Broadcom's VMware Acquisition: AT&T Faces A Staggering 1,050% Price Increase

Table of Contents

Understanding the Broadcom-VMware Deal and its Market Dominance

The Broadcom-VMware merger represents a monumental consolidation in the networking and virtualization markets. Broadcom, already a major player in semiconductor and infrastructure software, significantly bolstered its position by acquiring VMware, a leader in virtualization technology. This acquisition creates a behemoth with unprecedented control over crucial elements of data center infrastructure.

- Key products and services offered by VMware: vSphere (server virtualization), vSAN (storage virtualization), NSX (network virtualization), and vRealize (cloud management). These are cornerstone technologies for many businesses, especially in the telecom sector.

- Broadcom's existing portfolio and synergies with VMware: Broadcom's existing portfolio complements VMware's offerings, creating significant synergies. This integration allows for tighter control over the entire infrastructure stack, from hardware to software.

- Potential for increased market share and reduced competition: The combined entity now holds a dominant position, raising concerns about reduced competition and potential for anti-competitive practices. This strengthened market position gives Broadcom considerable leverage in setting prices.

The Anatomy of AT&T's 1050% Price Hike

AT&T's reported 1050% price increase underscores the potential ramifications of Broadcom's acquisition. While the exact details of the contract and pricing structure remain undisclosed, several factors likely contributed to this dramatic surge:

- Specific VMware products affected: The price increase likely affects several key VMware products utilized by AT&T's extensive network infrastructure, including vSphere, NSX, and potentially others.

- Comparison of old and new pricing models: The shift from VMware's previous pricing model to a new one, potentially influenced by Broadcom’s strategies, is a key driver of this massive increase. Transparency on the new pricing structure is lacking, fueling speculation.

- Potential impact on AT&T's operating costs and profitability: This substantial price increase significantly impacts AT&T's operating costs, potentially affecting its profitability and ability to compete effectively. It forces AT&T to reassess its IT budgeting and potentially raise prices for its own services.

Wider Implications for the Telecom Industry and Businesses

The impact of Broadcom's VMware acquisition extends far beyond AT&T. Other telecom providers reliant on VMware technologies face similar, albeit potentially less drastic, price increases. Businesses across various sectors that depend on VMware for their IT infrastructure are also vulnerable.

- Impact on smaller telecom providers: Smaller telecom companies, with less bargaining power than AT&T, might face even steeper price increases, potentially jeopardizing their operations.

- Potential for increased IT budgets for businesses: Businesses using VMware products should expect significant increases in their IT budgets, forcing them to re-evaluate their spending and potentially seek alternative solutions.

- Possible regulatory responses to the price increases: The magnitude of the price increases has drawn regulatory scrutiny, raising concerns about potential antitrust violations and monopolistic practices.

Strategies for Mitigating the Impact of Increased VMware Costs

Facing such substantial price increases, businesses and telecom providers need proactive strategies to manage rising VMware costs:

- Negotiating with Broadcom: Direct negotiation with Broadcom is crucial. Leveraging volume discounts and negotiating favorable terms might offer some relief.

- Exploring open-source alternatives: Open-source virtualization solutions, such as Proxmox VE or OpenStack, can offer a cost-effective alternative, although they might require significant transition efforts.

- Optimizing VMware deployments: Thoroughly reviewing current VMware deployments to identify inefficiencies and optimize resource utilization can yield significant cost savings. Consolidation and right-sizing can reduce licensing needs.

Conclusion: Navigating the Post-Acquisition Landscape – The Future of Broadcom's VMware and Pricing Strategies

Broadcom's acquisition of VMware has fundamentally reshaped the competitive landscape. AT&T's staggering 1050% price increase serves as a stark warning of the potential consequences. This acquisition’s impact on pricing and the future of the virtualization market remain uncertain, with significant regulatory scrutiny likely. The future will depend on a combination of market forces, potential regulatory intervention, and the choices businesses make in response to these price increases. Don't get caught off guard! Learn more about mitigating the impact of Broadcom's VMware acquisition on your business by researching alternative solutions and negotiating effectively with Broadcom.

Featured Posts

-

The Whos Drummer Zak Starkey Townshend Dispels Departure Speculation

May 23, 2025

The Whos Drummer Zak Starkey Townshend Dispels Departure Speculation

May 23, 2025 -

Ihanet Goerdueguende Aninda Tepki Veren Burclar

May 23, 2025

Ihanet Goerdueguende Aninda Tepki Veren Burclar

May 23, 2025 -

Open Ai And The Ftc Examining The Investigation Into Chat Gpt

May 23, 2025

Open Ai And The Ftc Examining The Investigation Into Chat Gpt

May 23, 2025 -

Posthaste Understanding The Current Risks Within The Global Bond Market

May 23, 2025

Posthaste Understanding The Current Risks Within The Global Bond Market

May 23, 2025 -

Cat Deeley Shares Rare Photo Of Sons In Identical Zara Ski Gear

May 23, 2025

Cat Deeley Shares Rare Photo Of Sons In Identical Zara Ski Gear

May 23, 2025

Latest Posts

-

San Hejmo Line Up Alle Kuenstler Enthuellt Die Essener Freuen Sich

May 23, 2025

San Hejmo Line Up Alle Kuenstler Enthuellt Die Essener Freuen Sich

May 23, 2025 -

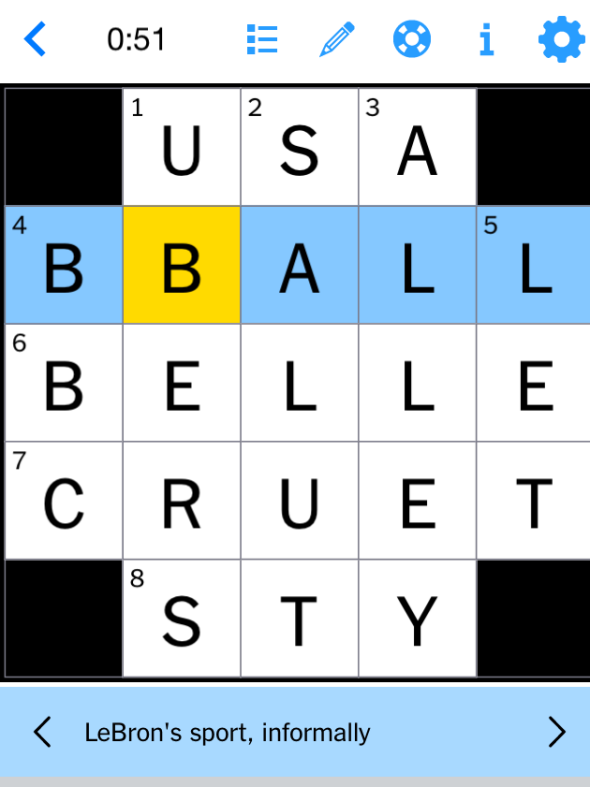

Get The Answers Nyt Mini Crossword March 24 2025

May 23, 2025

Get The Answers Nyt Mini Crossword March 24 2025

May 23, 2025 -

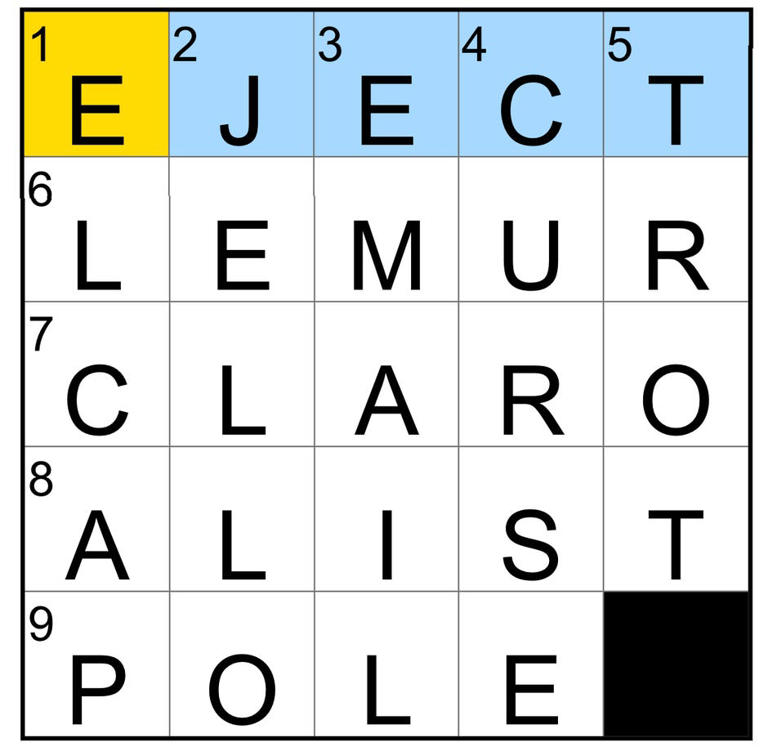

Nyt Mini Crossword March 16 2025 Hints And Solutions

May 23, 2025

Nyt Mini Crossword March 16 2025 Hints And Solutions

May 23, 2025 -

Essen Restaurant Shajee Traders Wegen Mangelnder Hygiene Geschlossen

May 23, 2025

Essen Restaurant Shajee Traders Wegen Mangelnder Hygiene Geschlossen

May 23, 2025 -

Nyt Mini Crossword March 26 2025 Full Solution Guide

May 23, 2025

Nyt Mini Crossword March 26 2025 Full Solution Guide

May 23, 2025