Bank Of Canada Interest Rate Outlook: Impact Of Tariffs And Employment Data

Table of Contents

The Impact of Tariffs on the Canadian Economy

Trade tariffs present a significant challenge to the Canadian economy and heavily influence the Bank of Canada's interest rate outlook. Increased tariffs directly impact the cost of imported goods, potentially fueling inflation. This is because businesses pass on these increased costs to consumers, leading to higher prices across various sectors.

-

Increased Inflation: Tariffs increase the price of imported goods, leading to higher consumer prices and potentially impacting the Bank of Canada's inflation targets. Statistics Canada data will be crucial in monitoring this effect.

-

Negative Impact on Businesses: Canadian businesses, particularly those reliant on international trade, face reduced competitiveness and profitability due to higher input costs. This can lead to decreased investment and potential job losses.

-

GDP Growth Slowdown: Reduced consumer spending, resulting from higher prices, and decreased business investment contribute to a slowdown in GDP growth. This dampened economic activity further complicates the Bank of Canada's monetary policy decisions.

-

Bank of Canada Response: To counteract tariff-induced inflation, the Bank of Canada might consider raising interest rates. This is a classic monetary policy tool used to cool down an overheating economy, but it can also negatively impact economic growth. The delicate balancing act required here significantly shapes the interest rate outlook.

Employment Data and its Influence on Interest Rates

Employment data provides crucial insights into the health of the Canadian economy and plays a pivotal role in the Bank of Canada's interest rate decisions. Strong employment numbers, reflecting robust job creation and wage growth, often signal potential inflationary pressures.

-

Inflationary Pressures: Low unemployment can lead to increased competition for workers, driving up wages. This wage growth, if significant, can contribute to inflationary pressures, influencing the Bank of Canada's interest rate outlook.

-

Bank of Canada's Reaction: The Bank of Canada closely monitors employment data released by Statistics Canada. Strong employment figures coupled with rising inflation might prompt the Bank to raise interest rates to control inflation. Conversely, weak employment data might encourage a more dovish approach.

-

Interest Rate Adjustments: Based on employment trends, the Bank of Canada may adjust interest rates to maintain price stability and promote sustainable economic growth. This delicate balancing act is a key factor shaping the interest rate outlook.

The Interplay Between Tariffs and Employment

The combined effects of tariffs and employment data on the Canadian economy create a complex scenario for the Bank of Canada. It's not a simple one-to-one relationship; these factors influence each other in intricate ways.

-

Combined Economic Impact: Tariffs can indirectly impact employment through reduced business investment and potential job losses in sectors heavily reliant on imports. This adds another layer of complexity to the Bank of Canada's decision-making process concerning interest rates.

-

Offsetting Effects: In some scenarios, strong employment numbers might partially offset the negative impacts of tariffs on economic growth. This demonstrates the intricate relationship between these economic indicators and the nuances the Bank of Canada must consider.

-

Balancing Act for the Bank of Canada: The Bank of Canada faces the challenge of balancing inflation control with the need to maintain employment targets. This requires a careful assessment of the interplay between tariffs, employment data, and their collective effect on the overall economy.

Forecasting the Bank of Canada's Next Move

Predicting the Bank of Canada's next move requires a careful consideration of both tariffs and employment data within the broader economic context. While precise forecasting is impossible, a reasoned prediction can be made based on current trends.

-

Interest Rate Prediction: Based on the analysis presented, a slight increase or a holding of the current interest rates seems likely given the current inflationary pressures and relatively strong employment numbers. However, this is subject to change based on evolving economic data.

-

Uncertainties and Caveats: Economic forecasting inherently involves uncertainties. Unexpected global events, such as further escalation of trade tensions or a sudden downturn in global markets, could significantly alter the outlook.

-

Impact of Global Events: The Bank of Canada's interest rate decisions are influenced by global economic developments. Geopolitical events, shifts in commodity prices, and changes in global trade dynamics can impact the Canadian economy and affect the Bank's policy decisions.

Conclusion

The Bank of Canada's interest rate outlook is significantly shaped by the complex interplay between escalating trade tariffs and fluctuating employment data. Tariffs can fuel inflation, while employment data offers insights into potential inflationary pressures and overall economic health. The Bank faces the challenging task of balancing inflation control with employment targets, making its interest rate decisions a crucial factor in the Canadian economy's trajectory. Stay informed about the Bank of Canada interest rate outlook and its implications for your financial decisions. Monitor employment data and tariff developments for crucial insights into future interest rate decisions. Regularly check reliable financial news sources for updates on the Bank of Canada's monetary policy. Understanding the Bank of Canada interest rates is crucial for making informed financial decisions.

Featured Posts

-

San Franciscos Anchor Brewing Company Announces Closure

May 12, 2025

San Franciscos Anchor Brewing Company Announces Closure

May 12, 2025 -

Tyreek Hill Vs Noah Lyles Michael Johnsons Take On The Hypothetical Race

May 12, 2025

Tyreek Hill Vs Noah Lyles Michael Johnsons Take On The Hypothetical Race

May 12, 2025 -

Hertha Bscs Struggles Insights From The Boateng Kruse Disagreement

May 12, 2025

Hertha Bscs Struggles Insights From The Boateng Kruse Disagreement

May 12, 2025 -

Z Dnem Narodzhennya Prints Endryu 65 Rokiv Fotoalbom Ditinstva

May 12, 2025

Z Dnem Narodzhennya Prints Endryu 65 Rokiv Fotoalbom Ditinstva

May 12, 2025 -

Carrie And The Creatures Boris Johnsons Animal Related Controversies

May 12, 2025

Carrie And The Creatures Boris Johnsons Animal Related Controversies

May 12, 2025

Latest Posts

-

Britain And Australias Myanmar Policy Hypocrisy Or Pragmatism

May 13, 2025

Britain And Australias Myanmar Policy Hypocrisy Or Pragmatism

May 13, 2025 -

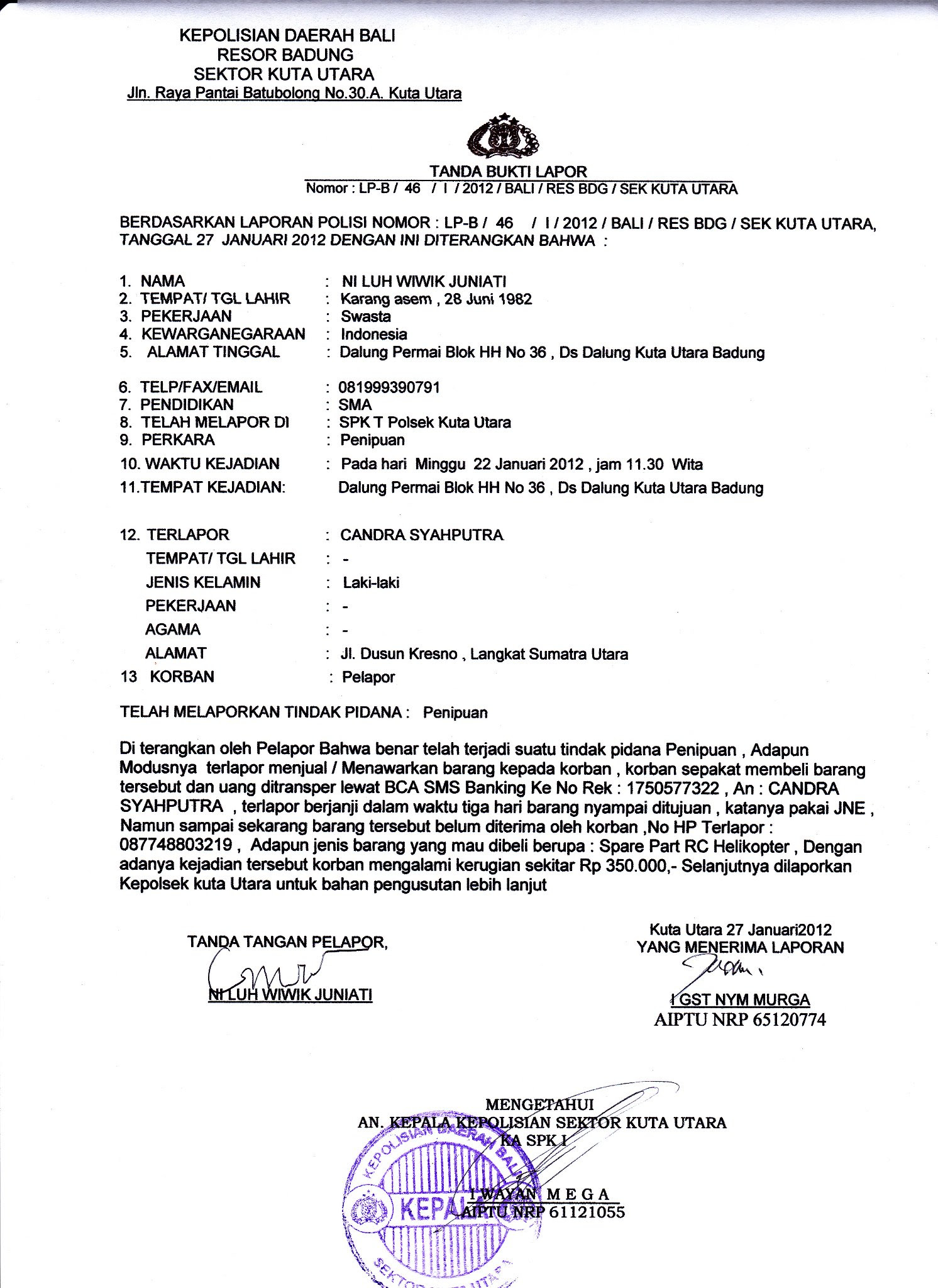

Foto Investigasi Jaringan Penipuan Online Internasional Di Myanmar Dampaknya Pada Pekerja Indonesia

May 13, 2025

Foto Investigasi Jaringan Penipuan Online Internasional Di Myanmar Dampaknya Pada Pekerja Indonesia

May 13, 2025 -

Myanmar Foto Foto Pekerja Korban Penipuan Online Internasional Wni Teridentifikasi

May 13, 2025

Myanmar Foto Foto Pekerja Korban Penipuan Online Internasional Wni Teridentifikasi

May 13, 2025 -

Ekspos Foto Korban Penipuan Online Internasional Di Myanmar Termasuk Warga Negara Indonesia

May 13, 2025

Ekspos Foto Korban Penipuan Online Internasional Di Myanmar Termasuk Warga Negara Indonesia

May 13, 2025 -

Potret Pilu Ribuan Pekerja Indonesia Terperangkap Penipuan Online Internasional Di Myanmar

May 13, 2025

Potret Pilu Ribuan Pekerja Indonesia Terperangkap Penipuan Online Internasional Di Myanmar

May 13, 2025