As Markets Swooned, Pros Sold—and Individuals Pounced: A Market Analysis

Table of Contents

Professional Investor Response to the Market Swoon

Selling Strategies Employed by Professionals

Professionals often employ several strategies during a market swoon to protect capital and mitigate risk. These include:

- Focus on risk mitigation: During periods of significant market volatility, like the recent market swoon, professionals prioritize preserving capital over chasing short-term gains. This often involves reducing overall market exposure.

- Short-term profit taking: Locking in profits from previous gains before potential losses is a standard practice. This allows them to secure realized profits and avoid potential losses on unrealized gains.

- Hedging strategies: Utilizing various financial instruments such as derivatives (options, futures, swaps) to protect against further declines is a common tactic. These hedging strategies help limit downside risk.

- Increased cash positions: Reducing exposure to volatile assets by increasing cash reserves allows professionals to capitalize on potential buying opportunities when the market swoon subsides. Holding more cash provides liquidity and reduces risk.

Reasons for Professional Selling During Market Volatility

Several factors contribute to professional selling during market downturns:

- Algorithm-driven selling: Automated trading systems, triggered by pre-programmed parameters related to price drops or volatility spikes, can contribute significantly to selling pressure during a market swoon.

- Client redemption requests: Meeting client demands for withdrawals during market uncertainty is a significant factor, forcing professionals to liquidate assets to meet these obligations.

- Fundamental analysis adjustments: Re-evaluating asset valuations based on changing market conditions often leads to sell decisions. This involves reassessing company fundamentals and economic indicators.

- Concerns about further economic downturn: Professionals often anticipate further market declines linked to macroeconomic factors, prompting them to sell assets and reduce exposure to potential losses. This proactive approach is crucial in mitigating significant risks.

Individual Investor Behavior During the Market Swoon

The "Buy the Dip" Mentality

Individual investors often adopt a "buy the dip" strategy during market swoons, believing that market corrections present opportunities. This behavior is driven by:

- Opportunity seeking: Viewing market corrections as opportunities to acquire undervalued assets at discounted prices. This strategy is predicated on the belief that the market will eventually recover.

- Fear of missing out (FOMO): Driven by a desire not to miss out on potential future gains, individuals may rush into the market, potentially making emotionally driven decisions.

- Long-term investment strategy: Many individual investors believe the current downturn is temporary and investing now offers long-term value, focusing on the long-term growth potential of assets.

- Increased retail investor participation: Market swoons often see an influx of new retail investors, entering the market often without sufficient knowledge or experience.

Risks Associated with Individual Investor Actions During a Market Swoon

While the "buy the dip" strategy can be successful, it carries several risks:

- Emotional decision-making: Investing based on fear or greed, rather than rational analysis, can lead to poor investment choices during a market swoon.

- Lack of diversification: Concentrating investments in a few assets, even during a perceived opportunity, significantly increases overall risk.

- Inadequate risk assessment: Underestimating the potential for further market declines can lead to substantial losses. A comprehensive understanding of risk tolerance is vital.

- Ignoring professional advice: Failing to seek guidance from experienced financial advisors increases the chances of making ill-informed investment decisions.

Analyzing the Divergence in Investor Behavior

The contrasting behaviors between professional and individual investors during a market swoon stem from several key differences:

Different Time Horizons

Professionals often have shorter time horizons, focusing on quarterly or annual performance, while individual investors typically adopt a longer-term perspective. This difference in time horizons heavily influences investment decisions during market volatility.

Access to Information and Resources

Professionals typically have access to more sophisticated analytical tools, market data, and research than individual investors. This information advantage allows them to make more informed decisions.

Risk Tolerance and Investment Goals

The risk appetite and investment goals of professionals and individuals often differ significantly. Professionals often operate under stricter risk management guidelines than individual investors.

Conclusion

The recent market swoon revealed a striking contrast between the selling strategies of professional investors and the buying behavior of many individual investors. While professionals prioritized risk mitigation and often acted swiftly to protect capital, individual investors, driven by the “buy the dip” mentality and the fear of missing out, pounced on perceived opportunities. This analysis underscores the importance of understanding the distinct motivations, strategies, and inherent risks associated with navigating market volatility. Whether you're a seasoned investor or just starting out, it's crucial to develop a well-informed and carefully considered strategy for dealing with market swoons and other periods of market instability. By learning from these contrasting approaches, investors can refine their strategies for navigating future market downturns and capitalizing on potential opportunities during a market swoon. Understanding how to mitigate risk during a market downturn is essential for long-term investment success.

Featured Posts

-

Broadcoms V Mware Acquisition A 1 050 Price Spike For At And T

Apr 28, 2025

Broadcoms V Mware Acquisition A 1 050 Price Spike For At And T

Apr 28, 2025 -

Yukon Mine Manager Faces Contempt Charges After Refusal To Testify

Apr 28, 2025

Yukon Mine Manager Faces Contempt Charges After Refusal To Testify

Apr 28, 2025 -

Richard Jeffersons Recent Comments On Shaquille O Neal Spark Debate

Apr 28, 2025

Richard Jeffersons Recent Comments On Shaquille O Neal Spark Debate

Apr 28, 2025 -

Syracuse Mets Acquire Nez Megill Starts For New York

Apr 28, 2025

Syracuse Mets Acquire Nez Megill Starts For New York

Apr 28, 2025 -

Virginia Giuffre Passes Away Examining The Legacy Of Her Allegations

Apr 28, 2025

Virginia Giuffre Passes Away Examining The Legacy Of Her Allegations

Apr 28, 2025

Latest Posts

-

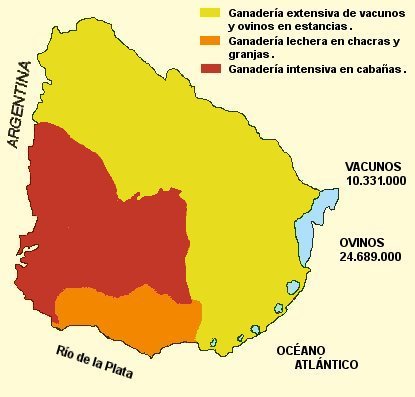

Uruguay Apuesta Por China Un Regalo Estrategico Para Las Exportaciones Ganaderas

May 11, 2025

Uruguay Apuesta Por China Un Regalo Estrategico Para Las Exportaciones Ganaderas

May 11, 2025 -

Analizando El Regalo De Uruguay A China Clave Para El Futuro De Sus Exportaciones Ganaderas

May 11, 2025

Analizando El Regalo De Uruguay A China Clave Para El Futuro De Sus Exportaciones Ganaderas

May 11, 2025 -

Diplomacia Ganadera Uruguay Y El Regalo Que Busca Impulsar Exportaciones A China

May 11, 2025

Diplomacia Ganadera Uruguay Y El Regalo Que Busca Impulsar Exportaciones A China

May 11, 2025 -

El Impacto Del Inusual Regalo De Uruguay En Las Exportaciones Ganaderas A China

May 11, 2025

El Impacto Del Inusual Regalo De Uruguay En Las Exportaciones Ganaderas A China

May 11, 2025 -

Exportaciones Ganaderas Que Significa El Regalo De Uruguay A China

May 11, 2025

Exportaciones Ganaderas Que Significa El Regalo De Uruguay A China

May 11, 2025