Buffett's Apple Investment: Navigating The Impact Of Trump-Era Tariffs

Table of Contents

The Trump Administration's Tariff Policies and Their Global Reach

The Trump administration implemented a series of tariffs, primarily targeting Chinese imports, aiming to protect American industries and renegotiate trade deals. This protectionist approach, however, significantly impacted global supply chains, including those crucial to Apple's operations. These tariffs weren't simply a matter of imposing taxes; they disrupted established trade relationships and forced companies like Apple to reassess their global strategies.

- Specific tariff percentages: Tariffs on various components used in Apple products, such as displays, memory chips, and other electronics, ranged from 10% to 25%.

- Countries primarily affected: China was the most significantly affected country due to its role as a major manufacturing hub for Apple's supply chain. However, the impact rippled through other countries involved in the global production network.

- Impact on international trade agreements: The imposition of these tariffs strained relationships with key trading partners and challenged the existing framework of international trade agreements, leading to retaliatory tariffs and increased global trade uncertainty. This uncertainty directly impacted investment decisions and supply chain stability.

Apple's Response to the Tariffs: Strategic Adjustments and Mitigation Efforts

Faced with increased costs due to tariffs, Apple implemented various strategies to mitigate the negative effects. These adjustments included diversification of sourcing, potentially shifting manufacturing locations, and absorbing some of the increased costs rather than passing them entirely on to consumers.

- Examples of Apple's diversification efforts: Apple likely explored and implemented strategies to source components from countries outside of China, reducing its reliance on a single manufacturing base and minimizing tariff impacts. This involved forging new partnerships and potentially investing in production facilities in other regions.

- Changes in sourcing components from different regions: Apple's supply chain, originally heavily reliant on Chinese manufacturers, likely underwent a significant restructuring. This process involved identifying and qualifying new suppliers in countries with favorable trade relationships and lower tariff exposures.

- Analysis of price changes for Apple products: While Apple did absorb some of the increased costs, some price adjustments were likely unavoidable. Analyzing Apple's pricing strategies during this period reveals the delicate balance between maintaining profitability and managing consumer price sensitivity.

The Impact of Tariffs on Berkshire Hathaway's Apple Investment Returns

The Trump-era tariffs undoubtedly impacted Berkshire Hathaway's substantial Apple holdings. While Apple's overall resilience and market dominance mitigated the potential damage, the increased costs and trade uncertainties would have influenced profitability and overall investment returns.

- Quantitative analysis of the impact on Berkshire Hathaway's ROI: Precise quantification is challenging without access to Berkshire Hathaway's internal data. However, analyzing Apple's stock performance during this period, along with the broader market conditions, provides clues to the potential impact on Berkshire's ROI.

- Comparison of Apple's stock performance before and after tariff implementation: A comparative analysis of Apple's stock performance before, during, and after the tariff implementation offers valuable insight into the extent of the impact.

- Evaluation of Buffett's public statements or actions regarding the tariffs: Examining Buffett's public statements and any actions taken by Berkshire Hathaway in response to the tariffs helps provide insights into his assessment of the situation and any strategic adjustments made to the investment portfolio.

Long-Term Implications for Apple, Berkshire Hathaway, and Global Trade

The long-term implications of the Trump-era tariffs extend beyond the immediate impact on Apple and Berkshire Hathaway. They highlight the vulnerability of global supply chains to protectionist policies and underscore the need for diversification and resilience.

- Prediction of future supply chain strategies for Apple: Apple's experience with the tariffs likely led to a fundamental shift in its supply chain strategy, emphasizing diversification, regionalization, and potentially reshoring of some manufacturing operations.

- Potential changes in investor sentiment toward Apple: The resilience of Apple's business model amidst the tariff challenges likely enhanced investor confidence, while also highlighting the potential risks associated with geopolitical instability and trade wars.

- Long-term effects on global trade patterns: The tariffs served as a reminder of the potential for disruptions in global trade, influencing long-term investment decisions and potentially leading to a reassessment of global supply chain structures and international trade relationships.

Conclusion: Understanding Buffett's Apple Investment in the Age of Trade Wars

The Trump-era tariffs presented a significant challenge to Buffett's Apple investment and highlighted the interconnectedness of global trade and investment strategies. While Apple demonstrated resilience through strategic adjustments, the experience underscored the vulnerabilities inherent in complex global supply chains. Understanding these dynamics is crucial for navigating the complexities of international trade and for making informed investment decisions. Learn more about Buffett's Apple investment and understand the impact of trade tariffs to better navigate the complexities of global trade and protect your own portfolio.

Featured Posts

-

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025 -

Mia Farrow Supports Fellow Tony Nominee Sadie Sink On Broadway

May 24, 2025

Mia Farrow Supports Fellow Tony Nominee Sadie Sink On Broadway

May 24, 2025 -

Change And Consequences Navigating The Risks Of Challenging The Status Quo

May 24, 2025

Change And Consequences Navigating The Risks Of Challenging The Status Quo

May 24, 2025 -

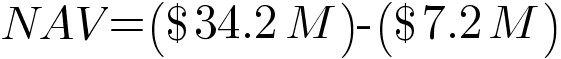

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

From Grace To Disgrace 17 Celebrity Reputations Ruined Overnight

May 24, 2025

From Grace To Disgrace 17 Celebrity Reputations Ruined Overnight

May 24, 2025

Latest Posts

-

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025 -

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025 -

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025 -

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025