BigBear.ai Holdings, Inc. (BBAI): Analyst Downgrade And Growth Concerns

Table of Contents

Analyst Downgrades: Understanding the Rationale

The recent negative sentiment surrounding BigBear.ai (BBAI) is largely fueled by a series of analyst downgrades. Understanding the reasoning behind these actions is crucial for investors seeking to assess the true risk and reward of investing in BBAI stock.

Specific Analyst Actions:

Several prominent financial firms have recently downgraded their ratings on BBAI stock. For example, [Insert Analyst Firm 1] lowered its rating from [Previous Rating] to [New Rating], citing [Quote from Analyst Report 1 about specific concerns, e.g., "concerns about the company's ability to scale operations efficiently"]. Similarly, [Insert Analyst Firm 2] reduced its rating from [Previous Rating] to [New Rating], highlighting [Quote from Analyst Report 2, e.g., "disappointing Q2 earnings and a weaker-than-expected revenue outlook"]. [Include links to the original analyst reports whenever possible].

-

Key Concerns Cited by Analysts:

- Slower-than-anticipated revenue growth.

- Increased competition from larger, more established AI companies.

- Challenges in scaling operations and achieving profitability.

- Difficulty securing and executing large-scale government contracts.

-

Financial Metrics Triggering Downgrades:

- Lower-than-expected earnings per share (EPS).

- Reduced revenue guidance for the next quarter and/or fiscal year.

- Higher-than-anticipated operating expenses.

Impact of Downgrades on Investor Sentiment:

The analyst downgrades have significantly impacted investor sentiment, leading to a decline in BBAI's stock price. [Include a chart or graph illustrating the stock price movement following the downgrades, if possible]. This negative sentiment reflects a loss of confidence in the company's ability to meet its growth targets and achieve sustained profitability in the competitive AI market. The uncertainty surrounding BBAI's future performance has understandably made investors cautious.

Growth Concerns: Assessing the Challenges

BigBear.ai (BBAI) faces significant challenges in achieving its growth ambitions. These concerns contribute significantly to the negative investor sentiment surrounding the stock.

Competition in the AI Market:

BigBear.ai operates in a highly competitive AI market dominated by larger, more established players with substantial resources and market share. Key competitors include [List key competitors and briefly describe their strengths]. BigBear.ai's relatively smaller size and market capitalization present a significant hurdle to its growth aspirations.

-

Challenges in Competing with Larger Players:

- Limited brand recognition and market awareness compared to industry giants.

- Difficulty attracting and retaining top talent in the competitive AI talent market.

- Potential for slower innovation due to limited resources for research and development.

-

Market Share and Growth Potential: BigBear.ai's current market share is [insert data if available]. The company's growth potential hinges on its ability to successfully navigate the competitive landscape, secure new contracts, and develop innovative AI solutions that differentiate it from its competitors.

Financial Performance and Sustainability:

Analyzing BigBear.ai's financial health is critical for evaluating its long-term viability.

-

Key Financial Indicators:

- Revenue growth rate (year-over-year and quarter-over-quarter).

- Profitability margins (gross margin, operating margin, net margin).

- Debt levels and leverage ratios.

- Cash flow from operations.

-

Sustainability of the Business Model: BigBear.ai's ability to generate consistent profits and positive cash flow is crucial for its long-term sustainability. Concerns exist about the company's reliance on specific contracts and its ability to diversify its revenue streams. A careful examination of its financial statements and future projections is crucial before making any investment decisions.

Potential Future Outlook for BigBear.ai (BBAI)

Despite the recent negative news, there are potential catalysts that could improve BigBear.ai's prospects.

Factors Influencing Future Growth:

-

New Contract Wins: Securing significant new contracts, especially large government contracts, could significantly boost BigBear.ai's revenue and improve its financial position.

-

Technological Advancements: Developing and launching innovative AI solutions with a clear competitive advantage could attract new clients and increase market share.

-

Strategic Partnerships: Collaborating with larger technology companies or government agencies could provide access to new markets and resources.

-

Potential Scenarios:

- Positive Scenario: BigBear.ai successfully secures major contracts, develops innovative AI solutions, and improves its operational efficiency, leading to increased revenue and profitability.

- Negative Scenario: The company fails to secure new contracts, faces increased competition, and struggles to achieve profitability, potentially leading to further stock price declines.

Investment Strategies:

Based on the analysis presented, investors considering BigBear.ai (BBAI) should adopt a cautious approach. The current situation presents significant risks, and the potential for further negative news remains.

- Investment Recommendations (Disclaimer: This is not financial advice):

- Hold: Investors with a long-term perspective and a high-risk tolerance may choose to hold their existing BBAI shares, hoping for a turnaround.

- Sell: Investors concerned about the risks associated with BBAI may consider selling their shares to limit potential losses.

- Wait and See: It may be prudent to wait and monitor BigBear.ai's performance and the market sentiment before making any investment decisions.

It's crucial to conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to BigBear.ai (BBAI) stock.

Conclusion: BigBear.ai (BBAI) Investment Decisions: A Cautious Approach

This analysis highlights the significant challenges facing BigBear.ai (BBAI), including analyst downgrades fueled by concerns about revenue growth, increased competition, and the sustainability of its business model. The recent negative sentiment surrounding BBAI stock underscores the importance of thorough research and careful consideration before making any investment decisions. While potential catalysts for future growth exist, the risks remain substantial. Investors must carefully weigh these risks against their own risk tolerance and investment goals. Before investing in BigBear.ai (BBAI) or any other stock, conduct your own thorough due diligence and consult with a qualified financial advisor. Remember to continue monitoring BBAI stock performance, stay informed about industry trends, and make informed investment decisions based on your own research.

Featured Posts

-

Reddits 12 Best Ai Stocks A Comprehensive Overview

May 21, 2025

Reddits 12 Best Ai Stocks A Comprehensive Overview

May 21, 2025 -

Dimokratiki Rodoy Synaylia Kathigiton Apo To Dimotiko Odeio

May 21, 2025

Dimokratiki Rodoy Synaylia Kathigiton Apo To Dimotiko Odeio

May 21, 2025 -

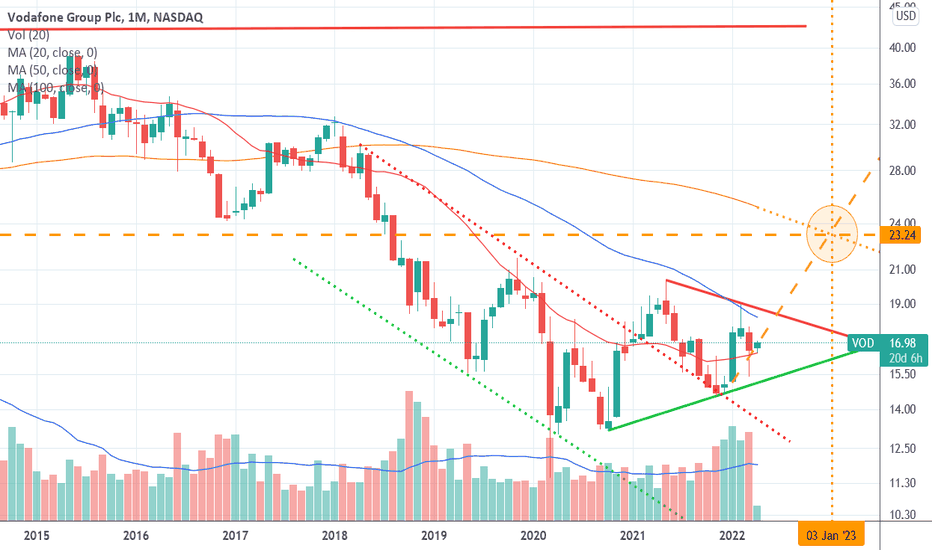

Vodacoms Vod Improved Earnings Drive Higher Than Expected Payout

May 21, 2025

Vodacoms Vod Improved Earnings Drive Higher Than Expected Payout

May 21, 2025 -

Connaissez Vous Vraiment La Loire Atlantique Un Quiz Pour Le Decouvrir

May 21, 2025

Connaissez Vous Vraiment La Loire Atlantique Un Quiz Pour Le Decouvrir

May 21, 2025 -

D Wave Quantum Qbts Stock Slump On Monday Investigating The Underlying Factors

May 21, 2025

D Wave Quantum Qbts Stock Slump On Monday Investigating The Underlying Factors

May 21, 2025

Latest Posts

-

Dancehall Kingpin Beenie Man Announces New York It Venture

May 22, 2025

Dancehall Kingpin Beenie Man Announces New York It Venture

May 22, 2025 -

Beenie Mans It Empire A New York Power Play

May 22, 2025

Beenie Mans It Empire A New York Power Play

May 22, 2025 -

Nuffys Dream Sharing The Stage With Vybz Kartel

May 22, 2025

Nuffys Dream Sharing The Stage With Vybz Kartel

May 22, 2025 -

Beenie Mans New York Takeover Is This The Next Big Thing In It

May 22, 2025

Beenie Mans New York Takeover Is This The Next Big Thing In It

May 22, 2025 -

Nuffy Touring With Vybz Kartel A Dream Realized

May 22, 2025

Nuffy Touring With Vybz Kartel A Dream Realized

May 22, 2025