Understanding The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is the Amundi Dow Jones Industrial Average UCITS ETF?

The Amundi Dow Jones Industrial Average UCITS ETF is designed to track the performance of the iconic Dow Jones Industrial Average (DJIA). This index comprises 30 of the largest, most influential publicly traded companies in the United States, representing a broad cross-section of the American economy. The ETF aims to replicate the DJIA's returns, offering investors a convenient and diversified way to gain exposure to these blue-chip stocks.

- Investment Objective: To track the performance of the Dow Jones Industrial Average.

- Tracking Index: Dow Jones Industrial Average.

- Investment Strategy: Passive replication of the index.

- UCITS Structure: This ETF's UCITS (Undertakings for Collective Investment in Transferable Securities) structure means it complies with EU regulations, making it accessible to investors across Europe and other jurisdictions that recognize UCITS funds. This ensures a high level of investor protection and transparency.

- Key Features: Typically, these ETFs boast a low expense ratio, making them a cost-effective way to invest in the DJIA. The inherent diversification across 30 major companies also helps mitigate risk.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

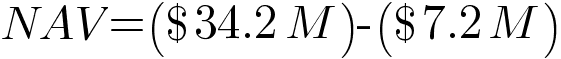

The NAV (Net Asset Value) of the Amundi Dow Jones Industrial Average UCITS ETF represents the net value of the ETF's assets minus its liabilities, per share. It's calculated daily, reflecting the current market value of the underlying assets. The process generally involves the following steps:

- Daily Valuation of Underlying Assets: The fund manager calculates the market value of each of the 30 Dow Jones Industrial Average component stocks at the end of the trading day.

- Aggregation of Asset Values: These individual stock values are aggregated to determine the total market value of the ETF's holdings.

- Accounting for Dividends and Expenses: Dividends received from the underlying stocks are added to the total asset value, while ETF expenses (management fees, etc.) are subtracted.

- Calculation of NAV per Share: The net asset value (total assets minus liabilities) is then divided by the total number of outstanding ETF shares to arrive at the NAV per share.

- Fund Manager's Role: The fund manager, Amundi, is responsible for overseeing the accurate calculation and dissemination of the NAV.

Factors influencing the daily NAV include:

- Changes in Stock Prices: Fluctuations in the prices of the constituent stocks within the DJIA directly impact the ETF's NAV.

- Dividend Payments: Dividends paid by the underlying companies increase the ETF's NAV.

- ETF Expenses: Management fees and other operational expenses reduce the NAV.

Understanding NAV and its Importance for Investment Decisions

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is a crucial indicator of its performance and value. While the ETF's share price on the exchange may deviate slightly from its NAV due to factors like supply and demand, understanding the relationship is vital. This difference is often referred to as tracking error.

- NAV and Share Price: The NAV provides a more accurate reflection of the intrinsic value of the ETF compared to its market price.

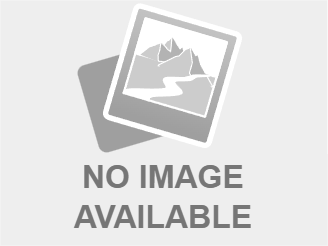

- Assessing Performance: By monitoring daily NAV changes, investors can gauge the ETF's performance relative to the DJIA.

- Buy/Sell Decisions: Investors can use the NAV to determine the value they are buying or selling the ETF at, ensuring they are getting a fair price.

- Comparative Analysis: Comparing the NAV of this ETF to other similar ETFs tracking the DJIA can help investors make informed decisions about which fund best suits their needs.

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV?

The daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is readily accessible through several reliable sources:

- Amundi's Website: The official website of Amundi, the ETF provider, is the primary source for accurate and up-to-date NAV information.

- Financial News Websites: Reputable financial news websites and portals often publish ETF NAVs.

- Brokerage Platforms: Most brokerage platforms that offer trading in this ETF will display the current NAV on your account dashboard.

The NAV is typically presented as a currency value (e.g., EUR, USD) per share and is usually updated at the close of the market each day.

Conclusion

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is fundamental for making sound investment decisions. By monitoring the daily NAV, assessing its relationship to the share price, and comparing it to similar ETFs, investors can track performance, make informed buy/sell decisions, and ultimately maximize their investment potential. Remember to regularly monitor your Amundi Dow Jones Industrial Average UCITS ETF NAV and stay informed about your Amundi Dow Jones Industrial Average UCITS ETF NAV. Understanding your Amundi Dow Jones Industrial Average UCITS ETF NAV is crucial for successful investing. Consult with a financial advisor for personalized guidance tailored to your investment goals and risk tolerance.

Featured Posts

-

H Nonline Sk Zrusene Pracovne Miesta V Nemecku Prehlad Najvaecsich Spolocnosti

May 24, 2025

H Nonline Sk Zrusene Pracovne Miesta V Nemecku Prehlad Najvaecsich Spolocnosti

May 24, 2025 -

Innokentiy Smoktunovskiy Stoletie Geniya Dokumentalniy Film Menya Vela Kakaya To Sila

May 24, 2025

Innokentiy Smoktunovskiy Stoletie Geniya Dokumentalniy Film Menya Vela Kakaya To Sila

May 24, 2025 -

Securing Your Bbc Big Weekend 2025 Sefton Park Tickets A Step By Step Guide

May 24, 2025

Securing Your Bbc Big Weekend 2025 Sefton Park Tickets A Step By Step Guide

May 24, 2025 -

Paris Facing Financial Strain Analysis Of The Luxury Sectors Decline

May 24, 2025

Paris Facing Financial Strain Analysis Of The Luxury Sectors Decline

May 24, 2025 -

Refleksiya Fedora Lavrova Pavel I Trillery I Tyaga K Adrenalinu

May 24, 2025

Refleksiya Fedora Lavrova Pavel I Trillery I Tyaga K Adrenalinu

May 24, 2025

Latest Posts

-

Apple Stock And Tariffs Assessing The Risks To Buffetts Portfolio

May 24, 2025

Apple Stock And Tariffs Assessing The Risks To Buffetts Portfolio

May 24, 2025 -

Analysts 254 Apple Stock Prediction Time To Buy

May 24, 2025

Analysts 254 Apple Stock Prediction Time To Buy

May 24, 2025 -

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025 -

Apple Stock 200 Entry Point Before 254 Target

May 24, 2025

Apple Stock 200 Entry Point Before 254 Target

May 24, 2025 -

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025