Appeal Filed: FTC Challenges Judge's Decision On Microsoft-Activision Merger

Table of Contents

The FTC's Arguments Against the Merger

The FTC's core argument centers on the potential anti-competitive effects of the Microsoft-Activision merger. The commission believes the acquisition would significantly reduce competition in the already consolidated gaming market, giving Microsoft undue market power. Their appeal outlines several key concerns:

-

Reduced Competition in Console Gaming: The FTC argues that Microsoft's acquisition of Activision Blizzard would substantially lessen competition in the console gaming market, potentially leading to higher prices and fewer choices for consumers. They point to the dominance of PlayStation and Xbox as the main players and argue that this merger would tip the scales even further in Microsoft's favor.

-

Leveraging Call of Duty and Other Activision Titles: A major point of contention is Microsoft's control over hugely popular franchises like Call of Duty. The FTC fears Microsoft could use these titles to stifle competitors, either by making them exclusive to Xbox or by imposing unfavorable terms on other platforms. This could severely disadvantage Sony and other gaming companies.

-

Concerns About Subscription Services and Market Dominance: The FTC also expresses worry about Microsoft's growing Game Pass subscription service. Acquiring Activision Blizzard's extensive game library would further strengthen Game Pass, potentially creating an insurmountable barrier to entry for smaller competitors and solidifying Microsoft's dominance in the subscription market. The FTC highlights this as a potential path to monopoly.

-

Evidence Presented: The FTC’s appeal includes detailed market analysis, expert testimony, and internal Microsoft documents which, they claim, support their assertions regarding anti-competitive practices and the potential harm to consumers.

The Judge's Original Ruling and its Rationale

In contrast to the FTC's concerns, the judge who initially approved the merger argued that Microsoft's commitments to keep Call of Duty available on competing platforms mitigated the potential anti-competitive risks. The judge’s reasoning highlighted several key aspects:

-

Assessment of the Competitive Landscape: The judge considered the broader competitive landscape in the gaming industry, arguing that other significant players, such as Nintendo and cloud gaming services, would limit Microsoft's ability to exert undue influence.

-

Evaluation of Microsoft's Commitments: The judge found Microsoft's commitment to keeping Call of Duty available on PlayStation and other platforms for at least ten years to be a sufficient safeguard against anti-competitive behavior. This commitment was a key factor in the initial approval.

-

Weight Given to Evidence: The judge weighed the evidence presented by both sides – Microsoft and Activision Blizzard emphasized the benefits of the merger, while the FTC highlighted the potential harms. Ultimately, the judge found Microsoft's arguments more convincing in the context of the presented evidence.

Potential Implications of the Appeal

The FTC's appeal carries significant implications for the gaming industry and the broader tech sector. The outcome will set a precedent for future mergers and acquisitions.

-

FTC Wins Appeal: If the FTC successfully overturns the judge's decision, the merger will be blocked. This would send shockwaves through the gaming industry, potentially impacting stock prices and significantly altering the competitive landscape. It would also reinforce the regulatory scrutiny applied to large tech mergers.

-

FTC Loses Appeal: A loss for the FTC would likely allow the merger to proceed, raising concerns about Microsoft's growing market power. While Call of Duty’s continued availability on other platforms might lessen immediate concerns, long-term effects on competition remain a point of discussion.

-

Settlement Reached: It's possible that a settlement could be reached between the FTC and Microsoft, perhaps involving further concessions from Microsoft to address the FTC's concerns. This could involve stricter regulations or conditions attached to the merger's approval.

The Timeline and Next Steps

The appeal process is expected to take several months, if not longer. Key steps include:

-

Initial Hearings and Briefing Schedules: The appeal will likely involve initial hearings to establish procedural matters and set briefing schedules for both parties.

-

Oral Arguments: Oral arguments will be presented before the appellate court, allowing both sides to present their case directly to the judges.

-

Final Ruling: The appellate court will then issue a final ruling, potentially upholding or overturning the lower court's decision. The timeline for this final ruling remains uncertain, but could take many months.

Conclusion: The Future of the Microsoft-Activision Merger Remains Uncertain

The FTC's appeal against the Microsoft-Activision merger represents a pivotal moment for the gaming industry and antitrust law. The outcome will significantly shape the competitive landscape and set a precedent for future mergers and acquisitions in the tech sector. The arguments presented by both sides highlight the complexities of regulating large tech companies and the challenges of balancing innovation with preserving competition. Stay informed about developments in this ongoing Microsoft-Activision merger appeal and related antitrust cases to understand the evolving regulatory environment and its impact on the gaming industry and beyond. You can find updates on the FTC website and through reputable news sources covering the case.

Featured Posts

-

Reddits Top 12 Ai Stocks An Investors Guide

May 21, 2025

Reddits Top 12 Ai Stocks An Investors Guide

May 21, 2025 -

Juergen Klopp To Return To Liverpool Before The Final Game

May 21, 2025

Juergen Klopp To Return To Liverpool Before The Final Game

May 21, 2025 -

Understanding The Love Monster Character Analysis And Story Impact

May 21, 2025

Understanding The Love Monster Character Analysis And Story Impact

May 21, 2025 -

Premier League 2024 25 Winning Team Picture Special

May 21, 2025

Premier League 2024 25 Winning Team Picture Special

May 21, 2025 -

Honest Review Watercolor A New Play By A Young Writer

May 21, 2025

Honest Review Watercolor A New Play By A Young Writer

May 21, 2025

Latest Posts

-

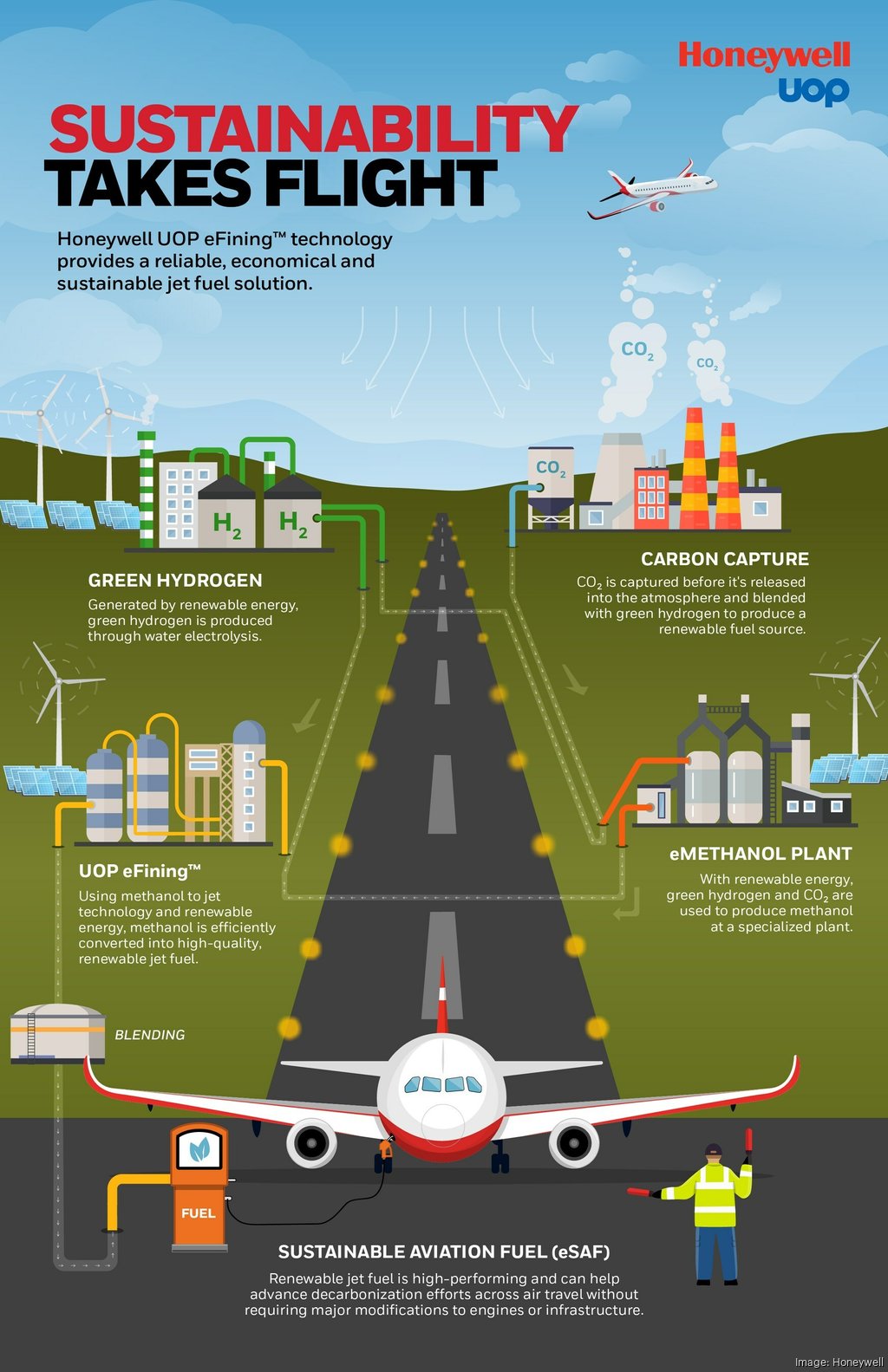

Honeywell And Johnson Matthey Near 1 8 B Deal

May 23, 2025

Honeywell And Johnson Matthey Near 1 8 B Deal

May 23, 2025 -

Johnson Matthey Sells Catalyst Unit To Honeywell For 2 4 Billion Impact And Analysis

May 23, 2025

Johnson Matthey Sells Catalyst Unit To Honeywell For 2 4 Billion Impact And Analysis

May 23, 2025 -

Honeywells 2 4 Billion Acquisition Of Johnson Mattheys Catalyst Unit A Deep Dive

May 23, 2025

Honeywells 2 4 Billion Acquisition Of Johnson Mattheys Catalyst Unit A Deep Dive

May 23, 2025 -

Honeywells Acquisition Of Johnson Mattheys Catalyst Technologies Boosting Its Process Technology Capabilities

May 23, 2025

Honeywells Acquisition Of Johnson Mattheys Catalyst Technologies Boosting Its Process Technology Capabilities

May 23, 2025 -

Reaching 100 Test Wickets The Challenges Facing Zimbabwes Muzarabani

May 23, 2025

Reaching 100 Test Wickets The Challenges Facing Zimbabwes Muzarabani

May 23, 2025