BofA's View: Why Current Stock Market Valuations Shouldn't Scare Investors

Table of Contents

BofA's Rationale Behind a Positive Market Outlook

BofA's positive market outlook isn't based on blind optimism; it rests on several key pillars supporting strong economic fundamentals and future growth potential.

Strong Corporate Earnings Growth

BofA projects continued robust corporate earnings growth, even amidst a potentially slowing economy. This prediction is fueled by several factors contributing to sustained profitability and positive stock market valuations.

- Technology Sector Strength: The technology sector continues to show exceptional earnings growth, driven by innovation and increasing demand for software and cloud services.

- Resilience in Financials: Despite rising interest rates, the financial sector demonstrates consistent profitability, benefiting from higher net interest margins.

- Energy Sector Boom: High energy prices have boosted the profitability of energy companies, contributing significantly to overall corporate earnings growth.

These strong earnings figures directly impact stock market valuations, providing a solid foundation for continued market growth, even in the face of economic headwinds. BofA's report highlights a projected X% increase in overall corporate earnings for the next fiscal year (replace X with data from BofA's report, if available).

Resilient Consumer Spending

Despite inflationary pressures, consumer spending remains remarkably resilient. BofA's analysis suggests that several factors contribute to this sustained consumer confidence:

- Strong Labor Market: Low unemployment rates provide consumers with financial security, allowing them to maintain spending habits.

- Pent-up Demand: Post-pandemic, there remains significant pent-up demand for goods and services, driving continued consumption.

- Savings Cushion: Many households built up savings during the pandemic, providing a buffer against rising prices.

This resilient consumer spending directly supports economic growth and positive stock market valuations, mitigating concerns about a potential recession.

Low Unemployment Rates

The persistently low unemployment rate is a significant factor bolstering BofA's positive outlook. This strong labor market fuels several positive economic cycles:

- Increased Wages: Low unemployment leads to higher wages, boosting consumer spending and overall economic activity.

- Increased Productivity: A tight labor market encourages companies to invest in technology and automation, leading to increased productivity.

- Strong Corporate Performance: A healthy labor market translates to a more efficient and productive workforce, directly impacting corporate profits and stock market valuations.

These positive feedback loops reinforce the overall optimistic outlook for stock market performance.

Addressing Concerns About High Stock Market Valuations

While acknowledging the high valuations, BofA addresses investor concerns by providing context and focusing on long-term prospects.

The Role of Interest Rates

BofA's analysis accounts for the impact of interest rate changes on stock valuations. While future rate hikes might impact corporate borrowing costs, the bank believes the current level and projected trajectory are manageable and won't derail market growth.

- Controlled Rate Increases: BofA projects measured and controlled increases in interest rates, minimizing the risk of a sharp economic downturn.

- Strong Corporate Balance Sheets: Many companies have strong balance sheets and can handle higher borrowing costs.

- Market Adaptation: Markets typically adapt to changes in monetary policy, and the current valuations partially reflect expectations of future interest rate movements.

This suggests that while interest rate adjustments impact stock market valuations, they are unlikely to trigger a significant market correction.

Long-Term Growth Prospects

BofA's optimistic outlook extends beyond the short term, focusing on long-term growth potential in key sectors:

- Technological Advancements: Continued innovation in technology is expected to drive significant long-term growth across various industries.

- Renewable Energy: The transition to renewable energy sources presents immense opportunities for investment and growth.

- Healthcare Innovation: Advancements in healthcare technology and treatments will continue to fuel market expansion.

These long-term growth prospects help to justify current stock market valuations, suggesting that they reflect future earnings potential rather than being overinflated.

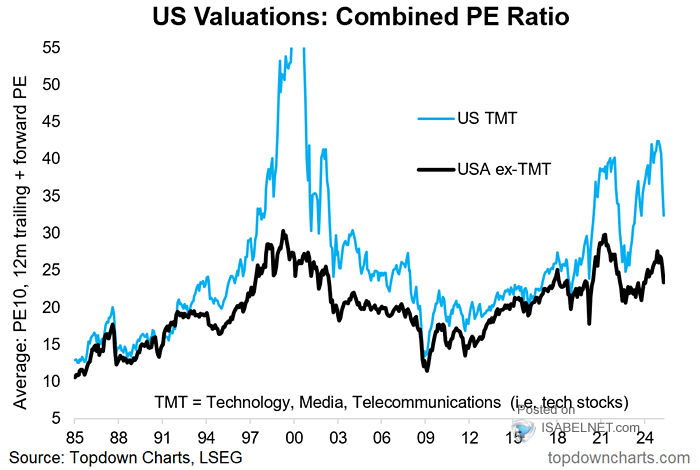

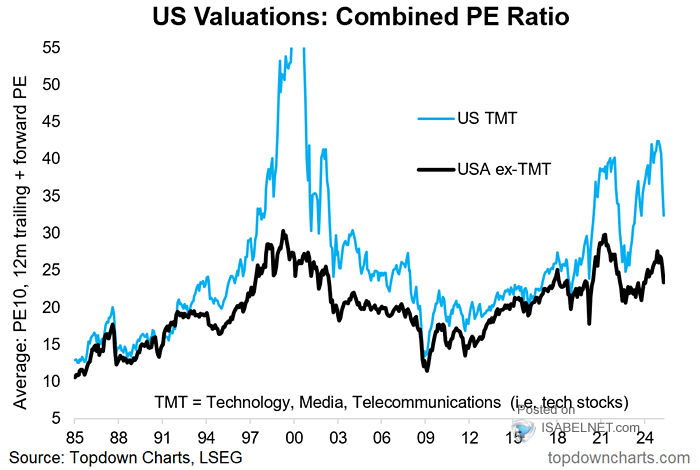

Comparative Valuations

BofA's report likely includes a comparison of current stock market valuations with historical averages and valuations in other markets (check the report for specific data). This comparative analysis helps to contextualize current levels, providing a more nuanced perspective.

- Historical Context: Comparing current valuations to historical averages reveals that while high, they are not unprecedented.

- Global Comparisons: Comparing U.S. valuations with those in other developed markets provides further perspective.

- Market Cycle Analysis: Understanding the position within a typical market cycle provides a framework for evaluating current valuations.

By considering these comparative aspects, investors can better assess whether current stock market valuations are truly excessive.

Conclusion: Why Current Stock Market Valuations Shouldn't Deter You

BofA's analysis suggests that despite seemingly high stock market valuations, a positive outlook remains justified. Strong corporate earnings growth, resilient consumer spending, low unemployment, and promising long-term growth potential all mitigate concerns about overvaluation. BofA's perspective highlights the importance of considering the broader economic context and long-term growth prospects when assessing market valuations. Review your investment strategy, understand stock market valuations thoroughly, and consider long-term growth potential before making any significant portfolio adjustments. To learn more about BofA's full report and its detailed analysis of stock market valuations, [insert link to BofA's report here].

Featured Posts

-

16 Mart Ta Dogmus Olanlarin Burcu Ve Oezellikleri Nelerdir

May 24, 2025

16 Mart Ta Dogmus Olanlarin Burcu Ve Oezellikleri Nelerdir

May 24, 2025 -

Lvmh Stock Slumps Q1 Sales Miss Targets By 8 2

May 24, 2025

Lvmh Stock Slumps Q1 Sales Miss Targets By 8 2

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025 -

Philips Annual General Meeting Of Shareholders Key Highlights

May 24, 2025

Philips Annual General Meeting Of Shareholders Key Highlights

May 24, 2025 -

Canada Post Strike Averted Details Of The New Offer

May 24, 2025

Canada Post Strike Averted Details Of The New Offer

May 24, 2025

Latest Posts

-

Rybakina Falls To Andreescu In Straight Sets At Italian Open

May 24, 2025

Rybakina Falls To Andreescu In Straight Sets At Italian Open

May 24, 2025 -

Bianca Andreescus Straight Sets Win Sends Her To Italian Open Fourth Round

May 24, 2025

Bianca Andreescus Straight Sets Win Sends Her To Italian Open Fourth Round

May 24, 2025 -

Pobeda Aleksandrovoy Nad Samsonovoy Na Turnire V Shtutgarte

May 24, 2025

Pobeda Aleksandrovoy Nad Samsonovoy Na Turnire V Shtutgarte

May 24, 2025 -

Pryamaya Translyatsiya Rybakina Protiv Eks Tretey Raketki Mira V Turnire Na 4 Milliarda

May 24, 2025

Pryamaya Translyatsiya Rybakina Protiv Eks Tretey Raketki Mira V Turnire Na 4 Milliarda

May 24, 2025 -

Shtutgart Aleksandrova Obygrala Samsonovu V Startovom Matche

May 24, 2025

Shtutgart Aleksandrova Obygrala Samsonovu V Startovom Matche

May 24, 2025