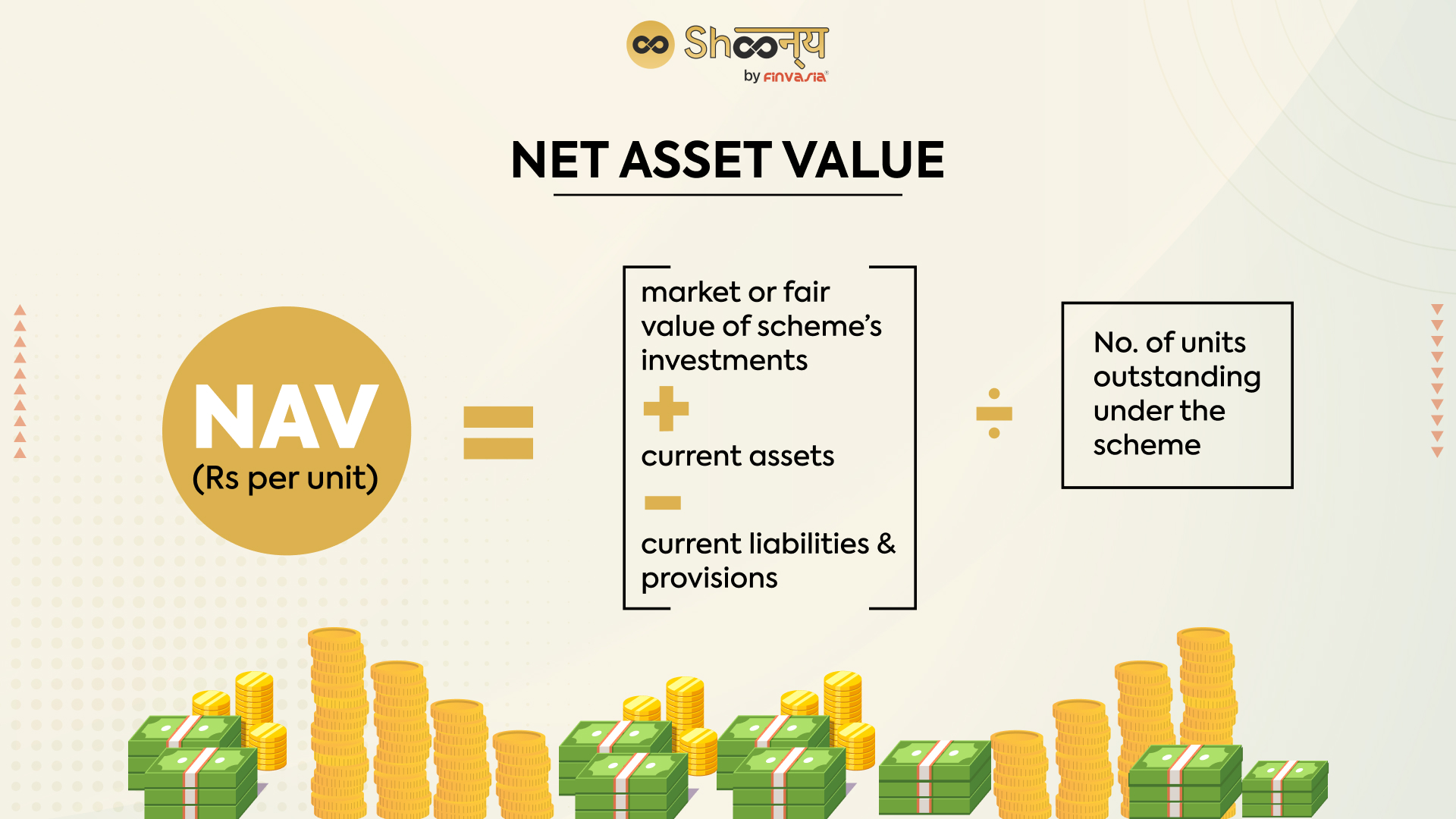

Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc: Investment Implications

Table of Contents

Factors Influencing the Amundi MSCI All Country World UCITS ETF USD Acc NAV

The Amundi MSCI All Country World UCITS ETF USD Acc NAV is not static; it fluctuates daily, reflecting the underlying performance of the assets it holds. Several key factors contribute to these changes:

-

Global market performance: The ETF tracks a broad global index, meaning its NAV is heavily influenced by the overall performance of global stock markets. Strong performance in the US stock market, European markets, or emerging markets will generally lead to a higher NAV, while downturns will have the opposite effect. For example, a positive growth period in Asia-Pacific markets would positively affect the ETF’s NAV. Conversely, a significant correction in the US technology sector could negatively impact the NAV.

-

Currency fluctuations: Since the ETF is denominated in USD, fluctuations in exchange rates between the USD and other major currencies (like the Euro, Yen, or Pound) directly impact the NAV. A strengthening USD relative to other currencies will generally increase the NAV (assuming all else is equal), while a weakening USD will tend to decrease it. This effect is particularly noticeable for holdings in non-USD denominated markets.

-

Individual stock performance: The ETF's holdings comprise a vast number of individual stocks across various sectors and geographies. The performance of each individual stock within the portfolio contributes to the overall NAV. Strong performance by key holdings will bolster the NAV, while underperformance of certain sectors could pull the NAV downwards.

-

Expense ratio and management fees: The ETF incurs expenses related to management, administration, and trading. These expenses are deducted from the assets under management, which, in turn, impacts the NAV. While the expense ratio is relatively small, it does gradually affect the overall NAV over time.

-

Dividend distributions and reinvestment: Dividend payments from the underlying stocks within the ETF reduce the NAV on the ex-dividend date. However, if these dividends are reinvested back into the ETF, this will partially offset the reduction in NAV in the long term.

Interpreting NAV Changes and Investment Strategies

Understanding how to interpret changes in the Amundi MSCI All Country World UCITS ETF USD Acc NAV is crucial for effective investment management.

-

Distinguishing between short-term volatility and long-term trends: Daily or even weekly fluctuations in NAV are normal, especially in a globally diversified ETF. Focus on long-term trends rather than getting caught up in short-term volatility. A long-term perspective is key to success.

-

Analyzing NAV changes in relation to market benchmarks: Compare the Amundi MSCI All Country World UCITS ETF USD Acc NAV performance to relevant benchmarks like the MSCI All Country World Index to assess its relative performance. This will help you understand whether the ETF is tracking its benchmark effectively.

-

Using NAV data to assess the ETF's performance against its investment objective: The ETF's investment objective is usually clearly defined in its prospectus. By monitoring the NAV against this objective, you can assess whether the ETF is achieving its goals.

-

Developing appropriate investment strategies based on NAV analysis: Consider strategies like dollar-cost averaging, where you invest a fixed amount of money at regular intervals, irrespective of NAV fluctuations. This reduces the risk associated with market timing. Such strategies help mitigate the risk of buying high and selling low.

Accessing Amundi MSCI All Country World UCITS ETF USD Acc NAV Data

Reliable and up-to-date NAV information is essential for informed decision-making. Here are some trustworthy sources:

-

Official ETF provider website (Amundi): The Amundi website is the primary source for accurate and official NAV data.

-

Financial news websites and data providers: Reputable financial websites such as Bloomberg, Yahoo Finance, and Google Finance typically provide daily NAV updates for major ETFs.

-

Brokerage platforms: If you hold the ETF through a brokerage account, your brokerage platform will usually provide real-time or near real-time NAV information.

Comparing NAV to Market Price (Premium/Discount)

While the NAV represents the theoretical value of the ETF's underlying assets, the market price is the actual price at which the ETF trades on the exchange. Sometimes, a discrepancy arises, creating a premium (market price > NAV) or a discount (market price < NAV).

-

Understanding premium and discount scenarios: Premiums might arise due to high demand for the ETF, while discounts could be caused by low trading volume or other market factors.

-

Factors contributing to these discrepancies: Supply and demand dynamics, trading costs, and market sentiment are some of the factors that drive these discrepancies.

-

Implications for investment decisions: A discount might present a buying opportunity, while a premium might signal a potential selling point, although this isn't always the case. Thoroughly analyze the situation before making any decisions based on these discrepancies.

Conclusion

The Amundi MSCI All Country World UCITS ETF USD Acc NAV is a dynamic indicator reflecting the performance of a globally diversified portfolio. Understanding the factors influencing its fluctuations, how to interpret NAV changes, and where to find reliable data are crucial for successful investment management. Remember to focus on the long-term trends, rather than being swayed by short-term volatility. Stay informed about your Amundi MSCI All Country World UCITS ETF USD Acc NAV to make informed investment decisions and optimize your portfolio's performance. Track your Amundi MSCI All Country World UCITS ETF USD Acc NAV for optimal investment results. Learn more about managing your investment based on Amundi MSCI All Country World UCITS ETF USD Acc NAV to ensure you are making the most of your global investment strategy.

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Ex United States Ucits Etf Acc Explained

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ex United States Ucits Etf Acc Explained

May 24, 2025 -

Escape To The Country Nicki Chapmans Profitable Property Investment

May 24, 2025

Escape To The Country Nicki Chapmans Profitable Property Investment

May 24, 2025 -

Nemecke Firmy A Masivne Prepustanie Analyza Situacie Na H Nonline Sk

May 24, 2025

Nemecke Firmy A Masivne Prepustanie Analyza Situacie Na H Nonline Sk

May 24, 2025 -

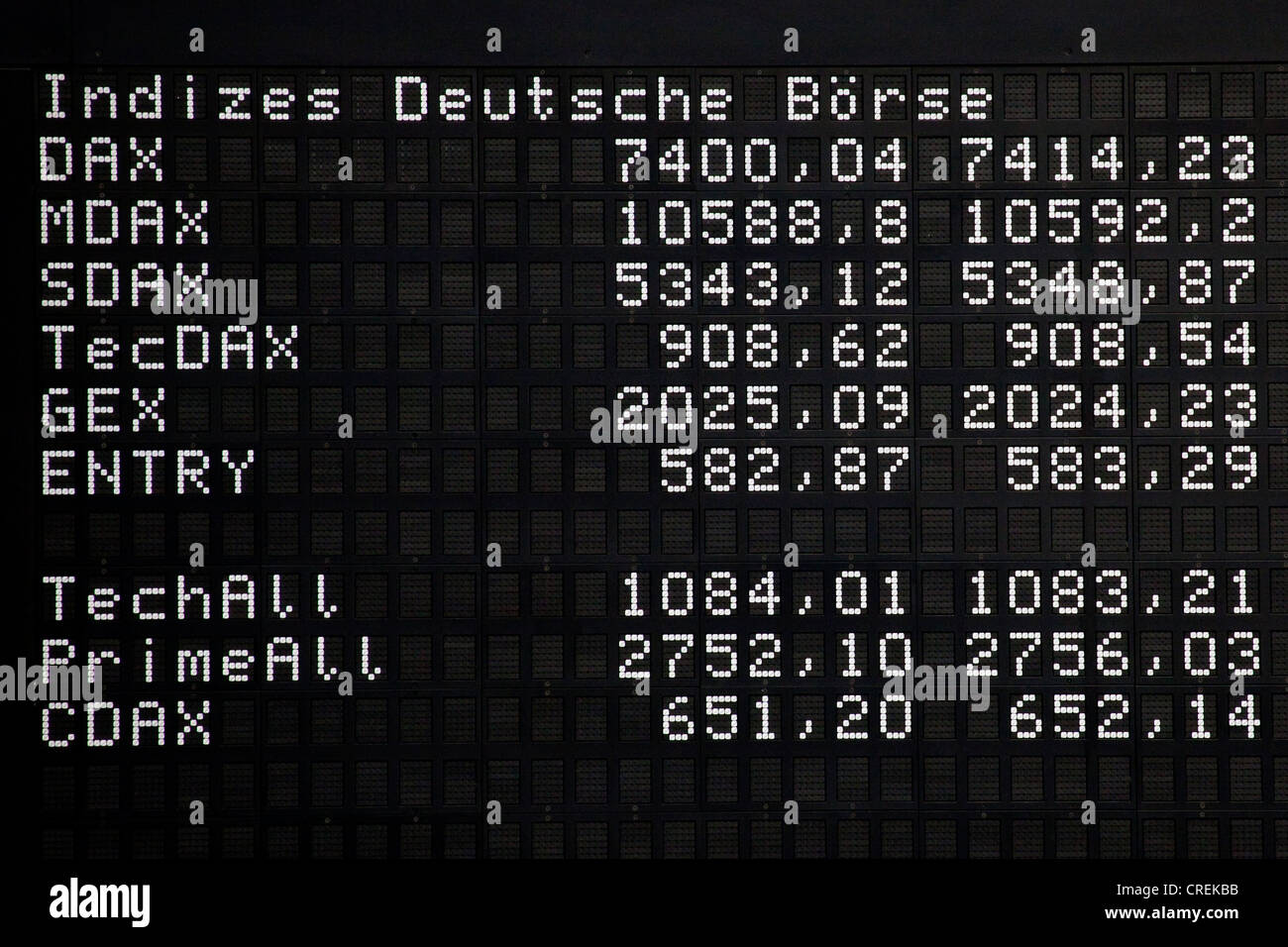

Frankfurt Stock Exchange Dax Climbs Towards New Record At Opening

May 24, 2025

Frankfurt Stock Exchange Dax Climbs Towards New Record At Opening

May 24, 2025 -

Top 10 Fastest Standard Production Ferraris Fiorano Lap Times

May 24, 2025

Top 10 Fastest Standard Production Ferraris Fiorano Lap Times

May 24, 2025

Latest Posts

-

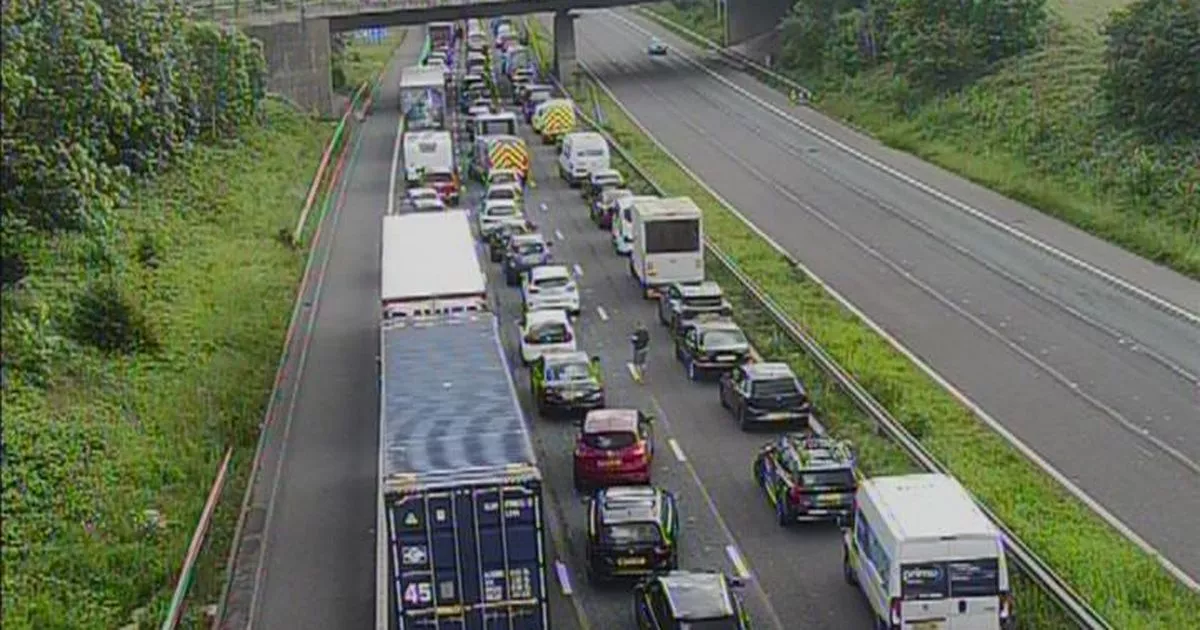

Severe M56 Crash Causes Significant Traffic Disruption Get Live Updates

May 24, 2025

Severe M56 Crash Causes Significant Traffic Disruption Get Live Updates

May 24, 2025 -

M56 Road Closure Live Traffic And Travel Updates After Accident

May 24, 2025

M56 Road Closure Live Traffic And Travel Updates After Accident

May 24, 2025 -

Long Queues On M56 Due To Crash Current Traffic Conditions

May 24, 2025

Long Queues On M56 Due To Crash Current Traffic Conditions

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025 -

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025