BigBear.ai Holdings, Inc. Accused Of Securities Violations

Table of Contents

The Allegations Against BigBear.ai

BigBear.ai is accused of various securities violations, primarily centering around allegations of accounting fraud and misleading financial reporting. These accusations suggest the company may have intentionally misrepresented its financial performance to investors, potentially violating federal securities laws.

-

Specific examples of alleged fraudulent activities: While specifics are still emerging and subject to ongoing investigations, initial reports suggest irregularities in revenue recognition, potentially inflating reported earnings. Further accusations involve the potential misrepresentation of contract values and the timing of revenue streams.

-

Regulatory bodies involved: The Securities and Exchange Commission (SEC) and potentially the Department of Justice (DOJ) are reportedly investigating these securities violations. The involvement of multiple agencies underscores the gravity of the allegations.

-

Financial irregularities cited: Accusations include improper accounting practices, potentially leading to overstated revenue and profits. This alleged manipulation of financial statements could be a violation of multiple securities laws, including those related to material misrepresentation. [Insert link to relevant news article or SEC filing if available].

-

Official statements: [Insert links to official statements from BigBear.ai, the SEC, or other relevant sources if available]. It's important to consult official channels for the most up-to-date information.

Impact on BigBear.ai's Stock Price and Investor Sentiment

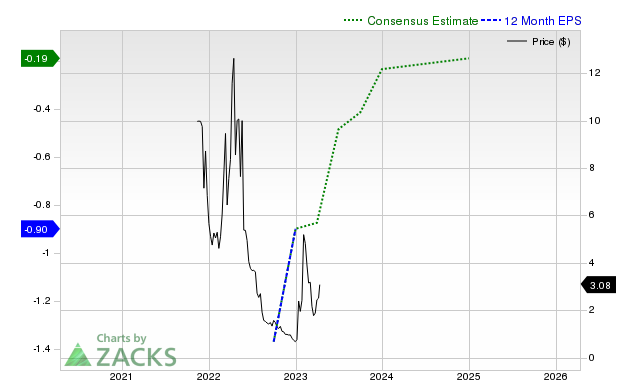

The allegations of securities violations have had a dramatic impact on BigBear.ai's stock price and investor sentiment. The stock has experienced significant volatility since the accusations surfaced, reflecting a loss of investor confidence.

-

Stock price fluctuations: [Insert chart or graph illustrating BigBear.ai's stock price performance since the allegations surfaced. Clearly label the axes and key dates]. The chart clearly shows a sharp decline in the stock price following the initial reports of the investigation.

-

Investor reactions and sell-offs: Investors have reacted negatively, leading to significant sell-offs and a decrease in trading volume. The uncertainty surrounding the outcome of the investigations has created a climate of fear and uncertainty.

-

Analyst rating downgrades: Several financial analysts have downgraded their ratings for BigBear.ai's stock, reflecting concerns about the potential financial and legal repercussions. These downgrades further fueled the negative investor sentiment.

-

Impact on future investment: The current situation has significantly damaged investor confidence in BigBear.ai, raising concerns about future investments and the long-term viability of the company. The outcome of the investigations will be crucial in determining future investment decisions.

Ongoing Investigations and Legal Ramifications

Several investigations are underway, examining the alleged securities violations. The potential legal ramifications for BigBear.ai and its executives are substantial.

-

SEC investigations and potential lawsuits: The SEC is conducting a thorough investigation into the alleged accounting irregularities and other financial misconduct. A formal lawsuit by the SEC is a strong possibility, which could result in significant fines and penalties.

-

Potential penalties and fines: Depending on the findings of the investigations, BigBear.ai could face substantial fines, penalties, and other sanctions for violating securities laws.

-

Class-action lawsuits: Several class-action lawsuits have already been filed by investors who claim they suffered financial losses due to the alleged securities violations. These lawsuits add another layer of legal and financial risk for the company.

-

Legal ramifications for executives: Depending on the extent of their involvement, company executives could face criminal charges, civil penalties, and reputational damage.

Potential Outcomes and Future for BigBear.ai

The future of BigBear.ai hinges on the outcome of the ongoing investigations and lawsuits. Several scenarios are possible.

-

Possible scenarios: The investigations could result in a settlement with the SEC, a conviction on criminal charges, or a significant corporate restructuring. Each scenario would have drastically different implications for the company's future.

-

Long-term effects on reputation and operations: Regardless of the outcome, the allegations of securities violations have significantly damaged BigBear.ai's reputation, potentially impacting its ability to attract customers, partners, and investors.

-

Future prospects for BigBear.ai's technology and market position: The advanced technology developed by BigBear.ai remains a key asset. However, the current crisis could significantly hinder its growth and market penetration if not addressed effectively.

Conclusion

This article has detailed the serious allegations of securities violations facing BigBear.ai Holdings, Inc., outlining their impact on the stock price, investor confidence, and ongoing legal battles. The situation remains fluid, with significant implications for the company’s future. The potential outcomes range from financial penalties and reputational damage to criminal charges against executives.

Call to Action: Stay informed about the unfolding situation surrounding BigBear.ai Holdings, Inc. and the ongoing investigations into these alleged securities violations. Continue to monitor news sources and official statements for updates on this developing story. Understanding the complexities of these securities violations and their potential impact is crucial for making informed investment decisions.

Featured Posts

-

Revealing Photos Of Paulina Gretzky Including A Topless Selfie

May 20, 2025

Revealing Photos Of Paulina Gretzky Including A Topless Selfie

May 20, 2025 -

Lightning 100s New Music Monday 2 24 25 Playlist

May 20, 2025

Lightning 100s New Music Monday 2 24 25 Playlist

May 20, 2025 -

Tottenham Loanees Stellar Performance Propels Leeds To Championship Summit

May 20, 2025

Tottenham Loanees Stellar Performance Propels Leeds To Championship Summit

May 20, 2025 -

Vtoroy Rebenok Dzhennifer Lourens Aktrisa I Ee Semya Popolnilis

May 20, 2025

Vtoroy Rebenok Dzhennifer Lourens Aktrisa I Ee Semya Popolnilis

May 20, 2025 -

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025