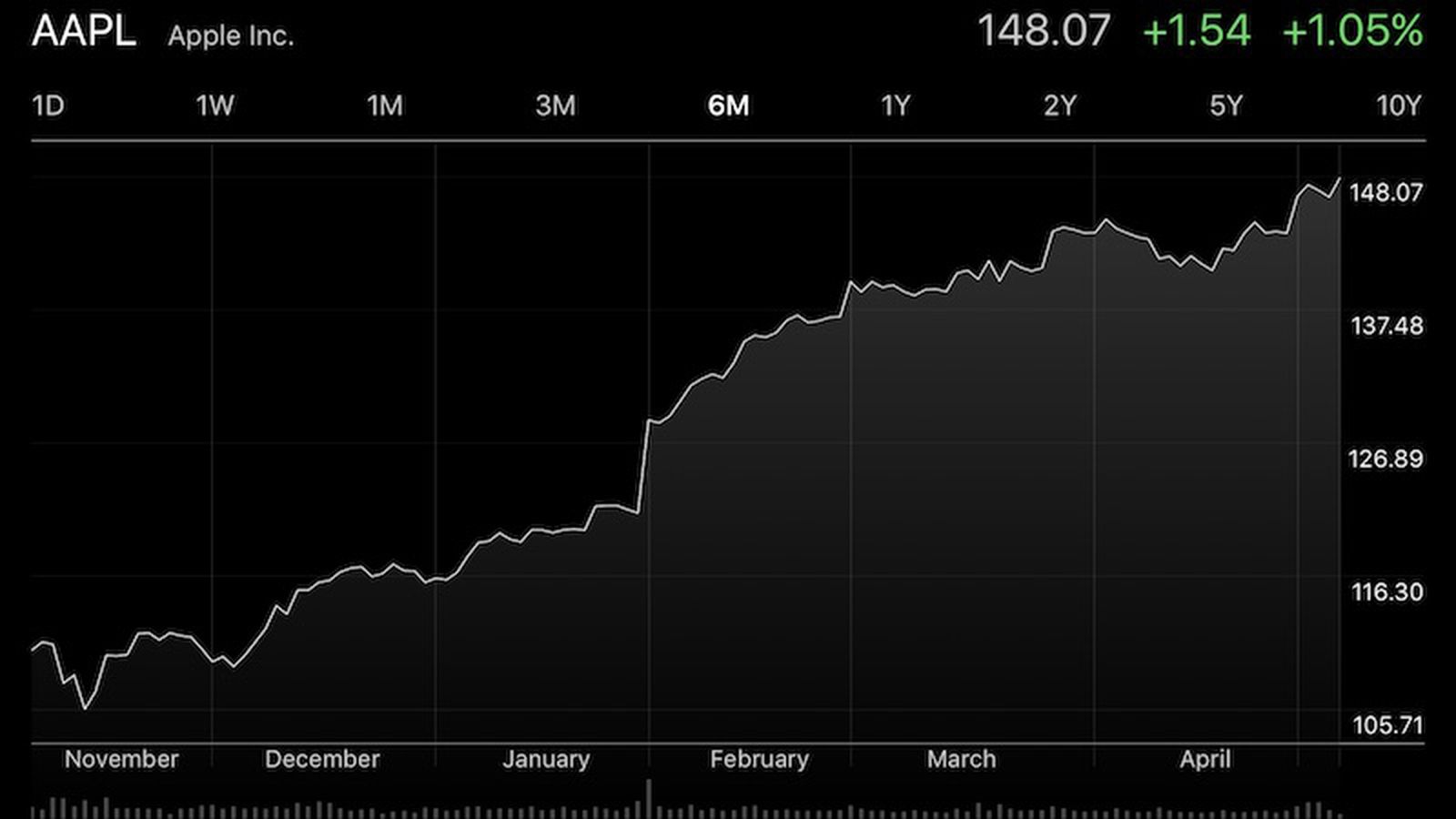

Apple Stock Under Pressure Ahead Of Q2 Results

Table of Contents

Weakening Demand and Supply Chain Concerns

Concerns regarding weakening iPhone demand, particularly in major markets like China, and persistent supply chain disruptions are significantly impacting Apple stock. These factors are intertwined and contribute to a less-than-rosy outlook for some analysts. The global macroeconomic climate is exacerbating these challenges.

- Decreased iPhone sales projections from analysts: Several prominent financial analysts have lowered their sales projections for iPhones in Q2, citing softening consumer spending. This directly impacts Apple's revenue and profit margins, influencing investor confidence.

- Impact of inflation and rising interest rates on consumer spending: Soaring inflation and rising interest rates are reducing consumer disposable income. As a result, consumers are delaying non-essential purchases, including premium electronics like iPhones. This decreased consumer spending power presents a significant headwind for Apple.

- Potential delays in new product launches due to supply chain issues: Ongoing supply chain bottlenecks and component shortages continue to pose a risk to Apple's ability to launch new products on time. Delays can disrupt sales cycles and negatively impact investor sentiment.

- Analysis of competitor performance in the smartphone market: The performance of Apple's competitors in the smartphone market also plays a role. Stronger-than-expected sales from competitors could indicate a shift in market share and further pressure Apple stock.

The Impact of Inflation and Economic Uncertainty

The current macroeconomic environment is fraught with uncertainty, impacting investor sentiment towards Apple and the tech sector as a whole. Inflation and the potential for a recession are key factors driving this uncertainty.

- Discussion of rising inflation and its effect on consumer discretionary spending: High inflation erodes purchasing power, leading consumers to cut back on discretionary spending, impacting demand for Apple products. This is a major factor impacting Apple stock price.

- Analysis of Federal Reserve policy and its influence on interest rates: The Federal Reserve's monetary policy tightening, aimed at curbing inflation, is raising interest rates. Higher interest rates increase borrowing costs for businesses and consumers, further dampening economic growth and impacting investment decisions.

- Explanation of the correlation between economic uncertainty and stock market volatility: Economic uncertainty generally leads to increased volatility in the stock market. Investors become more risk-averse, leading to price fluctuations and impacting Apple stock price.

- Comparison of Apple's performance against other tech giants during periods of economic downturn: Examining how Apple has performed historically during economic downturns can provide insights into potential future performance and inform investment strategies.

Expectations for Apple's Q2 Earnings Report

Apple's Q2 earnings report will be closely scrutinized by investors, who will be looking for clues about the company's future prospects. Key metrics to watch include earnings per share (EPS), revenue growth, product-specific sales figures (particularly iPhone sales), and the company's financial guidance.

- Summary of analyst consensus estimates for Q2 earnings: Analysts' consensus estimates provide a benchmark against which Apple's actual results will be compared. Any significant deviation from these estimates will likely impact the stock price.

- Key performance indicators (KPIs) to monitor in the earnings report: Investors should pay close attention to KPIs such as revenue growth, profit margins, and unit sales across different product categories.

- Potential for upside or downside surprises based on recent market trends: Given the current market conditions, there is potential for both upside and downside surprises in Apple's Q2 earnings report. Meeting or exceeding expectations could boost the stock price, while falling short could trigger a decline.

- Importance of management commentary and future guidance: Management's commentary during the earnings call and their outlook for future quarters will be crucial for assessing Apple's long-term prospects and informing investor decisions.

Strategies for Investors Navigating the Uncertainty

Navigating the uncertainty surrounding Apple stock requires a thoughtful investment strategy. This is not financial advice, but rather strategies to consider.

- Importance of a diversified investment portfolio: Diversification is a cornerstone of sound risk management. Spreading investments across different asset classes can help mitigate the impact of any single stock's performance.

- Strategies for managing risk in a volatile market: Investors should consider risk management techniques such as stop-loss orders to limit potential losses.

- Considerations for long-term versus short-term investment strategies: A long-term investment horizon can help weather short-term market fluctuations. Short-term investors may need a more reactive strategy.

- Emphasis on conducting thorough research before making any investment decisions: Thorough research, understanding the factors influencing Apple stock performance, and seeking advice from qualified financial professionals are crucial before making investment decisions.

Conclusion

The pressure on Apple stock ahead of its Q2 results stems from a confluence of factors, including weakening demand, macroeconomic headwinds, and investor expectations. Understanding these factors is crucial for navigating the current market conditions. The upcoming Apple Q2 earnings report will be pivotal, providing valuable insights into the company's performance and future outlook. Stay informed about the upcoming Apple Q2 earnings report and continue monitoring Apple stock performance for informed investment decisions. Understanding the factors influencing Apple stock performance is crucial for navigating the current market conditions. Further research and analysis of Apple's Q2 results and future prospects are recommended for all Apple stock investors.

Featured Posts

-

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Gazeta Trud O Lyubvi Ili Ilicha Klyuchevye Momenty I Interpretatsii

May 24, 2025

Gazeta Trud O Lyubvi Ili Ilicha Klyuchevye Momenty I Interpretatsii

May 24, 2025 -

Porsche 911 S T Pts Riviera Blue Now Available

May 24, 2025

Porsche 911 S T Pts Riviera Blue Now Available

May 24, 2025 -

Apple Stock Forecast 254 Price Target Should You Buy Now

May 24, 2025

Apple Stock Forecast 254 Price Target Should You Buy Now

May 24, 2025 -

Yevrobachennya 2014 2023 Doli Peremozhtsiv

May 24, 2025

Yevrobachennya 2014 2023 Doli Peremozhtsiv

May 24, 2025

Latest Posts

-

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025 -

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025 -

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025 -

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025