Broadcom's VMware Acquisition: AT&T Highlights A Potential 1,050% Cost Surge

Table of Contents

AT&T's Projected 1,050% Cost Increase: A Case Study

AT&T's reported 1,050% cost increase following the Broadcom VMware acquisition serves as a stark warning to other businesses relying on VMware's extensive product portfolio. While precise figures remain confidential, reports suggest a dramatic jump in licensing and support costs for several key VMware products.

-

Specific VMware Products Impacted: The price increase reportedly affects a range of VMware products crucial to AT&T's network infrastructure, including vSphere (for server virtualization), NSX (for network virtualization), and vRealize (for cloud management). The exact breakdown of costs per product isn't publicly available, but the overall impact is significant.

-

Breakdown of the 1050% Increase: Although the exact calculations aren't publicly disclosed, industry analysts suggest the increase stems from a combination of factors: renewal of existing contracts at drastically higher prices, increased licensing fees for new features, and potentially higher support costs. The magnitude of the increase underscores the potential for significant financial strain on businesses.

-

Impact on AT&T's Budget and Profitability: A 1,050% increase represents a massive blow to AT&T's operational budget. This could force them to re-evaluate spending priorities, potentially impacting investment in other areas of their business, including network upgrades and 5G expansion. The impact on their overall profitability is expected to be substantial.

-

Mitigation Options for AT&T: AT&T, given its size and resources, likely has avenues for cost mitigation. This could involve renegotiating contracts with Broadcom, exploring alternative virtualization solutions, or strategically optimizing their VMware deployments to reduce their reliance on the most expensive components. However, the scale of the increase suggests these options might offer limited relief.

The Underlying Reasons for the Price Surge

The dramatic price increases following the Broadcom VMware acquisition are driven by several factors:

-

Broadcom's Profit Maximization: Broadcom's acquisition of VMware was a multi-billion dollar investment. Maximizing returns on this investment through increased pricing is a likely driver of the cost hikes. This is a common strategy following large mergers and acquisitions.

-

Reduced Competition: The merger significantly reduces competition in the virtualization market. With fewer significant players, Broadcom has less pressure to maintain competitive pricing.

-

Future Price Increases: The 1050% increase for AT&T raises serious concerns about future price hikes across other VMware products and services. This lack of price predictability creates significant uncertainty for businesses reliant on VMware.

-

Regulatory Scrutiny and Antitrust Concerns: The acquisition has already faced regulatory scrutiny, with antitrust concerns being raised. However, the approval of the deal suggests that the current regulatory landscape may not fully mitigate the potential for price gouging.

Broader Implications for the Telecom Industry and Beyond

The impact of the Broadcom VMware acquisition extends far beyond AT&T, affecting the entire telecom industry and even wider sectors:

-

Impact on Smaller Telecom Companies: Smaller telecom companies, with less negotiating leverage than AT&T, are particularly vulnerable to these price increases. They may face even steeper cost surges, potentially impacting their viability.

-

Implications for Cloud Computing Costs: The acquisition has implications for cloud computing costs more broadly. VMware is a crucial component of many cloud infrastructures, and increased VMware costs could translate into higher cloud service prices across the board.

-

Shifts in Vendor Relationships: This merger could lead to significant shifts in vendor relationships and market dynamics. Companies may need to re-evaluate their reliance on VMware and explore alternative solutions to reduce their exposure to price increases.

-

Long-Term Consequences for Innovation: The reduced competition could stifle innovation within the virtualization market. Without competitive pressures, there's less incentive for Broadcom to invest in developing new features and improving existing products.

Alternatives and Mitigation Strategies

Businesses facing similar price increases need to explore several options:

-

Open-Source Alternatives: Open-source virtualization platforms, such as Proxmox VE and oVirt, offer cost-effective alternatives to VMware. Migrating to these platforms could significantly reduce expenses, though it requires significant effort and technical expertise.

-

Migration to Different Cloud Providers: Exploring different cloud providers that offer less reliance on VMware could also help mitigate costs. This might involve rewriting applications or re-architecting existing systems.

-

Cost Optimization Strategies: Optimizing existing VMware deployments can help control costs. This could involve consolidating virtual machines, improving resource allocation, and streamlining management processes.

-

Long-Term Contract Negotiation: Proactive planning and strong contract negotiation are crucial for managing future costs. Businesses should carefully evaluate their VMware contracts and negotiate favorable terms before renewal.

Conclusion

The Broadcom VMware acquisition has the potential to drastically increase costs for businesses, as evidenced by AT&T's projected 1,050% cost surge. This increase stems from various factors, including reduced competition and potential profit maximization strategies by Broadcom. The implications extend far beyond AT&T, affecting the entire telecom industry and the broader enterprise software market. Understanding the potential impact of the Broadcom VMware acquisition is crucial for businesses reliant on VMware products. Proactive planning, exploration of alternatives, and strong contract negotiations are essential to mitigate potential cost increases. Don't wait until it's too late – carefully evaluate your reliance on VMware and develop a mitigation strategy for the Broadcom VMware acquisition today.

Featured Posts

-

The Selena Gomez Taylor Swift Rift Blake Lively At The Center Of The Storm

May 22, 2025

The Selena Gomez Taylor Swift Rift Blake Lively At The Center Of The Storm

May 22, 2025 -

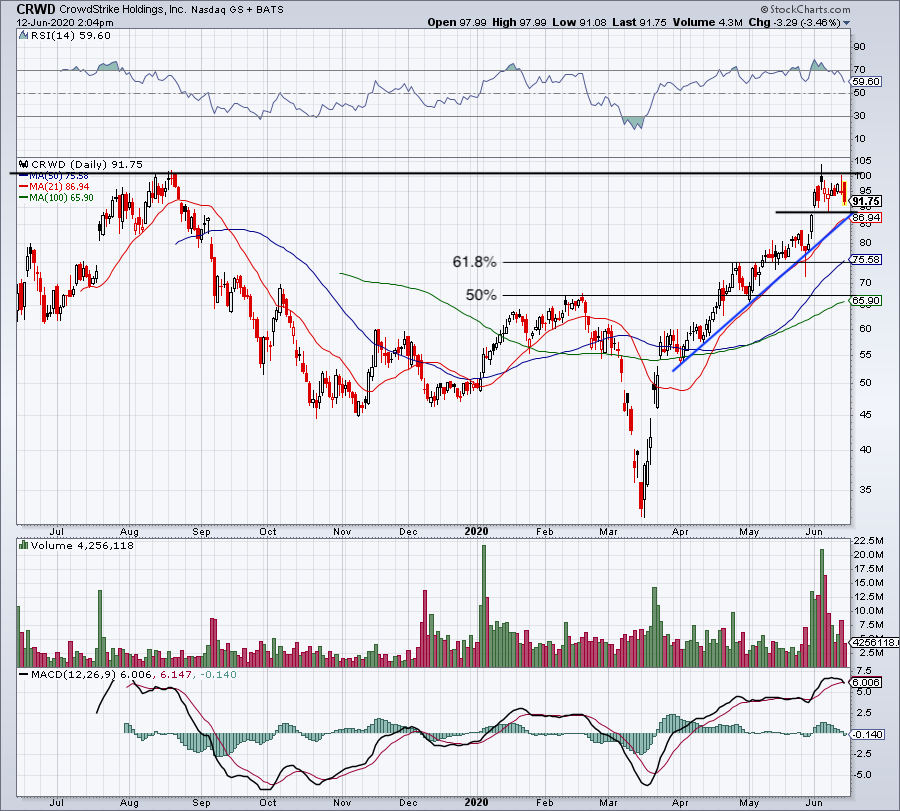

Why Did Core Weave Crwv Stock Price Increase Today

May 22, 2025

Why Did Core Weave Crwv Stock Price Increase Today

May 22, 2025 -

Thursdays Core Weave Crwv Stock Decline A Detailed Explanation

May 22, 2025

Thursdays Core Weave Crwv Stock Decline A Detailed Explanation

May 22, 2025 -

How Two Ceos Romance Led To A Business Scandal

May 22, 2025

How Two Ceos Romance Led To A Business Scandal

May 22, 2025 -

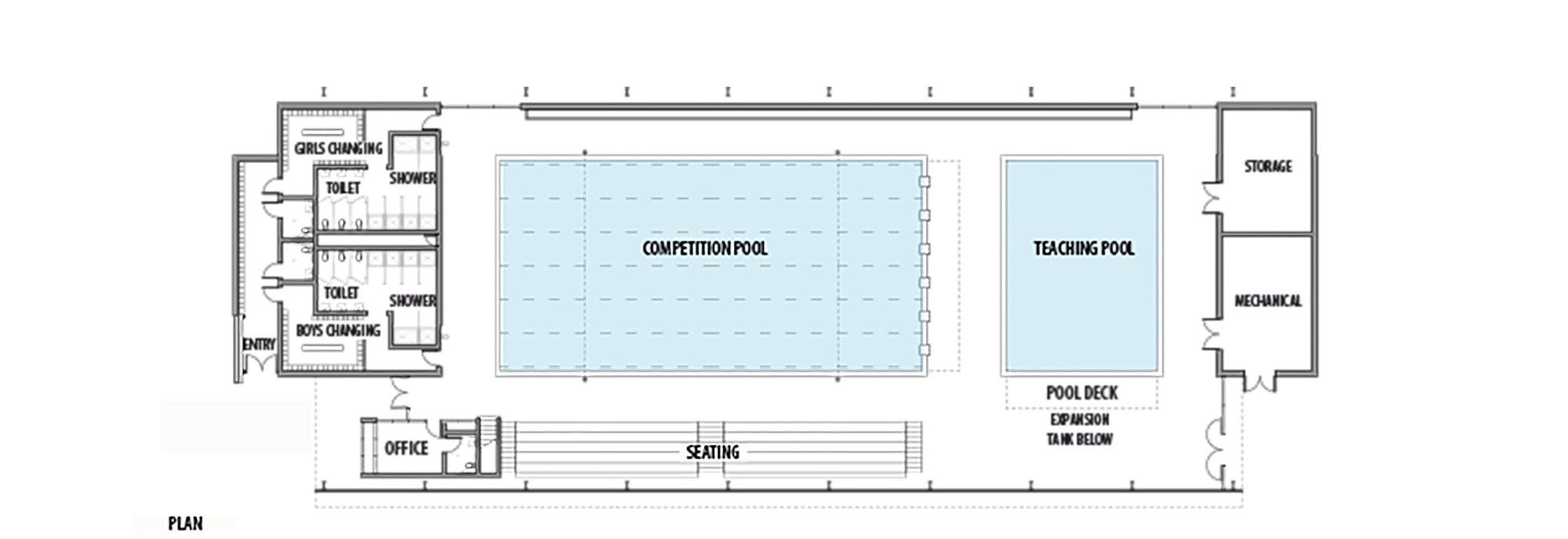

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 22, 2025

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 22, 2025

Latest Posts

-

Ten Cau Va Duong Ket Noi Binh Duong Va Tay Ninh

May 22, 2025

Ten Cau Va Duong Ket Noi Binh Duong Va Tay Ninh

May 22, 2025 -

Hai Lo Nho Tren Dau Usb Ban Co Biet Chung La Gi Khong

May 22, 2025

Hai Lo Nho Tren Dau Usb Ban Co Biet Chung La Gi Khong

May 22, 2025 -

Cau Va Duong Noi Binh Duong Tay Ninh Ten Goi Va Thong Tin Chi Tiet

May 22, 2025

Cau Va Duong Noi Binh Duong Tay Ninh Ten Goi Va Thong Tin Chi Tiet

May 22, 2025 -

Hieu Ro Chuc Nang Hai Lo Vuong Tren Dau Noi Usb

May 22, 2025

Hieu Ro Chuc Nang Hai Lo Vuong Tren Dau Noi Usb

May 22, 2025 -

Usb Co Hai Lo Vuong Chuc Nang Va Tam Quan Trong

May 22, 2025

Usb Co Hai Lo Vuong Chuc Nang Va Tam Quan Trong

May 22, 2025