BOE Rate Cut Probabilities Reduced: Pound Gains After UK Inflation Figures

Table of Contents

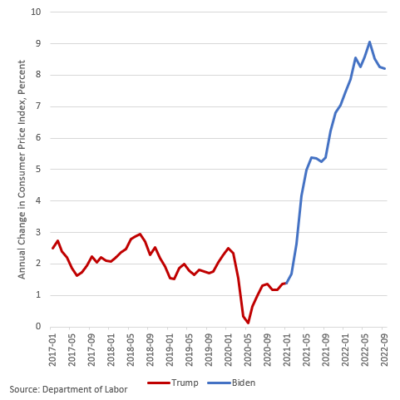

H2: Unexpectedly High UK Inflation Figures

H3: Details of the Inflation Report

The Office for National Statistics (ONS) recently released UK inflation figures that surprised many analysts. The Consumer Price Index (CPI) rose to [Insert Actual CPI Percentage]% in [Insert Month, Year], exceeding market expectations of [Insert Expected CPI Percentage]% and the previous month's figure of [Insert Previous Month's CPI Percentage]%. Similarly, the Retail Price Index (RPI), a broader measure of inflation, also showed a significant increase.

- CPI: [Insert Actual CPI Percentage]% (vs. expected [Insert Expected CPI Percentage]%, previous month [Insert Previous Month's CPI Percentage]%)

- RPI: [Insert Actual RPI Percentage]% (vs. expected [Insert Expected RPI Percentage]%, previous month [Insert Previous Month's RPI Percentage]%)

- Key Contributing Factors: The rise was driven by persistent increases in energy prices, elevated food costs, and strong core inflation, indicating broader price pressures within the UK economy.

H3: Market Reaction to Inflation Data

The market reacted swiftly and decisively to the higher-than-expected inflation data. The Pound Sterling strengthened immediately against major currencies like the US dollar (USD) and the Euro (EUR). Government bond yields also rose, reflecting investors' expectations of continued high inflation and potentially further monetary policy tightening by the BOE.

- Pound Sterling: Experienced an immediate appreciation of approximately [Insert Percentage]% against the USD and [Insert Percentage]% against the EUR.

- Government Bonds: Yields on UK government bonds increased, indicating a rise in borrowing costs.

- Expert Opinion: "[Insert quote from a financial analyst regarding market reaction and its significance]."

H2: Impact on BOE Rate Cut Probabilities

H3: BOE's Mandate and Inflation Target

The Bank of England's primary mandate is to maintain price stability. Its inflation target is currently set at [Insert BOE Inflation Target]%. The latest inflation figures demonstrate a significant deviation from this target, placing pressure on the BOE to act. Persistent high inflation erodes purchasing power and undermines the BOE's credibility.

- BOE Monetary Policy Stance: The BOE is currently focused on controlling inflation, even at the potential cost of slower economic growth.

- Implications for BOE Credibility: Failure to bring inflation back to the target could damage the BOE's reputation and its effectiveness in managing the UK economy.

H3: Reduced Likelihood of Rate Cuts

Given the unexpectedly high inflation figures, the probability of a BOE interest rate cut has significantly diminished. A rate cut at this juncture would risk further fueling inflation, potentially exacerbating existing price pressures. Instead, the BOE is more likely to maintain its current interest rate policy or even consider further increases.

- Reasons for Reduced Rate Cut Probability: The risk of exacerbating inflation, the need to maintain credibility, and the strength of the Pound Sterling all contribute to a less likely scenario of a rate cut.

- Alternative Policy Options: The BOE might explore other policy tools, such as quantitative tightening or forward guidance, to manage inflation without resorting to rate cuts.

H2: Implications for the Pound Sterling

H3: Pound Strengthens Against Major Currencies

Following the release of the inflation data, the Pound Sterling (GBP) experienced a noticeable strengthening against several major currencies. This reflects increased investor confidence in the UK economy, given the expectation of less monetary easing and the potential for higher interest rates in the future.

- GBP/USD: The Pound appreciated by approximately [Insert Percentage]%.

- GBP/EUR: The Pound appreciated by approximately [Insert Percentage]%.

- Long-term Implications: The long-term impact on the Pound's value will depend on several factors, including future inflation figures and the BOE's monetary policy decisions.

H3: Impact on UK Businesses and Consumers

The stronger Pound can benefit UK businesses by reducing import costs, although it could hurt exporters. Higher inflation, regardless of currency fluctuations, continues to negatively affect consumers' purchasing power, squeezing household budgets.

- Businesses: Importers will benefit from lower costs, while exporters may face reduced competitiveness.

- Consumers: Consumers will continue to face the pressure of higher prices for goods and services, impacting their disposable income.

3. Conclusion

In summary, unexpectedly high UK inflation figures have significantly reduced the probability of a BOE rate cut, leading to a strengthening of the Pound Sterling. This development has significant implications for UK businesses, consumers, and the overall economic outlook. The persistence of high inflation remains a key concern for the BOE, and its response will continue to shape the value of the Pound and the UK's economic trajectory.

Call to Action: Stay informed about the latest developments regarding BOE rate cuts and UK inflation figures. Regularly check reputable financial news sources to stay updated on potential shifts in monetary policy and their effect on the Pound Sterling. Understanding BOE rate cut probabilities is crucial for investors and anyone impacted by the UK economy.

Featured Posts

-

The Blake Lively Allegations An Analysis Of Recent Reports

May 22, 2025

The Blake Lively Allegations An Analysis Of Recent Reports

May 22, 2025 -

Su Kien The Thao Hon 200 Nguoi Chay Bo Tu Dak Lak Den Phu Yen

May 22, 2025

Su Kien The Thao Hon 200 Nguoi Chay Bo Tu Dak Lak Den Phu Yen

May 22, 2025 -

Nvidias Huang Us Export Controls Failed Trump Praised

May 22, 2025

Nvidias Huang Us Export Controls Failed Trump Praised

May 22, 2025 -

Stijgende Huizenprijzen In Nederland Abn Amros Analyse En Rentevoorspelling

May 22, 2025

Stijgende Huizenprijzen In Nederland Abn Amros Analyse En Rentevoorspelling

May 22, 2025 -

Core Inflation Surge The Bank Of Canadas Policy Challenge

May 22, 2025

Core Inflation Surge The Bank Of Canadas Policy Challenge

May 22, 2025

Latest Posts

-

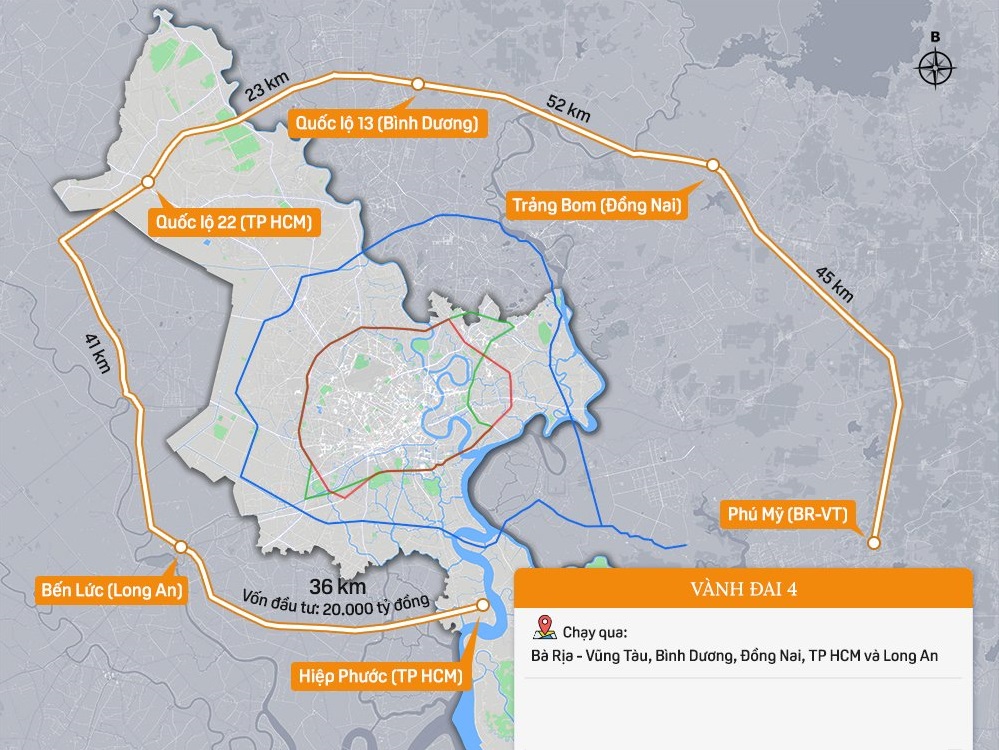

Dong Nai Kien Nghi Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Noi Binh Phuoc

May 22, 2025

Dong Nai Kien Nghi Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Noi Binh Phuoc

May 22, 2025 -

Duong Cao Toc Dong Nai Vung Tau San Sang Thong Xe Vao Dip Le 2 9

May 22, 2025

Duong Cao Toc Dong Nai Vung Tau San Sang Thong Xe Vao Dip Le 2 9

May 22, 2025 -

Tuyen Cao Toc Dong Nai Vung Tau Thong Tin Moi Nhat Ve Ngay Thong Xe

May 22, 2025

Tuyen Cao Toc Dong Nai Vung Tau Thong Tin Moi Nhat Ve Ngay Thong Xe

May 22, 2025 -

At Be X Ntt Multi Interconnect Ascii Jp

May 22, 2025

At Be X Ntt Multi Interconnect Ascii Jp

May 22, 2025 -

Cao Toc Dong Nai Vung Tau Du Kien Hoan Thanh Va Thong Xe Thang 9

May 22, 2025

Cao Toc Dong Nai Vung Tau Du Kien Hoan Thanh Va Thong Xe Thang 9

May 22, 2025