BigBear.ai (BBAI): Buy Rating Persists As Defense Investments Rise

Table of Contents

Increased Government Spending Fuels BBAI Growth

A significant driver behind the positive outlook for BBAI stock is the dramatic increase in global defense budgets. Governments worldwide are modernizing their armed forces and investing heavily in cutting-edge technologies, particularly artificial intelligence (AI). This surge in spending directly benefits companies like BigBear.ai, which specializes in providing advanced AI-powered solutions to defense and intelligence agencies.

- Increased demand for AI-driven solutions in defense: AI is revolutionizing military operations, from intelligence analysis to autonomous systems. This creates a massive market opportunity for companies like BBAI.

- Growing number of government contracts awarded to AI companies: The increased defense budgets translate into a significant rise in government contracts for AI technologies. BBAI is well-positioned to capitalize on this trend.

- BBAI's unique position in providing advanced analytics and AI capabilities: BigBear.ai offers a comprehensive suite of AI-powered solutions tailored to the specific needs of defense and intelligence organizations. Their expertise in data analytics and sophisticated algorithms sets them apart.

- Specific examples of recent contracts or partnerships: (Note: This section requires specific examples of recent contracts or partnerships. Include links to verifiable sources for improved SEO and credibility. For example: "BigBear.ai recently secured a multi-million dollar contract with the US Army for the development of [specific AI solution]. [Link to source]".)

BigBear.ai's Competitive Advantage in the AI Defense Market

BigBear.ai's success stems from its strong core competencies and a robust technological foundation. These advantages translate directly into a significant competitive edge in securing lucrative government contracts.

- Advanced AI and machine learning capabilities: BBAI possesses cutting-edge AI and machine learning expertise, enabling the development of highly sophisticated solutions for complex defense challenges.

- Expertise in data analytics and cybersecurity: Their deep understanding of data analytics and cybersecurity is crucial in the defense sector, where data protection and threat detection are paramount.

- Strategic partnerships and collaborations: Collaborations with other technology leaders expand BBAI's reach and capabilities, further solidifying its market position.

- Strong intellectual property portfolio: A substantial IP portfolio protects BBAI's innovative technologies and provides a barrier to entry for competitors.

Analyst Ratings and Price Targets for BBAI Stock

The analyst consensus on BBAI stock is overwhelmingly positive, with many analysts issuing "buy" ratings and setting ambitious price targets. (Note: This section requires specific examples of analyst ratings and price targets from reputable sources, including links to the reports. For example: "Barclays recently issued a 'buy' rating on BBAI stock with a price target of $[price]. [Link to report].")

The rationale behind these buy ratings frequently cites strong revenue growth projections, potential for high profit margins, and the significant growth potential within the defense AI market. However, it's important to acknowledge potential risks. These could include increased competition, delays in securing government contracts, or changes in government spending priorities.

Analyzing BBAI's Financial Performance and Future Outlook

BigBear.ai's financial performance supports the positive outlook for the stock. (Note: This section requires inclusion of key financial metrics like revenue, earnings, and growth rates. Include charts and graphs, if available, to enhance understanding and visual appeal. Source these figures from reliable financial reporting sites.) The company's growth trajectory indicates a significant upward trend, suggesting continued strong performance in the coming years. BBAI's strategic initiatives, focused on expanding its AI capabilities and securing new contracts, are expected to further boost future earnings.

Conclusion: Investing in the Future of Defense with BigBear.ai (BBAI)

The continued "buy" rating for BBAI stock is well-supported by several factors: increased defense spending, BigBear.ai's competitive advantages in the AI defense market, and a positive outlook based on its financial performance. BBAI represents a compelling investment opportunity within the rapidly expanding AI defense sector. The key takeaway is that BigBear.ai is well-positioned to benefit from significant growth in government spending on AI-driven defense technologies.

Consider conducting further research into BBAI stock and exploring the potential investment opportunities. Is BigBear.ai a good buy? The evidence suggests a strong possibility. The consistent "buy" rating, combined with the growth projections and BBAI's competitive advantage, makes it a stock worthy of serious consideration for investors interested in the future of defense technology and BigBear.ai investment opportunities. Assess your own risk tolerance and investment strategy before making any decisions regarding BBAI stock outlook.

Featured Posts

-

Huuhkajat Saavat Vahvistuksen Benjamin Kaellmanin Maalintekotaidot

May 20, 2025

Huuhkajat Saavat Vahvistuksen Benjamin Kaellmanin Maalintekotaidot

May 20, 2025 -

Nyt Mini Crossword Answers For March 18 2024

May 20, 2025

Nyt Mini Crossword Answers For March 18 2024

May 20, 2025 -

Climate Risk And Your Home Loan Will Rising Temperatures Impact Your Credit Score

May 20, 2025

Climate Risk And Your Home Loan Will Rising Temperatures Impact Your Credit Score

May 20, 2025 -

Rey Fenixs Wwe Smack Down Debut Ring Name Revealed

May 20, 2025

Rey Fenixs Wwe Smack Down Debut Ring Name Revealed

May 20, 2025 -

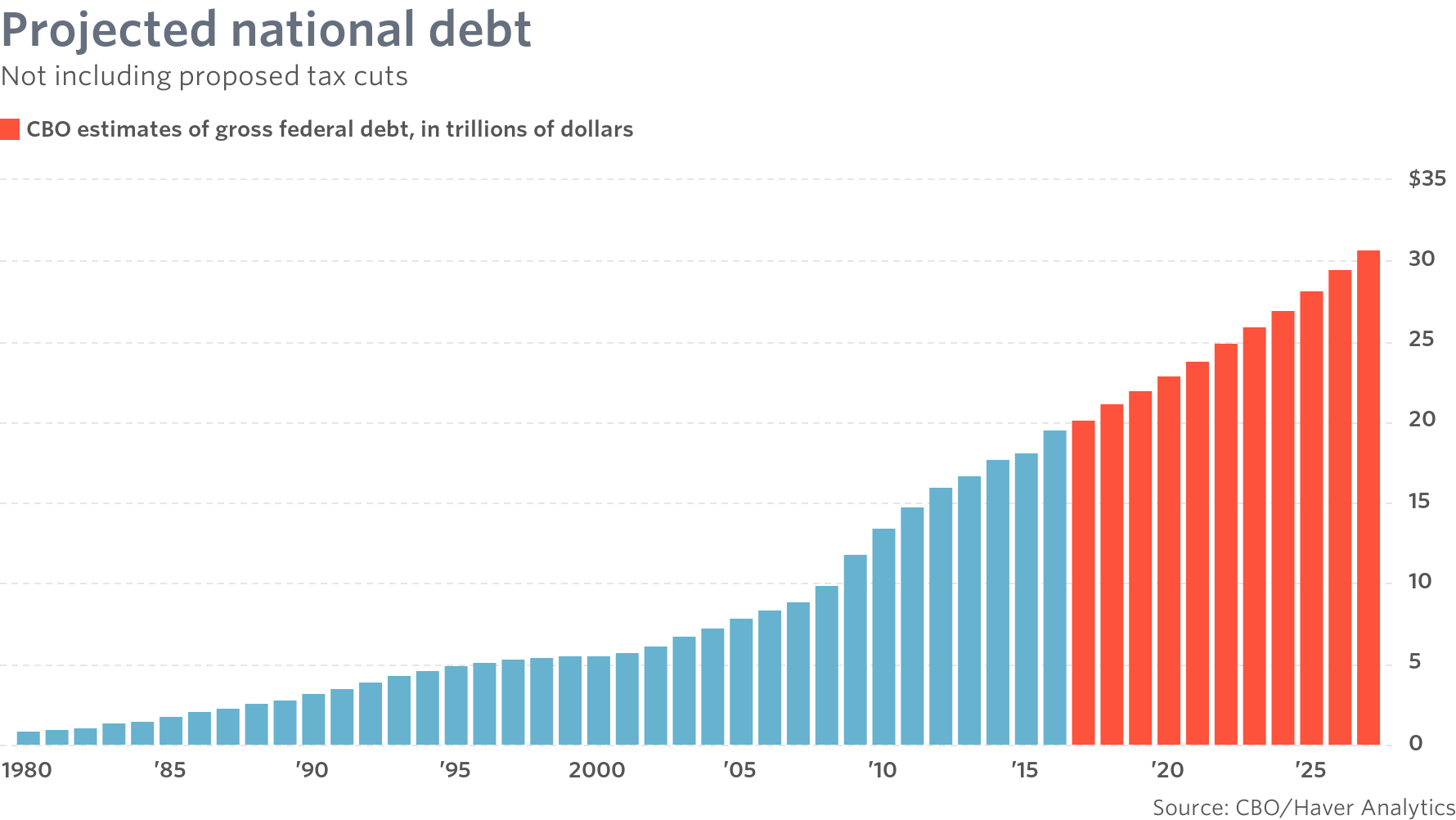

Analyzing The Gop Tax Plan The Reality Of Deficit Reduction

May 20, 2025

Analyzing The Gop Tax Plan The Reality Of Deficit Reduction

May 20, 2025