Apple Stock: Will Q2 Results Reverse The Recent Decline?

Table of Contents

Analyzing Apple's Recent Performance and the Factors Contributing to the Decline

Several interconnected factors have contributed to the recent dip in Apple stock. Understanding these is crucial for predicting the impact of the Q2 results.

Macroeconomic Factors

Global economic uncertainty is significantly impacting investor confidence.

- Inflation: Persistently high inflation rates are eroding consumer spending power, potentially reducing demand for Apple's premium products. The Consumer Price Index (CPI) consistently exceeding expectations is a key indicator.

- Rising Interest Rates: Increased interest rates make borrowing more expensive, impacting both consumer spending and corporate investment. The Federal Reserve's interest rate hikes have directly influenced market sentiment.

- Global Economic Slowdown: Fears of a recession in major economies are weighing heavily on investor sentiment, leading to a risk-off approach impacting tech stocks like Apple. The International Monetary Fund's (IMF) growth forecasts are closely watched.

Supply Chain Issues

Disruptions to Apple's supply chain continue to pose challenges.

- Chip Shortages: The ongoing semiconductor shortage continues to impact iPhone production, limiting Apple's ability to meet demand. This constraint directly affects revenue projections.

- Logistical Bottlenecks: Global shipping delays and port congestion add costs and complicate timely product delivery, potentially affecting sales figures.

- Geopolitical Risks: Tensions and instability in various regions of the world disrupt manufacturing and logistics, impacting Apple's global operations.

Competition and Market Saturation

Apple faces increasing competition in its core markets.

- Android Smartphone Competition: Android smartphone manufacturers are continuously improving their offerings, challenging Apple's market dominance, particularly in price-sensitive segments. Samsung and other major players are aggressively competing.

- Innovation Slowdown (Perceived): Some analysts argue that Apple's recent product innovations haven't been as groundbreaking as in the past, leading to less excitement among consumers. This perception can influence sales and stock prices.

- Market Saturation: The smartphone market is approaching saturation in many developed countries, making it increasingly difficult for Apple to achieve significant growth in these regions.

Q2 Earnings Expectations and Key Metrics to Watch

The upcoming Q2 earnings report will provide critical insights into Apple's performance.

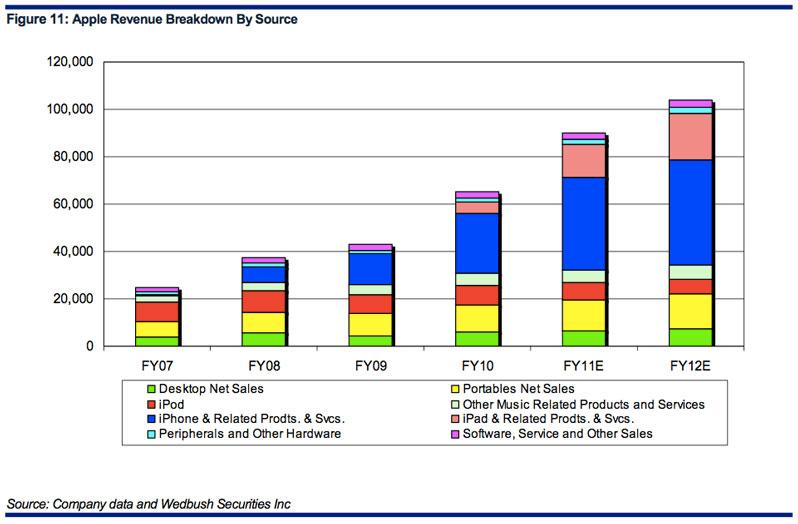

Revenue Projections

Analysts are closely watching Apple's Q2 revenue figures.

- Moderate Growth Predicted: Most analysts predict a moderate increase in revenue compared to Q1, but this growth is expected to be slower than in previous years. Morgan Stanley and Goldman Sachs, for example, have published their predictions.

- Currency Fluctuations: Changes in foreign exchange rates can significantly impact Apple's reported revenue, potentially masking the underlying strength of its business.

- Impact of Pricing: Any price increases implemented by Apple on its products will directly influence revenue figures.

iPhone Sales

iPhone sales are a key driver of Apple's overall revenue.

- Demand for New Models: The success of newly launched iPhone models (if any) will play a significant role in determining Q2 performance. Pre-orders and initial sales figures are often a good indicator.

- Upgrade Cycle: The timing of the upgrade cycle among existing iPhone users also has a considerable impact on overall sales.

- Pricing and Competition: The pricing strategies of Apple and its competitors will directly affect consumer choices and iPhone sales figures.

Services Revenue

Apple's services segment is becoming increasingly important for its long-term profitability.

- Growth Trajectory: Analysts expect continued strong growth in Apple's services revenue, driven by the App Store, Apple Music, iCloud, and other subscription services. This sector is less susceptible to macroeconomic fluctuations.

- User Engagement: The level of user engagement with Apple's services will significantly influence revenue generation.

- New Service Launches: The introduction of any new services or features during Q2 will influence revenue projections and market perception.

Potential Scenarios and Investment Strategies

Based on the factors discussed, several scenarios are possible for Apple's Q2 earnings.

Bullish Case

A positive surprise is possible if:

- iPhone sales exceed expectations, driven by strong demand for new models.

- Services revenue growth surpasses projections, indicating increased user engagement and adoption of new services.

- Supply chain issues are mitigated, allowing Apple to meet demand more effectively.

Bearish Case

A disappointing report could occur if:

- iPhone sales fall short of expectations due to weak consumer demand or intensifying competition.

- Services revenue growth slows down, indicating a potential saturation of the market.

- Macroeconomic headwinds intensify, further impacting consumer spending.

Investment Advice (Disclaimer)

This analysis is for informational purposes only and should not be considered investment advice. Investing in the stock market carries inherent risks. Always conduct thorough research and consider consulting with a qualified financial advisor before making any investment decisions. Apple stock is a complex investment, and individual circumstances should be carefully considered.

Conclusion: Apple Stock: Navigating the Q2 Results and Future Outlook

The upcoming Apple Q2 earnings report will offer valuable insights into the company's performance and the broader tech market. Macroeconomic conditions, supply chain issues, and competition will all play a significant role in shaping the results. While a positive surprise is possible, a disappointing report could trigger further downward pressure on the Apple stock price. Stay informed about the upcoming Apple Q2 earnings report and conduct thorough research to make informed decisions about your Apple stock investment strategy. Careful Apple stock analysis is crucial for navigating this period of uncertainty. Remember to consider factors like Apple stock valuation and Apple's Q2 earnings history when forming your investment strategy.

Featured Posts

-

Should You Follow Wedbushs Lead On Apple Stock Despite Price Target Cut

May 24, 2025

Should You Follow Wedbushs Lead On Apple Stock Despite Price Target Cut

May 24, 2025 -

Early Pandemic Life How A Seattle Green Space Became A Womans Safe Haven

May 24, 2025

Early Pandemic Life How A Seattle Green Space Became A Womans Safe Haven

May 24, 2025 -

Kriza V Nemecku Prepustia Tisice Zamestnancov Z Najvaecsich Spolocnosti

May 24, 2025

Kriza V Nemecku Prepustia Tisice Zamestnancov Z Najvaecsich Spolocnosti

May 24, 2025 -

Ferrari Day In Bangkok Flagship Facility Unveiled Bangkok Post

May 24, 2025

Ferrari Day In Bangkok Flagship Facility Unveiled Bangkok Post

May 24, 2025 -

Analyse Snelle Marktdraai Europese Aandelen Wat Volgt

May 24, 2025

Analyse Snelle Marktdraai Europese Aandelen Wat Volgt

May 24, 2025

Latest Posts

-

7 Billion Theme Park Universals Bold Bid To Rival Disney

May 24, 2025

7 Billion Theme Park Universals Bold Bid To Rival Disney

May 24, 2025 -

Fatal Shooting Outside Jewish Museum Israeli Embassy Staff Casualties Confirmed

May 24, 2025

Fatal Shooting Outside Jewish Museum Israeli Embassy Staff Casualties Confirmed

May 24, 2025 -

Sam Altmans Secret Device What He Told Open Ai And Jony Ive

May 24, 2025

Sam Altmans Secret Device What He Told Open Ai And Jony Ive

May 24, 2025 -

Universals 7 Billion Theme Park Redefining The Entertainment Landscape

May 24, 2025

Universals 7 Billion Theme Park Redefining The Entertainment Landscape

May 24, 2025 -

How Alix Earle Conquered Gen Z Marketing On Dancing With The Stars

May 24, 2025

How Alix Earle Conquered Gen Z Marketing On Dancing With The Stars

May 24, 2025