Apple Stock Forecast: $254 Price Target - Should You Buy Now?

Table of Contents

Analyzing the $254 Apple Stock Price Target

Factors Contributing to the $254 Target

Several positive factors contribute to the optimistic $254 Apple stock price target. Apple's continued dominance in the smartphone market, driven by strong iPhone sales, remains a cornerstone of its success. Furthermore, the company's burgeoning services revenue, encompassing Apple Music, iCloud, Apple TV+, and other offerings, demonstrates impressive growth potential. This diversification reduces reliance on hardware sales alone, creating a more resilient revenue stream. Innovative new products, such as the highly anticipated Vision Pro headset, promise to further fuel growth and attract new customer segments.

- Strong iPhone Sales: Despite economic headwinds, iPhone sales remain robust, consistently exceeding expectations.

- Booming Services Revenue: Apple's services sector is experiencing rapid expansion, demonstrating a significant recurring revenue model. Year-over-year growth in this sector is consistently above 10%. [Link to reputable financial news source]

- Innovative New Products: The Vision Pro represents a significant leap into augmented and virtual reality, potentially opening a new frontier for Apple.

- Robust Financial Health: Apple maintains a strong balance sheet with substantial cash reserves, providing financial flexibility and stability.

Potential Risks and Challenges

While the outlook is positive, several potential downsides could impact the $254 Apple stock price target. Global economic uncertainty presents a significant risk, potentially affecting consumer spending and impacting demand for Apple products. Increased competition in the smartphone market, particularly from Android manufacturers, remains a persistent challenge. Supply chain disruptions, though less prevalent than in recent years, still carry the potential to cause production delays and impact revenue. Finally, regulatory scrutiny and potential legal battles in various jurisdictions could pose headwinds for the company.

- Global Economic Uncertainty: A recession or significant economic slowdown could significantly impact consumer discretionary spending.

- Intense Competition: Android manufacturers continue to innovate, posing a threat to Apple's market share.

- Supply Chain Disruptions: Geopolitical instability and unforeseen events could disrupt Apple's supply chains.

- Regulatory Hurdles: Increasing regulatory scrutiny globally could lead to increased compliance costs and potential fines.

Apple Stock Valuation and Comparison to Peers

Analyzing Apple's Valuation Metrics

Understanding Apple's valuation is crucial for assessing the $254 price target. Analyzing key metrics like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio provides insight into its relative valuation compared to historical data and industry benchmarks. A high P/E ratio can suggest investor optimism for future growth, but it also carries higher risk. A thorough examination of these metrics, in conjunction with the company's financial statements, is essential for a comprehensive assessment.

- P/E Ratio: Comparing Apple's current P/E ratio to its historical average and to competitors reveals whether it's overvalued or undervalued. [Link to a reliable financial data source]

- Price-to-Sales Ratio (P/S): This metric provides another perspective on Apple's valuation, particularly useful when considering its high profitability and strong brand. [Link to a reliable financial data source]

- Other Valuation Metrics: Consider other relevant metrics such as PEG ratio and dividend yield to gain a well-rounded view of Apple's valuation.

Comparison with Competitors

Comparing Apple to its main competitors, such as Microsoft, Google (Alphabet), and Amazon, helps contextualize its performance and valuation. While all four companies are tech giants, they operate in different sectors, creating unique growth opportunities and risk profiles. Microsoft's strength in enterprise software, Google's dominance in search and advertising, and Amazon's leadership in e-commerce and cloud computing all present distinct competitive landscapes. A comparative analysis helps identify relative strengths and weaknesses for informed investment decisions.

- Microsoft: Strong in enterprise software and cloud services (Azure).

- Google (Alphabet): Dominates online search and advertising, with growing cloud services.

- Amazon: Leader in e-commerce, cloud computing (AWS), and other diverse businesses.

Should You Buy Apple Stock Now? Investment Strategies

Considering Your Risk Tolerance

Before investing in Apple stock, or any stock for that matter, critically assess your personal risk tolerance. Investing in the stock market always carries inherent risk, and Apple stock, while generally considered a relatively stable blue-chip stock, is not immune to market fluctuations. The potential rewards of investing in Apple are significant, but so are the potential downsides. Understand your comfort level with potential losses before making any investment decisions.

Diversification and Long-Term Investment

Diversification is a cornerstone of sound investment strategy. Don't put all your eggs in one basket. Consider diversifying your investment portfolio across different asset classes and sectors to mitigate risk. For long-term investors, Apple stock, given its historical performance and projected growth, could be a valuable addition to a diversified portfolio. The $254 Apple stock price target, while optimistic, is only one perspective.

Conclusion: Final Thoughts on the Apple Stock Forecast and $254 Price Target

The $254 Apple stock price target presents an intriguing possibility, supported by strong fundamentals and growth prospects. However, it's crucial to acknowledge potential risks, including global economic uncertainty and competition. Thoroughly analyze Apple's valuation metrics, compare it to its peers, and carefully consider your personal risk tolerance before making any investment decisions. While the potential for growth is there, remember that no investment is guaranteed. While the $254 Apple stock price target presents an enticing prospect, remember to conduct thorough due diligence before making any investment decisions. Analyze your personal risk tolerance and financial goals before committing to buying Apple stock. Remember to consult a financial advisor for personalized guidance.

Featured Posts

-

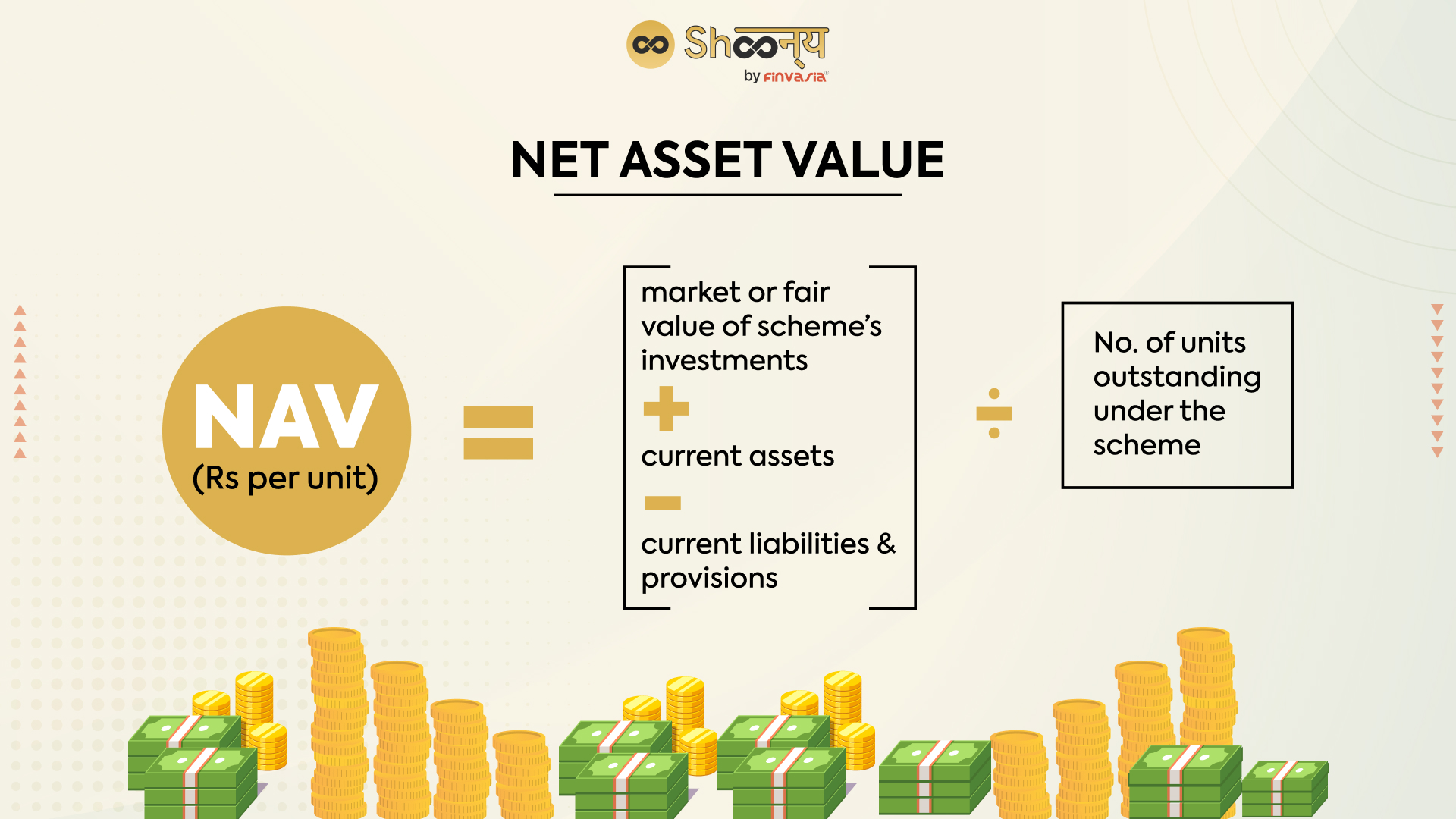

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc Investment Implications

May 24, 2025

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc Investment Implications

May 24, 2025 -

Inside The Inaugural Ferrari Service Centre Bengaluru

May 24, 2025

Inside The Inaugural Ferrari Service Centre Bengaluru

May 24, 2025 -

French Stock Market Cac 40 Week Ending March 7 2025 Analysis

May 24, 2025

French Stock Market Cac 40 Week Ending March 7 2025 Analysis

May 24, 2025 -

Sergey Yurskiy 90 Let Geniyu Paradoksov

May 24, 2025

Sergey Yurskiy 90 Let Geniyu Paradoksov

May 24, 2025 -

The Legal Battle Over Character Ais Chatbots And Freedom Of Speech

May 24, 2025

The Legal Battle Over Character Ais Chatbots And Freedom Of Speech

May 24, 2025

Latest Posts

-

Covid 19 Pandemic Lab Owners Guilty Plea For False Test Results

May 24, 2025

Covid 19 Pandemic Lab Owners Guilty Plea For False Test Results

May 24, 2025 -

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025 -

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025 -

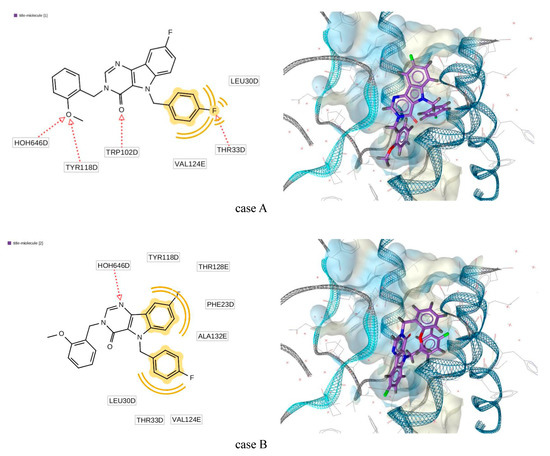

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025