Bank Of Canada's Inflation Dilemma: Rising Core Prices Force Tough Choices

Table of Contents

Understanding Core Inflation and its Persistence

What is Core Inflation and Why is it Important?

Headline inflation, often reported in the news, captures the overall change in prices across the economy. However, this figure can be significantly influenced by short-term fluctuations in the prices of food and energy. Core inflation, on the other hand, provides a more accurate picture of underlying inflationary pressures by removing these volatile components. The Bank of Canada uses several measures of core inflation, including the trimmed mean and the median Consumer Price Index (CPI). These measures identify the central tendency of price changes, filtering out extreme outliers that might distort the overall picture. Core inflation is a crucial indicator because it helps policymakers assess the persistence and breadth of inflationary pressures within the economy, providing a more reliable basis for monetary policy decisions.

Factors Driving Persistent Core Inflation in Canada

Several factors contribute to the persistent rise in core inflation in Canada:

- Strong Consumer Demand: Robust consumer spending, fueled by factors such as pent-up demand from the pandemic and government stimulus, has contributed significantly to increased demand-pull inflation.

- Supply Chain Disruptions: Although easing, lingering supply chain bottlenecks continue to constrain the supply of goods and services, pushing prices upwards. This is particularly evident in sectors like manufacturing and transportation.

- Rising Wages: Increased wages, while positive for workers, also contribute to inflationary pressures as businesses pass increased labor costs onto consumers. This wage-price spiral is a key concern for central banks globally.

- Imported Inflation: The global nature of inflation means that price increases in other countries can be imported into Canada, affecting the prices of goods and services. The strength of the Canadian dollar plays a significant role here.

Specific examples of goods and services driving core inflation include:

- Housing: Rent and home prices remain elevated, contributing significantly to core inflation.

- Services: Prices for services like transportation, healthcare, and recreation continue to rise.

- Durable Goods: While some supply chain issues have eased, prices for certain durable goods remain stubbornly high.

The Bank of Canada's Policy Response Options

The Bank of Canada faces a difficult choice in determining its policy response to persistent core inflation. Several options exist, each with potential benefits and drawbacks.

Maintaining the Current Interest Rate Path

The Bank of Canada has already implemented several interest rate hikes. Maintaining the current interest rate path, while potentially less disruptive in the short term, risks allowing core inflation to become entrenched. This could lead to higher inflation expectations and necessitate even more aggressive rate hikes in the future. The risk of a prolonged period of high inflation negatively impacting economic growth and consumer confidence is significant.

Further Interest Rate Hikes

Increasing interest rates further could effectively curb demand and cool down the economy, potentially reducing inflationary pressures. However, aggressive rate hikes carry substantial risks. They could trigger a recession, leading to job losses and a significant economic slowdown. The Bank of Canada must carefully balance the need to control inflation with the desire to maintain economic growth. This delicate balancing act is central to their decision-making process.

Alternative Policy Tools

Beyond interest rate adjustments, the Bank of Canada has other tools at its disposal. Quantitative tightening (QT), involving the reduction of its balance sheet, can help withdraw liquidity from the financial system and reduce inflationary pressures. Furthermore, clear and consistent communication about its inflation targets and policy intentions can help manage inflation expectations, making it easier to control the overall price level.

The Economic Implications of the Bank of Canada's Decisions

The Bank of Canada's decisions on monetary policy will have wide-ranging economic implications.

Impact on Businesses and Consumers

Higher interest rates increase borrowing costs for businesses, potentially reducing investment and hindering economic expansion. Consumers will also face higher borrowing costs for mortgages, loans, and credit cards, potentially dampening consumer spending. The housing market is particularly vulnerable, with higher interest rates likely leading to a slowdown in house price growth or even declines. Increased interest rates will also place further strain on already elevated household debt levels.

Long-term Economic Outlook

The long-term economic outlook hinges on the success of the Bank of Canada's inflation-fighting strategies. Different policy scenarios lead to varied projections for future inflation rates and economic growth. The ideal outcome is a "soft landing," where inflation is brought under control without triggering a recession. However, the risk of a "hard landing," characterized by a sharp economic contraction, remains a significant concern. The Bank of Canada's actions will have lasting effects on the Canadian economy for years to come.

Conclusion

The Bank of Canada faces a complex and challenging inflation dilemma. Persistent core inflation necessitates careful consideration of policy options. Further interest rate hikes might curb inflation but risk triggering a recession, while maintaining the current path might allow inflation to become entrenched. The central bank's decisions will have significant and far-reaching implications for businesses, consumers, and Canada's long-term economic outlook.

Call to Action: Stay informed about the Bank of Canada's evolving strategies to manage inflation and understand how these decisions affect your financial well-being. Follow our updates on the Bank of Canada inflation situation for the latest analysis and insights. Understanding the Bank of Canada inflation dynamics is crucial for navigating the current economic landscape and making informed financial decisions.

Featured Posts

-

Grem Zaklikaye Do Vidnovlennya Viyskovoyi Dopomogi Ukrayini Analiz Situatsiyi Vid Unian

May 22, 2025

Grem Zaklikaye Do Vidnovlennya Viyskovoyi Dopomogi Ukrayini Analiz Situatsiyi Vid Unian

May 22, 2025 -

Exclusive Partnership Ford And Nissan Join Forces For Ev Battery Plant

May 22, 2025

Exclusive Partnership Ford And Nissan Join Forces For Ev Battery Plant

May 22, 2025 -

Broadcoms V Mware Acquisition At And T Highlights A Potential 1 050 Cost Surge

May 22, 2025

Broadcoms V Mware Acquisition At And T Highlights A Potential 1 050 Cost Surge

May 22, 2025 -

Hieu Ro Chuc Nang Hai Lo Vuong Tren Dau Noi Usb

May 22, 2025

Hieu Ro Chuc Nang Hai Lo Vuong Tren Dau Noi Usb

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Passes Away

May 22, 2025

Adam Ramey Dropout Kings Vocalist Passes Away

May 22, 2025

Latest Posts

-

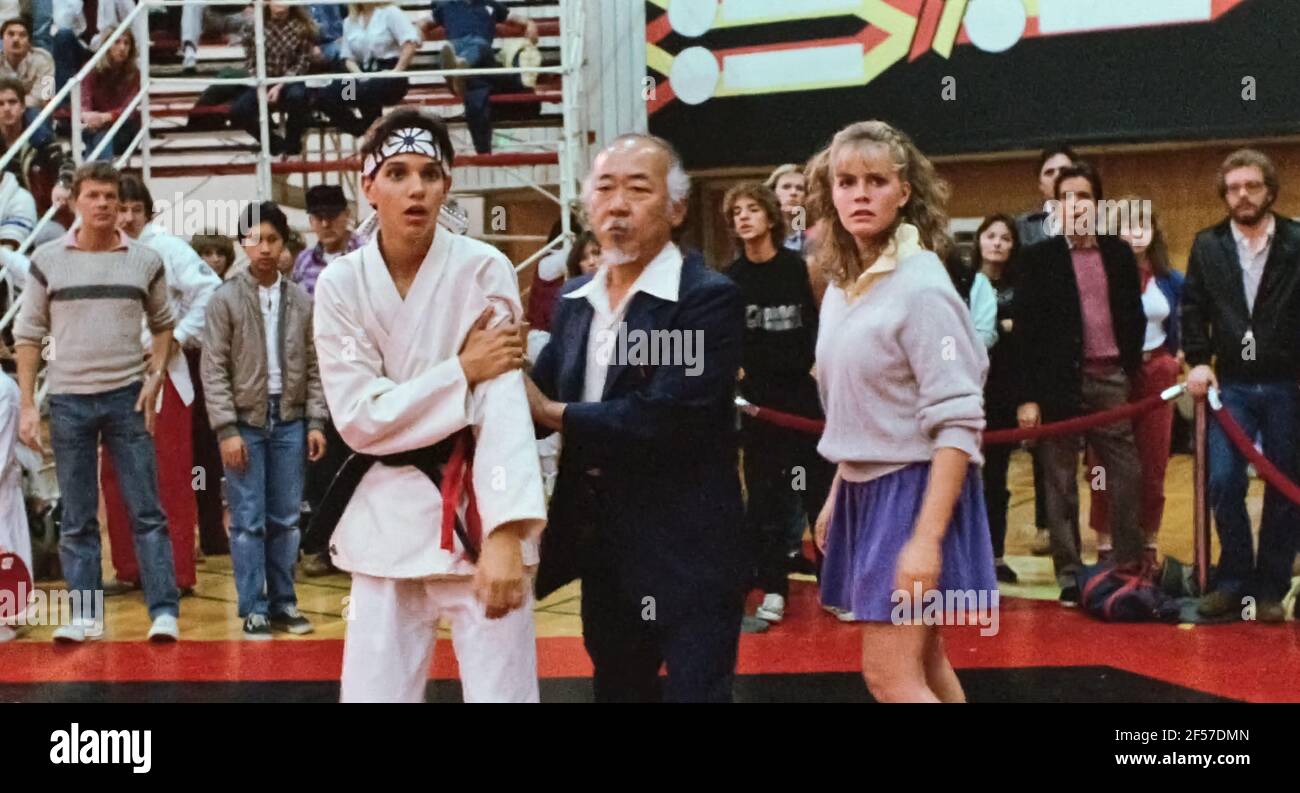

The Karate Kid Part Ii Its Impact On Martial Arts Cinema

May 23, 2025

The Karate Kid Part Ii Its Impact On Martial Arts Cinema

May 23, 2025 -

Mixed Feelings Ralph Macchios Karate Kid 6 Return And A Potential Project Controversy

May 23, 2025

Mixed Feelings Ralph Macchios Karate Kid 6 Return And A Potential Project Controversy

May 23, 2025 -

How Karate Kid Legend Of Miyagi Do Fits Into The Larger Story

May 23, 2025

How Karate Kid Legend Of Miyagi Do Fits Into The Larger Story

May 23, 2025 -

Ralph Macchio Returns For Karate Kid 6 But Another Film Revival Is Considered

May 23, 2025

Ralph Macchio Returns For Karate Kid 6 But Another Film Revival Is Considered

May 23, 2025 -

Karate Kid Legend Of Miyagi Dos Connection To The Franchise

May 23, 2025

Karate Kid Legend Of Miyagi Dos Connection To The Franchise

May 23, 2025