Analyzing Palantir Stock Before The May 5th Deadline

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Understanding Palantir's financial health is paramount before making any investment decisions. Analyzing Palantir's recent performance and future projections requires scrutinizing key metrics.

Revenue Growth and Profitability

Palantir's revenue growth and profitability are key indicators of its financial strength. Analyzing Palantir revenue growth requires looking at several quarters' data. Let's examine some key figures:

- Q4 2022: [Insert actual Q4 2022 revenue figures and percentage growth compared to Q4 2021. Include a chart illustrating this growth]. This demonstrates [explain the significance of this growth – positive or negative and why].

- Full Year 2022: [Insert full-year 2022 revenue and profitability data, comparing it to the previous year and industry benchmarks]. This shows [explain the overall performance and compare it to expectations and industry trends].

- Operating Margins: [Include data on Palantir's operating margins and explain the trends]. Improving operating margins indicate [explain the positive implications of improving margins].

Analyzing Palantir profitability also involves looking at its net income, operating income, and other profitability metrics. This provides a comprehensive picture of its financial health. We need to carefully compare Palantir's financial performance to its competitors and industry averages to understand its relative strength.

Government Contracts and Commercial Partnerships

A significant aspect of analyzing Palantir's future is the balance between its government contracts and commercial partnerships. Palantir government contracts have been a cornerstone of its revenue stream. However, diversification into the commercial sector is crucial for long-term growth.

- Key Government Contracts: [List some significant government contracts and their value]. These contracts provide [discuss the stability and predictability these contracts offer].

- Commercial Partnerships: [List some key commercial partnerships and their potential impact on revenue]. This expansion into the commercial sector indicates [explain the strategic importance of this diversification].

- Risks and Rewards: While government contracts offer stability, they can be subject to budget cuts and shifting political priorities. Commercial partnerships offer higher growth potential but carry higher risk.

Assessing Market Sentiment and Analyst Opinions

Understanding market sentiment and analyst opinions is crucial when analyzing Palantir stock. This provides an external perspective on the company's prospects.

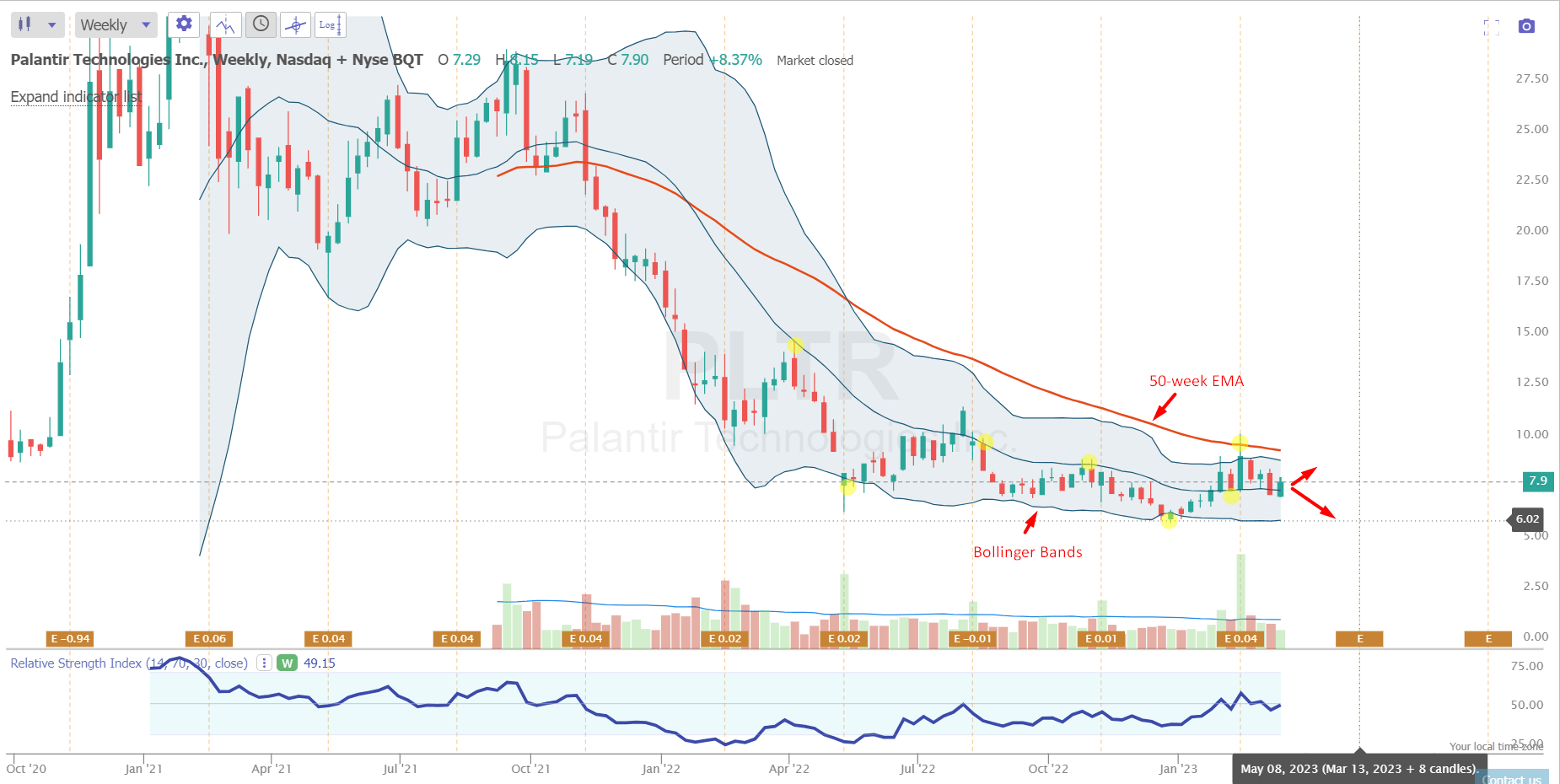

Stock Price Volatility and Trading Volume

Palantir's stock price has shown significant volatility. Analyzing Palantir stock price requires monitoring its daily, weekly, and monthly fluctuations.

- Stock Price Fluctuations: [Include data on recent stock price highs and lows, percentage changes, and any significant price movements]. These fluctuations are likely due to [explain the reasons behind the price movements, mentioning news, earnings reports, or market trends].

- Trading Volume: [Include data on trading volume, showing periods of high and low activity]. High trading volume often indicates [explain the meaning of high and low trading volume in relation to investor interest and market sentiment].

Analyst Ratings and Price Targets

Analyst ratings and price targets offer valuable insights into market sentiment. Many financial analysts track Palantir's performance and offer their perspectives.

- Buy, Hold, Sell Ratings: [List several prominent analysts and their ratings (buy, hold, sell) on Palantir stock]. The consensus view appears to be [summarize the overall sentiment based on analyst ratings].

- Price Targets: [List the price targets set by these analysts and explain the rationale behind them]. These price targets indicate [explain what these targets suggest about the potential future price of the stock].

Identifying Potential Risks and Opportunities

A comprehensive analysis must consider both the potential risks and opportunities facing Palantir.

Competitive Landscape and Technological Disruptions

Palantir operates in a competitive landscape. Analyzing Palantir's competitive advantage requires considering potential threats.

- Key Competitors: [List Palantir's main competitors and describe their strengths and weaknesses relative to Palantir]. Palantir’s competitive advantage lies in [explain Palantir's unique strengths and how it differentiates itself from competitors].

- Technological Disruptions: [Discuss potential technological advancements that could disrupt Palantir’s business model]. Palantir needs to [explain how Palantir can mitigate these risks and adapt to technological changes].

Macroeconomic Factors and Geopolitical Risks

External factors can significantly impact Palantir's performance.

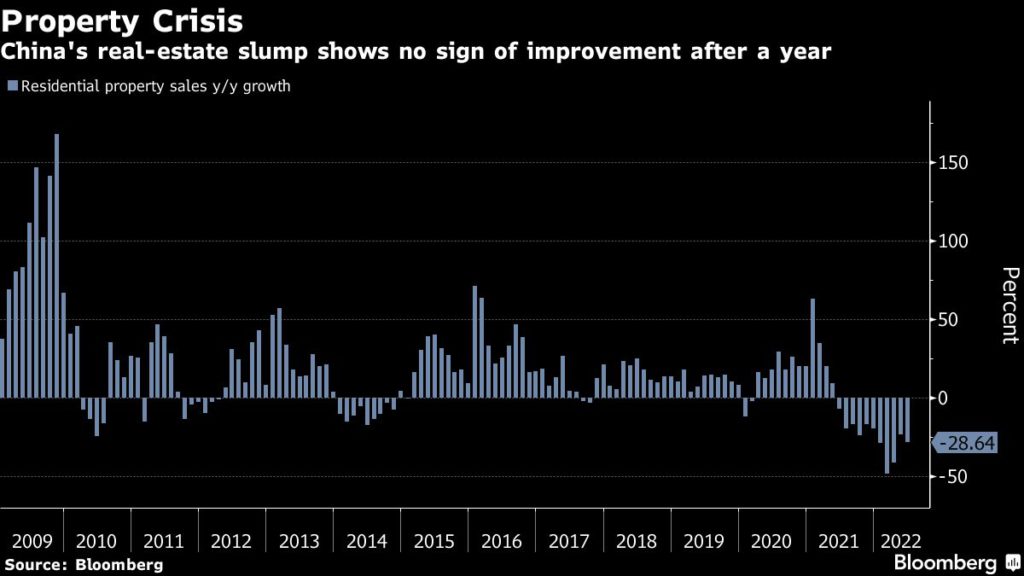

- Macroeconomic Factors: [Discuss how factors like inflation, interest rates, and economic growth could affect Palantir's business]. These macroeconomic conditions could [explain how these factors might influence Palantir's revenue, profitability, and stock price].

- Geopolitical Risks: [Discuss geopolitical events or instability that could impact Palantir's operations or government contracts]. Geopolitical uncertainties may [explain the potential impact of these risks on Palantir’s business and its stock price].

Conclusion: Final Thoughts on Analyzing Palantir Stock Before the May 5th Deadline

Analyzing Palantir stock before the May 5th deadline requires a careful consideration of its financial performance, market sentiment, and potential risks and opportunities. The company's revenue growth, profitability, and the balance between government contracts and commercial partnerships are key factors to evaluate. Furthermore, understanding analyst opinions, stock price volatility, and the competitive landscape are essential for a comprehensive analysis. Remember to consider macroeconomic and geopolitical factors that might impact Palantir's future. Conduct your own thorough research and consider consulting with a financial advisor before making any investment decisions. Further analyzing Palantir stock and conducting a thorough analysis of Palantir will allow you to make informed decisions on Palantir investment. Access reputable financial news sources and company filings for additional data to support your analysis.

Featured Posts

-

Elon Musk Net Worth Dips Under 300 Billion Analysis Of Teslas Recent Challenges

May 10, 2025

Elon Musk Net Worth Dips Under 300 Billion Analysis Of Teslas Recent Challenges

May 10, 2025 -

Cassidy Hutchinson Plans Memoir On Her Jan 6 Testimony

May 10, 2025

Cassidy Hutchinson Plans Memoir On Her Jan 6 Testimony

May 10, 2025 -

Putins Limited Ceasefire Analyzing The Victory Day Announcement

May 10, 2025

Putins Limited Ceasefire Analyzing The Victory Day Announcement

May 10, 2025 -

Casey Means Trumps Choice For Surgeon General And The Maha Movement

May 10, 2025

Casey Means Trumps Choice For Surgeon General And The Maha Movement

May 10, 2025 -

Chinas Steel Production Cuts And The Future Of Iron Ore Prices

May 10, 2025

Chinas Steel Production Cuts And The Future Of Iron Ore Prices

May 10, 2025