Apple Stock Plummets: $900 Million Tariff Impact

Table of Contents

The $900 Million Tariff Hit: A Detailed Breakdown

The newly imposed tariffs represent a substantial increase in the cost of manufacturing and importing several key Apple products. While the exact breakdown of which products are affected may vary slightly depending on the specific tariff schedules, the impact centers primarily on products manufactured in China. This includes flagship products like iPhones, iPads, and MacBooks. The percentage increase in costs due to these tariffs varies depending on the product and its component parts, but estimates suggest an average increase in the range of 5-15%, significantly impacting Apple's profit margins.

- Geographical Regions Impacted:

- Increased tariffs on products manufactured in China, impacting a large portion of Apple's production.

- Potential disruption to Apple's supply chain diversification strategies as it seeks alternative manufacturing locations.

- The tariff's effect is most pronounced on higher-priced products like iPhones and MacBooks, potentially affecting consumer demand.

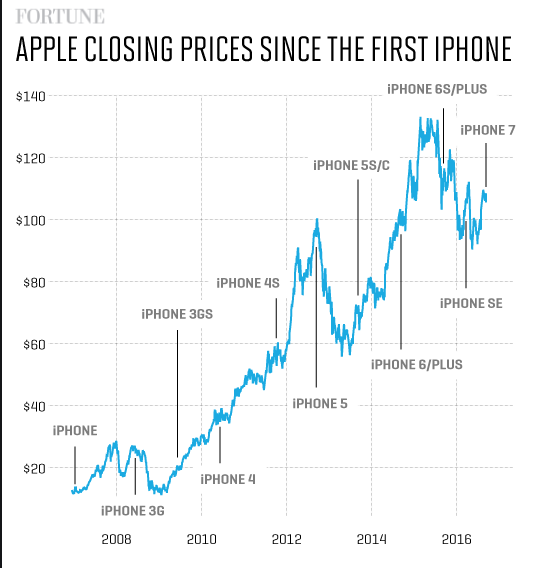

Impact on Apple's Profitability and Stock Price

The $900 million tariff hit directly impacts Apple's profitability. This translates to a reduced profit margin on each unit sold, forcing the company to either absorb the increased costs, reducing overall profit, or pass them on to consumers through price increases. The stock market reacted swiftly and negatively to the news, showcasing the volatility of Apple stock in the face of unexpected economic headwinds. Following the tariff announcement, Apple's stock price experienced a significant percentage drop, with analysts citing the tariffs as a primary driver of this decline.

- Possible Consequences:

- Reduced consumer demand due to higher prices, particularly in price-sensitive markets.

- Apple absorbing some costs, impacting its overall profitability and potentially affecting future investments and research & development.

- Negative investor sentiment leading to further stock price depreciation and increased uncertainty for shareholders.

Apple's Strategic Response to the Tariffs

Apple has yet to release a comprehensive, public strategy to mitigate the impact of the $900 million tariff hit. However, several possible countermeasures are being considered and some actions have been hinted at in company statements. These include:

- Price Increases: Passing the increased costs onto consumers through higher prices is a straightforward, though potentially risky, option. This could lead to decreased sales, especially in competitive markets.

- Production Diversification: Shifting production to other countries like Vietnam or India would be a longer-term solution, requiring substantial investments in new facilities and infrastructure. This may also lead to temporary production slowdowns.

- Lobbying Efforts: Apple may increase its lobbying efforts to influence trade policy and potentially reduce or eliminate the tariffs.

Broader Implications for Investors and the Tech Industry

The $900 million tariff impact on Apple has broader implications that extend beyond the company itself. The ripple effect touches the broader tech industry and the global economy. Other companies relying on manufacturing in affected regions face similar challenges, creating increased uncertainty in the market. Investors are reevaluating their strategies, considering the potential for further tariff escalations and the increased risks associated with companies heavily reliant on specific manufacturing hubs.

- Concerns for Investors:

- Increased market uncertainty due to unpredictable trade policies.

- Potential for further tariff increases impacting various sectors of the economy.

- Need for a reassessment of investment strategies in the tech sector and beyond, diversifying holdings to mitigate risk.

Conclusion

The $900 million tariff impact on Apple has undeniably caused a significant plummet in its stock price, demonstrating the vulnerability of even tech giants to geopolitical factors and trade disputes. Understanding the intricacies of these tariffs, their impact on Apple's profitability, and the company's strategic response is crucial for investors and anyone interested in the future of the tech industry. The situation remains dynamic. Continued monitoring of Apple stock, trade relations, and the overall economic climate is vital. Consider diversifying your portfolio to mitigate the risks associated with Apple stock and other companies affected by trade policies. Stay informed about future developments regarding Apple stock and the ongoing impact of tariffs to make informed investment decisions.

Featured Posts

-

Joy Crookes Unveils New Single Carmen

May 24, 2025

Joy Crookes Unveils New Single Carmen

May 24, 2025 -

Analyzing The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025

Analyzing The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025 -

The Legal Battle Over Character Ais Chatbots And Freedom Of Speech

May 24, 2025

The Legal Battle Over Character Ais Chatbots And Freedom Of Speech

May 24, 2025 -

Apple Stock Analysis I Phone Drives Strong Q2 Results

May 24, 2025

Apple Stock Analysis I Phone Drives Strong Q2 Results

May 24, 2025 -

Reduced Budgets Reduced Accessibility The State Of Gaming

May 24, 2025

Reduced Budgets Reduced Accessibility The State Of Gaming

May 24, 2025

Latest Posts

-

Goroskopy I Predskazaniya Polniy Prognoz Na Mesyats

May 24, 2025

Goroskopy I Predskazaniya Polniy Prognoz Na Mesyats

May 24, 2025 -

Astrologicheskie Goroskopy I Predskazaniya

May 24, 2025

Astrologicheskie Goroskopy I Predskazaniya

May 24, 2025 -

Goroskopy I Predskazaniya Lyubov Karera Zdorove

May 24, 2025

Goroskopy I Predskazaniya Lyubov Karera Zdorove

May 24, 2025 -

Luchshie Goroskopy I Predskazaniya Dlya Znakov Zodiaka

May 24, 2025

Luchshie Goroskopy I Predskazaniya Dlya Znakov Zodiaka

May 24, 2025 -

Tochnye Goroskopy I Predskazaniya Na Nedelyu

May 24, 2025

Tochnye Goroskopy I Predskazaniya Na Nedelyu

May 24, 2025