Analyzing The CoreWeave (CRWV) Stock Decline On Tuesday

Table of Contents

2.1. Pre-Market Volatility and Initial Reactions

The CoreWeave (CRWV) stock decline wasn't a sudden shock; pre-market trading activity hinted at the volatility to come. A noticeable percentage drop in the pre-market session set a concerning tone for the day's trading. Initial investor reactions, as observed on social media platforms like Twitter and StockTwits, and financial news outlets, ranged from cautious concern to outright panic selling. The sentiment was largely negative, fueled by uncertainty surrounding the reasons for the early decline.

- Percentage change in pre-market trading: While precise figures vary depending on the data source, reports indicated a significant pre-market drop, setting the stage for further losses during regular trading hours.

- Significant news or announcements preceding the drop: While no major negative news was explicitly released before the market opened, the absence of positive news or catalysts could have contributed to investor apprehension. The lack of bullish sentiment might have triggered profit-taking among some investors.

- Quotes from analysts or experts: Initial expert commentary leaned towards caution, advising investors to monitor the situation closely before making rash decisions. Many analysts pointed to the need for further information before making any definitive statements regarding the long-term implications of the CRWV pre-market activity.

This initial CRWV pre-market volatility significantly influenced investor sentiment and played a major role in the subsequent CoreWeave stock price decrease.

2.2. Impact of Broad Market Trends

The CoreWeave (CRWV) stock decline didn't occur in isolation. The broader market experienced a downturn on Tuesday, impacting various sectors, including technology. Many tech stocks, and particularly those in the cloud computing sector, saw declines, suggesting a wider market correction was underway.

- Relevant market indices: The Nasdaq Composite and S&P 500 both experienced negative movement on the day, indicating a general market downturn impacting investor confidence across sectors.

- Macroeconomic factors: Rising interest rates and persistent inflation concerns continued to weigh heavily on investor sentiment, contributing to a risk-off environment that affected even relatively strong performers like CoreWeave. This market downturn created a challenging environment for growth stocks, especially in the relatively new cloud computing space.

- Comparison to competitors: A comparison of CRWV performance to other established players in the cloud computing market showed a similar negative trend across the board, suggesting that the sector, as a whole, was impacted by the overall market conditions.

The impact of these broad market trends and macroeconomic factors cannot be overlooked when analyzing the CoreWeave stock decline.

2.3. Specific Factors Affecting CoreWeave (CRWV)

Beyond the general market conditions, specific factors relating to CoreWeave itself may have contributed to the CRWV stock price decrease. While no single catastrophic event was reported, several possibilities warrant consideration.

- Specific news releases or announcements from CoreWeave: The absence of positive news, such as new partnerships or contracts, might have disappointed investors anticipating further growth catalysts. Any lack of positive news during this period could have triggered profit-taking.

- Impact of recent financial reports or earnings calls: If recent earnings reports or forecasts fell short of expectations, it could have fueled selling pressure. Scrutiny of the financial reports is vital for understanding the specifics of the company's performance.

- Analyst ratings and price target changes: Downgrades from analysts or revisions of price targets could have also contributed to the negative sentiment surrounding CoreWeave stock. These kinds of analyst updates significantly impact the market's perception.

Identifying any of these company-specific events would provide greater clarity into the reasons behind the CoreWeave (CRWV) stock decline.

2.4. Technical Analysis of the CRWV Chart

A technical analysis of the CRWV stock chart provides further insights into the decline. This analysis, which may include charts and graphs in a more detailed report, would examine support and resistance levels, trading volume, and potential chart patterns to understand the price movements.

- Key support and resistance levels: Identifying key support and resistance levels helps to understand where the price might find stability or face further pressure. Breaching certain support levels might have triggered stop-loss orders and further selling.

- Trading volume analysis: High trading volume during the decline suggests significant investor participation in the selling pressure. Conversely, low volume may indicate less conviction in the selling.

- Significant chart patterns: Any identifiable chart patterns (e.g., head and shoulders, double tops) could offer clues about potential future price movements.

Technical analysis supplements the fundamental analysis, providing a more holistic understanding of the CoreWeave (CRWV) stock decline.

3. Conclusion: Future Outlook for CoreWeave (CRWV) Stock

The CoreWeave (CRWV) stock decline on Tuesday resulted from a confluence of factors: pre-market volatility, broader market trends, and possibly company-specific news (although more information is needed to confirm this). The impact of macroeconomic factors and general market sentiment cannot be ignored. While the short-term outlook might seem uncertain, the long-term potential of CoreWeave in the growing cloud computing market remains a significant factor.

To effectively navigate the future of CoreWeave (CRWV) stock, continued monitoring of market trends, company news, and technical indicators is crucial. Investors should conduct thorough due diligence and consider their risk tolerance before making any investment decisions. Stay informed, conduct your own research, and make responsible investing choices concerning CoreWeave (CRWV) stock and similar cloud computing investments.

Featured Posts

-

Manhattan Forgotten Foods Festival A Celebration Of Rare Ingredients

May 22, 2025

Manhattan Forgotten Foods Festival A Celebration Of Rare Ingredients

May 22, 2025 -

Peppa Pigs Parents Host Gender Reveal Party A Family Celebration

May 22, 2025

Peppa Pigs Parents Host Gender Reveal Party A Family Celebration

May 22, 2025 -

Kamerbrief Certificaten Abn Amro Programma Details En Strategieen

May 22, 2025

Kamerbrief Certificaten Abn Amro Programma Details En Strategieen

May 22, 2025 -

Pro Palestine Terrorist Attack Claims Life Of Israeli Diplomat In D C

May 22, 2025

Pro Palestine Terrorist Attack Claims Life Of Israeli Diplomat In D C

May 22, 2025 -

White House Confirms Bidens Last Prostate Cancer Screening In 2014

May 22, 2025

White House Confirms Bidens Last Prostate Cancer Screening In 2014

May 22, 2025

Latest Posts

-

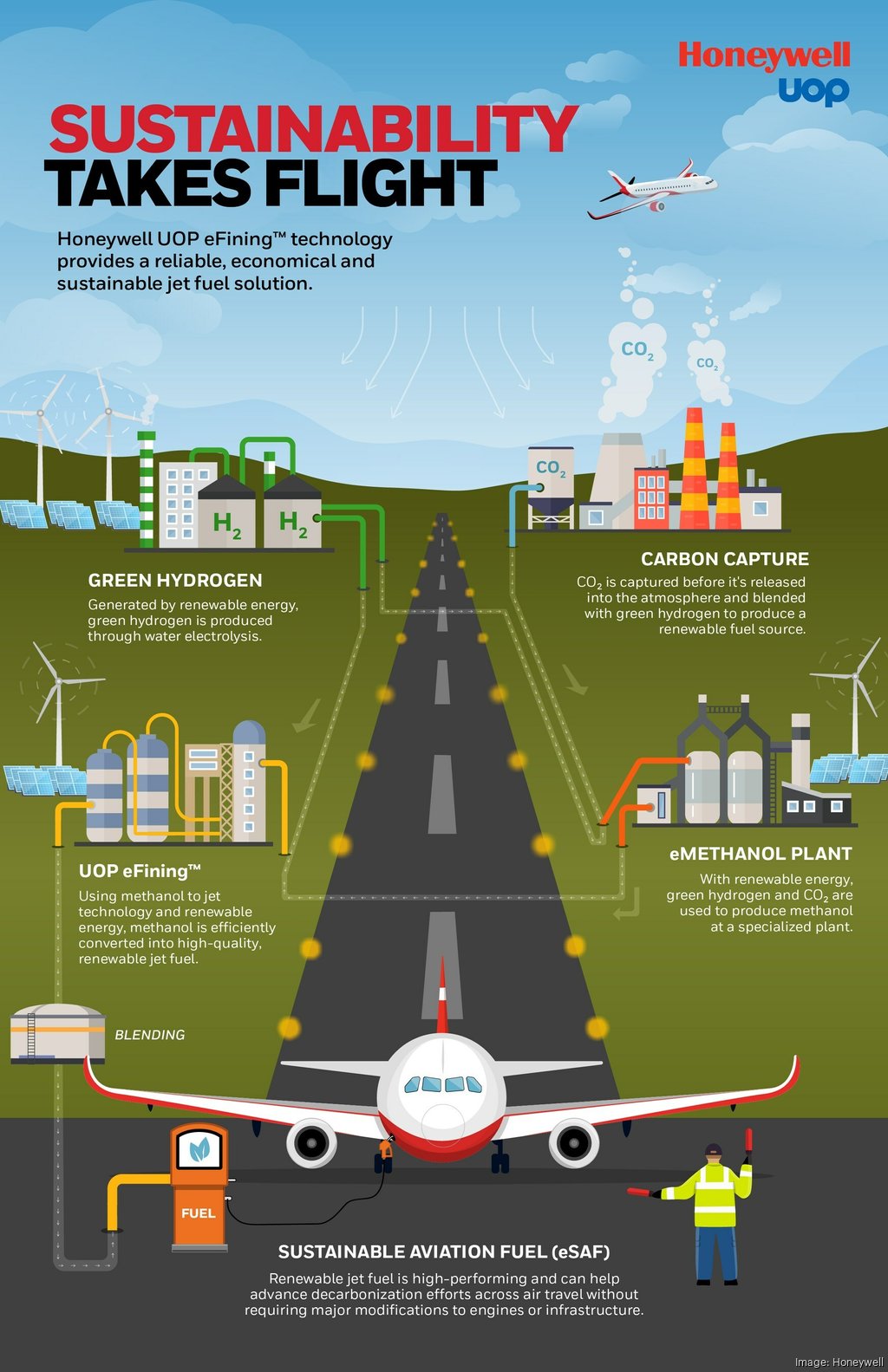

Honeywell And Johnson Matthey Near 1 8 B Deal

May 23, 2025

Honeywell And Johnson Matthey Near 1 8 B Deal

May 23, 2025 -

Johnson Matthey Sells Catalyst Unit To Honeywell For 2 4 Billion Impact And Analysis

May 23, 2025

Johnson Matthey Sells Catalyst Unit To Honeywell For 2 4 Billion Impact And Analysis

May 23, 2025 -

Honeywells 2 4 Billion Acquisition Of Johnson Mattheys Catalyst Unit A Deep Dive

May 23, 2025

Honeywells 2 4 Billion Acquisition Of Johnson Mattheys Catalyst Unit A Deep Dive

May 23, 2025 -

Honeywells Acquisition Of Johnson Mattheys Catalyst Technologies Boosting Its Process Technology Capabilities

May 23, 2025

Honeywells Acquisition Of Johnson Mattheys Catalyst Technologies Boosting Its Process Technology Capabilities

May 23, 2025 -

Reaching 100 Test Wickets The Challenges Facing Zimbabwes Muzarabani

May 23, 2025

Reaching 100 Test Wickets The Challenges Facing Zimbabwes Muzarabani

May 23, 2025