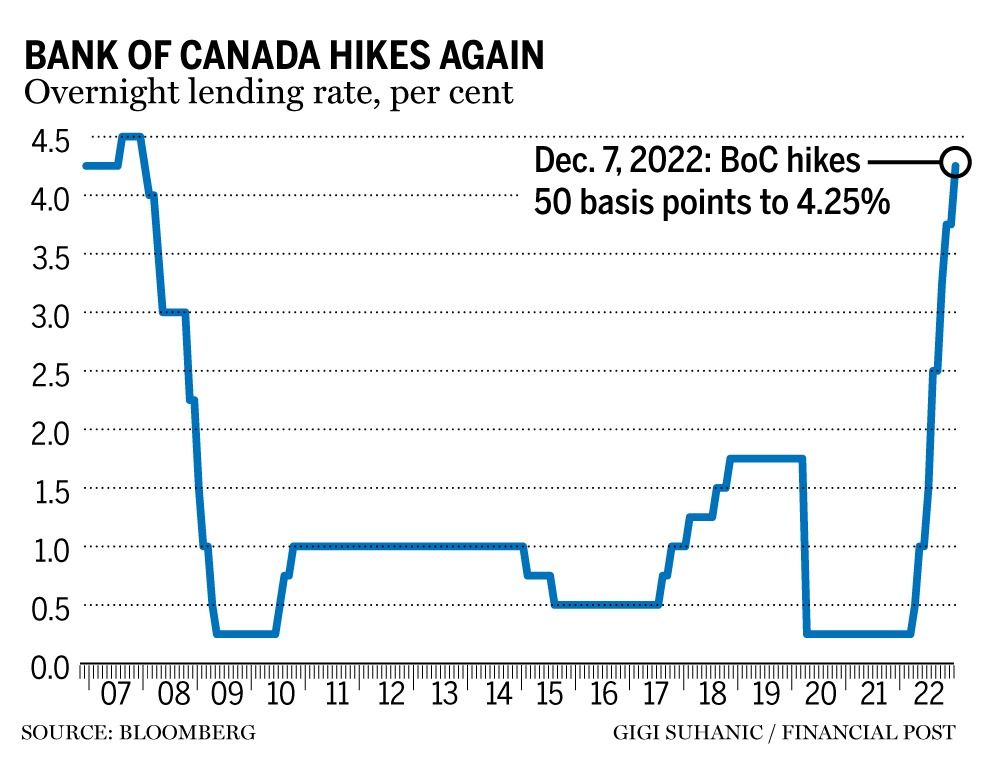

Bank Of Canada Rate Cuts: Desjardins Predicts Three More

Table of Contents

Desjardins' Rationale for Predicting Further Bank of Canada Rate Cuts

Desjardins' prediction of further Bank of Canada rate cuts is rooted in a confluence of economic factors. Their analysis points to a weakening economy, persistent inflation concerns, and significant global economic uncertainty.

Weakening Economic Growth

Canada's economic growth is slowing, impacting key sectors. Statistics Canada's recent GDP reports reveal a deceleration in key areas. The housing market, once a robust engine of growth, is showing signs of cooling, with sales and prices declining in many regions. Similarly, the manufacturing sector is facing headwinds due to reduced consumer spending and global uncertainty.

- Decreased consumer spending: High inflation and rising interest rates have eroded consumer confidence, leading to reduced discretionary spending.

- Impact of global uncertainty: Geopolitical tensions and economic slowdowns in key trading partners, such as the United States, are impacting Canadian exports and investment.

- High inflation persisting: While inflation has begun to ease, it remains stubbornly above the Bank of Canada's target range, prompting concerns about its persistence.

Persistent Inflation Concerns, Despite Recent Decreases

While the Consumer Price Index (CPI) shows a recent decline in inflation, it remains above the Bank of Canada's target of 1-3%. Core inflation, which excludes volatile components like food and energy, is also proving sticky. Lingering supply chain issues and strong wage growth contribute to these persistent inflationary pressures.

- Analysis of the Consumer Price Index (CPI): Though declining, the CPI still reflects elevated prices across various goods and services.

- Discussion of core inflation: The persistence of core inflation signals underlying inflationary pressures within the economy.

- Bank of Canada's mandate and inflation target: The Bank of Canada's primary mandate is to maintain price stability, underscoring the importance of bringing inflation back to its target range.

Global Economic Uncertainty and its Impact on Canada

The global economic landscape is fraught with uncertainty. Recessionary fears in the United States, geopolitical instability, and ongoing supply chain disruptions pose significant risks to the Canadian economy.

- Impact of global trade on the Canadian economy: Canada's reliance on exports makes it vulnerable to global economic slowdowns.

- Vulnerability of Canadian exports: Decreased global demand for Canadian goods could negatively impact economic growth and employment.

- Potential for capital flight: Uncertainty in the global markets could lead to capital flight from Canada, further impacting the economy.

Potential Impact of Further Bank of Canada Rate Cuts

Further Bank of Canada rate cuts will have far-reaching consequences across the Canadian economy.

Effect on Borrowing Costs

Lower interest rates will directly impact borrowing costs for consumers and businesses. Mortgage rates, business loans, and consumer credit will likely become more affordable.

- Potential for increased borrowing: Lower rates could stimulate borrowing and economic activity, potentially boosting demand.

- Stimulating economic activity: Lower borrowing costs may encourage businesses to invest and expand, creating jobs and stimulating growth.

- Risks associated with easy credit: Easy access to credit could potentially fuel unsustainable consumption and exacerbate inflationary pressures.

Impact on the Canadian Dollar

Rate cuts often lead to a weaker Canadian dollar relative to other currencies.

- Attractiveness to foreign investors: Lower interest rates can make Canadian assets less attractive to foreign investors, leading to capital outflows.

- Impact on imports and exports: A weaker dollar could boost exports by making Canadian goods cheaper for foreign buyers but also increase the cost of imports.

- Potential for currency devaluation: Significant rate cuts could lead to a considerable devaluation of the Canadian dollar.

Influence on Inflation

The impact of further rate cuts on inflation is a complex issue with potential for both positive and negative effects.

- Stimulus effect on demand: Lower interest rates could boost consumer spending and investment, potentially leading to higher demand and prices.

- Potential for increased prices due to easy credit: Increased borrowing could drive up demand, exacerbating inflationary pressures.

- Risks of prolonging inflation: If rate cuts are insufficient to stimulate economic growth, they could prolong the period of elevated inflation.

What Consumers and Businesses Should Do in Anticipation of Bank of Canada Rate Cuts

Preparing for potential Bank of Canada rate cuts requires proactive financial planning.

Financial Planning Strategies for Consumers

Consumers should review their financial strategies to take advantage of potentially lower borrowing costs.

- Reviewing mortgage rates: Explore refinancing options to secure potentially lower mortgage payments.

- Adjusting savings strategies: Consider adjusting savings plans to align with lower interest rates on savings accounts.

- Considering investment opportunities: Evaluate investment opportunities that may benefit from lower interest rates.

Strategies for Businesses

Businesses need to adapt their strategies to navigate the changing economic environment.

- Capital expenditure planning: Businesses may find it more attractive to invest in capital expenditures with lower borrowing costs.

- Inventory management: Adjust inventory levels based on anticipated changes in consumer demand.

- Strategies for accessing credit: Explore various credit options and secure favorable terms in anticipation of potential changes.

Conclusion

Desjardins' prediction of three more Bank of Canada rate cuts presents a critical juncture for the Canadian economy. While lower interest rates offer potential benefits such as stimulating economic growth and reducing borrowing costs, the risks of renewed inflationary pressures and a weakening Canadian dollar remain significant. Consumers and businesses must proactively adapt their financial strategies to navigate this evolving landscape. Stay informed on further developments regarding Bank of Canada rate cuts, monitor key economic indicators, and consult with financial professionals for personalized advice to effectively manage your finances in this dynamic environment.

Featured Posts

-

Scrutiny Of Thames Water Executive Bonuses Were They Justified

May 23, 2025

Scrutiny Of Thames Water Executive Bonuses Were They Justified

May 23, 2025 -

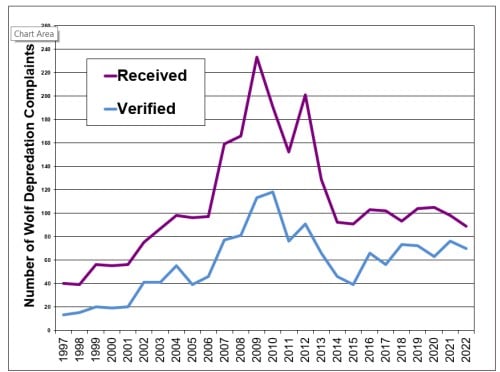

Addressing The Rising Number Of Wolf Incidents In The North State

May 23, 2025

Addressing The Rising Number Of Wolf Incidents In The North State

May 23, 2025 -

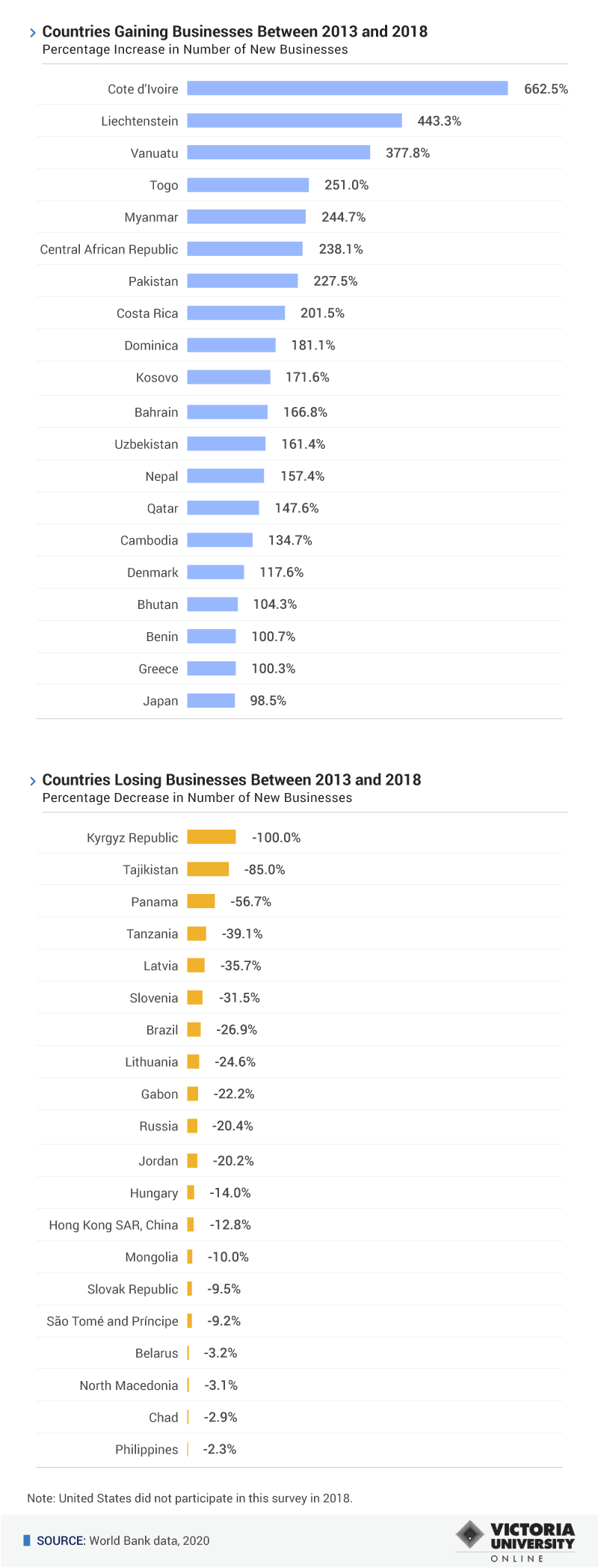

Identifying And Analyzing The Countrys Fastest Growing Business Regions

May 23, 2025

Identifying And Analyzing The Countrys Fastest Growing Business Regions

May 23, 2025 -

Historic Test Victory For Zimbabwe Against Bangladesh

May 23, 2025

Historic Test Victory For Zimbabwe Against Bangladesh

May 23, 2025 -

Zimbabwes Impressive Day One Performance Against Bangladesh

May 23, 2025

Zimbabwes Impressive Day One Performance Against Bangladesh

May 23, 2025

Latest Posts

-

Yevrobachennya 2025 Eksklyuzivniy Prognoz Konchiti Vurst Vid Unian

May 24, 2025

Yevrobachennya 2025 Eksklyuzivniy Prognoz Konchiti Vurst Vid Unian

May 24, 2025 -

Yevrobachennya Peremozhtsi Ostannogo Desyatilittya Ta Yikhni Dosyagnennya

May 24, 2025

Yevrobachennya Peremozhtsi Ostannogo Desyatilittya Ta Yikhni Dosyagnennya

May 24, 2025 -

Peredbachennya Konchiti Vurst Khto Peremozhe Na Yevrobachenni 2025 Unian

May 24, 2025

Peredbachennya Konchiti Vurst Khto Peremozhe Na Yevrobachenni 2025 Unian

May 24, 2025 -

Seattle Green Space A Womans Sanctuary During The Early Pandemic

May 24, 2025

Seattle Green Space A Womans Sanctuary During The Early Pandemic

May 24, 2025 -

A Seattle Womans Pandemic Refuge Finding Solace In A City Green Space

May 24, 2025

A Seattle Womans Pandemic Refuge Finding Solace In A City Green Space

May 24, 2025