Bitcoin (BTC) Price Surge: Trump's Actions And Fed Influence

Table of Contents

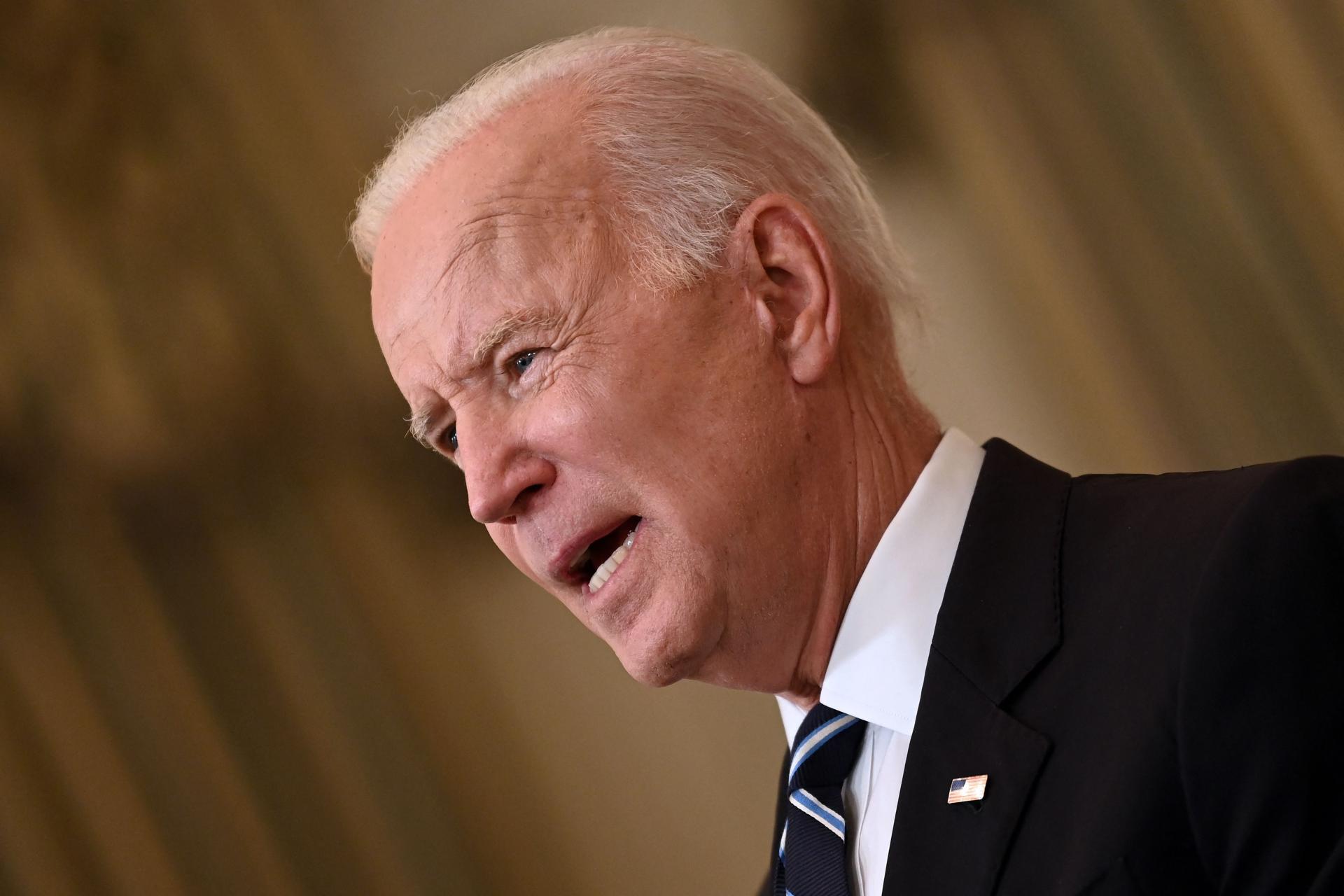

Donald Trump's Influence on Bitcoin (BTC) Price

Donald Trump's pronouncements, whether directly related to Bitcoin or touching upon broader economic themes, have historically moved markets. Understanding his influence requires analyzing both his direct mentions of cryptocurrency and the indirect impact of his broader economic policies.

Trump's Social Media Activity and Bitcoin

Trump's frequent use of social media has often resulted in market reactions. While he hasn't explicitly endorsed Bitcoin, his past comments on various financial instruments have proven influential. Any mention of cryptocurrency, positive or negative, from such a high-profile figure, can significantly sway market sentiment.

- Examples of Trump's relevant statements (or lack thereof): A comprehensive analysis of his social media and public statements reveals limited direct comments on Bitcoin. This absence of direct endorsement, however, doesn't negate his potential indirect influence.

- Analysis of market reactions: Even without direct mentions, the overall economic climate created under his presidency could be considered. Periods of economic optimism or uncertainty often correlate with Bitcoin price movements.

- Mention of the "Trump effect" on various markets: The "Trump effect," characterized by significant market swings in reaction to his statements and policies, is well-documented across various asset classes. Bitcoin, as a highly volatile asset, is susceptible to such effects.

Trump's Economic Policies and Bitcoin Adoption

Trump's economic policies, particularly tax cuts and deregulation, may have indirectly fueled Bitcoin adoption. These policies, while aimed at stimulating traditional markets, could have created an environment where investors sought alternative assets as a hedge against potential inflation or economic uncertainty.

- Specific economic policies enacted under Trump: The Tax Cuts and Jobs Act of 2017, for instance, significantly lowered corporate and individual income taxes.

- How these policies might have influenced investor behavior towards Bitcoin: Some investors might have viewed Bitcoin as a hedge against potential inflation resulting from these policies, or as a safe haven from a potentially overheated stock market.

- Data supporting or refuting a correlation: While a direct causal link is difficult to establish, analyzing Bitcoin's price performance during Trump's presidency alongside relevant economic indicators can provide insights into a potential correlation.

The Federal Reserve (Fed) and its Impact on Bitcoin (BTC)

The Federal Reserve's monetary policies have a profound impact on the global economy, and consequently, on Bitcoin's price. Understanding the Fed's role necessitates examining its influence on inflation, interest rates, and the US dollar's strength.

Inflationary Pressures and Bitcoin as a Safe Haven

The Fed's actions concerning inflation are directly relevant to Bitcoin's price. Periods of high inflation can erode the value of fiat currencies, leading investors to seek alternative stores of value, including Bitcoin.

- Explanation of inflation and its effects on traditional assets: Inflation diminishes the purchasing power of money, impacting bonds, stocks, and other traditional investments.

- Analysis of Bitcoin's potential as a store of value during inflationary periods: Bitcoin's fixed supply of 21 million coins makes it a potential hedge against inflation for some investors.

- Relevant charts and data: Analyzing historical data comparing inflation rates with Bitcoin's price can reveal potential correlations.

Interest Rate Hikes and Bitcoin Volatility

The Fed's interest rate hikes can significantly impact Bitcoin's volatility. Higher interest rates generally make traditional investments more attractive, potentially diverting capital away from riskier assets like Bitcoin.

- Explanation of how interest rate hikes affect the overall economy and financial markets: Increased interest rates make borrowing more expensive, slowing down economic growth and potentially impacting stock markets.

- How this might influence investor decisions regarding Bitcoin: Higher interest rates can make holding cash or investing in bonds more appealing, leading some investors to sell their Bitcoin holdings.

- Historical data demonstrating correlation (or lack thereof): Analyzing historical data on interest rate hikes and Bitcoin price movements can help determine the strength of the correlation.

The Dollar's Strength and Bitcoin's Price

An inverse relationship often exists between the US dollar's strength and Bitcoin's price. As the dollar strengthens, Bitcoin's price might decline, and vice versa. The Fed's policies directly influence the dollar's value.

- Explanation of the inverse relationship: A stronger dollar makes Bitcoin more expensive for holders of other currencies, potentially reducing demand.

- Data illustrating this relationship historically: Historical data can reveal the inverse correlation between the US dollar index and Bitcoin's price.

- Analysis of current market trends: Observing current trends in the dollar's strength and Bitcoin's price can provide further insight into this relationship.

Conclusion

This article explored the intricate relationship between former President Trump's influence, the Federal Reserve's policies, and the recent Bitcoin (BTC) price surge. While Bitcoin's price is influenced by numerous factors, both Trump's actions and the Fed's monetary decisions clearly play significant roles in shaping investor sentiment and market dynamics. The relationship between macroeconomics and the cryptocurrency market remains complex and requires continuous observation.

Call to Action: Understanding the multifaceted factors influencing Bitcoin (BTC) price is crucial for successful navigation of this volatile market. Stay informed about the latest developments from the Federal Reserve, significant political events, and prevailing market trends to make informed decisions about your Bitcoin investments. Continue learning about Bitcoin and its potential to stay ahead in the ever-evolving world of cryptocurrency.

Featured Posts

-

Oblivion Remastered Official Announcement And Release Date

Apr 24, 2025

Oblivion Remastered Official Announcement And Release Date

Apr 24, 2025 -

Tarantinov Odbijanje Film S Travoltom Koji Ne Zeli Vidjeti

Apr 24, 2025

Tarantinov Odbijanje Film S Travoltom Koji Ne Zeli Vidjeti

Apr 24, 2025 -

Exclusive Report World Economic Forum Faces Scrutiny Over Klaus Schwabs Role

Apr 24, 2025

Exclusive Report World Economic Forum Faces Scrutiny Over Klaus Schwabs Role

Apr 24, 2025 -

Canadian Dollar Weakness A Deeper Dive Into Recent Currency Movements

Apr 24, 2025

Canadian Dollar Weakness A Deeper Dive Into Recent Currency Movements

Apr 24, 2025 -

The Bold And The Beautiful April 9th Recap Steffy Bill Finn And Liams Critical Decisions

Apr 24, 2025

The Bold And The Beautiful April 9th Recap Steffy Bill Finn And Liams Critical Decisions

Apr 24, 2025