BigBear.ai Stock Plunges Following Disappointing Q1 Earnings

Table of Contents

Key Factors Contributing to BigBear.ai's Q1 Earnings Miss

BigBear.ai's Q1 earnings report revealed several critical factors contributing to its disappointing performance and subsequent stock plunge. The results significantly missed analyst expectations across key metrics, raising serious concerns among investors.

-

Significant Revenue Shortfall: The company reported a substantial revenue shortfall compared to analyst projections. This miss, representing a considerable deviation from predicted figures, immediately triggered negative market sentiment. The specific shortfall needs further investigation to pinpoint the exact causes.

-

Lower-Than-Projected Earnings Per Share (EPS): The reported earnings per share (EPS) fell dramatically short of expectations. This metric, a crucial indicator of profitability, highlighted the company's struggles in translating revenue into profit. A deeper dive into the company's financial statements is necessary to understand the contributing factors.

-

Negative Downward Revision of Full-Year Guidance: Perhaps the most alarming aspect of the report was the company's decision to significantly lower its full-year guidance. This demonstrates a lack of confidence in future performance and further fueled investor anxieties.

-

Increased Operating Costs and Potential Cost Overruns: Rising operating costs and potential cost overruns played a significant role in eroding profitability. This could be attributed to various factors, including increased labor costs, expansion efforts, or inefficiencies in operations.

-

Delays in Securing Key Government Contracts: BigBear.ai operates significantly within the government services sector. Delays in securing crucial contracts directly impacted revenue streams and contributed to the disappointing Q1 results. The competitiveness of the government contracting landscape is known to be intense.

-

Increased Competition in the AI and Government Services Sectors: The AI sector, and specifically the niche BigBear.ai occupies, is experiencing intense competition. This competitive pressure makes securing and maintaining market share increasingly challenging.

-

Market Saturation Impacting Growth Potential: Analysis of the market suggests a potential saturation impacting BigBear.ai's growth trajectory. This indicates a possible slowing of market expansion for their services, further hindering their growth prospects.

Market Reaction and Investor Sentiment Following the Earnings Report

The market's response to BigBear.ai's disappointing Q1 earnings was swift and severe. The negative news triggered a significant sell-off, reflecting widespread investor concern.

-

Sharp Stock Price Decline: BigBear.ai's stock price plummeted following the earnings announcement, indicating a significant loss of investor confidence. The percentage drop needs to be analyzed in the context of broader market movements for a more accurate assessment.

-

Increased Trading Volume: The increased trading volume surrounding BigBear.ai's stock after the earnings release reflected heightened investor activity – a mix of selling pressure and potential short-selling.

-

Analyst Downgrades and Price Target Reductions: Numerous analysts responded to the disappointing results by downgrading their ratings on BigBear.ai stock and reducing their price targets. This further contributed to the negative market sentiment.

-

Decline in Investor Confidence and Overall Market Sentiment: The overall sentiment surrounding BigBear.ai shifted dramatically, impacting investor confidence in the company's long-term prospects. This decline in confidence is a significant factor affecting the stock price.

-

Sell-Off and its Impact on Investor Portfolios: The sell-off caused significant losses for investors holding BigBear.ai stock. Understanding the impact on individual portfolios requires a deeper look at investor holdings.

-

Short Selling Activity: The potential for increased short-selling activity needs to be evaluated as another contributing factor to the stock price decline. A sharp increase in short positions is a warning sign.

BigBear.ai's Future Outlook and Potential for Recovery

While the Q1 results were undeniably disappointing, BigBear.ai's future is not necessarily bleak. The company's ability to address the challenges that led to the poor performance will determine its trajectory.

-

Addressing Q1 Issues: BigBear.ai needs to clearly articulate its plans to address the revenue shortfall, cost overruns, and contract delays. A transparent communication strategy is crucial to regaining investor trust.

-

Future Contracts and Pipeline: The company's pipeline of potential future government and commercial contracts will be a key indicator of its growth potential. Securing significant new business is paramount.

-

Technological Innovation and Competitive Advantage: BigBear.ai's ability to innovate and maintain a competitive advantage in a rapidly evolving AI landscape will be essential for its long-term success. Continuous investment in R&D is crucial.

-

Management Response and Turnaround Strategy: The effectiveness of the management team's response and their ability to implement a comprehensive turnaround strategy will be critical in determining future performance.

-

Long-Term Investment Potential and Risks: Investors must carefully weigh the long-term investment potential against the inherent risks associated with BigBear.ai's current situation. A thorough risk assessment is vital before investing.

Conclusion

BigBear.ai's disappointing Q1 earnings report resulted in a significant stock plunge, driven by a substantial revenue miss, lower-than-expected EPS, and a negative revision of full-year guidance. The market reacted swiftly, with a sharp decline in stock price and a significant decrease in investor confidence. While the future remains uncertain, the company's success hinges on securing new contracts, fostering innovation, and effectively managing costs. The ability of management to implement a clear turnaround strategy will be critical.

Call to Action: Stay informed on the latest developments surrounding BigBear.ai stock and the broader AI market. Continuously monitor the company's progress, upcoming earnings reports, and analyst commentary to make well-informed investment decisions regarding BigBear.ai and similar AI stocks. Always conduct thorough research and fully understand the risks involved before investing in BigBear.ai or any other high-risk stock.

Featured Posts

-

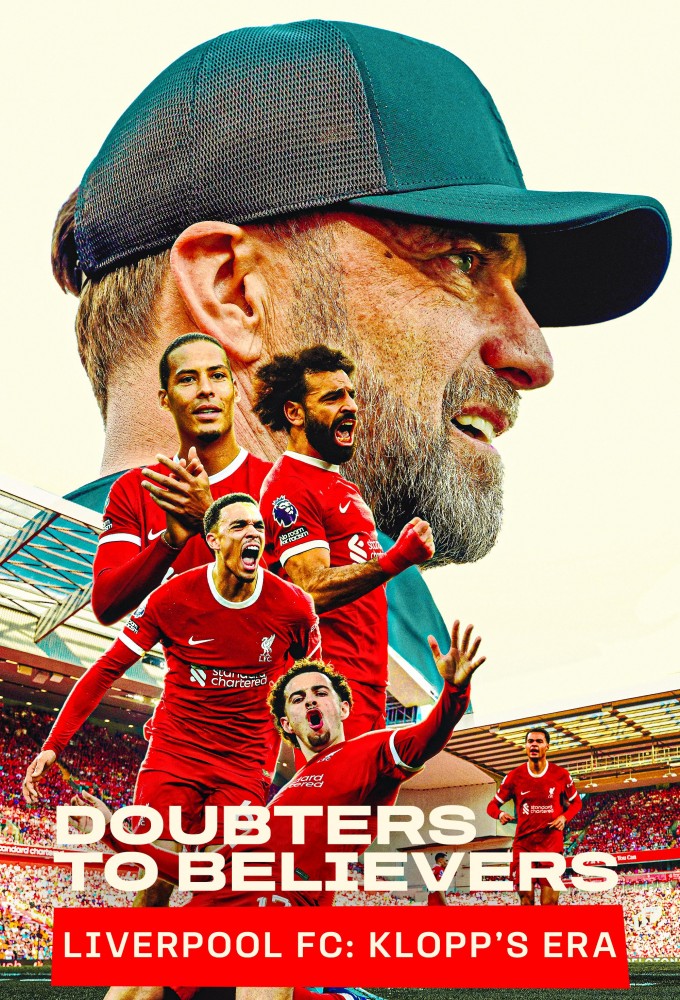

The Juergen Klopp Era At Liverpool Transforming Doubters Into Believers

May 21, 2025

The Juergen Klopp Era At Liverpool Transforming Doubters Into Believers

May 21, 2025 -

Kaellmanin Potentiaali Uusi Aikakausi Huuhkajissa

May 21, 2025

Kaellmanin Potentiaali Uusi Aikakausi Huuhkajissa

May 21, 2025 -

Understanding The Monday Increase In D Wave Quantum Inc Qbts Stock Price

May 21, 2025

Understanding The Monday Increase In D Wave Quantum Inc Qbts Stock Price

May 21, 2025 -

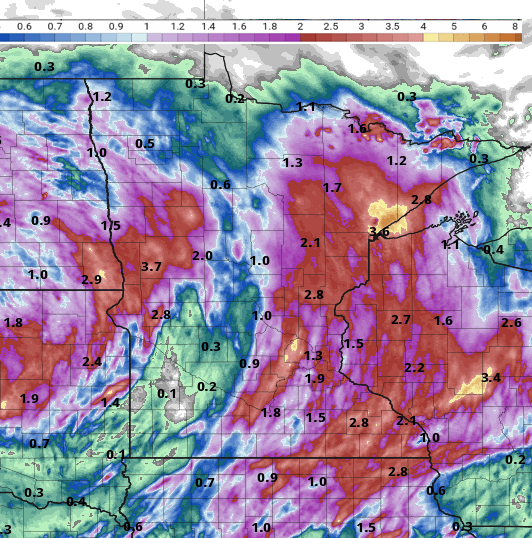

Updated Rain Forecast Knowing When Showers Will Start And Stop

May 21, 2025

Updated Rain Forecast Knowing When Showers Will Start And Stop

May 21, 2025 -

Lazios Late Equalizer Secures 1 1 Draw Against 10 Man Juventus

May 21, 2025

Lazios Late Equalizer Secures 1 1 Draw Against 10 Man Juventus

May 21, 2025

Latest Posts

-

The Goldbergs Impact And Cultural Significance

May 22, 2025

The Goldbergs Impact And Cultural Significance

May 22, 2025 -

Vybz Kartel On Skin Bleaching A Journey Of Self Love And Acceptance

May 22, 2025

Vybz Kartel On Skin Bleaching A Journey Of Self Love And Acceptance

May 22, 2025 -

Exploring The Enduring Appeal Of The Goldbergs

May 22, 2025

Exploring The Enduring Appeal Of The Goldbergs

May 22, 2025 -

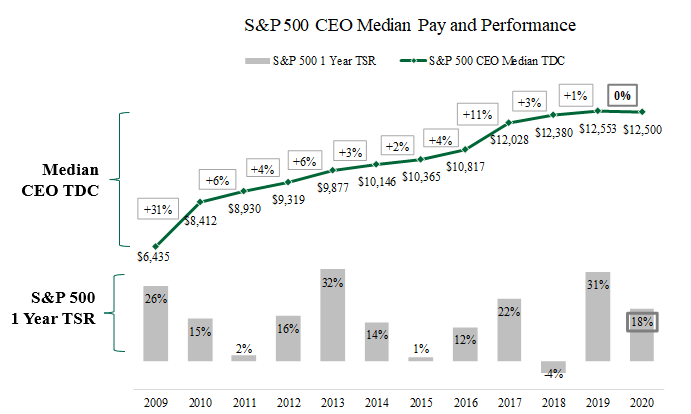

Bp Announces 31 Decrease In Ceo Compensation

May 22, 2025

Bp Announces 31 Decrease In Ceo Compensation

May 22, 2025 -

The Impact Of Low Self Esteem Vybz Kartels Experience With Skin Bleaching

May 22, 2025

The Impact Of Low Self Esteem Vybz Kartels Experience With Skin Bleaching

May 22, 2025