Bitcoin's Record High: Fueled By US Regulatory Optimism

Table of Contents

Gradual Shift in US Regulatory Stance Towards Cryptocurrencies

The recent surge in Bitcoin's price is undeniably linked to a perceptible shift in the US regulatory approach towards cryptocurrencies. This easing of regulatory uncertainty has emboldened institutional investors and fueled broader market confidence.

Easing of Regulatory Uncertainty

Recent statements and actions from key US regulatory bodies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) suggest a more nuanced and potentially less restrictive approach to Bitcoin and the broader cryptocurrency market.

- Examples of positive regulatory signals: While outright approval is still pending for many crypto assets, the SEC's increased engagement with crypto companies and its willingness to consider Bitcoin exchange-traded funds (ETFs) are positive signs. The CFTC's continued regulation of Bitcoin futures markets also provides a sense of stability.

- Proposed legislation and bills: Several bills are currently under consideration in Congress that aim to clarify the regulatory framework for digital assets, potentially leading to a more conducive environment for Bitcoin’s growth. These bills aim to address issues such as taxation and investor protection.

Increased Institutional Investment

The reduced regulatory ambiguity has directly correlated with a significant rise in institutional investment in Bitcoin. Large financial institutions, previously hesitant due to regulatory uncertainty, are now increasingly allocating assets to Bitcoin.

- Examples of significant institutional investments: Several major investment firms have publicly declared substantial Bitcoin holdings, demonstrating a growing acceptance of Bitcoin as an asset class.

- Impact of institutional investment on Bitcoin's price: Institutional inflows generally increase market liquidity and demand, contributing to price appreciation. The sheer volume of capital invested by these institutions significantly impacts Bitcoin's price trajectory.

Growing Institutional Adoption and Infrastructure Development

Beyond regulatory changes, the growth of supporting infrastructure has played a crucial role in Bitcoin's record high. This includes enhanced access to derivatives markets and improved security solutions.

Increased Availability of Bitcoin Futures and ETFs

The expansion of regulated Bitcoin futures markets and the ongoing discussions regarding Bitcoin ETFs are vital components of this growth. These instruments provide institutional investors with more sophisticated and regulated avenues for Bitcoin exposure.

- Impact of futures and ETFs on market liquidity and institutional participation: Futures contracts and ETFs significantly enhance liquidity, making it easier for institutional players to enter and exit the Bitcoin market efficiently. This increased liquidity further stabilizes price fluctuations.

- Significant developments: The ongoing review process for Bitcoin ETFs in the US signifies a monumental shift in the regulatory landscape, which, if approved, would likely significantly boost Bitcoin’s price and adoption.

Improved Custodial Solutions and Security

The development of secure and regulated custodial services is vital for attracting institutional investors wary of self-custody risks. Robust security measures are essential for building trust and confidence in the market.

- Leading Bitcoin custody providers: Several companies offer secure custodial solutions, providing institutional investors with peace of mind. These providers adhere to stringent security protocols and regulatory compliance standards.

- How improved security measures contribute to investor confidence: Advanced security technologies and insurance solutions significantly reduce the risk of theft or loss, making Bitcoin a more attractive investment for institutions.

The Role of Macroeconomic Factors in Bitcoin's Price Surge

While regulatory optimism and institutional adoption are primary drivers, macroeconomic factors also play a significant role in Bitcoin's price volatility and recent record high.

Inflationary Concerns and Safe-Haven Demand

Rising inflation rates globally have fueled demand for Bitcoin as a potential hedge against inflation. Bitcoin's fixed supply of 21 million coins makes it a potentially attractive alternative to traditional fiat currencies prone to devaluation.

- Bitcoin as "digital gold": Bitcoin is often compared to gold, a traditional safe-haven asset. Its decentralized nature and limited supply make it an appealing alternative to gold for some investors.

- Data on inflation rates and Bitcoin's price correlation: While correlation isn't always direct, historical data suggests a relationship between inflation concerns and Bitcoin's price performance.

Geopolitical Instability and its Influence

Geopolitical uncertainty and global instability can also drive investors towards Bitcoin, seen by some as a decentralized and censorship-resistant store of value.

- Examples of how geopolitical instability impacts Bitcoin investment: Times of heightened geopolitical tension frequently see an increase in Bitcoin’s price as investors seek refuge in assets outside traditional financial systems.

- Bitcoin's decentralized nature and resilience to geopolitical risks: Bitcoin's decentralized nature makes it less susceptible to the influence of single governments or institutions, contributing to its appeal during times of uncertainty.

Conclusion

Bitcoin's recent record high is a confluence of factors, with positive US regulatory sentiment playing a pivotal role. Easing regulatory uncertainty has spurred institutional investment, improved infrastructure, and increased confidence in the long-term viability of Bitcoin. Macroeconomic factors, such as inflation and geopolitical instability, have further contributed to this surge. Understanding these interwoven elements is crucial for comprehending the dynamics behind Bitcoin's remarkable price increase. Learn more about navigating the evolving world of Bitcoin, stay updated on Bitcoin's price and regulatory developments, and understand the factors driving Bitcoin's record high to make informed decisions in this dynamic market.

Featured Posts

-

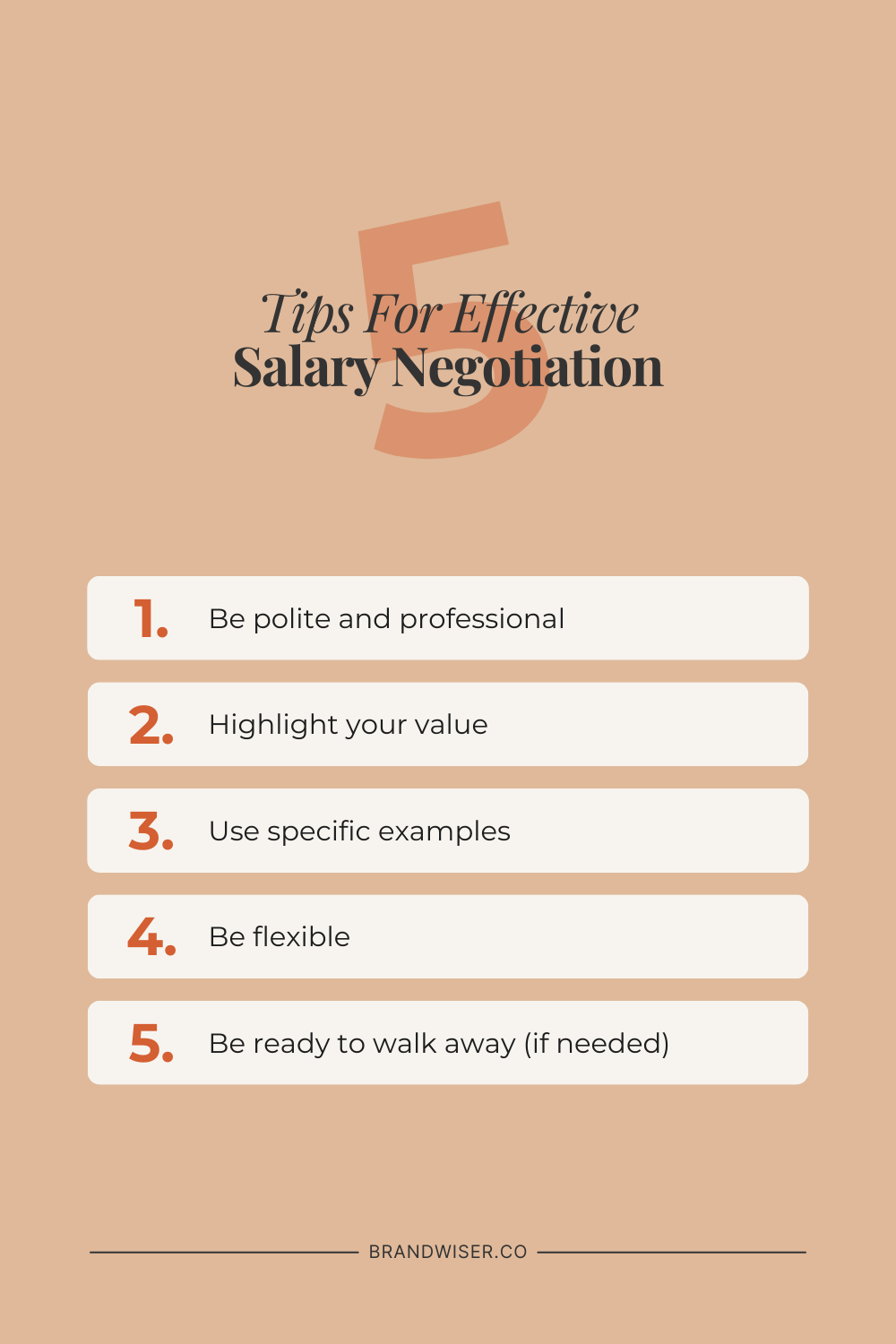

Can You Negotiate After A Best And Final Job Offer A Practical Guide

May 24, 2025

Can You Negotiate After A Best And Final Job Offer A Practical Guide

May 24, 2025 -

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025 -

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025 -

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Chetverka Favoritov

May 24, 2025

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Chetverka Favoritov

May 24, 2025 -

Trump Tax Bill Passes House Key Provisions And Analysis

May 24, 2025

Trump Tax Bill Passes House Key Provisions And Analysis

May 24, 2025

Latest Posts

-

The Jonas Brothers A Married Couples Unexpected Dispute And Joes Response

May 24, 2025

The Jonas Brothers A Married Couples Unexpected Dispute And Joes Response

May 24, 2025 -

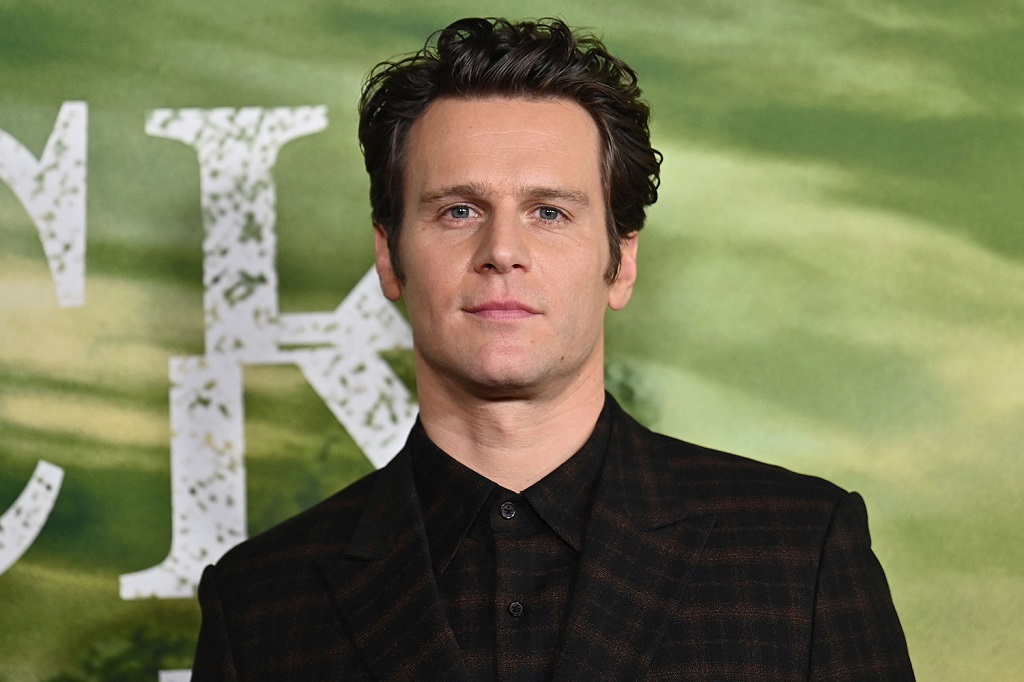

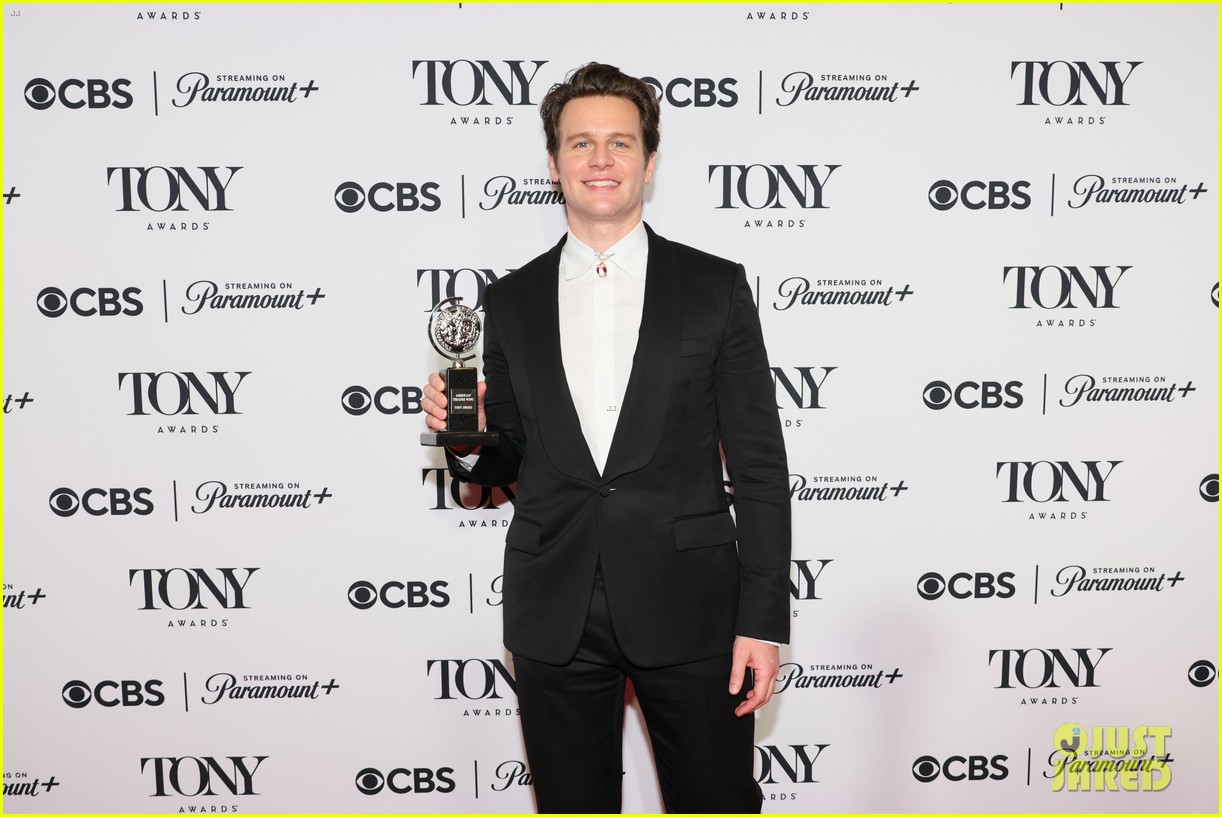

Jonathan Groff Could Just In Time Secure Him A Tony Award

May 24, 2025

Jonathan Groff Could Just In Time Secure Him A Tony Award

May 24, 2025 -

Jonathan Groffs Tony Awards Potential A Look At Just In Time

May 24, 2025

Jonathan Groffs Tony Awards Potential A Look At Just In Time

May 24, 2025 -

Joe Jonas Perfect Response To Couples Fight Over Him

May 24, 2025

Joe Jonas Perfect Response To Couples Fight Over Him

May 24, 2025 -

The Jonas Brothers Drama A Married Couples Unexpected Feud

May 24, 2025

The Jonas Brothers Drama A Married Couples Unexpected Feud

May 24, 2025