Bank Of Canada Rate Expectations: Rosenberg's Interpretation Of The Latest Labour Data

Table of Contents

The latest Canadian labour market report, released [insert date], revealed [insert key data points, e.g., unemployment rate, job creation numbers, wage growth figures]. This data significantly influences the Bank of Canada's monetary policy decisions, as it provides valuable insights into the health of the economy and the potential for inflationary pressures. Our focus will be on deciphering how Rosenberg views this data and what it means for future interest rates.

Rosenberg's Perspective on the Latest Labour Market Report

Unemployment Rate Analysis

Rosenberg's assessment of the unemployment rate is [insert Rosenberg's assessment: e.g., "surprisingly high," "in line with expectations," "slightly lower than anticipated"]. The reported unemployment rate of [insert number]% [insert context, e.g., represents a slight increase/decrease from the previous month/year].

- Participation Rate: Rosenberg likely highlighted the labour force participation rate, noting [insert Rosenberg's comments on participation rate, e.g., whether it's increasing, decreasing, or stagnant, and what that suggests about the health of the labour market].

- Types of Employment: His analysis probably included a breakdown of employment changes across different sectors, noting strength in [insert sectors] and weakness in [insert sectors], impacting overall Canadian unemployment figures.

- Regional Variations: Regional disparities in employment growth are crucial. Rosenberg may have pointed out significant differences between provinces, potentially indicating localized economic strengths and weaknesses.

Wage Growth Assessment

Rosenberg's interpretation of wage growth data is key to understanding his Bank of Canada rate expectations. [Insert whether Rosenberg is concerned about wage growth and why]. He may have focused on [insert specific data points, e.g., average hourly earnings, specific sector wage growth].

- Wage Inflation Concerns: Rosenberg's assessment likely includes an analysis of whether current wage inflation poses a significant threat to overall price stability. He may express concerns about the potential for a wage-price spiral.

- Relationship to CPI: His analysis will inevitably tie wage inflation to the consumer price index (CPI), examining whether wage increases are outpacing inflation or contributing to it.

- Impact on Monetary Policy: He'll likely discuss the implications of wage growth for the Bank of Canada's monetary policy decisions.

Overall Economic Health According to Rosenberg

Based on the labour data, Rosenberg's overall view of the Canadian economy's health is [insert Rosenberg's overall assessment: e.g., cautiously optimistic, pessimistic, concerned]. This assessment likely considers various factors beyond just employment figures.

- Consumer Spending: He would likely consider the impact of wage growth and unemployment on consumer spending and its contribution to Canadian economic growth.

- Business Investment: Business investment decisions are highly sensitive to interest rates and economic outlook. Rosenberg will probably comment on its implications for GDP growth.

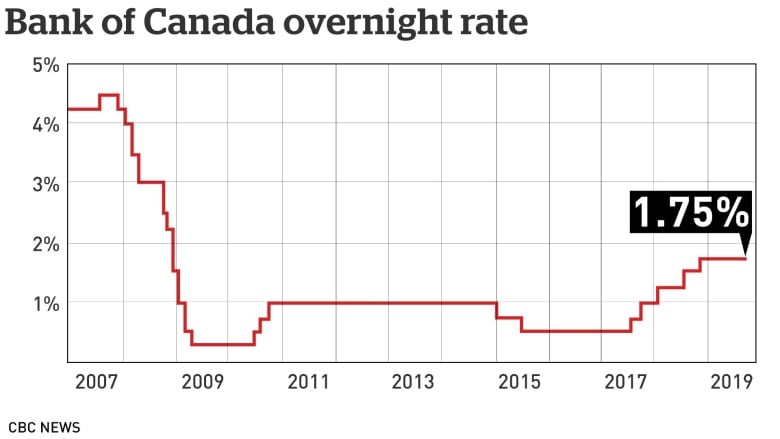

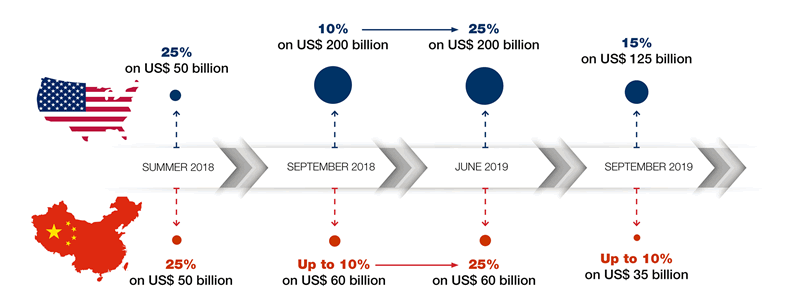

- External Factors: Global economic conditions and geopolitical events play a role. He may discuss their potential impact on the economic outlook.

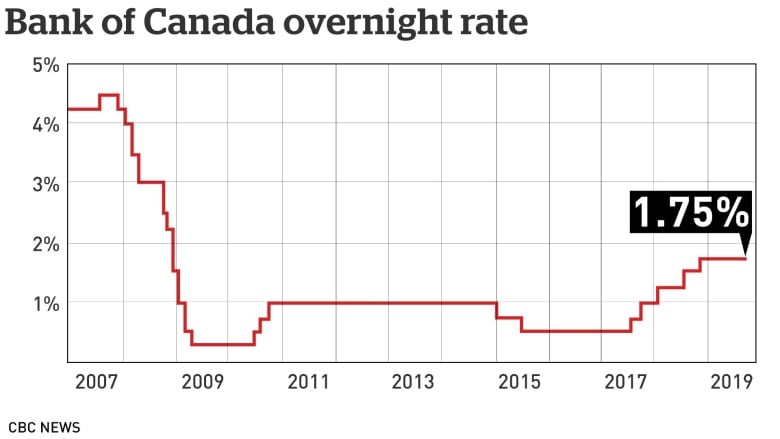

Implications for Bank of Canada Rate Decisions

Rosenberg's Predictions for Future Rate Hikes/Cuts

Based on his analysis, Rosenberg likely predicts [insert Rosenberg's prediction: e.g., further interest rate hikes, a pause in rate increases, potential rate cuts].

- Inflation Expectations: His prediction is strongly influenced by his assessment of inflationary pressures and whether the Bank of Canada will consider them sufficiently controlled.

- Economic Growth Forecasts: His economic growth forecast plays a crucial role. A robust forecast might support further rate hikes, while a weaker one could suggest a pause or even cuts.

- Monetary Policy Response: He'll discuss the likely monetary policy response to the labour market data and its implications for interest rate hikes.

Comparison with Market Consensus

Rosenberg's predictions may differ from the market consensus. The market generally anticipates [insert market consensus]. [Explain the divergence, if any, and its significance].

- Expert Opinions: Comparing Rosenberg's view with other prominent economists and financial analysts helps gauge the range of interest rate forecasts and the level of market uncertainty.

- Market Expectations: This section will highlight how Rosenberg's perspective aligns with or deviates from the broader market expectations regarding future Bank of Canada policy.

- Economic Forecasts: A comparison of economic forecasts will emphasize the underlying assumptions driving diverse viewpoints on the direction of interest rates.

Potential Risks and Uncertainties

Several factors could influence the accuracy of Rosenberg's predictions.

- Global Economic Conditions: Global economic slowdown or recession could significantly impact the Canadian economy and the Bank of Canada's response.

- Geopolitical Events: Unforeseen geopolitical events can introduce significant economic uncertainty and affect the global economic outlook.

- Unexpected Data Releases: Future economic data releases could contradict current trends, affecting the Bank of Canada's decision-making.

Conclusion: Understanding Bank of Canada Rate Expectations – Key Takeaways and Next Steps

Rosenberg's analysis of the latest labour data provides valuable insights into Bank of Canada rate expectations. His concerns about [mention key concerns] highlight potential risks and uncertainties. While his predictions [mention prediction], it's crucial to consider the inherent uncertainties in economic forecasting.

Key takeaways include the importance of monitoring wage growth, the divergence between Rosenberg's views and market consensus, and the significant role of global factors.

Stay updated on the latest Bank of Canada rate expectations and expert analyses to make informed financial decisions. Learn more about the factors influencing Bank of Canada rate expectations by following our updates.

Featured Posts

-

The Posthaste Impact How The Recent Tariff Ruling Affects Canada

May 31, 2025

The Posthaste Impact How The Recent Tariff Ruling Affects Canada

May 31, 2025 -

2025 Pro Motocross Championship What To Expect

May 31, 2025

2025 Pro Motocross Championship What To Expect

May 31, 2025 -

Beautician Avoids Jail After Racial Abuse Of Bouncer

May 31, 2025

Beautician Avoids Jail After Racial Abuse Of Bouncer

May 31, 2025 -

Detroit Tigers Broadcast Features Jack White Insights On Baseball And The Hall Of Fame

May 31, 2025

Detroit Tigers Broadcast Features Jack White Insights On Baseball And The Hall Of Fame

May 31, 2025 -

Rising Covid 19 Infections A New Variant According To The Who

May 31, 2025

Rising Covid 19 Infections A New Variant According To The Who

May 31, 2025