Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Increases

Table of Contents

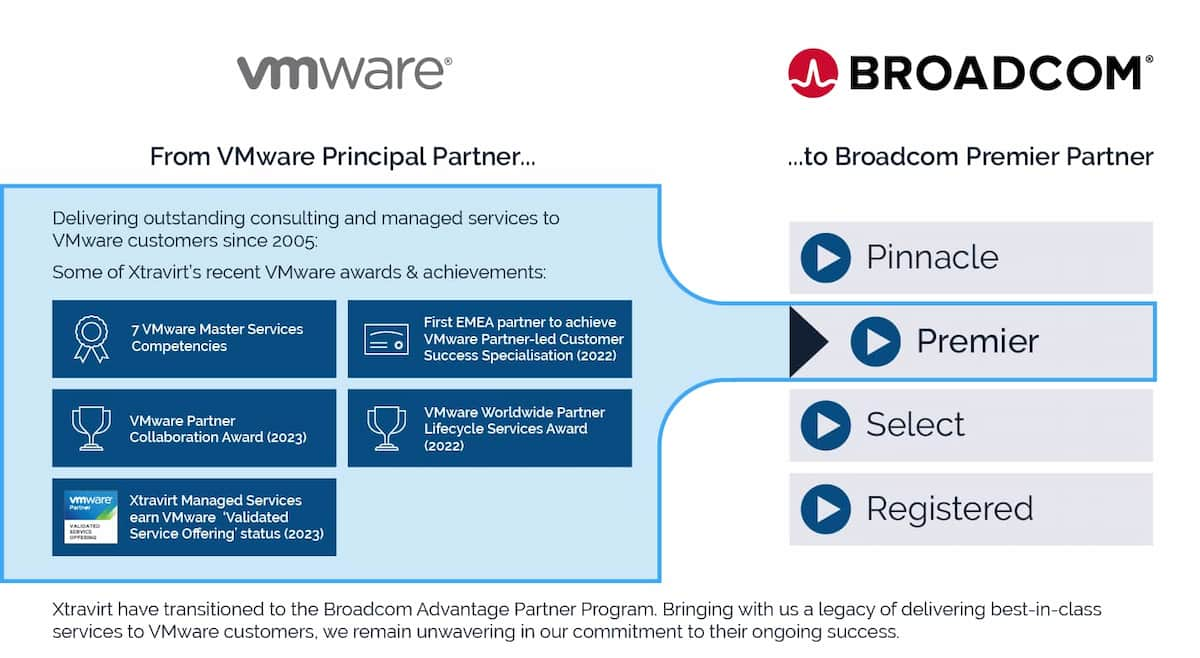

AT&T's Experience with Post-Acquisition Price Hikes

AT&T, a massive telecommunications company heavily reliant on VMware's virtualization technologies, is facing substantial challenges in the wake of the Broadcom acquisition. The price hikes are not subtle; they represent a significant blow to their IT budget and operational costs.

Significant Increases in VMware Licensing Fees

Reports suggest double-digit percentage increases in VMware licensing fees for AT&T. These increases aren't limited to a single product; they affect a broad range of VMware's core offerings.

- Specific examples: Increases have been reported for vSphere, the flagship virtualization platform; vSAN, the software-defined storage solution; and NSX, the network virtualization platform. Precise figures remain largely undisclosed due to the confidential nature of enterprise contracts, but industry analysts suggest increases ranging from 20% to upwards of 50% in some cases.

- Impact on AT&T: These substantial increases directly impact AT&T's IT budget, forcing them to re-evaluate their spending and potentially cut back on other crucial projects. The unforeseen costs represent a significant financial burden.

- Supporting evidence: While specific contractual details are confidential, numerous industry news outlets and analyst reports cite anecdotal evidence of substantial VMware price increases following the Broadcom acquisition. These reports consistently point towards a common trend of sharply increased costs for large enterprise clients.

Limited Negotiating Power Post-Acquisition

The acquisition has significantly diminished AT&T's negotiating power. Before the merger, AT&T could leverage competition between VMware and other virtualization providers to secure favorable contract terms. Now, with Broadcom's near-monopoly, negotiating leverage has significantly decreased.

- Reduced Competition: The Broadcom acquisition removed a major competitor from the enterprise virtualization market, leaving fewer alternatives for large companies like AT&T.

- Future Contract Renewals: AT&T now faces the daunting prospect of renewing contracts with significantly higher prices, leaving them with limited options for negotiation.

- Challenges in Finding Alternatives: Migrating away from VMware represents a complex and costly undertaking, forcing AT&T to accept less favorable terms or face a substantial disruption to its operations.

Broader Implications for the Enterprise Software Market

The experience of AT&T is not an isolated incident; it highlights a broader concern about the impact of Broadcom's acquisition on the enterprise software market and the implications for businesses of all sizes.

Concerns about Monopoly Power and Anti-Competitive Practices

The acquisition has raised significant concerns about Broadcom's growing market dominance and the potential for anti-competitive practices. Industry experts and regulatory bodies are closely scrutinizing the situation.

- Ongoing Investigations: Several regulatory bodies are investigating the potential anti-competitive implications of the merger, focusing on the impact on pricing and competition within the virtualization market.

- Impact on Innovation: A lack of competition can stifle innovation, leading to less choice and potentially hindering the development of new, more efficient technologies.

- Antitrust Concerns: Numerous articles and reports express concern over the potential for Broadcom to leverage its market power to increase prices unfairly, restricting choices for customers.

The Ripple Effect on Other Businesses

The price increases experienced by AT&T are likely a harbinger of things to come for other businesses relying heavily on VMware products. The ripple effect will be felt across numerous sectors.

- Impacted Industries: Businesses in finance, healthcare, telecommunications, and many other sectors utilizing VMware technologies face the prospect of similar price hikes.

- Long-Term Impacts: These increased costs will have a long-term impact on IT budgets, strategic planning, and overall profitability for businesses worldwide.

- Proactive Measures: Businesses need to proactively address the potential for significant price increases to avoid significant financial disruptions.

Strategies for Mitigating the Impact of Rising VMware Costs

While the situation is challenging, businesses can employ several strategies to mitigate the impact of rising VMware costs.

Negotiation and Contract Review

Effective negotiation and thorough contract review are crucial for minimizing the financial impact.

- Leverage Volume Discounts: Companies with significant VMware deployments should negotiate for volume discounts to reduce per-unit costs.

- Alternative Licensing Models: Explore cloud-based licensing models or subscription-based options that may offer better cost predictability and flexibility.

- Consolidation: Consolidating VMware deployments can lead to potential cost savings through optimized resource utilization.

Exploring Alternative Technologies

Migrating away from VMware might be a viable option for some businesses, although it's a significant undertaking.

- Competing Technologies: Explore alternatives such as Microsoft Hyper-V, Citrix XenServer, or cloud-based virtualization solutions from AWS, Azure, or Google Cloud.

- Migration Challenges: Consider the complexity and potential disruption involved in migrating away from a well-established VMware environment. This often requires significant planning and resources.

- Cost-Benefit Analysis: Carefully weigh the costs and benefits of migration, including potential downtime, retraining, and the cost of new infrastructure.

Budgeting and Long-Term Planning

Proactive budgeting and long-term planning are vital for navigating the changing landscape.

- Forecasting Tools: Utilize forecasting tools and techniques to predict potential VMware cost increases and incorporate them into the annual budget.

- Regular Contract Reviews: Implement regular reviews of VMware contracts to identify opportunities for cost optimization and renegotiation.

- Cost Analysis: Conduct thorough cost analyses to understand the true cost of VMware ownership and explore potential cost-saving measures.

Conclusion

The Broadcom VMware acquisition has already resulted in significant price increases for AT&T, highlighting a concerning trend for businesses worldwide. The acquisition raises significant concerns about market dominance, potential anti-competitive practices, and the escalating cost of enterprise software. This situation demands proactive strategies from businesses to mitigate the impact of rising VMware costs. Don't be caught off guard by escalating costs. Proactively assess your VMware contracts, explore alternative solutions, and plan strategically to navigate the new landscape created by the Broadcom VMware acquisition. Understanding the implications of this merger and developing a robust cost-management strategy is crucial for the long-term financial health of your organization.

Featured Posts

-

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025 -

Trumps Stance On Powell No Plans For Fed Chair Dismissal

Apr 24, 2025

Trumps Stance On Powell No Plans For Fed Chair Dismissal

Apr 24, 2025 -

Saudi Arabia And India Partner To Build Two New Oil Refineries

Apr 24, 2025

Saudi Arabia And India Partner To Build Two New Oil Refineries

Apr 24, 2025 -

Covid 19 Test Fraud Lab Owner Pleads Guilty

Apr 24, 2025

Covid 19 Test Fraud Lab Owner Pleads Guilty

Apr 24, 2025 -

Tesla Space X And The Epa How Elon Musk And Dogecoin Changed The Narrative

Apr 24, 2025

Tesla Space X And The Epa How Elon Musk And Dogecoin Changed The Narrative

Apr 24, 2025