due Diligence: Conduct thorough due diligence before making any investment decisions. Consult a financial advisor for personalized advice. This due diligence is a critical component of sound financial planning.

Analyst's $254 Apple Stock Prediction: Is it the Right Time for You?

The Analyst's $254 Apple Stock Prediction rests on Apple's strong financial performance, future growth drivers, and its competitive position. However, market volatility, economic uncertainty, and your individual investment strategy are crucial considerations. Ultimately, the decision on whether to invest in Apple stock based on this Analyst's $254 Apple Stock Prediction is yours. Conduct thorough research and make a decision that aligns with your investment goals. Remember to carefully consider all the factors discussed before making any investment decisions related to the $254 Apple Stock Prediction. Consult a financial advisor for personalized guidance.

Featured Posts

-

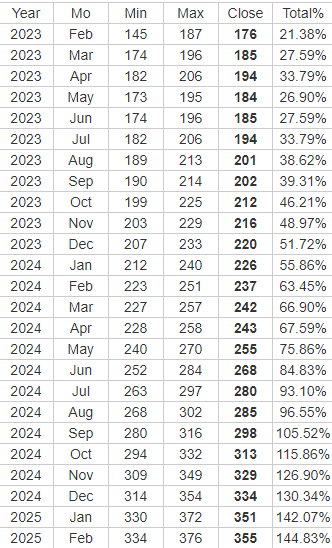

80 Millio Forintos Extrak Porsche 911 Atalakitas

May 24, 2025

80 Millio Forintos Extrak Porsche 911 Atalakitas

May 24, 2025 -

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025 -

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 24, 2025

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 24, 2025 -

Slight Weekly Decline For Cac 40 Despite Fridays Losses March 7 2025

May 24, 2025

Slight Weekly Decline For Cac 40 Despite Fridays Losses March 7 2025

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Latest Posts

-

Reduced Budgets Reduced Accessibility The State Of Gaming

May 24, 2025

Reduced Budgets Reduced Accessibility The State Of Gaming

May 24, 2025 -

Guest Anonymity A Key Feature Of Trumps Memecoin Dinner

May 24, 2025

Guest Anonymity A Key Feature Of Trumps Memecoin Dinner

May 24, 2025 -

Industry Downturn Impacts Game Accessibility Features

May 24, 2025

Industry Downturn Impacts Game Accessibility Features

May 24, 2025 -

Tik Tok Fame A Former Bishops Viral Encounter

May 24, 2025

Tik Tok Fame A Former Bishops Viral Encounter

May 24, 2025 -

Analyzing Anonymity Policies At Trumps Memecoin Event

May 24, 2025

Analyzing Anonymity Policies At Trumps Memecoin Event

May 24, 2025