Analyzing Trump's Oil Price Preferences: Insights From Goldman Sachs

Table of Contents

Trump's Stated Preferences and Energy Policy Goals

Understanding Trump's stated oil price preferences requires examining his public statements and the overarching goals of his energy policy. Keywords such as Trump energy policy, energy independence, domestic oil production, shale oil, and OPEC are central to this section.

-

Ideal Oil Prices: While Trump didn't explicitly state an ideal oil price, his rhetoric frequently emphasized lower gasoline prices for consumers. This implied a preference for oil prices that wouldn't significantly impact the pump price, benefiting American drivers. His focus was consistently on energy independence and affordability.

-

Promoting Domestic Oil and Gas Production: A cornerstone of Trump's energy policy was boosting domestic oil and gas production. This involved significant deregulation, streamlining environmental permitting processes, and promoting the expansion of the US shale oil industry. The administration aimed to reduce reliance on foreign oil and enhance energy security.

-

The Shale Oil Boom: Trump's policies directly contributed to a boom in US shale oil production. Deregulation lessened the regulatory burden on energy companies, leading to increased investment and output. This increased domestic supply had a demonstrable effect on global oil prices.

-

Relationship with OPEC: The relationship between the Trump administration and OPEC was complex. While there was some cooperation on supply management, there were also periods of tension. Trump's focus on US energy independence often meant less deference to OPEC's influence on global oil prices than seen in previous administrations.

Goldman Sachs' Analysis of the Impact of Trump's Policies

Goldman Sachs, a leading investment bank, provided extensive analysis of the Trump administration's impact on oil prices. This section focuses on keywords like Goldman Sachs analysis, oil price predictions, economic modeling, market impact, and geopolitical risks.

-

Key Findings: Goldman Sachs' analysis likely highlighted a correlation between Trump's pro-production policies and increased US oil output. Their models probably demonstrated that this increased supply exerted downward pressure on global crude oil prices, at least temporarily.

-

Economic Modeling: The bank likely employed sophisticated economic models to assess the impact of deregulation, increased domestic production, and geopolitical factors on oil price forecasts. These models considered factors like supply and demand elasticity, economic growth projections, and geopolitical events.

-

Oil Price Predictions: Goldman Sachs' predictions during the Trump era likely incorporated the effects of his policies. While predicting oil prices is notoriously difficult, their models would have attempted to quantify the impact of his energy policies on future price trajectories.

-

Geopolitical Implications: Goldman Sachs' analysis probably considered the geopolitical implications of increased US oil production. This included assessing the impact on US energy security, its relationship with OPEC, and the broader global energy landscape.

The Economic Consequences of Trump's Oil Price Preferences

The economic consequences of Trump's oil price preferences and policies were multifaceted. This section uses keywords like economic growth, inflation, consumer prices, gasoline prices, and national security.

-

Impact on Economic Growth: Lower oil prices generally stimulate economic growth by reducing production costs for businesses and increasing consumer spending power (due to lower gasoline prices). However, the impact is complex and depends on various economic factors.

-

Inflation and Consumer Spending: Lower gasoline prices directly impact consumer prices, leading to lower inflation. This increased consumer purchasing power boosts demand for goods and services, further contributing to economic growth.

-

US Trade Balance: Increased domestic oil production reduced US dependence on oil imports, improving the trade balance. This has positive implications for the overall economic health of the country.

-

Energy and National Security: Increased domestic oil production enhances US energy security, reducing vulnerability to supply disruptions from unstable regions. This strengthens national security interests.

Alternative Perspectives and Criticisms

It's crucial to acknowledge alternative perspectives and criticisms regarding Goldman Sachs' analysis and Trump's energy policies. This section uses keywords such as oil market volatility, political influence, regulatory impact, and economic forecasting.

-

Limitations of Economic Modeling: Predicting oil prices is inherently challenging due to market volatility and unpredictable geopolitical events. Economic models, while helpful, have limitations and can't account for all potential factors.

-

Political Influence: Some might criticize Goldman Sachs' analysis for potential political bias or for neglecting to fully consider the environmental impacts of increased fossil fuel production.

-

Other Influencing Factors: Numerous factors beyond presidential policy influence oil prices, including global demand, OPEC decisions, and technological advancements. Any analysis must acknowledge these complexities.

Conclusion

This article analyzed Goldman Sachs' insights into Donald Trump's oil price preferences, examining his stated goals, the impact of his administration's policies, and the resulting economic consequences. The analysis highlighted the complex interplay between presidential actions, energy policy, and global oil market dynamics. Understanding the influence of presidential policies on oil prices is crucial for investors and policymakers alike. Further research into analyzing Trump's oil price preferences, particularly using Goldman Sachs' methodologies, is vital for predicting future market trends and shaping effective energy strategies.

Featured Posts

-

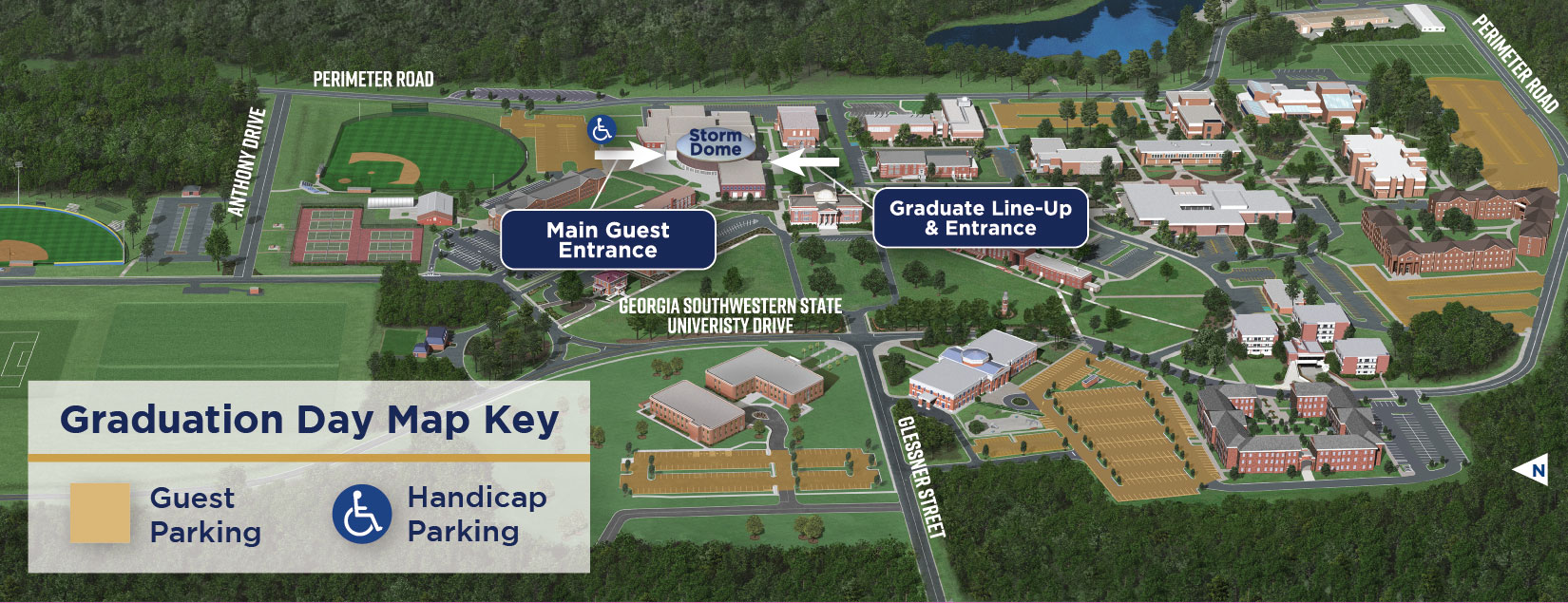

Gsw Campus Lockdown Lifted Individual Taken Into Custody

May 16, 2025

Gsw Campus Lockdown Lifted Individual Taken Into Custody

May 16, 2025 -

Dodgers Forgotten Prospect Finally Gets His Chance

May 16, 2025

Dodgers Forgotten Prospect Finally Gets His Chance

May 16, 2025 -

Exploring Androids Refreshed Design Language

May 16, 2025

Exploring Androids Refreshed Design Language

May 16, 2025 -

Trumps Egg Price Forecast Fact Or Fiction A Deeper Look

May 16, 2025

Trumps Egg Price Forecast Fact Or Fiction A Deeper Look

May 16, 2025 -

Grab Your Boston Celtics Finals Gear Now Deals Under 20

May 16, 2025

Grab Your Boston Celtics Finals Gear Now Deals Under 20

May 16, 2025