Analyzing The Upcoming QBTS Earnings Report: What To Expect For Investors

Table of Contents

Key Metrics to Watch in the QBTS Earnings Report

The QBTS earnings report will contain several key performance indicators (KPIs) that investors should carefully scrutinize. Understanding these metrics and their context is crucial for accurate QBTS earnings report analysis.

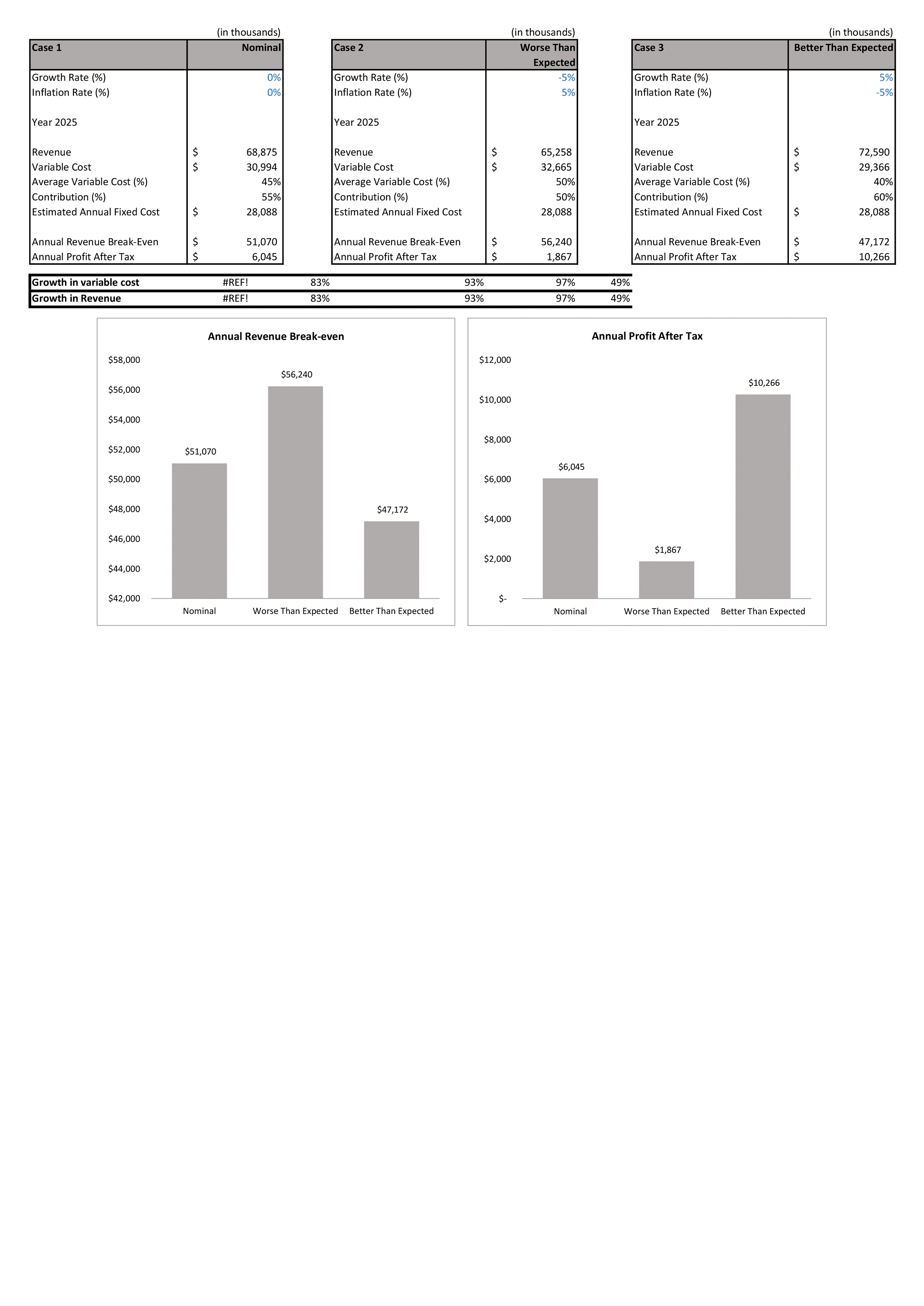

Revenue Growth

Analyzing year-over-year and quarter-over-quarter revenue growth is paramount. This reveals the company's ability to generate sales and expand its market share. Several factors influence revenue growth, and a comprehensive QBTS earnings report analysis needs to consider them all.

- Examine revenue from core products/services: The performance of QBTS's core offerings indicates the health of its existing business model. A decline here could signal underlying problems.

- Assess the impact of new product launches or acquisitions: New products or acquisitions should ideally contribute to revenue growth. The QBTS earnings report should detail their success (or lack thereof).

- Consider seasonal factors affecting revenue: Some businesses experience natural fluctuations in revenue throughout the year. Understanding these seasonal trends is vital for accurate QBTS earnings report interpretation.

- Identify any significant changes in pricing strategies: Price increases or decreases can significantly impact revenue. The reasons behind such changes should be explored within the context of the QBTS earnings report.

Earnings Per Share (EPS)

Earnings Per Share (EPS) is a crucial metric reflecting the company's profitability on a per-share basis. A strong EPS indicates robust earnings and healthy profitability. Analyzing EPS within the QBTS earnings report involves comparing it to previous periods and analyst expectations.

- Evaluate the impact of cost-cutting measures: Cost reduction initiatives can boost EPS, but their long-term sustainability should be assessed.

- Identify any one-time charges or gains: Extraordinary items can skew EPS; identifying and adjusting for them is crucial for accurate analysis of the QBTS earnings report.

- Compare EPS growth to industry benchmarks: Comparing QBTS's EPS growth to its competitors provides valuable context and highlights its relative performance within the industry.

- Consider the impact of interest rates and debt: High interest rates or significant debt can negatively impact EPS, a factor to consider when analyzing the QBTS earnings report.

Cash Flow

Cash flow analysis offers a deeper understanding of a company's financial health beyond just profitability. Analyzing cash flow from operations, investing, and financing activities reveals the company's ability to generate and manage cash.

- Analyze free cash flow (FCF) and its implications for future investments and dividends: High FCF suggests the ability to reinvest in the business or return capital to shareholders.

- Evaluate capital expenditures (CAPEX) and their impact on profitability: High CAPEX can temporarily reduce profitability but is essential for long-term growth. The QBTS earnings report should explain these investments.

- Assess debt levels and their impact on future cash flow: High debt levels can constrain future cash flow and increase financial risk.

- Examine the company's dividend policy and its sustainability: Dividend payouts should be sustainable given the company's cash flow generation capacity.

Understanding the QBTS Business Outlook and Guidance

Beyond the historical data, the QBTS earnings report provides crucial insights into the company's future plans and expectations.

Management Commentary

Management's commentary during the earnings call is a goldmine of information. Their insights and explanations provide context to the numbers in the QBTS earnings report.

- Look for any revisions to long-term financial targets: Changes in targets reflect shifts in company strategy or challenges encountered.

- Identify key priorities and strategic initiatives for the coming quarters: Understanding management's priorities helps predict future performance.

- Evaluate the management team’s confidence in the company's prospects: Their tone and messaging reveal their outlook for the future.

- Assess any risks or challenges that could affect future performance: Identifying potential headwinds is crucial for realistic investment planning.

Future Projections

The QBTS earnings report will likely include forward-looking statements and guidance for future performance. These projections provide a glimpse into the company's expectations.

- Compare the company's projections to analyst estimates: This comparison reveals the market's expectations versus the company's internal assessment.

- Assess the degree of uncertainty around the company's projections: Management may highlight risks or uncertainties that could impact projections.

- Consider the potential impact of macroeconomic factors on future performance: External factors like inflation or economic downturns can influence the company's outlook.

- Evaluate the reasonableness of the company's growth expectations: Are the projections realistic and achievable, or overly optimistic?

Market Reaction and Investment Strategies After the QBTS Earnings Report

The market's reaction to the QBTS earnings report will significantly impact the stock price and provide additional information for investors.

Stock Price Movement

The immediate impact of the QBTS earnings report on the stock price will be a key indicator of investor sentiment.

- Consider the volume of trading activity after the report: High volume suggests strong investor interest and conviction.

- Assess the impact of the report on investor sentiment: Positive results will typically lead to increased investor confidence.

- Compare the market reaction to the company's past earnings reports: This helps establish a historical pattern of market response.

- Understand the impact of broader market conditions on the stock price: Overall market trends can influence the stock price regardless of the earnings report.

Investment Implications

The QBTS earnings report should inform your investment strategy, guiding your decisions regarding the stock.

- Decide whether to hold, buy, or sell QBTS stock based on the results: This decision should be based on your own risk tolerance and investment goals.

- Re-evaluate your investment thesis in light of the new information: The report may require adjustments to your original investment rationale.

- Consider diversifying your portfolio to manage risk: Diversification is a crucial aspect of risk management.

- Consult with a financial advisor for personalized investment advice: Professional advice can offer valuable insights tailored to your individual circumstances.

Conclusion

The QBTS earnings report will offer crucial information for investors. By carefully analyzing key metrics such as revenue growth, EPS, and cash flow, along with management commentary and future projections, investors can gain valuable insights into the company's financial health and future prospects. Remember to consider the market reaction and develop an informed investment strategy based on your analysis. Stay informed and continue monitoring the QBTS earnings report and related news to make optimal investment decisions. Understanding the nuances of the QBTS earnings report analysis will help you navigate the complexities of the market and make better-informed decisions regarding your investments in QBTS.

Featured Posts

-

Racial Hatred Tweet Appeal Update On Ex Tory Councillors Wifes Case

May 21, 2025

Racial Hatred Tweet Appeal Update On Ex Tory Councillors Wifes Case

May 21, 2025 -

Juergen Klopp Nereye Gidecek Son Dakika Transfer Haberleri

May 21, 2025

Juergen Klopp Nereye Gidecek Son Dakika Transfer Haberleri

May 21, 2025 -

Programma Synaylias Kathigites Dimotikoy Odeioy Rodoy

May 21, 2025

Programma Synaylias Kathigites Dimotikoy Odeioy Rodoy

May 21, 2025 -

Gretzkys Loyalty Legacy Tarnished By Trump Ties

May 21, 2025

Gretzkys Loyalty Legacy Tarnished By Trump Ties

May 21, 2025 -

The Resurgence Of Little Britain A Gen Z Perspective

May 21, 2025

The Resurgence Of Little Britain A Gen Z Perspective

May 21, 2025

Latest Posts

-

Bp Valuation To Double Ceos Plans And Ft Report

May 22, 2025

Bp Valuation To Double Ceos Plans And Ft Report

May 22, 2025 -

Saskatchewan Political Panel Reacts To Federal Leaders Comments

May 22, 2025

Saskatchewan Political Panel Reacts To Federal Leaders Comments

May 22, 2025 -

Bps Future Ceos Strategy For Increased Valuation London Listing Confirmed

May 22, 2025

Bps Future Ceos Strategy For Increased Valuation London Listing Confirmed

May 22, 2025 -

Financial Times Bp Ceo On Doubling Valuation And Remaining In London

May 22, 2025

Financial Times Bp Ceo On Doubling Valuation And Remaining In London

May 22, 2025 -

Bp Ceo Aims To Double Company Valuation Rejects Us Listing

May 22, 2025

Bp Ceo Aims To Double Company Valuation Rejects Us Listing

May 22, 2025