Assessing Canada's Fiscal Health: The Need For Responsible Governance

Table of Contents

Current State of Canada's Finances

Understanding the current state of Canada's finances requires a close look at key indicators. The government's debt-to-GDP ratio, a crucial measure of fiscal health, reflects the country's ability to service its debt. Currently, [Insert current debt-to-GDP ratio from a credible source like Statistics Canada]. This figure, while [Insert assessment: concerning/manageable/etc.], requires ongoing monitoring.

Key indicators further illuminate the situation:

- GDP Growth Rate: [Insert current GDP growth rate and source]. This rate significantly influences tax revenue and the government's ability to manage its debt.

- Tax Revenue Projections: [Insert projected tax revenue figures and source]. Factors such as economic growth, tax policies, and changes in employment directly impact these projections.

- Government Spending Patterns: A significant portion of government spending is allocated to [List major spending sectors with percentages from a credible source, e.g., healthcare, social programs, defense]. Analyzing these spending patterns reveals priorities and areas where potential efficiencies might be found.

- Credit Rating and Potential Risks: Canada currently holds a [Insert current credit rating and source]. However, sustained high debt levels could pose risks to this rating, potentially increasing borrowing costs in the future.

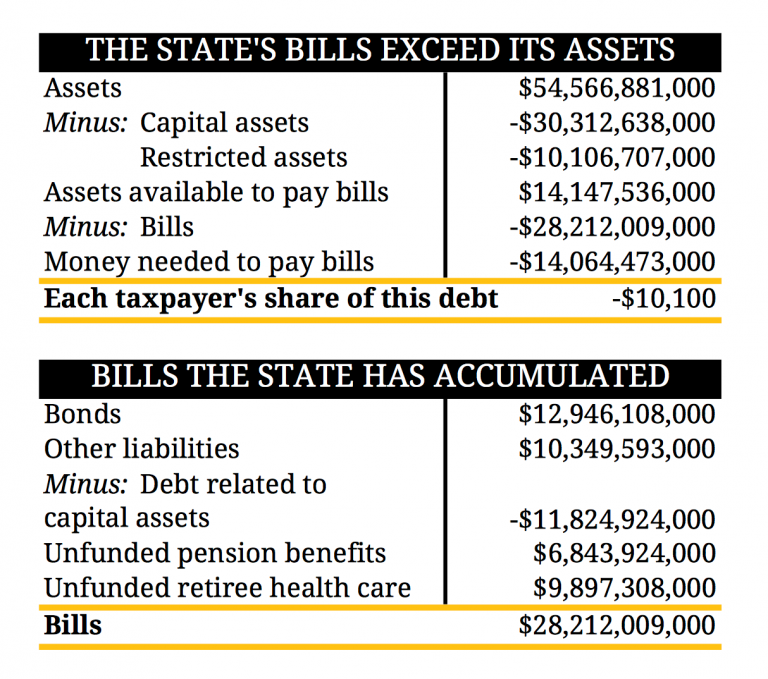

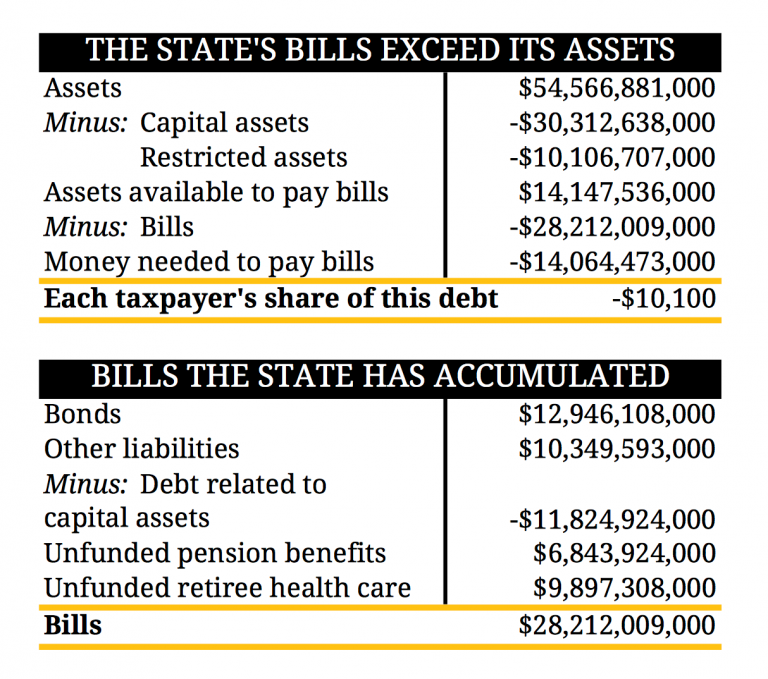

[Insert a chart or graph visually representing the key indicators mentioned above].

Factors Affecting Canada's Fiscal Health

Canada's fiscal health is shaped by a complex interplay of internal and external factors.

Internal Factors:

- Aging Population and Healthcare Costs: Canada's aging population is placing increasing pressure on healthcare spending, a major driver of government expenditure. [Include statistics on population aging and healthcare cost projections].

- Provincial/Territorial Fiscal Challenges: Provincial and territorial governments face their own fiscal challenges, impacting overall national fiscal health. [Briefly discuss variations in fiscal health across provinces/territories].

- Infrastructure Needs and Investment: Significant investments are needed to modernize and expand Canada's infrastructure, requiring considerable government funding. [Discuss the scale of infrastructure needs and potential funding mechanisms].

- Social Programs and their Sustainability: Canada's robust social safety net, while essential, represents a significant portion of government spending. Ensuring its long-term sustainability requires careful consideration and potential reforms.

External Factors:

- Global Economic Conditions and Uncertainty: Global economic downturns or uncertainties significantly impact Canada's economy and government revenue. [Discuss recent or potential global economic risks].

- Commodity Prices (oil, natural resources): Fluctuations in commodity prices, particularly oil and other natural resources, directly affect Canada's export earnings and government revenue. [Discuss the impact of recent commodity price changes].

- International Trade and Agreements: International trade agreements and global trade relations significantly influence Canada's economic growth and fiscal health. [Discuss the impact of trade agreements on the Canadian economy].

- Geopolitical Risks: Geopolitical instability and international conflicts can create economic uncertainty and impact Canada's fiscal outlook. [Mention any relevant geopolitical risks impacting Canada's economy].

The Role of Responsible Governance in Improving Fiscal Health

Responsible governance is paramount to improving Canada's fiscal health. This involves:

- Fiscal Transparency and Accountability: Open and transparent reporting on government finances is crucial for public trust and accountability. [Suggest improvements to current transparency measures].

- Responsible Budgeting and Spending: Strategies for responsible budgeting include:

- Prioritizing essential government services based on evidence and impact assessments.

- Implementing efficient and effective program delivery mechanisms to minimize waste.

- Implementing measures to control the growth of government spending, focusing on value for money.

- Exploring alternative revenue sources, such as tax reforms focused on efficiency and fairness.

- Learning from other countries: Examining successful fiscal management strategies employed by other countries with similar economic structures can offer valuable insights. [Give an example of a country with effective fiscal management].

Potential Risks and Future Outlook for Canada's Fiscal Health

High levels of debt and deficits pose several risks:

- Increased borrowing costs

- Reduced government flexibility to respond to economic shocks

- Potential for credit rating downgrades

- Crowding out private investment

Different economic and political scenarios will significantly influence Canada's fiscal future. [Discuss potential scenarios, e.g., a scenario with sustained economic growth vs. a scenario with a recession]. Irresponsible fiscal management could lead to long-term consequences, burdening future generations with unsustainable debt levels.

A Call for Responsible Governance to Secure Canada's Fiscal Health

In conclusion, Canada's fiscal health requires immediate attention. The current levels of debt and the interplay of internal and external factors demand a proactive approach. Fiscal transparency, accountability, and strategic budgeting are essential for navigating the challenges ahead. Improving Canada's fiscal health is not merely a matter of economic policy; it's about ensuring a sustainable and prosperous future for all Canadians. Understanding and actively engaging with the intricacies of Canada's fiscal health is crucial. Demand transparency and accountability from your elected officials to ensure a fiscally responsible future for all Canadians. Let's work together to safeguard Canada's fiscal future.

Featured Posts

-

Bitcoin Btc Reacts To Easing Trade Tensions And Fed Policy

Apr 24, 2025

Bitcoin Btc Reacts To Easing Trade Tensions And Fed Policy

Apr 24, 2025 -

Inside John Travoltas Family Home A Look At The Recent Photo Incident

Apr 24, 2025

Inside John Travoltas Family Home A Look At The Recent Photo Incident

Apr 24, 2025 -

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025 -

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 24, 2025

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 24, 2025 -

The Impact Of The Epa On Tesla And Space X Elon Musks Dogecoin Strategy

Apr 24, 2025

The Impact Of The Epa On Tesla And Space X Elon Musks Dogecoin Strategy

Apr 24, 2025