Are High Stock Market Valuations A Concern? BofA's Analysis

Table of Contents

BofA's Key Findings on High Stock Market Valuations:

Bank of America's analysis of current stock market valuations presents a nuanced perspective. While acknowledging the elevated levels, BofA doesn't necessarily sound an alarm bell, instead highlighting a complex interplay of factors. Their conclusions suggest that while valuations are high, they may not be entirely unjustified, at least not yet. However, they also stress the importance of monitoring key metrics and remaining aware of potential risks.

-

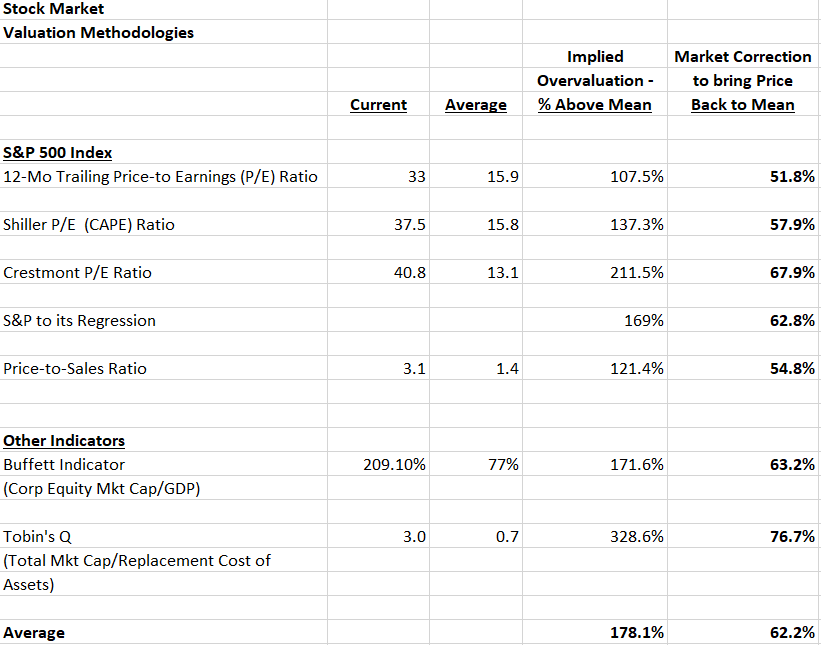

Specific data points: BofA's report often cites elevated Price-to-Earnings (P/E) ratios compared to historical averages. While the exact figures vary depending on the index and the time frame considered, the consistent trend points toward higher-than-usual valuations across broad market segments. Forward earnings estimates, used to calculate forward P/E ratios, play a crucial role in BofA's assessment, reflecting expectations for future corporate performance.

-

Key influencing factors: BofA highlights several key factors driving these high stock market valuations: persistently low interest rates, which encourage investment in riskier assets like stocks; strong corporate earnings growth, supporting higher price-to-earnings ratios; and expectations of continued, albeit moderated, inflation. These elements create a positive feedback loop that can push valuations higher.

-

Potential risks assessment: BofA does not disregard the inherent risks associated with high valuations. The primary concern is the potential for a market correction if interest rates rise unexpectedly, corporate earnings disappoint, or inflation becomes more persistent and uncontrollable than currently forecast. This could lead to a reassessment of stock valuations, potentially resulting in a significant market downturn.

Factors Contributing to High Stock Market Valuations:

Several intertwined economic and market factors contribute to the current high stock market valuations. Understanding these factors is crucial for assessing the sustainability of these valuations and making informed investment choices.

-

Low interest rate environment: The prolonged period of low interest rates, particularly following quantitative easing (QE) programs implemented by central banks globally, has significantly impacted investor behavior. With low returns on traditional fixed-income investments, investors have flocked to equities, boosting demand and driving up prices. This also lowers corporate borrowing costs, boosting profitability and contributing to higher valuations.

-

Strong corporate earnings growth: Healthy corporate earnings growth is a fundamental driver of stock prices. Strong profits justify higher valuations, as investors are willing to pay more for companies demonstrating robust financial performance. However, the sustainability of this growth is crucial for determining if current valuations are justified.

-

The role of inflation: Inflation’s impact is complex. Moderate inflation can boost corporate earnings and justify higher stock prices. However, unexpectedly high or persistent inflation erodes purchasing power and can lead central banks to raise interest rates, which negatively impacts stock valuations. BofA's analysis carefully weighs the current inflation rate and market expectations for its future trajectory.

-

Impact of Quantitative Easing (QE): QE policies, implemented to stimulate economies after the 2008 financial crisis and again during the pandemic, significantly increased the money supply. This excess liquidity flowed into the stock market, contributing to higher valuations. The unwinding of QE policies could impact future market performance.

Analyzing Price-to-Earnings Ratios (P/E) and other valuation metrics:

Price-to-Earnings (P/E) ratios are a widely used metric for assessing the relative valuation of a stock or the overall market. Understanding their nuances is key to interpreting BofA’s analysis.

-

Different types of P/E ratios: The trailing P/E ratio uses past earnings, while the forward P/E ratio uses projected future earnings. BofA likely uses both to provide a comprehensive view. The forward P/E is considered more relevant for predicting future performance.

-

Limitations of P/E ratios: P/E ratios should not be used in isolation. They need to be considered alongside other metrics and within the context of the overall economic environment. A high P/E ratio might be justified if a company is experiencing high growth or operates in a rapidly expanding market.

-

Other valuation metrics: BofA’s analysis likely considers other key metrics, including Price-to-Sales (P/S) ratios, which relate a company's stock price to its revenue, and Price-to-Book (P/B) ratios, which compare market value to net asset value. These provide a more comprehensive valuation picture than P/E alone.

-

BofA’s context: BofA’s analysis contextualizes these metrics within the current market climate. They compare current ratios to historical averages and industry benchmarks to determine if current valuations are unusually high and whether this is a cause for concern relative to other market factors.

Investment Strategies in a High Valuation Environment:

Navigating a market with potentially high valuations requires a cautious and strategic approach. Based on BofA's findings and the overall market context, here's some advice for investors:

-

Risk mitigation strategies: Diversification is crucial. Spread your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce your overall risk. Defensive investing, focusing on lower-risk, stable companies, can be considered. Value investing, seeking undervalued companies, offers potential opportunities.

-

Opportunities in high valuations: While overall valuations might be high, there may still be opportunities for selective stock picking. Focus on companies with strong fundamentals, sustainable growth prospects, and competitive advantages.

-

Long-term investing: Maintain a long-term perspective and avoid making emotional decisions based on short-term market fluctuations. High valuations don't necessarily predict an immediate market crash; patience and discipline are key.

-

Alternative asset classes: Consider diversifying into alternative asset classes, such as real estate, commodities, or private equity, to further reduce risk and potentially enhance returns.

Conclusion:

BofA's analysis of high stock market valuations doesn't necessarily signal immediate alarm, but it does highlight the need for caution and informed decision-making. While strong corporate earnings and low interest rates contribute to elevated valuations, the potential for a correction if these conditions change remains a risk. The bank's analysis emphasizes the importance of a holistic approach to valuation, considering various metrics and economic factors.

While BofA's analysis provides valuable insights, understanding the nuances of high stock market valuations requires careful consideration. Continue researching and stay informed about market trends to make informed investment decisions concerning high stock market valuations. Consult with a financial advisor to create a personalized investment strategy that aligns with your risk tolerance and financial goals.

Featured Posts

-

Tech Tycoons Sunken Superyacht Diver Fatality During Salvage

May 10, 2025

Tech Tycoons Sunken Superyacht Diver Fatality During Salvage

May 10, 2025 -

Us Tariffs French Minister Pushes For Increased Eu Retaliation

May 10, 2025

Us Tariffs French Minister Pushes For Increased Eu Retaliation

May 10, 2025 -

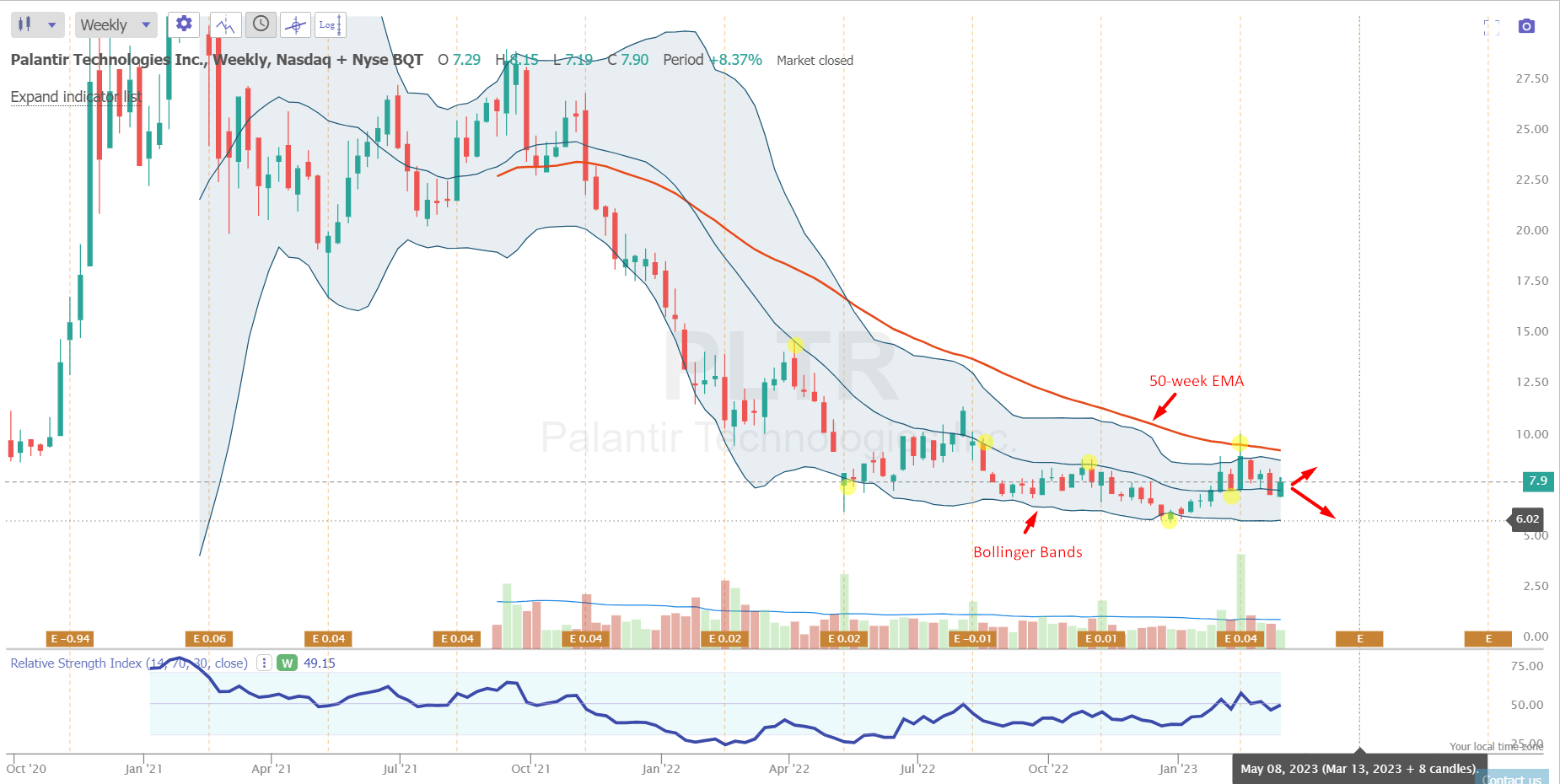

Analyzing Palantir Stock Before The May 5th Deadline

May 10, 2025

Analyzing Palantir Stock Before The May 5th Deadline

May 10, 2025 -

Gpb Capital Founder Sentenced 7 Years For Ponzi Like Scheme

May 10, 2025

Gpb Capital Founder Sentenced 7 Years For Ponzi Like Scheme

May 10, 2025 -

New Asylum Crackdown In Uk Three Nations Under Increased Pressure

May 10, 2025

New Asylum Crackdown In Uk Three Nations Under Increased Pressure

May 10, 2025