Bitcoin Hits All-Time High Amidst Positive US Regulatory Outlook

Table of Contents

Positive US Regulatory Signals Boost Bitcoin Price

The recent Bitcoin all-time high is significantly influenced by a changing tide in US regulatory sentiment. A more nuanced and less hostile approach is creating a more stable environment, attracting significant investment.

Gradual Regulatory Clarity

The US government's evolving approach to cryptocurrency regulation is fostering a sense of stability and encouraging institutional investment. This reduced uncertainty is a key driver of the current Bitcoin bull run.

- Reduced uncertainty about future regulatory crackdowns: Clearer guidelines reduce the fear of sudden policy shifts that could negatively impact Bitcoin's price.

- Increased institutional confidence leading to larger investments: With less regulatory risk, large institutions feel more comfortable allocating significant capital to Bitcoin.

- More clarity around taxation and compliance: Improved clarity on tax implications and compliance procedures makes Bitcoin investment more appealing to businesses and high-net-worth individuals.

Potential for Bitcoin ETF Approval

The ongoing debate surrounding Bitcoin Exchange-Traded Funds (ETFs) in the US is generating significant positive momentum. Approval of a Bitcoin ETF would dramatically increase accessibility and potentially propel the price even higher.

- Increased liquidity and trading volume: An ETF would bring substantially more liquidity to the Bitcoin market, leading to increased trading volume and price stability.

- Easier access for retail investors: ETFs provide a simple and regulated way for everyday investors to buy and hold Bitcoin through their brokerage accounts.

- Potentially significant price appreciation: Increased demand driven by ETF accessibility could lead to substantial price appreciation, further contributing to a Bitcoin all-time high.

Increased Institutional Adoption Fuels Bitcoin Demand

Beyond regulatory shifts, the growing embrace of Bitcoin by institutional investors is a major factor driving the current price surge and contributing to the Bitcoin all-time high.

MicroStrategy and Other Corporate Investments

Large corporations, like MicroStrategy, are strategically adding Bitcoin to their balance sheets, showcasing a strong belief in its long-term value as a store of value and a hedge against inflation.

- Diversification strategies for corporate treasuries: Bitcoin offers diversification beyond traditional assets, reducing overall portfolio risk.

- Hedge against inflation and economic uncertainty: Many see Bitcoin as a potential safeguard against inflation and economic instability.

- Demonstrates Bitcoin's growing acceptance as a legitimate asset: Corporate adoption legitimizes Bitcoin in the eyes of traditional financial markets.

Growing Involvement of Financial Institutions

Major financial institutions are increasingly offering Bitcoin-related services, including custody solutions and trading platforms, making it easier and more secure for institutional investors to participate.

- Improved accessibility for institutional investors: Improved access through established financial channels reduces barriers to entry.

- Enhanced security and regulatory compliance: Financial institutions provide robust security measures and ensure regulatory compliance, boosting investor confidence.

- Increased credibility and legitimacy within the traditional finance sector: The involvement of reputable financial institutions lends credibility to Bitcoin within the traditional finance world.

Macroeconomic Factors Contributing to Bitcoin's Rise

Beyond regulatory and institutional factors, broader macroeconomic trends are also driving demand and pushing Bitcoin to new all-time highs.

Inflationary Pressures and Safe-Haven Demand

Concerns about inflation and the stability of fiat currencies are fueling demand for Bitcoin as a potential hedge against economic uncertainty.

- Bitcoin's limited supply acts as a natural inflation hedge: Bitcoin's fixed supply of 21 million coins contrasts with the potential for inflationary expansion of fiat currencies.

- Increasing demand as a store of value: Investors increasingly view Bitcoin as a reliable store of value, protecting against inflation erosion.

- Attracting investors seeking alternative investments: Bitcoin offers an alternative to traditional assets, attracting investors looking for diversification.

Global Economic Uncertainty

Geopolitical instability and economic uncertainties worldwide are pushing investors towards decentralized, less vulnerable assets like Bitcoin.

- Bitcoin's decentralized nature provides resilience against geopolitical risks: Bitcoin's decentralized nature makes it less susceptible to government controls and geopolitical events.

- Increased demand during times of global uncertainty: Investors seek safe havens during turbulent times, boosting demand for Bitcoin.

- Positioning Bitcoin as a safe-haven asset: Bitcoin's characteristics are increasingly viewed as offering a hedge against economic and political uncertainty.

Conclusion

The recent Bitcoin all-time high is a multifaceted event, resulting from a combination of positive US regulatory developments, accelerating institutional adoption, and prevailing macroeconomic uncertainties. This surge highlights Bitcoin's growing maturity and acceptance as a legitimate asset class. While volatility remains a characteristic of the cryptocurrency market, the current climate suggests a potentially strong future for Bitcoin. Stay informed about the evolving regulatory landscape and market trends to make informed decisions regarding your Bitcoin investment strategy. Learn more about how the ongoing positive regulatory outlook continues to push Bitcoin towards new all-time highs. Don't miss out on the potential of Bitcoin; research and invest wisely.

Featured Posts

-

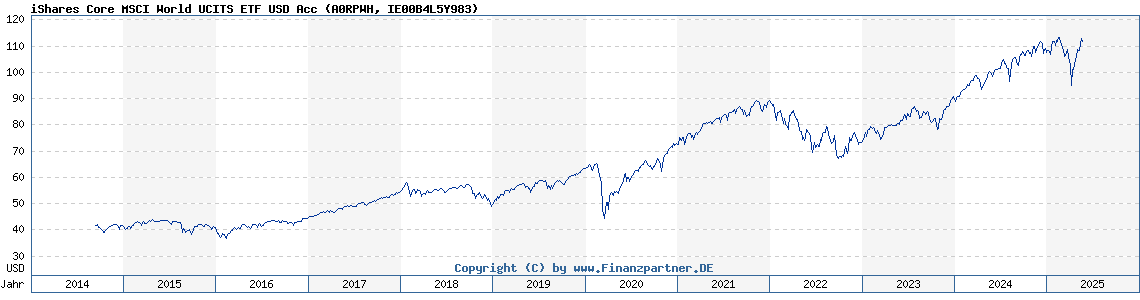

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Net Asset Value

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Net Asset Value

May 24, 2025 -

Nisan 2024 Te Zengin Olmaya Hazirlanan Burclar Finansal Tahminler

May 24, 2025

Nisan 2024 Te Zengin Olmaya Hazirlanan Burclar Finansal Tahminler

May 24, 2025 -

Ai Stuwt Relx Door Economische Recessie Sterke Resultaten En Positieve Voorspellingen

May 24, 2025

Ai Stuwt Relx Door Economische Recessie Sterke Resultaten En Positieve Voorspellingen

May 24, 2025 -

Iste En Cimri 3 Burc Ve Tasarruf Sirlari

May 24, 2025

Iste En Cimri 3 Burc Ve Tasarruf Sirlari

May 24, 2025 -

3 En Tutumlu Burc Paranizi Nasil Yoenettiklerini Oegrenin

May 24, 2025

3 En Tutumlu Burc Paranizi Nasil Yoenettiklerini Oegrenin

May 24, 2025

Latest Posts

-

Review Jonathan Groffs Just In Time A 1965 Inspired Triumph

May 24, 2025

Review Jonathan Groffs Just In Time A 1965 Inspired Triumph

May 24, 2025 -

Just In Time Musical Review Groffs Captivating Bobby Darin Portrayal

May 24, 2025

Just In Time Musical Review Groffs Captivating Bobby Darin Portrayal

May 24, 2025 -

Jonathan Groffs Just In Time A Stellar 1965 Style Performance

May 24, 2025

Jonathan Groffs Just In Time A Stellar 1965 Style Performance

May 24, 2025 -

Jonathan Groff Discusses His Past And Asexuality

May 24, 2025

Jonathan Groff Discusses His Past And Asexuality

May 24, 2025 -

How Jonathan Groff Brought Bobby Darin To Life In Just In Time

May 24, 2025

How Jonathan Groff Brought Bobby Darin To Life In Just In Time

May 24, 2025