Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Key Arguments for a Calm Market Outlook

BofA's relatively optimistic outlook rests on several key pillars. Their analysis suggests that while valuations may seem stretched by some metrics, several factors support their belief that a significant market downturn isn't imminent.

-

Long-Term Growth Potential: BofA points to strong long-term growth potential in several key sectors, particularly technology and renewable energy. They cite projected increases in earnings and revenue for these sectors as justification for current valuations. For instance, advancements in artificial intelligence and the global shift towards sustainable energy are expected to drive significant growth over the next decade. This long-term growth perspective helps to contextualize current market valuation multiples.

-

Robust Corporate Earnings Growth: The analysis emphasizes the strength of corporate earnings, both current and projected. Strong earnings growth, they argue, can justify higher price-to-earnings ratios (P/E ratios). BofA highlights specific companies and sectors exceeding earnings expectations, supporting their claims with detailed financial data and projections. This reinforces their argument that current valuations aren't entirely detached from underlying fundamentals.

-

Interest Rate Adjustments and Their Influence: BofA acknowledges the impact of interest rate adjustments on stock market valuations. While higher interest rates can theoretically reduce valuations by increasing the discount rate used in discounted cash flow (DCF) models, their analysis suggests that the current level of interest rates, while rising, is still supportive of current valuations given the projected earnings growth. They carefully analyze the relationship between interest rate changes and historical market performance.

-

Valuation Metrics: BofA doesn't rely on a single valuation metric. While acknowledging the significance of the P/E ratio and the Shiller PE (cyclically adjusted price-to-earnings ratio), their analysis incorporates multiple valuation metrics, including market valuation multiples and other industry-specific benchmarks, to gain a comprehensive understanding. This multifaceted approach provides a more nuanced picture than a single metric could offer.

Addressing Concerns About High Valuations

It's undeniable that some sectors appear richly valued, fueling concerns about potential market bubbles or overvalued stocks. Many investors fear a sharp market correction or even a bear market. BofA addresses these concerns in several ways:

-

Historical Context: BofA counters concerns about overvaluation by comparing current valuations to past market cycles. Their analysis shows that while valuations are high by some historical standards, they are not unprecedented. This historical perspective helps to put current valuations in a broader context.

-

Sector-Specific Analysis: Instead of viewing the market as a monolith, BofA provides a sector-by-sector breakdown, acknowledging that some sectors are indeed more richly valued than others. They identify specific factors contributing to these high valuations and assess the sustainability of those factors.

-

Low Interest Rates (Historical): While interest rates are rising, BofA acknowledges the role that historically low interest rates played in supporting higher valuations in recent years. They explain how this environment fostered increased investment and higher asset prices.

-

Alternative Valuation Metrics: BofA's analysis utilizes a range of valuation metrics, some of which paint a less alarming picture than traditional P/E ratios, offering a more balanced perspective.

BofA's Investment Strategy Recommendations

Based on their valuation analysis, BofA suggests a cautious yet optimistic investment strategy:

-

Sector Allocation: They recommend a strategic allocation towards sectors with robust long-term growth potential, such as technology and renewable energy, while maintaining appropriate diversification.

-

Portfolio Diversification: BofA strongly emphasizes the importance of diversification across asset classes and sectors to mitigate risk.

-

Investment Vehicles: They suggest utilizing a mix of ETFs (Exchange-Traded Funds) and index funds to achieve broad market exposure and diversification.

-

Risk Management: Their recommendations emphasize a long-term investment horizon and a risk management strategy tailored to individual investor profiles, acknowledging that not all investors have the same risk tolerance. This approach is directly linked to their valuation arguments, emphasizing that long-term growth prospects can offset perceived short-term risks.

Maintaining Calm Amidst Stock Market Valuations

BofA's analysis suggests that while stock market valuations may appear high by some measures, several underlying factors support a relatively calm outlook. Their approach emphasizes the importance of long-term growth potential, robust corporate earnings, and a diversified investment strategy. While acknowledging potential risks, BofA's assessment underscores the need for a balanced perspective, incorporating various valuation metrics and a long-term investment horizon. Remember to conduct thorough research and seek professional financial advice before making any investment decisions. For a deeper understanding of BofA's analysis, review their full report on stock market valuations. Don't let anxieties about stock market valuations dictate your long-term investment plan.

Featured Posts

-

A Day In The Life The Untold Story Of Chalet Girls In Europe

Apr 24, 2025

A Day In The Life The Untold Story Of Chalet Girls In Europe

Apr 24, 2025 -

Teslas Q1 Earnings Report 71 Net Income Decline Impact Of Political Backlash

Apr 24, 2025

Teslas Q1 Earnings Report 71 Net Income Decline Impact Of Political Backlash

Apr 24, 2025 -

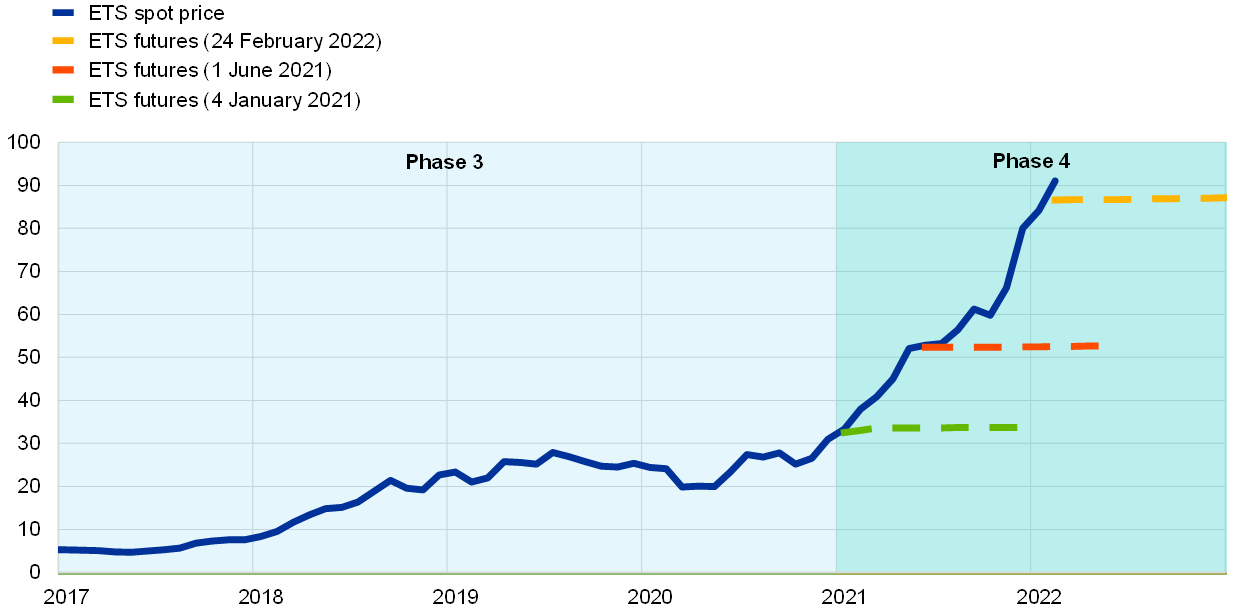

Eu To Phase Out Russian Gas Spot Market In Focus

Apr 24, 2025

Eu To Phase Out Russian Gas Spot Market In Focus

Apr 24, 2025 -

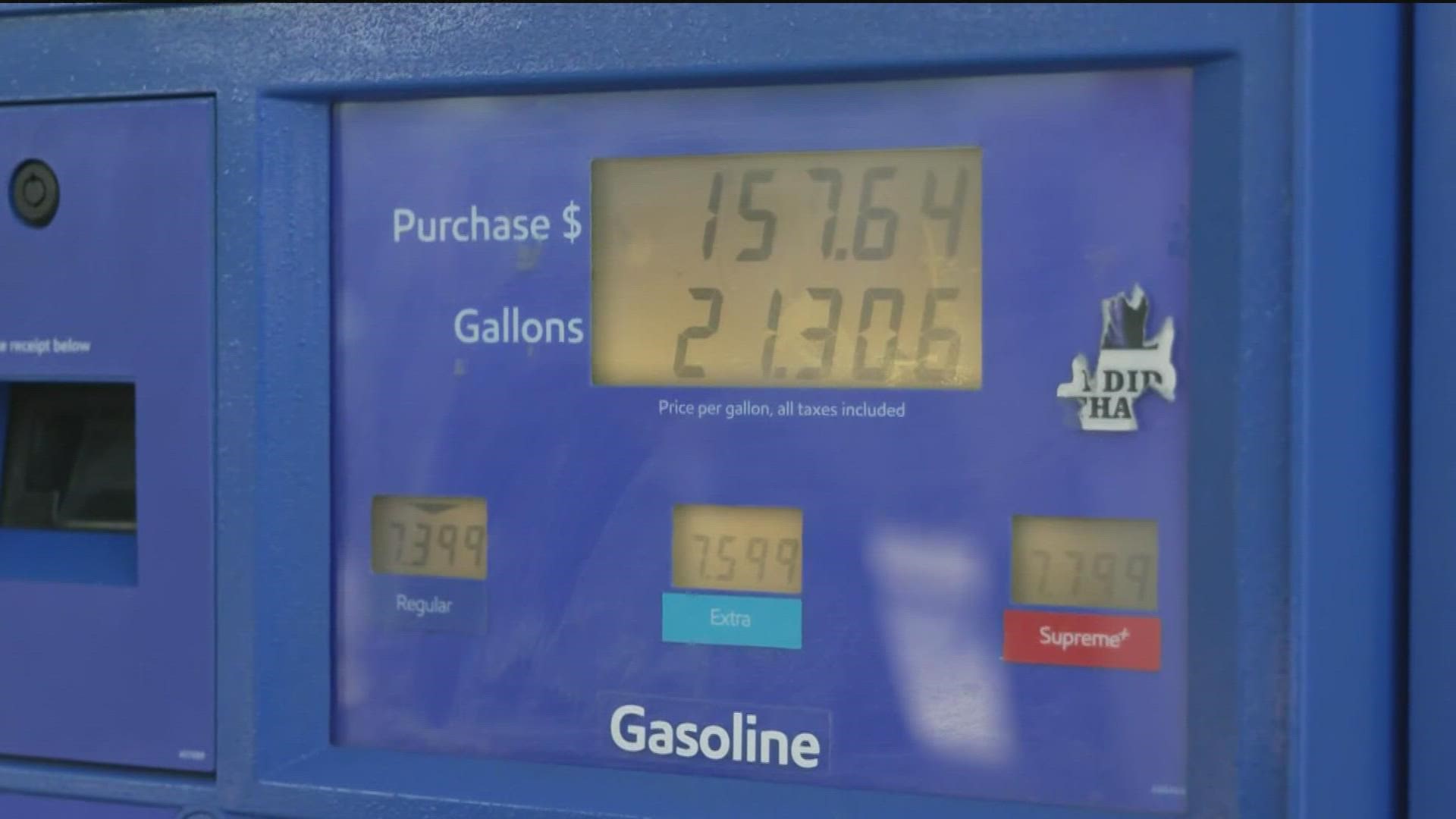

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025 -

Open Ais Interest In Google Chrome A Chat Gpt Ceo Statement Analysis

Apr 24, 2025

Open Ais Interest In Google Chrome A Chat Gpt Ceo Statement Analysis

Apr 24, 2025