Bitcoin Surges Past 10-Week High, Nears $100,000

Table of Contents

Factors Contributing to Bitcoin's Price Surge

Several converging factors are responsible for Bitcoin's recent price explosion. These factors range from increased institutional adoption to macroeconomic shifts, creating a powerful bullish momentum.

Institutional Adoption

Major financial institutions and corporations are increasingly embracing Bitcoin as a legitimate asset class. This institutional adoption is a key driver of the recent price surge.

- Increased Investment: Companies like MicroStrategy have made significant investments in Bitcoin, holding substantial amounts on their balance sheets. Tesla's initial foray into Bitcoin, though later partially reversed, demonstrated the growing acceptance within established corporations.

- Growing Acceptance: The perception of Bitcoin as a speculative asset is shifting towards recognition as a store of value and a potential hedge against inflation. This shift in perception is attracting substantial institutional capital.

- Impact: These significant institutional investments directly increase demand and push the price upwards. The credibility associated with institutional involvement also boosts market confidence.

- MicroStrategy holds over 130,000 Bitcoins.

- Tesla's initial investment signaled a significant shift in mainstream acceptance.

Regulatory Clarity (or Lack Thereof)

Regulatory developments, or the lack thereof, significantly influence Bitcoin's price. While some jurisdictions are embracing clear regulatory frameworks, others remain hesitant, creating uncertainty.

- Positive Regulatory Announcements: Positive regulatory news, such as the approval of Bitcoin ETFs or clearer guidelines for cryptocurrency trading, can boost investor confidence and lead to price increases.

- Negative Regulatory Developments: Conversely, negative news, like stricter regulations or bans, can cause significant price drops.

- Global Variation: Different regulatory approaches across countries create a complex landscape, with some regions fostering innovation while others impose restrictions. This global regulatory patchwork impacts market sentiment.

- The ongoing debate surrounding Bitcoin regulation in the US significantly impacts global market sentiment.

- Favorable regulatory changes in certain jurisdictions can attract investors, increasing demand and price.

Growing Demand and Scarcity

Bitcoin's inherent scarcity, coupled with growing demand, is a fundamental factor driving its price.

- Limited Supply: Only 21 million Bitcoins will ever exist, creating an intrinsically deflationary asset.

- Increasing Demand: The demand is driven by both retail investors looking for alternative investments and institutional investors seeking diversification and exposure to the cryptocurrency market.

- Scarcity Principle: The limited supply makes Bitcoin increasingly valuable as demand increases, mirroring the principles of supply and demand in traditional economics.

- The halving events, which reduce the rate of new Bitcoin creation, further contribute to scarcity and price appreciation.

Macroeconomic Factors

Global macroeconomic conditions significantly influence Bitcoin's price.

- Inflation Hedge: Many view Bitcoin as a hedge against inflation, given its fixed supply. In times of high inflation, investors may flock to Bitcoin as a store of value.

- Geopolitical Instability: Geopolitical uncertainty can also drive investment in Bitcoin, as investors seek safe haven assets.

- Correlation with Traditional Markets: While Bitcoin's price is not always directly correlated with traditional markets, there can be some degree of influence.

- Periods of economic uncertainty often see increased investment in Bitcoin.

- High inflation rates can trigger increased demand for Bitcoin as a hedge against currency devaluation.

Analyzing the Path to $100,000

Reaching the $100,000 milestone depends on various factors, including technical analysis, market sentiment, and long-term projections.

Technical Analysis

Technical analysis of Bitcoin's charts provides insights into potential price movements.

- Chart Patterns: Analyzing chart patterns, such as support and resistance levels, can help predict future price trends.

- Technical Indicators: Indicators like moving averages and relative strength index (RSI) offer further insights into momentum and potential reversals.

- Predictions: While not foolproof, technical analysis can offer clues about potential price targets and potential corrections.

- Breakouts above key resistance levels often signal further price appreciation.

Market Sentiment and Psychology

Market sentiment and investor psychology play a crucial role in Bitcoin's price fluctuations.

- Social Media Influence: Social media platforms significantly impact market sentiment. Positive news and hype can boost the price, while negative news can trigger sell-offs.

- Investor Fear and Greed: Investor behavior, driven by fear and greed, can cause dramatic price swings.

- Market Corrections: Market corrections are inevitable in any asset class, including Bitcoin. Understanding the potential for corrections is crucial for informed investment decisions.

- Significant price drops are often followed by periods of consolidation before the next upward trend.

Long-Term Projections

Experts offer varying long-term projections for Bitcoin's price.

- Future Catalysts: Continued institutional adoption, wider regulatory clarity, and technological advancements could drive further price growth.

- Potential Risks: Regulatory crackdowns, technological vulnerabilities, and competing cryptocurrencies represent potential risks.

- Expert Opinions: While predicting the future is impossible, analyzing expert opinions and forecasts can provide valuable insights into potential price trajectories.

- Some experts predict Bitcoin will reach significantly higher prices in the coming years.

- Others caution against over-optimism and highlight the inherent volatility of the cryptocurrency market.

Conclusion

Bitcoin's recent surge past its 10-week high and its approach to $100,000 is a significant event fueled by a confluence of factors including institutional adoption, regulatory developments, growing demand, and macroeconomic influences. While the path to $100,000 remains subject to market volatility and unforeseen events, the current momentum indicates a strong bullish sentiment.

Call to Action: Stay informed about this exciting development in the world of cryptocurrency. Continue to monitor the Bitcoin price and learn more about the factors driving its fluctuations to make informed decisions about your Bitcoin investment strategy. Understand the risks associated with Bitcoin and other cryptocurrencies before investing. Learn more about Bitcoin trading and investment strategies now!

Featured Posts

-

Lewis Capaldis Rare Photo With Towie Star Shows Him Happy And Healthy

May 07, 2025

Lewis Capaldis Rare Photo With Towie Star Shows Him Happy And Healthy

May 07, 2025 -

Parkland Acquisition Us 9 Billion Deal Heads To Shareholder Vote In June

May 07, 2025

Parkland Acquisition Us 9 Billion Deal Heads To Shareholder Vote In June

May 07, 2025 -

Understanding Greg Abel Warren Buffetts Chosen Successor

May 07, 2025

Understanding Greg Abel Warren Buffetts Chosen Successor

May 07, 2025 -

Spolka Skarzy Dziennikarzy Onetu Domagajac Sie 100 000 Zl

May 07, 2025

Spolka Skarzy Dziennikarzy Onetu Domagajac Sie 100 000 Zl

May 07, 2025 -

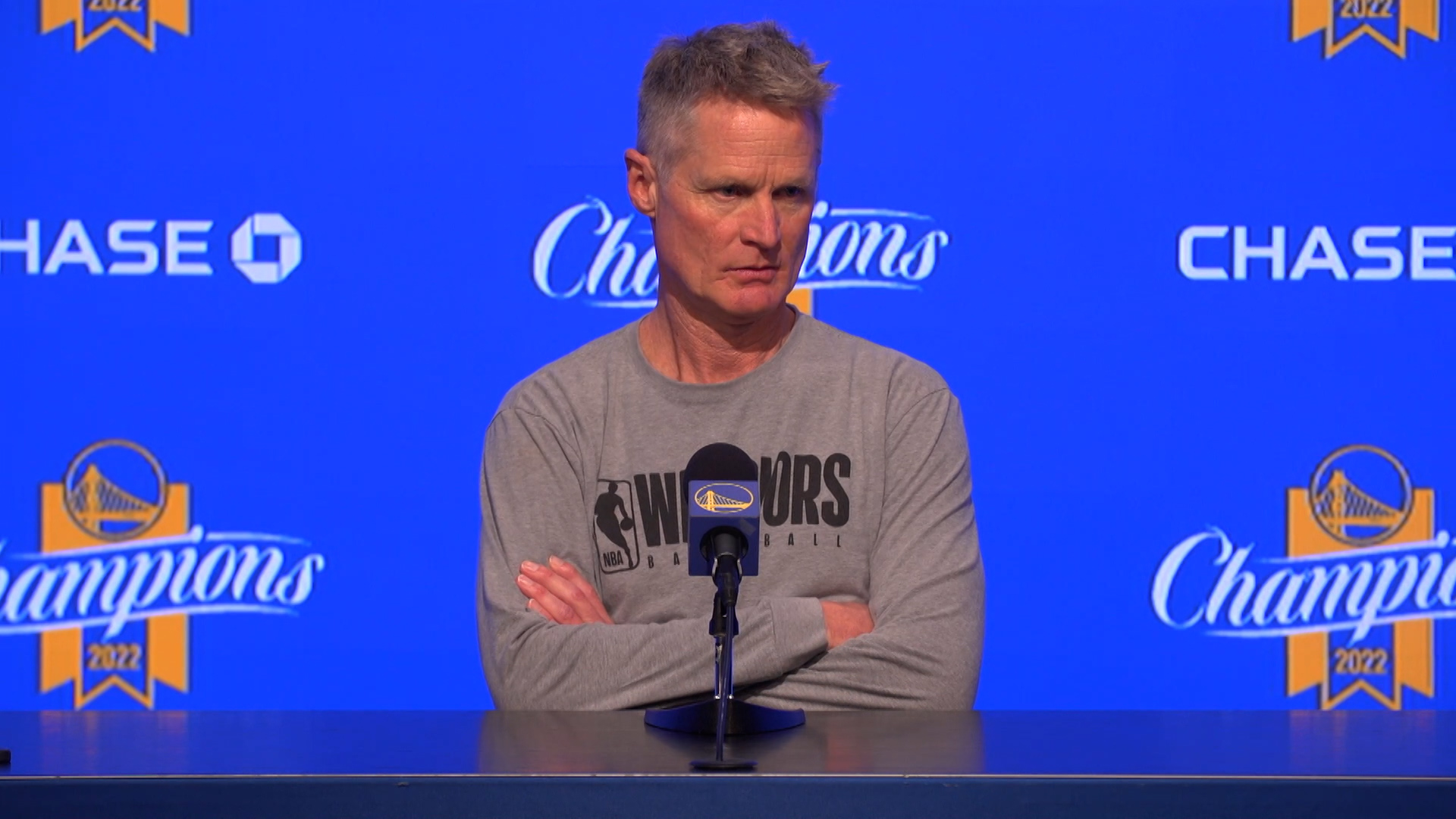

Steve Kerr Remains Optimistic About Stephen Currys Speedy Recovery

May 07, 2025

Steve Kerr Remains Optimistic About Stephen Currys Speedy Recovery

May 07, 2025