Analyzing The Correlation Between Trump's Presidency And Bitcoin's Value

Table of Contents

Trump's Economic Policies and Bitcoin's Price

The Trump administration's economic policies, characterized by deregulation and significant fiscal spending, created a unique environment for Bitcoin and other cryptocurrencies.

Deregulation and its Impact

One of the most significant aspects of the Trump era was a push towards deregulation across various sectors. This approach potentially boosted Bitcoin's appeal as an alternative asset, largely unregulated and operating outside traditional financial systems.

- Reduced regulatory burdens could have encouraged increased investment in alternative assets, including cryptocurrencies, as investors sought higher returns and perceived less government oversight.

- Trump's tax cuts, for instance, might have indirectly fueled Bitcoin's price increases by injecting liquidity into the market and potentially encouraging investment in riskier assets. While not a direct cause-and-effect relationship, the increased capital availability could have contributed to the overall market sentiment, impacting Bitcoin price.

- The lack of stringent regulations on cryptocurrencies during this period might have appealed to some investors seeking to avoid stricter compliance requirements associated with traditional financial instruments.

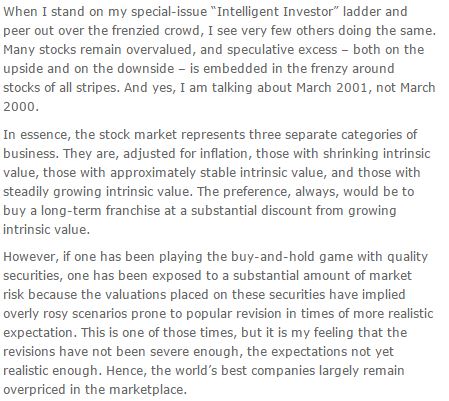

It's crucial to note that correlation doesn't equal causation. While deregulation may have created a more favorable environment for Bitcoin, other factors were undoubtedly at play. Further research is needed to quantify the exact impact of these policies on Bitcoin's price.

Fiscal Spending and Inflationary Pressures

Trump's significant fiscal spending initiatives raised concerns about potential inflationary pressures. This factor could have, indirectly, influenced Bitcoin's value as a hedge against inflation.

- Some investors might have viewed Bitcoin as a store of value, potentially protecting their wealth from the erosion of purchasing power caused by inflation.

- Economic uncertainty caused by increased government spending might have driven some investors towards Bitcoin as a safe haven asset, albeit a volatile one.

- However, the relationship between inflation and Bitcoin's price is complex and not always directly proportional. Other economic variables, including market sentiment and technological advancements, play significant roles.

Geopolitical Events and Bitcoin's Safe-Haven Status

Trump's presidency was marked by significant geopolitical events, some of which might have contributed to Bitcoin's price fluctuations.

Trade Wars and Market Volatility

The trade wars initiated by the Trump administration led to increased market volatility across various asset classes. Bitcoin, often seen as a safe-haven asset during periods of uncertainty, might have experienced price fluctuations linked to these global trade tensions.

- Increased market uncertainty, driven by trade disputes, might have led investors to seek refuge in alternative assets like Bitcoin, driving up its price temporarily.

- Conversely, periods of heightened geopolitical tensions could also trigger sell-offs in riskier assets, including Bitcoin, as investors opted for safer investments.

- Specific examples like the trade dispute with China could be analyzed to determine potential correlations between escalating tensions and Bitcoin price movements.

International Relations and Cryptocurrency Adoption

Trump's foreign policy also potentially influenced the adoption of Bitcoin in different countries.

- Changes in international relations, driven by Trump's policies, might have affected regulatory landscapes in various nations, impacting the legal status and adoption of cryptocurrencies.

- Shifts in global cryptocurrency markets could be partly linked to Trump's diplomatic initiatives or conflicts, as countries responded differently to his policies.

- For example, a country facing economic sanctions might witness increased Bitcoin adoption as a means of circumventing traditional financial systems.

Regulatory Uncertainty and the Bitcoin Market

The lack of a clear regulatory framework for cryptocurrencies during Trump's presidency presented both opportunities and challenges for the Bitcoin market.

Lack of Clear Regulatory Framework

The absence of comprehensive regulations surrounding Bitcoin created significant regulatory uncertainty.

- This uncertainty might have affected investor confidence, leading to periods of both significant price increases and sharp declines.

- Without clear guidelines on taxation, anti-money laundering (AML) compliance, and other regulatory aspects, investors faced challenges navigating the cryptocurrency market.

- The lack of concrete regulatory action during this period is a critical factor that needs further investigation to understand its impact on Bitcoin's volatility.

Conclusion: Synthesizing the Trump-Bitcoin Relationship

The relationship between Trump's presidency and Bitcoin's price movements is complex and multifaceted. While clear causal links are difficult to establish definitively, economic policies, geopolitical events, and regulatory uncertainty all played a role in shaping the cryptocurrency market during this period. The impact of deregulation, fiscal spending, trade wars, and a lack of comprehensive regulation on Bitcoin's price warrants further detailed analysis. This article highlights potential correlations, but more research is needed to fully understand the intricate interplay between political events and the cryptocurrency market. Continue researching the relationship between political events and cryptocurrency values to gain a deeper understanding of this dynamic landscape. Explore further the intricate connection between Trump and Bitcoin to navigate the ever-evolving world of digital finance. Further reading on macroeconomic influences on cryptocurrency markets is strongly recommended.

Featured Posts

-

Apples Ai Future A Crossroads Analysis

May 09, 2025

Apples Ai Future A Crossroads Analysis

May 09, 2025 -

Spieltag 27 Der 2 Bundesliga Koeln Neuer Tabellenfuehrer

May 09, 2025

Spieltag 27 Der 2 Bundesliga Koeln Neuer Tabellenfuehrer

May 09, 2025 -

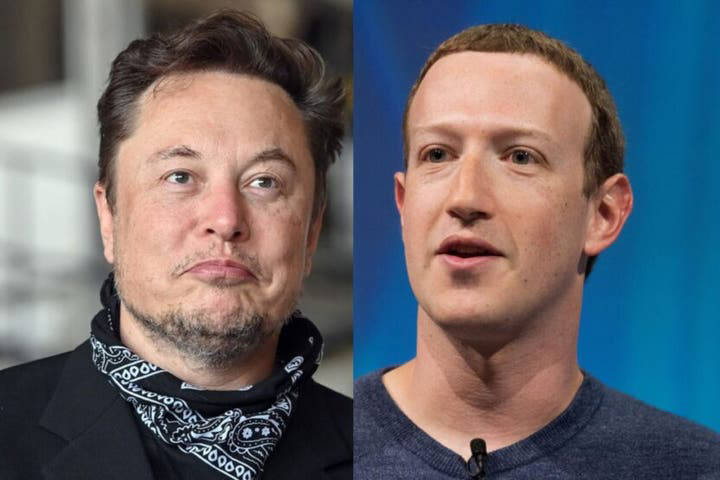

The Zuckerberg Trump Dynamic Implications For Tech And Governance

May 09, 2025

The Zuckerberg Trump Dynamic Implications For Tech And Governance

May 09, 2025 -

Top 5 Stephen King Books Have You Read Them All

May 09, 2025

Top 5 Stephen King Books Have You Read Them All

May 09, 2025 -

Alterya Joins Chainalysis A Strategic Move In Blockchain And Ai

May 09, 2025

Alterya Joins Chainalysis A Strategic Move In Blockchain And Ai

May 09, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025 -

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025 -

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025 -

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025 -

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025