Bitcoin Price Rebound: A Look At Potential Future Growth

Table of Contents

1. Introduction:

Bitcoin's price has experienced considerable fluctuation recently, influenced by a confluence of factors including regulatory shifts, evolving institutional adoption, and broader macroeconomic conditions. This volatility creates both uncertainty and opportunity. The purpose of this article is to analyze potential factors contributing to a Bitcoin price rebound and assess its future growth potential, providing a balanced perspective for informed decision-making.

2. Main Points:

H2: Technical Analysis: Identifying Rebound Signals

Technical analysis provides valuable insights into potential price movements. Examining chart patterns and key indicators can help us identify potential Bitcoin price rebound signals.

H3: Chart Patterns: Bullish chart patterns frequently precede price increases. A "double bottom," for instance, indicates a potential reversal after a price drop. Similarly, a "head and shoulders reversal" pattern can signal the end of a downtrend and the beginning of an uptrend. (Include images of these chart patterns here)

H3: Key Support and Resistance Levels: Support levels represent price points where buying pressure is expected to outweigh selling pressure, potentially halting a price decline. Resistance levels, conversely, mark price points where selling pressure might overcome buying pressure, potentially capping price increases. A strong break above a key resistance level is a bullish signal, potentially fueling a significant Bitcoin price rebound.

- Specific technical indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can offer further confirmation of bullish sentiment. An RSI above 70 often indicates overbought conditions, while a reading below 30 suggests oversold conditions, potentially preceding a rebound.

- Trading volume is crucial; a significant increase in volume accompanying a price increase confirms the strength of the move, suggesting a sustainable Bitcoin price rebound.

- Risk management is paramount in cryptocurrency trading. Employing stop-loss orders and diversifying your portfolio are essential to mitigate potential losses.

H2: Fundamental Factors Driving Potential Growth

Beyond technical analysis, fundamental factors strongly influence Bitcoin's long-term growth and potential for a Bitcoin price rebound.

H3: Increased Institutional Adoption: The growing interest from institutional investors, including hedge funds and major corporations, significantly impacts Bitcoin's price. As institutional money flows into the market, demand increases, driving prices higher.

H3: Growing Developer Activity and Network Upgrades: Ongoing development and network upgrades enhance Bitcoin's scalability and efficiency. The Lightning Network, for example, aims to significantly improve transaction speeds and reduce fees, boosting Bitcoin's usability and attracting more users.

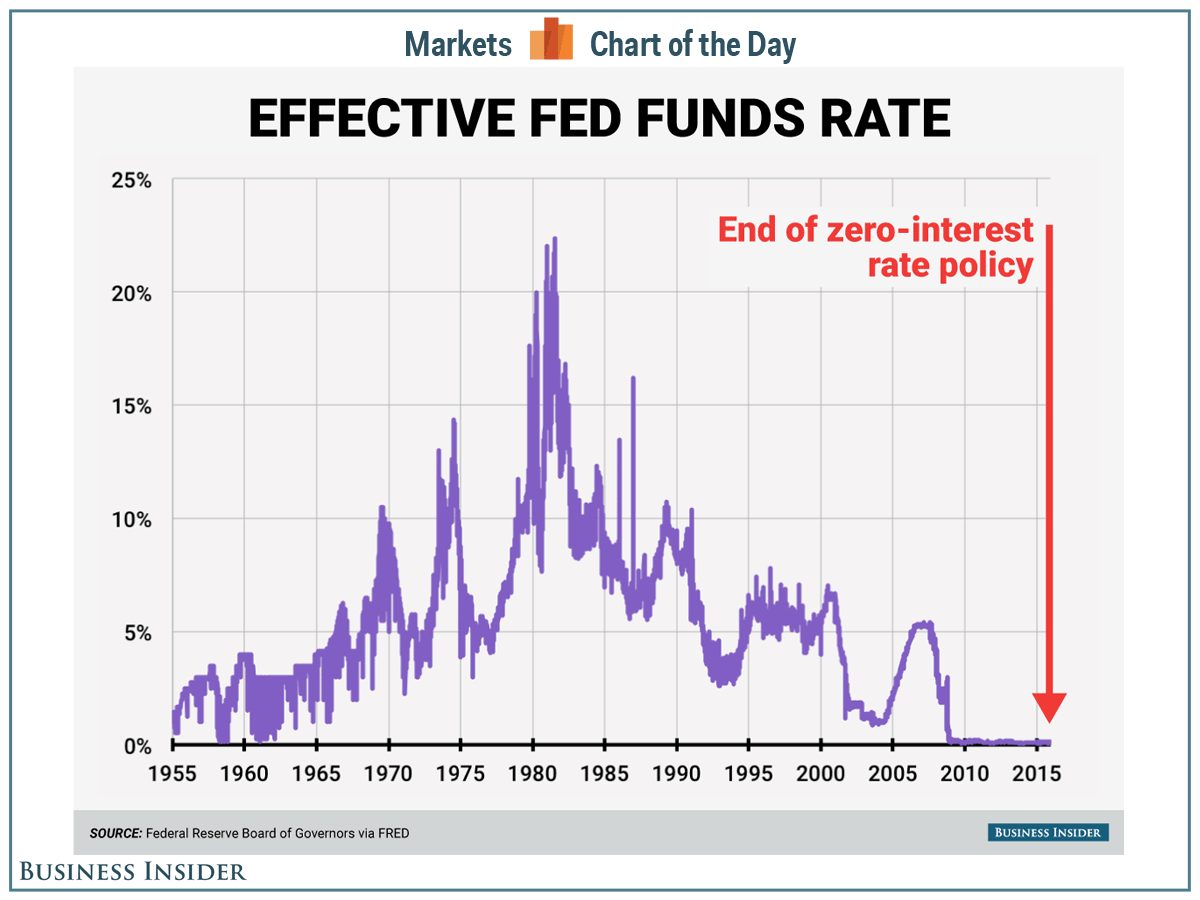

H3: Global Macroeconomic Factors: Geopolitical instability and inflation can drive investors towards Bitcoin as a safe-haven asset. During periods of economic uncertainty, Bitcoin's decentralized nature and limited supply can make it an attractive investment, fueling a Bitcoin price rebound.

- Examples of institutional adoption include MicroStrategy and Tesla's significant Bitcoin investments.

- The Lightning Network and other scaling solutions address Bitcoin's scalability challenges, making it more suitable for everyday transactions.

- Bitcoin's scarcity and its potential as a hedge against inflation are key drivers of its long-term value.

H2: Risks and Challenges to a Bitcoin Price Rebound

Despite the positive signals, several risks and challenges could impede a Bitcoin price rebound.

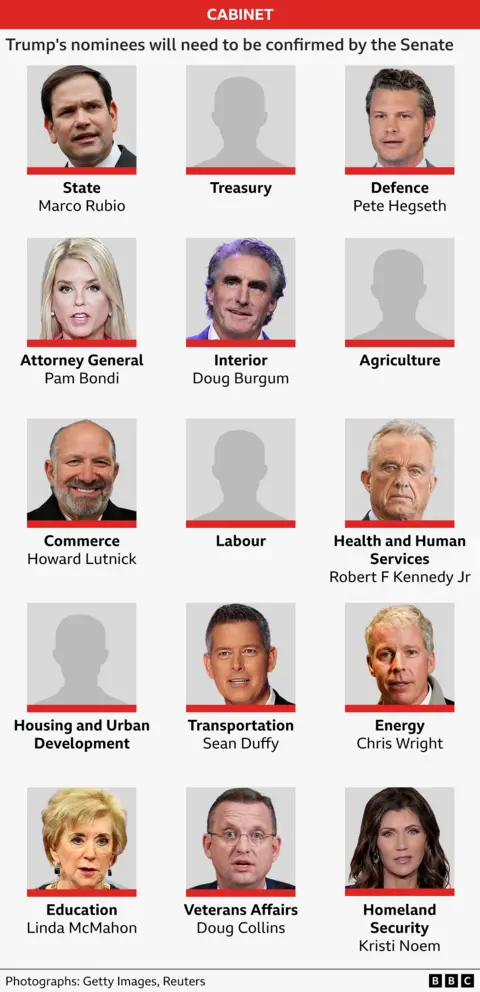

H3: Regulatory Uncertainty: Varying regulatory approaches across different countries create uncertainty and can impact Bitcoin's price. Strict regulations could suppress demand, while favorable regulations could boost it.

H3: Market Volatility and Corrections: The cryptocurrency market is inherently volatile. Even with a potential rebound, sharp price corrections are possible. Investors should be prepared for periods of significant price swings.

H3: Competition from Altcoins: The emergence of other cryptocurrencies (altcoins) presents competition for Bitcoin. While Bitcoin remains the dominant cryptocurrency, altcoins could potentially attract investors and reduce Bitcoin's market share.

- Regulatory challenges include concerns about money laundering, tax implications, and the environmental impact of Bitcoin mining.

- Historical Bitcoin price corrections serve as reminders of the market's volatility. Understanding these historical trends is crucial for informed investment decisions.

- Altcoins offer various features and functionalities that could potentially appeal to investors seeking alternatives to Bitcoin.

3. Conclusion:

The potential for a Bitcoin price rebound is supported by several converging factors, including encouraging technical indicators, growing institutional adoption, and the influence of macroeconomic conditions. However, investors must acknowledge the inherent risks, including regulatory uncertainty, market volatility, and competition from altcoins. Before making any investment decisions, it is crucial to conduct thorough research and understand the complexities of the Bitcoin market. Monitor the Bitcoin price rebound closely, analyze the Bitcoin market dynamics, and consider investing in Bitcoin only after careful consideration of your own risk tolerance and financial goals. For further resources on Bitcoin investing, please [link to relevant resource].

Featured Posts

-

Pozitsiya Stivena Kinga Stosovno Trampa Ta Maska Pislya Yogo Povernennya Na Kh

May 09, 2025

Pozitsiya Stivena Kinga Stosovno Trampa Ta Maska Pislya Yogo Povernennya Na Kh

May 09, 2025 -

The Us Attorney General And Fox News Analyzing The Daily Appearances

May 09, 2025

The Us Attorney General And Fox News Analyzing The Daily Appearances

May 09, 2025 -

Interest Rate Decision The Fed Weighs Inflation And Unemployment

May 09, 2025

Interest Rate Decision The Fed Weighs Inflation And Unemployment

May 09, 2025 -

Madeleine Mc Cann Investigation Arrest At Uk Airport

May 09, 2025

Madeleine Mc Cann Investigation Arrest At Uk Airport

May 09, 2025 -

Trump Ag Pam Bondis Laughter Amidst Comers Epstein Files Outrage

May 09, 2025

Trump Ag Pam Bondis Laughter Amidst Comers Epstein Files Outrage

May 09, 2025

Latest Posts

-

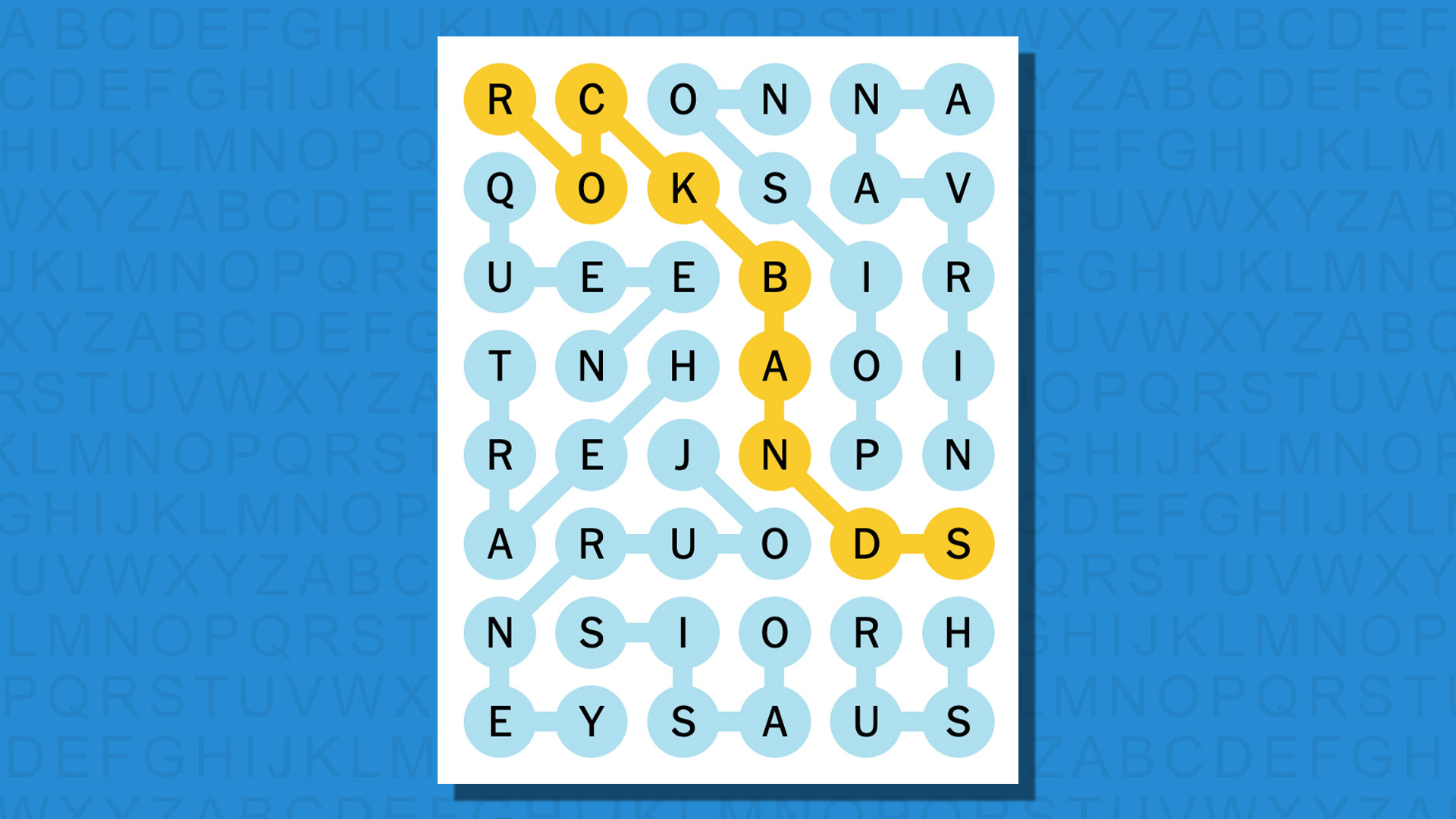

Nyt Strands Game 405 Saturday April 12 Hints And Solutions

May 09, 2025

Nyt Strands Game 405 Saturday April 12 Hints And Solutions

May 09, 2025 -

Solve Nyt Strands Game 402 Wednesday April 9th Hints And Answers

May 09, 2025

Solve Nyt Strands Game 402 Wednesday April 9th Hints And Answers

May 09, 2025 -

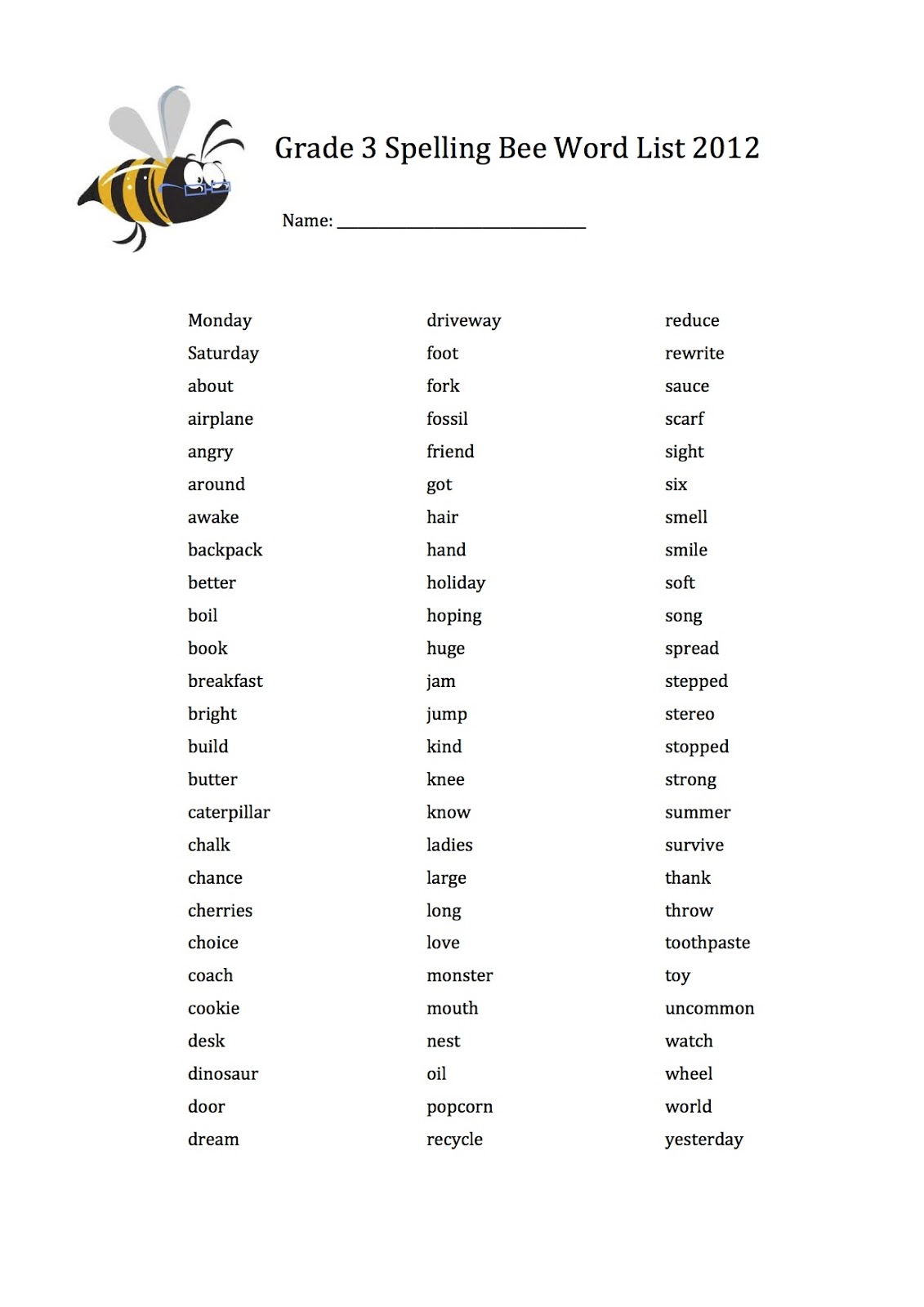

Solve The Nyt Spelling Bee April 1 2025 Complete Guide

May 09, 2025

Solve The Nyt Spelling Bee April 1 2025 Complete Guide

May 09, 2025 -

Wednesday April 9th Nyt Strands Game 402 Hints And Answers

May 09, 2025

Wednesday April 9th Nyt Strands Game 402 Hints And Answers

May 09, 2025 -

Nyt Spelling Bee April 1 2025 Hints Answers And Pangram

May 09, 2025

Nyt Spelling Bee April 1 2025 Hints Answers And Pangram

May 09, 2025