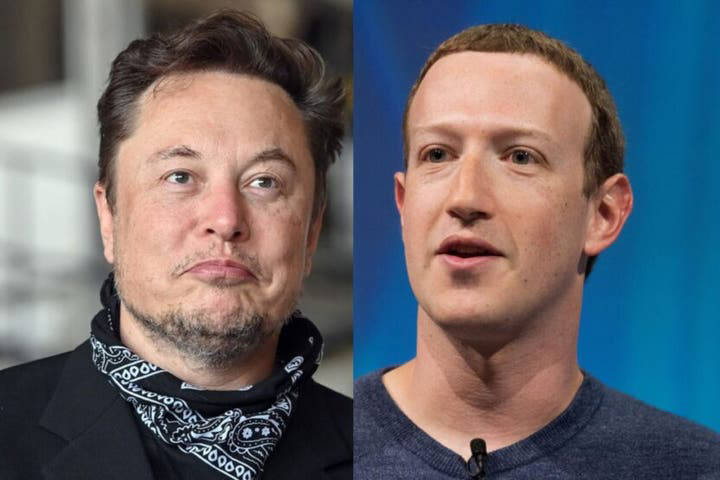

Analyzing The Correlation Between US Power And Elon Musk's Net Worth: A Tesla Perspective

Table of Contents

Tesla's Contribution to the US Economy

Tesla's impact on the US economy is multifaceted and substantial, extending far beyond simply selling electric vehicles.

Job Creation and Technological Advancement

Tesla's rapid growth has fueled significant job creation across various sectors. From manufacturing and engineering to software development and AI research, the company has created tens of thousands of high-skilled jobs in the US. Furthermore, its relentless pursuit of innovation has spurred technological advancements in several key areas:

- Investments in US infrastructure: Tesla has invested heavily in building Gigafactories and expanding its manufacturing capabilities within the US, creating jobs and boosting local economies.

- Employee count: Tesla employs tens of thousands of people directly, with a significant portion located within the United States.

- Patents filed: Tesla holds numerous patents related to EV technology, battery technology, autonomous driving, and energy storage, solidifying its position as a technological leader.

- Technological breakthroughs: Tesla's advancements in battery technology, autonomous driving systems (Autopilot and Full Self-Driving), and supercharger infrastructure have pushed the boundaries of innovation in the automotive and energy sectors.

Boosting the US Automotive Industry

Tesla's disruptive entry into the automotive market has forced established automakers to accelerate their own EV development programs. This competitive pressure has led to significant innovation within the US automotive sector, pushing the industry towards a more sustainable and technologically advanced future.

- Competitor reactions: Traditional automakers like Ford, General Motors, and Volkswagen have all significantly increased their investments in EVs and related technologies in response to Tesla's success.

- Market share data: While Tesla's market share might fluctuate, its presence has undeniably altered the competitive landscape and accelerated the overall market adoption of EVs.

- Impact on supply chains: Tesla's demand has influenced the development and expansion of US-based supply chains related to battery production, electric motors, and other EV components.

Global Competitiveness and Export Revenue

Tesla's international success contributes significantly to the US economy through exports, foreign direct investment, and enhanced brand image.

- Export figures: A substantial portion of Tesla vehicles are exported globally, generating significant export revenue for the US.

- International factory locations: While Tesla has expanded internationally, its US-based operations remain crucial to its global success.

- Brand recognition data: Tesla enjoys high brand recognition globally, which enhances the perception of US technological leadership.

Elon Musk's Net Worth and its Reflection of US Economic Power

Elon Musk's immense wealth is largely tied to Tesla's stock performance, which in turn is influenced by various factors, including broader US economic indicators.

The Interplay of Stock Market Performance and US Economic Indicators

Tesla's stock price is closely correlated with overall market sentiment and US economic indicators. Positive economic news often boosts investor confidence, leading to increased demand for Tesla shares, thus increasing Musk's net worth.

- Economic trends affecting Tesla's stock: Factors like GDP growth, inflation rates, interest rates, and consumer confidence significantly impact Tesla's stock valuation.

- Correlations between stock prices and economic data: Studies show a positive correlation between strong US economic performance and Tesla's stock price, implying a link between US economic power and Musk's wealth.

Musk's Influence on Investor Sentiment and Market Confidence

Elon Musk's public pronouncements and actions can significantly sway investor sentiment towards Tesla and the broader technology sector. His tweets, announcements, and even personal activities can cause substantial stock price fluctuations.

- Examples of Musk's impact on stock prices: Numerous instances demonstrate how Musk's tweets or announcements have directly impacted Tesla's stock price, highlighting his influence on market sentiment.

- Analysis of market reactions: The market's often dramatic reactions to Musk's actions demonstrate his significant influence on investor perceptions and market confidence.

The Role of Government Policies and Regulations

US government policies, including tax incentives for electric vehicles and environmental regulations, have played a role in supporting Tesla's growth and, indirectly, Elon Musk's wealth.

- Specific examples of relevant government policies: Tax credits for EV purchases, investments in renewable energy infrastructure, and environmental regulations have all contributed to a favorable environment for Tesla's expansion.

Challenges and Limitations to the Correlation

It's crucial to acknowledge that the relationship between US power and Elon Musk's net worth is not solely dependent on Tesla's success. Many external factors complicate this correlation.

External Factors Affecting Tesla's Performance

Global economic instability, geopolitical events, supply chain disruptions, and intense competition all significantly impact Tesla's performance and, consequently, Elon Musk's net worth.

- Examples of external factors and their effects: The COVID-19 pandemic, global chip shortages, and geopolitical tensions have all demonstrated their ability to influence Tesla's production and sales, affecting its stock price.

The Complexity of Causality

While a correlation exists, it's essential to avoid oversimplifying the relationship. Numerous factors beyond Tesla's success contribute to both US economic power and Elon Musk's personal wealth.

- Alternative contributing factors: The overall strength of the US economy, global market conditions, and innovative advancements in various other sectors all contribute to both US economic power and the wealth of successful entrepreneurs.

Conclusion

The analysis reveals a complex and intertwined relationship between US economic strength, Tesla's remarkable success, and Elon Musk's substantial net worth. While a correlation is evident, it's crucial to acknowledge the multiple factors at play. Tesla's contribution to job creation, technological advancement, and global competitiveness undoubtedly strengthens the US economy, but this is just one piece of a much larger puzzle. Further analysis of the correlation between US power and Elon Musk's net worth is needed to fully understand the nuances of this dynamic relationship. Deepen your understanding of the interplay between Tesla's success and the US economy by continuing your research into the impact of technological innovation on national economic strength.

Featured Posts

-

Alpines Clear Message To Doohan Latest F1 News

May 09, 2025

Alpines Clear Message To Doohan Latest F1 News

May 09, 2025 -

Oilers Star Leon Draisaitl Lower Body Injury And Potential Playoff Return

May 09, 2025

Oilers Star Leon Draisaitl Lower Body Injury And Potential Playoff Return

May 09, 2025 -

Palantir Stock Wall Streets Prediction Before May 5th Should You Invest

May 09, 2025

Palantir Stock Wall Streets Prediction Before May 5th Should You Invest

May 09, 2025 -

Fur Rondy Shorter Race Unwavering Spirit

May 09, 2025

Fur Rondy Shorter Race Unwavering Spirit

May 09, 2025 -

The Fentanyl Crisis And Its Impact On Us China Trade Relations

May 09, 2025

The Fentanyl Crisis And Its Impact On Us China Trade Relations

May 09, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025 -

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025 -

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025 -

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025 -

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025