Analyzing Palantir Stock: Investment Strategies Before May 5th

Table of Contents

1. Palantir's Recent Financial Performance and Future Projections

1.1 Revenue Growth and Profitability: Palantir's recent quarterly reports reveal a mixed bag. While revenue has shown consistent year-over-year growth, profitability remains a key area of focus for investors.

- Year-over-year growth: Analyze the percentage increase in revenue compared to the same period last year. A slowing growth rate could signal potential challenges.

- Revenue streams: Examine the breakdown of revenue from government and commercial clients. A heavy reliance on one sector poses inherent risks.

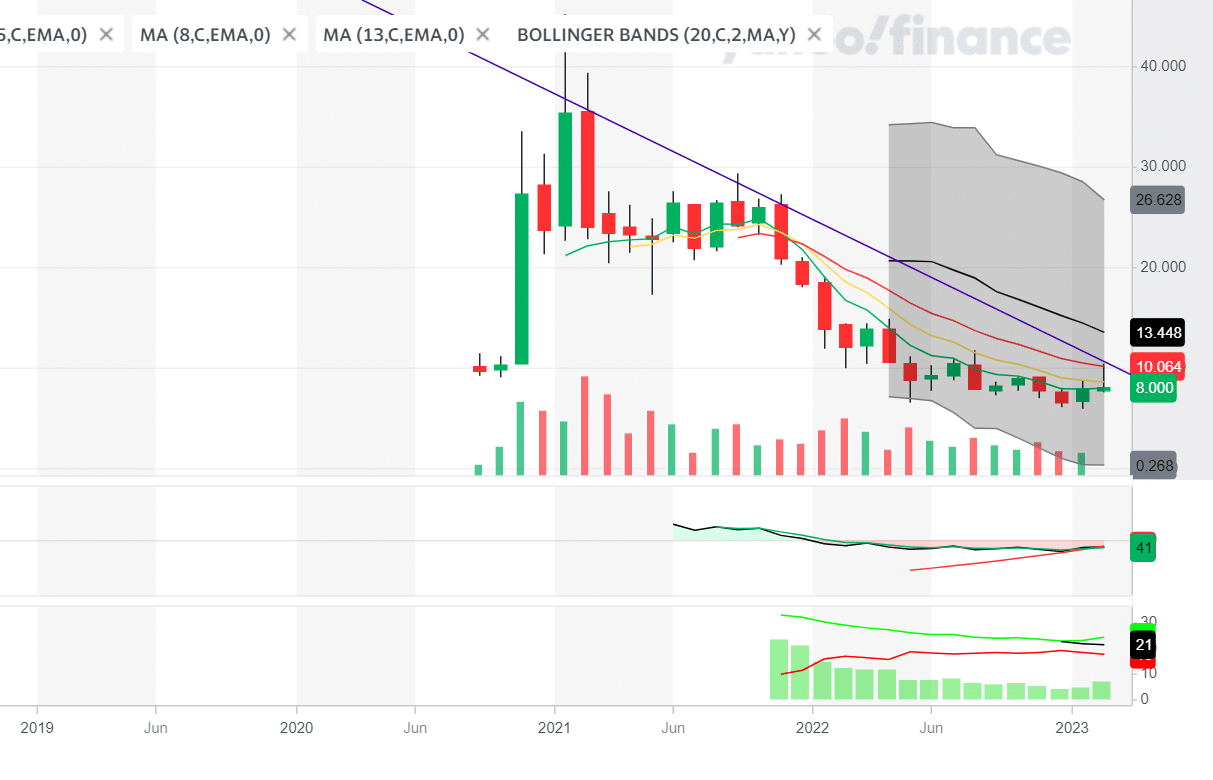

- Earnings guidance: Pay close attention to the company's projections for future earnings. This provides valuable insight into their expectations and potential for growth. [Insert chart showing revenue growth over time here]

1.2 Key Contracts and Partnerships: Securing significant contracts is vital for Palantir's growth. Recent wins, particularly large government contracts and strategic commercial partnerships, bolster investor confidence.

- High-value contracts: Identify and analyze the specifics of any large contracts announced, focusing on their duration and potential impact on revenue.

- Strategic partnerships: Examine the benefits of new partnerships. Do they provide access to new markets, enhance technology, or improve operational efficiency?

- Long-term implications: Assess how these contracts and partnerships contribute to Palantir's long-term sustainability and growth potential.

1.3 Competition and Market Share: Palantir operates in a competitive big data analytics market. Understanding its position relative to competitors is crucial for assessing its future prospects.

- Key competitors: Identify major players like AWS, Microsoft, and Google Cloud. Compare their offerings and market positions.

- Competitive advantages: Palantir's proprietary technology and focus on data integration offer distinct advantages. Analyze their effectiveness in a competitive environment.

- Market share growth: Assess Palantir's potential to gain market share based on its innovation, competitive pricing, and go-to-market strategy.

2. Understanding Palantir's Business Model and Growth Strategy

2.1 Government vs. Commercial Revenue: Palantir's revenue is split between government and commercial sectors. Each segment presents distinct opportunities and challenges.

- Growth rates: Compare the year-over-year growth rates in both sectors. Identify which is the primary driver of revenue expansion.

- Government contract dependence: Assess the risks associated with a substantial reliance on government contracts, including potential funding fluctuations or changes in government priorities.

- Diversification strategy: Analyze Palantir's efforts to diversify its revenue streams and reduce its dependence on any single sector.

2.2 Technological Innovation and Product Development: Continuous innovation is essential for Palantir's long-term success. Evaluate its R&D investments and new product launches.

- Significant innovations: Highlight any breakthroughs in artificial intelligence, machine learning, or data integration that provide a competitive edge.

- Competitive advantages: Assess how new technologies and product enhancements translate into increased market share and revenue growth.

- Impact on future revenue: Project the potential revenue contributions from newly launched products or significant technological improvements.

2.3 Long-Term Growth Potential: Considering Palantir's current trajectory, market trends, and competitive landscape, what is its long-term outlook?

- Growth drivers: Identify factors likely to fuel future growth, such as expanding market demand, successful product launches, and strategic acquisitions.

- Growth hindrances: Recognize potential obstacles, such as intense competition, economic downturns, and regulatory challenges.

- Industry forecasts: Consult reputable industry reports and analyses to gain a more comprehensive understanding of the long-term prospects of the big data analytics market.

3. Risk Assessment and Investment Strategies Before May 5th

3.1 Market Volatility and Economic Factors: The stock market is inherently volatile. Understanding potential risks is critical for informed investment decisions.

- Inflation and interest rates: Assess the impact of inflation and interest rate hikes on Palantir's stock price and the broader market.

- Recessionary risks: Consider the potential for an economic downturn and its implications for Palantir's revenue and profitability.

- Geopolitical events: Evaluate the influence of global events on investor sentiment and Palantir's stock performance.

3.2 Investment Strategies (Short-Term vs. Long-Term): Investment strategies should align with individual risk tolerance and time horizons.

- Buy, hold, or sell: Consider different strategies based on your assessment of Palantir's future performance and your investment goals.

- Options trading: For experienced investors, options trading can offer sophisticated strategies to manage risk and potentially enhance returns. (Note: Options trading carries significant risk.)

- Diversification: Diversify your investment portfolio to mitigate risks associated with investing in a single stock.

3.3 Setting Stop-Loss Orders and Managing Risk: Protecting your investments is crucial. Utilizing stop-loss orders is a key risk management technique.

- Stop-loss orders: Understand how stop-loss orders work and how they can help limit potential losses.

- Portfolio diversification: Spread your investments across various asset classes to reduce overall risk.

- Risk tolerance assessment: Honestly evaluate your personal risk tolerance before making any investment decisions.

Conclusion:

Analyzing Palantir stock requires a thorough examination of its financial performance, business model, growth strategy, and the broader market environment. Before making any investment decisions regarding Palantir stock before May 5th, remember to conduct thorough due diligence and consult with a financial advisor if needed. Effective analyzing Palantir stock requires a holistic approach, considering both its strengths and potential weaknesses. Remember that this analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Bodycam Video Police Rescue Toddler Choking On Food

May 09, 2025

Bodycam Video Police Rescue Toddler Choking On Food

May 09, 2025 -

Nyt Strands Game 366 Hints And Answers For Tuesday March 4

May 09, 2025

Nyt Strands Game 366 Hints And Answers For Tuesday March 4

May 09, 2025 -

40 Up In 2025 Analyzing Palantir Stocks Potential For Growth

May 09, 2025

40 Up In 2025 Analyzing Palantir Stocks Potential For Growth

May 09, 2025 -

Significant Fentanyl Seizure Pam Bondi Addresses The Growing Opioid Crisis

May 09, 2025

Significant Fentanyl Seizure Pam Bondi Addresses The Growing Opioid Crisis

May 09, 2025 -

Minister Announces Expedited Construction For 14 Edmonton Schools

May 09, 2025

Minister Announces Expedited Construction For 14 Edmonton Schools

May 09, 2025

Latest Posts

-

Hkayat Mdkhnyn Krt Alqdm Mn Alnjwm Ila Almshakl Alshyt

May 09, 2025

Hkayat Mdkhnyn Krt Alqdm Mn Alnjwm Ila Almshakl Alshyt

May 09, 2025 -

From Wolves Discard To Europes Elite His Rise To Success

May 09, 2025

From Wolves Discard To Europes Elite His Rise To Success

May 09, 2025 -

Laebwa Krt Alqdm Almdkhnwn Drast Fy Altathyr Alslby Ela Alsht Walmhnt

May 09, 2025

Laebwa Krt Alqdm Almdkhnwn Drast Fy Altathyr Alslby Ela Alsht Walmhnt

May 09, 2025 -

Once Rejected Now The Heartbeat Of Europes Best Team

May 09, 2025

Once Rejected Now The Heartbeat Of Europes Best Team

May 09, 2025 -

Njwm Krt Alqdm Waltbgh Qst Idman Ghyr Mtwqet

May 09, 2025

Njwm Krt Alqdm Waltbgh Qst Idman Ghyr Mtwqet

May 09, 2025