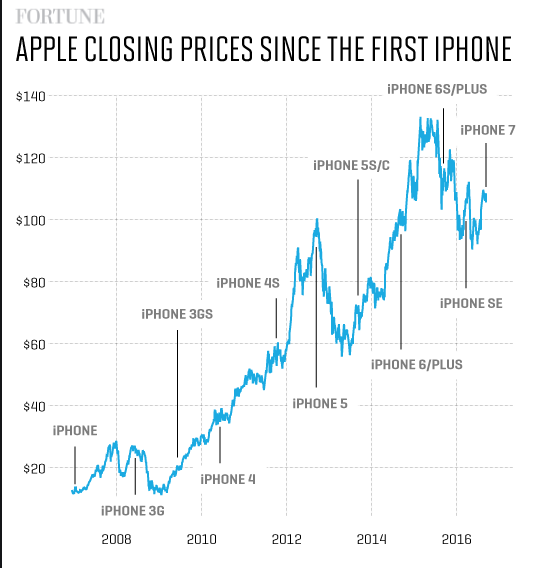

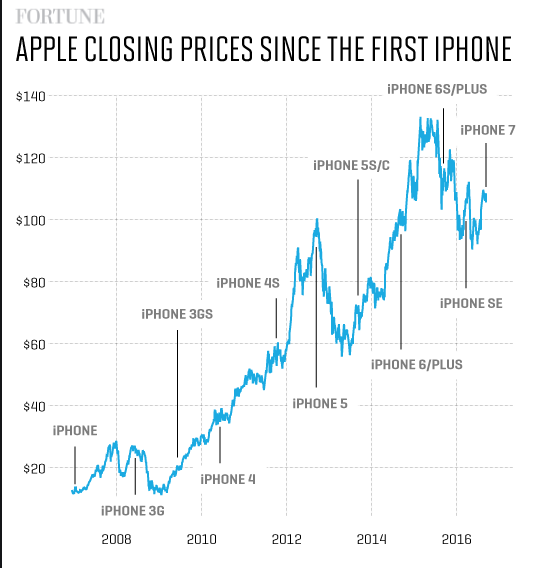

Apple Stock Analysis: IPhone Drives Strong Q2 Results

Table of Contents

iPhone Sales: The Engine of Growth

Record iPhone Sales:

Apple reported record iPhone sales in Q2, exceeding analyst expectations and outperforming previous quarters.

- Sales Figures: Specific numbers (replace with actual Q2 data) showing a significant year-over-year increase in iPhone unit sales. For example: "iPhone sales reached X million units, a Y% increase compared to Q2 of the previous year."

- Percentage Growth: Highlight the percentage growth compared to the same quarter last year and the previous quarter, demonstrating consistent upward momentum.

- Market Share Gains: Mention any significant gains in market share compared to competitors like Samsung and other Android manufacturers. This showcases Apple's dominance in the premium smartphone market.

The strong iPhone sales can be attributed to several factors:

- iPhone 14 Series Success: The launch of the iPhone 14 series, with its improved features and camera capabilities, drove significant demand.

- Effective Marketing Campaigns: Apple's marketing efforts effectively highlighted the new features and benefits of the iPhone 14, attracting a wide range of consumers.

- Strong Consumer Demand: Despite economic headwinds, consumer demand for premium smartphones remained robust, benefiting Apple's high-end positioning.

- Geographic Performance: Note any specific regions that showed exceptionally strong iPhone sales growth. This provides valuable insights into market dynamics and future growth potential.

iPhone Pricing Strategy:

Apple's premium pricing strategy continues to be a key driver of revenue and profitability.

- Price Points: Discuss the price points of the various iPhone models (iPhone 14, 14 Plus, 14 Pro, 14 Pro Max) and how they cater to different market segments.

- Impact of Inflation: Analyze how inflation may have influenced Apple's pricing decisions, and the extent to which price increases have affected sales volume.

Apple's premium pricing strategy has several advantages:

- Brand Perception: Maintaining high prices reinforces Apple's brand image as a provider of high-quality, premium products.

- Profitability: Higher prices translate directly into higher profit margins, contributing to Apple's overall financial strength.

- Competitive Positioning: While facing competition, Apple maintains a distinct position in the market, focusing on innovation and premium features rather than solely competing on price.

Services Revenue Continues to Shine

Growth in Subscription Services:

Apple's services segment, encompassing the App Store, Apple Music, iCloud, Apple TV+, and other subscription services, continues to demonstrate impressive growth.

- Revenue Growth: Quantify the growth in services revenue, highlighting the percentage increase compared to the previous year and quarter.

- Key Drivers: Identify the primary drivers of this growth, such as increased user subscriptions, higher engagement with existing services, and the addition of new features within existing services.

The expansion and growth within the services sector is attributed to:

- New Service Offerings: Mention any recent additions or expansions to existing services that contributed to the growth.

- Market Expansion: Discuss any geographic expansion or efforts to attract new user demographics.

- Increased User Engagement: Highlight initiatives aimed at increasing user engagement and retention within Apple's services ecosystem.

Diversification and Future Growth Potential:

The continued growth of Apple's services segment is crucial for reducing reliance on hardware sales and creating a more stable and predictable revenue stream.

- Future Service Offerings: Discuss potential future services or partnerships that could further fuel growth in this sector. This could include areas like augmented reality, healthcare, or further expansion into the metaverse.

- Reduced Hardware Dependence: Emphasize the importance of a robust services segment in mitigating risks associated with fluctuating hardware sales.

A thriving services segment offers significant long-term implications:

- Financial Health: A diverse revenue stream strengthens Apple's financial position and resilience against economic downturns.

- Stock Valuation: A strong services segment contributes to a higher overall valuation of Apple stock, making it more attractive to investors.

Other Product Lines and Their Impact

Mac and iPad Performance:

The performance of Macs and iPads in Q2 provides further insight into the overall health of Apple's product portfolio.

- Sales Figures and Growth: Present sales figures for Macs and iPads, indicating growth or decline compared to previous quarters.

- Factors Affecting Performance: Discuss factors like market competition (e.g., Windows PCs, Android tablets), supply chain issues, or the product lifecycle stage (e.g., anticipation of new models).

An analysis of this segment provides valuable context:

- Market Trends: The performance of Macs and iPads reflects broader trends in the personal computing and tablet markets.

- Product Lifecycle: Understanding the product lifecycle of Macs and iPads helps predict future sales and the need for product refreshes.

Wearables, Home, and Accessories:

Apple's wearables, home, and accessories category continues to contribute significantly to overall revenue.

- Sales Figures and Growth Rates: Provide sales figures and growth rates for this category, showcasing its consistent performance.

- Significant Product Launches: Mention any noteworthy product launches or updates within this category that may have impacted sales.

This segment's performance highlights:

- Ecosystem Integration: The success of this segment underlines the strength of Apple's overall ecosystem, where devices and services complement each other.

- Growth Potential: The wearables market, in particular, offers significant opportunities for future growth.

Future Outlook for Apple Stock

Potential Challenges and Opportunities:

While Apple's Q2 results were strong, several factors could influence its future performance.

- Economic Downturn: Discuss the potential impact of an economic recession on consumer spending and demand for Apple products.

- Supply Chain Disruptions: Assess the ongoing risk of supply chain disruptions and their potential to affect production and sales.

- Competition: Analyze the competitive landscape and the potential for increased competition from other technology companies.

- Technological Advancements: Discuss the need for continuous innovation to maintain Apple's leading position in the market.

Understanding potential challenges is as important as recognizing opportunities:

- Innovation: Apple's consistent ability to innovate and launch new products will be crucial for long-term growth.

- Market Expansion: Expanding into new markets and demographics offers further growth potential.

Analyst Predictions and Investor Sentiment:

Financial analysts' opinions and investor sentiment provide valuable insights into the future of Apple stock.

- Target Prices and Ratings: Summarize the target prices and ratings from prominent analysts, providing a range of opinions on the stock's potential.

- Investor Confidence: Assess the level of investor confidence in Apple stock, considering any significant shifts in sentiment.

The overall market outlook is also important:

- Technology Stock Performance: The performance of the broader technology sector often influences the price of individual technology stocks, including Apple stock.

- Economic Factors: Macroeconomic factors like interest rates and inflation also play a role in investor sentiment.

Conclusion

Apple's Q2 performance, driven by strong iPhone sales and consistent growth in its services segment, paints a positive picture for the company. While challenges remain, Apple's diversified product portfolio and robust ecosystem position it favorably for continued growth. This analysis suggests that despite market volatility, Apple stock remains an attractive investment opportunity. For further insights and continued monitoring of Apple stock, stay tuned for future updates and consider consulting a financial advisor before making any investment decisions.

Featured Posts

-

The Nfls Tush Push A Celebratory Look At A Surviving Tradition

May 24, 2025

The Nfls Tush Push A Celebratory Look At A Surviving Tradition

May 24, 2025 -

Get Your Bbc Radio 1 Big Weekend Tickets Everything You Need To Know

May 24, 2025

Get Your Bbc Radio 1 Big Weekend Tickets Everything You Need To Know

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025 -

Joy Crookes Shares New Music The Carmen Single

May 24, 2025

Joy Crookes Shares New Music The Carmen Single

May 24, 2025 -

La Lutte Contre La Dissidence Chinoise En France

May 24, 2025

La Lutte Contre La Dissidence Chinoise En France

May 24, 2025

Latest Posts

-

Updated Italian Citizenship Law Eligibility Through Great Grandparents

May 24, 2025

Updated Italian Citizenship Law Eligibility Through Great Grandparents

May 24, 2025 -

Jony Ives Ai Company The Open Ai Acquisition Speculation

May 24, 2025

Jony Ives Ai Company The Open Ai Acquisition Speculation

May 24, 2025 -

Harnessing Space Crystals For Advanced Pharmaceuticals

May 24, 2025

Harnessing Space Crystals For Advanced Pharmaceuticals

May 24, 2025 -

How Trumps Cuts Are Reshaping Museum Programming In America

May 24, 2025

How Trumps Cuts Are Reshaping Museum Programming In America

May 24, 2025 -

Viral Video Tik Tokers Encounter With Pope Leo Years After Confirmation

May 24, 2025

Viral Video Tik Tokers Encounter With Pope Leo Years After Confirmation

May 24, 2025