Apple Vs. Trump Tariffs: Will Buffett's Top Tech Stock Crack?

Table of Contents

The Impact of Tariffs on Apple's Manufacturing and Supply Chain

Apple's immense success is deeply intertwined with its global supply chain, heavily reliant on Chinese manufacturing. The Trump-era tariffs, imposed on various imported goods from China, significantly increased the cost of components and finished products for Apple. This directly impacted their bottom line in several ways:

- Increased Production Costs: Tariffs added a substantial surcharge to the price of importing crucial components like processors, screens, and other parts from China, directly increasing Apple's manufacturing costs.

- Potential Delays in Product Launches: The added complexity and uncertainty introduced by tariffs could potentially lead to delays in the production and release of new Apple products.

- Pressure on Profit Margins: Higher input costs inevitably squeezed Apple's profit margins, forcing them to consider strategic adjustments to maintain profitability.

- Shifting Production Strategies: Faced with increased costs and uncertainty, Apple began exploring strategies to diversify its manufacturing locations, reducing its reliance on China. This involved significant investment and logistical challenges.

Keywords: Apple supply chain, China tariffs, manufacturing costs, import duties, Apple manufacturing

Consumer Impact and Sales Figures – Did Tariffs Affect Demand?

A crucial question is whether these increased costs, ultimately passed on to consumers through higher prices, dampened demand for Apple products. Analyzing sales figures before, during, and after the tariff period offers insights:

- Changes in Apple Product Sales: While Apple maintained its dominant market position, some analysts noted a slight softening of sales growth during periods of heightened tariff uncertainty.

- Analysis of Consumer Behavior in Response to Higher Prices: The price elasticity of demand for Apple products became a key area of study. While loyal customers remained relatively unaffected, some price-sensitive consumers might have delayed purchases or considered alternatives.

- Competitor Market Share Gains or Losses: While no significant competitor market share gains were definitively attributed solely to Apple's tariff-related price increases, the situation highlighted the importance of competitive pricing in a dynamic market.

Keywords: Apple sales, consumer demand, price elasticity, market share, Apple product pricing

Apple's Strategic Response to Tariffs – Adaptation and Mitigation

Apple didn't passively accept the impact of the tariffs. The company implemented several strategies to mitigate the negative effects:

- Negotiations with the Government: Apple, along with other tech giants, engaged in lobbying efforts and negotiations with the US government to influence tariff policies.

- Investment in Domestic or Alternative Manufacturing: To diversify its manufacturing base and reduce reliance on China, Apple invested in manufacturing capabilities in other countries, including India and Vietnam. This involved significant long-term investments.

- Price Adjustments and Marketing Strategies: While raising prices was unavoidable to some extent, Apple strategically managed price increases and implemented marketing strategies to maintain consumer demand.

- Lobbying Efforts: Apple actively participated in lobbying efforts to influence trade policy and minimize the impact of tariffs on its business.

Keywords: Apple strategy, tariff mitigation, supply chain diversification, manufacturing relocation, Apple lobbying

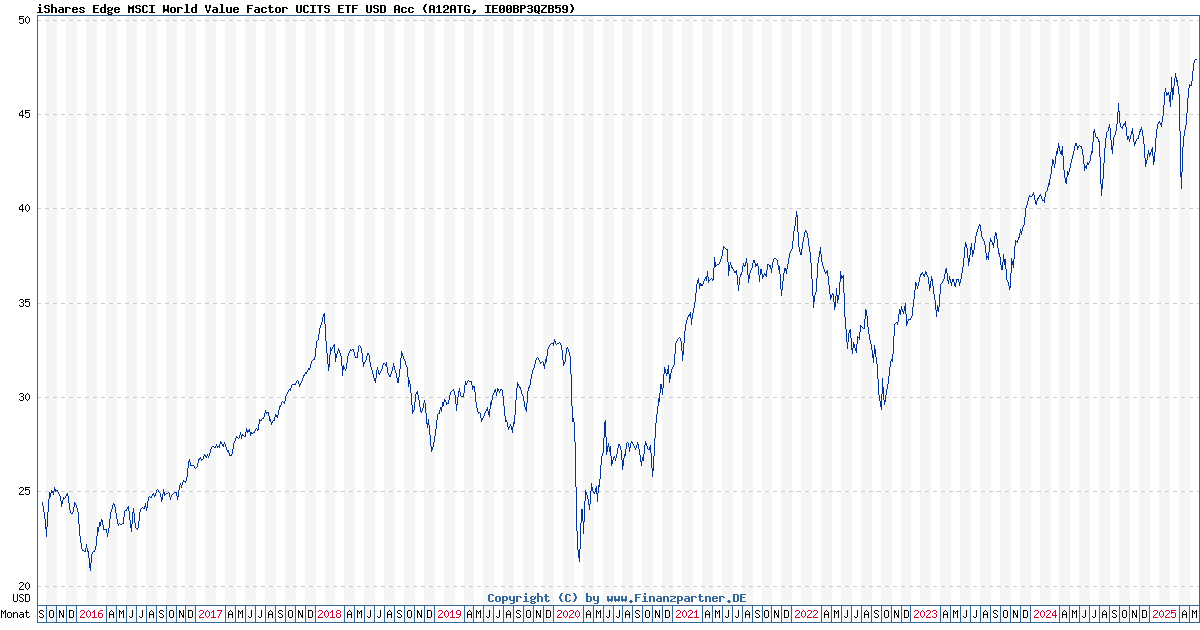

Long-Term Implications for Apple's Stock and Buffett's Investment

The long-term effects of the Trump-era tariffs on Apple's stock price and Buffett's investment are complex and multifaceted:

- Stock Price Volatility: The uncertainty surrounding tariffs did introduce some volatility into Apple's stock price, but the company ultimately proved remarkably resilient.

- Investor Confidence: While some investors might have expressed concerns, the overall investor confidence in Apple remained relatively strong, given its consistent innovation and strong market position.

- Impact on Berkshire Hathaway's Overall Performance: Apple's performance, despite the tariff challenges, remained a positive contributor to Berkshire Hathaway's overall investment portfolio.

- Future Geopolitical Risks: The experience highlighted the ongoing risk associated with geopolitical instability and changing global trade policies impacting multinational corporations.

Keywords: Apple stock price, Buffett investment, long-term impact, geopolitical risk, Berkshire Hathaway

Conclusion: The Future of Apple in a Changing Trade Landscape

In conclusion, while the "Apple vs. Trump Tariffs" conflict presented a significant challenge, Apple demonstrated remarkable resilience. The tariffs did increase costs and introduce some complexities, but the company successfully adapted, diversifying its supply chain and strategically managing its response. While the short-term impact on sales and profit margins was noticeable, Apple’s long-term prospects remain strong, solidifying Buffett's investment choice. The experience serves as a reminder of the interconnectedness of global trade and the ongoing challenges for multinational corporations navigating volatile geopolitical landscapes. Continue researching Apple vs. Trump Tariffs and the broader impact of global trade on the tech industry to stay informed about this evolving dynamic. Further reading on the effects of tariffs on other tech companies is highly recommended.

Featured Posts

-

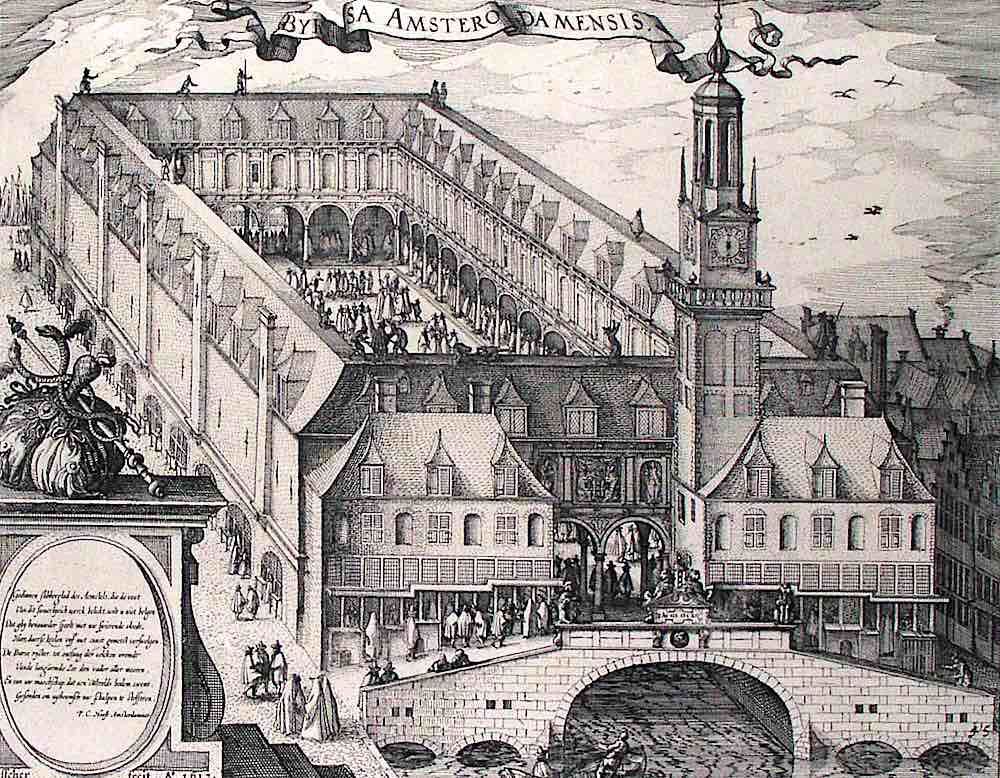

Amsterdam Stock Market 7 Opening Plunge Reflects Global Trade Uncertainty

May 24, 2025

Amsterdam Stock Market 7 Opening Plunge Reflects Global Trade Uncertainty

May 24, 2025 -

I Phone Ai

May 24, 2025

I Phone Ai

May 24, 2025 -

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazione Ue

May 24, 2025

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazione Ue

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Net Asset Value Nav Explained

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Net Asset Value Nav Explained

May 24, 2025 -

Kyle Walker And The Serbian Models A Milan Party After Wifes Departure

May 24, 2025

Kyle Walker And The Serbian Models A Milan Party After Wifes Departure

May 24, 2025

Latest Posts

-

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025 -

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025 -

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025 -

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025