Parkland Acquisition: US$9 Billion Deal Heads To Shareholder Vote In June

Table of Contents

Deal Details and Rationale

Marathon Petroleum's proposed acquisition of Parkland Fuel is valued at approximately US$9 billion. The deal structure involves a combination of cash and stock, offering Parkland shareholders a compelling proposition. Key players involved include Marathon Petroleum, Parkland Fuel, and their respective financial and legal advisors. This energy merger aims to create a more robust and efficient fuel distribution network.

- Acquisition price per share: The exact price per share will be determined based on the final deal structure and prevailing market conditions.

- Breakdown of payment method: A detailed breakdown of the cash and stock components of the payment will be released closer to the shareholder vote.

- Expected closing date: The deal is expected to close sometime after the successful completion of the shareholder vote in June, pending regulatory approvals.

- Synergies and cost-saving measures: Marathon anticipates significant synergies and cost savings through operational efficiencies, streamlined supply chains, and reduced administrative overhead post-merger.

From Marathon's perspective, the strategic rationale is multifaceted. The acquisition expands their market reach significantly, particularly in Canada, where Parkland holds a substantial market share. This expansion allows Marathon to benefit from economies of scale, leading to improved operational efficiencies and enhanced profitability. The increased market share strengthens Marathon's competitive position within the North American fuel distribution market.

Shareholder Perspectives and Potential Outcomes

The Parkland acquisition will undoubtedly have significant implications for both Parkland and Marathon shareholders. Parkland shareholders stand to benefit from the proposed acquisition price, representing a premium over the company's pre-announcement share price. However, there are potential risks involved, including the possibility of regulatory hurdles and unexpected integration challenges. Marathon shareholders, on the other hand, will be assessing the long-term potential for increased profitability and value creation resulting from the merger.

- Potential benefits for shareholders: Increased share value, potential for enhanced dividends, and access to a larger, more diversified energy portfolio.

- Concerns and potential risks: Regulatory delays, integration challenges, and unforeseen market fluctuations impacting the overall success of the merger.

While initial reactions to the Parkland acquisition have been largely positive, some dissenting opinions exist. Concerns regarding potential job losses following the merger and the impact on competition within certain markets need to be addressed.

- Expected voting outcome predictions: While definitive predictions are challenging, analysts suggest a generally favorable outcome for the shareholder vote, given the proposed acquisition price.

- Potential impact on share prices: Share prices for both companies are expected to fluctuate in the period leading up to and following the June vote, reflecting market sentiment and investor confidence in the successful completion of the deal.

- Analyst opinions and predictions: Most analysts view the merger as strategically sound, with potential for significant long-term value creation, though the success hinges upon smooth integration and regulatory approvals.

Regulatory Scrutiny and Antitrust Concerns

The Parkland acquisition faces significant regulatory scrutiny. Antitrust reviews by relevant authorities in the US and Canada are crucial to ensuring the deal doesn't stifle competition within the fuel distribution market. Potential delays in regulatory approvals could impact the timeline for the merger's completion.

- Relevant regulatory bodies: The approval process will involve various regulatory bodies in both the US and Canada, including the Federal Trade Commission (FTC) and the Canadian Competition Bureau.

- Potential antitrust concerns: Concerns exist about reduced competition in certain geographic areas following the merger. Marathon will need to address these concerns effectively through potential divestitures or other remedies.

- Timeline for regulatory approvals: The regulatory review process could take several months, adding uncertainty to the overall timeline for the acquisition's completion.

Impact on the Energy Sector

The successful completion of the Parkland acquisition will have a substantial impact on the North American energy sector. The combined entity will control a significant portion of the fuel distribution network, potentially influencing fuel prices, impacting competition among distributors, and impacting employment levels within the industry.

- Expected impact on fuel distribution networks: The merger will result in a more consolidated and integrated fuel distribution network across North America.

- Potential changes to pricing strategies: The combined market power could lead to changes in pricing strategies, although the exact impact remains to be seen and will be subject to regulatory oversight.

- Long-term consequences for consumers and businesses: While potential benefits include operational efficiencies and improved supply chain management, the ultimate impact on consumers and businesses depends on the effectiveness of the post-merger integration and regulatory outcomes.

Conclusion

The US$9 billion Parkland acquisition by Marathon Petroleum represents a significant event for the North American energy sector. The upcoming shareholder vote in June is crucial to determining the fate of this landmark energy merger. The deal presents both opportunities and challenges, with potential benefits such as increased efficiency and market share, alongside risks related to regulatory approvals and integration complexities. The outcome will have profound consequences for both companies' shareholders and the broader fuel industry. The potential for increased profitability through synergies is balanced against potential antitrust concerns and regulatory hurdles.

Stay tuned for updates on the outcome of the Parkland acquisition shareholder vote in June. Follow [Your Website/News Source] for comprehensive coverage of this landmark energy merger and analysis of its impact on the fuel industry.

Featured Posts

-

Mercredi L Histoire De La Rencontre Entre Jenna Ortega Et Lady Gaga

May 07, 2025

Mercredi L Histoire De La Rencontre Entre Jenna Ortega Et Lady Gaga

May 07, 2025 -

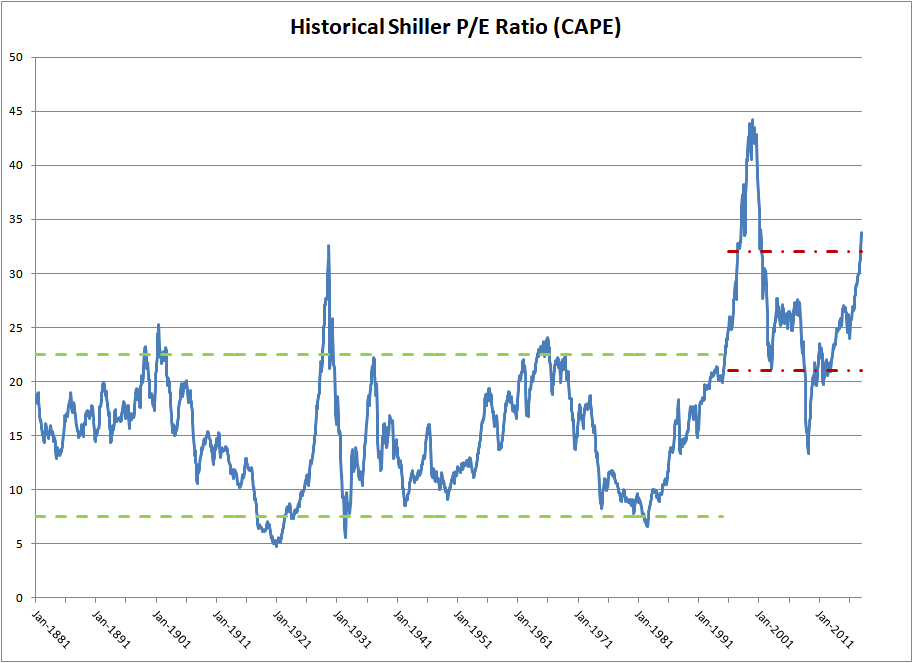

Stock Market Valuations Bof A Says Dont Panic

May 07, 2025

Stock Market Valuations Bof A Says Dont Panic

May 07, 2025 -

Snl 50 Jenna Ortegas Impressive Performance And Sabrina Carpenters Shout Out Gain Viral Attention

May 07, 2025

Snl 50 Jenna Ortegas Impressive Performance And Sabrina Carpenters Shout Out Gain Viral Attention

May 07, 2025 -

Podcast Stan Wyjatkowy Odcinki Onetu I Newsweeka

May 07, 2025

Podcast Stan Wyjatkowy Odcinki Onetu I Newsweeka

May 07, 2025 -

Where To Invest Mapping The Countrys Hottest New Business Locations

May 07, 2025

Where To Invest Mapping The Countrys Hottest New Business Locations

May 07, 2025