Buffett's Retirement: What's Next For Berkshire Hathaway's Apple Investment?

Table of Contents

The Legacy of Buffett's Apple Investment Strategy

Buffett's Apple investment represents a significant departure from his traditional focus on value stocks. His initial investment rationale, however, was rooted in his understanding of Apple's strong brand loyalty, robust cash flow, and the enduring appeal of its products. This wasn't a typical Berkshire Hathaway investment; it signaled a willingness to embrace a tech giant with a different profile than his usual picks. This strategy proved incredibly successful.

Berkshire Hathaway's Apple investment has generated significant returns, contributing substantially to the company's overall portfolio performance. The size of the investment continues to grow, demonstrating Buffett's confidence in Apple's long-term prospects. This success is a testament to Buffett's ability to adapt his investment philosophy to the changing dynamics of the modern market. His long-term value investing philosophy, which focuses on identifying companies with strong fundamentals and holding them for the long haul, proved remarkably effective in the case of Apple.

- Initial investment size and timing: Berkshire Hathaway's initial investment in Apple began in 2016, gradually increasing to become a cornerstone of their portfolio.

- Key milestones and growth of the Apple holdings: The investment has grown exponentially, making Apple one of Berkshire's largest holdings. This growth reflects Apple's consistent performance and market dominance.

- Comparison to other Berkshire Hathaway investments: While traditional Berkshire investments often focused on less tech-heavy businesses, the Apple investment highlights a shift towards growth stocks with strong brand recognition and consistent earnings.

Succession Planning and its Impact on Apple Holdings

The succession plan at Berkshire Hathaway is crucial in determining the future of its Apple investment. Greg Abel and Ajit Jain, potential successors to Buffett, have different backgrounds and investment styles. While both are highly regarded within the company, their approaches to managing the Apple investment could differ significantly.

Maintaining the status quo is a possibility. Abel and Jain might continue to hold the Apple stock due to its proven success and continued strong performance. However, a shift in strategy is also possible. They could choose to diversify further, reduce exposure to the tech sector, or adopt a more active trading strategy.

- Profiles of Abel and Jain and their investment philosophies: Understanding their backgrounds and approaches is key to predicting the future of Berkshire's Apple holdings.

- Potential changes in Berkshire's investment approach under new leadership: A new leadership team might prioritize different sectors or investment strategies, potentially altering the portfolio's composition.

- Risks associated with a change in leadership and investment strategy: Any significant change in investment strategy carries inherent risks, including potential capital losses.

Future Market Conditions and their Influence on Apple's Value

Apple's future performance, and consequently the value of Berkshire Hathaway's investment, is inherently tied to market conditions. Analyzing current and projected market conditions, including macroeconomic factors, technological advancements, and competition, is essential for evaluating the investment's future.

The current valuation of Apple stock is a crucial factor. Potential risks include economic downturns that could affect consumer spending on electronics, increased competition from other technology companies, and regulatory challenges. Opportunities lie in Apple's continued innovation and expansion into new markets and product categories like augmented reality and artificial intelligence.

- Analysis of current Apple stock valuation: Is Apple currently overvalued or undervalued compared to its historical performance and future prospects?

- Potential impact of emerging technologies (e.g., VR/AR, AI): How will Apple's investment in and development of these technologies affect its market position and profitability?

- Competitive landscape and threats to Apple's market share: The ongoing competition from companies like Samsung, Google, and other tech giants presents ongoing challenges.

The Role of ESG Considerations in Future Investment Decisions

Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions. Berkshire Hathaway's future approach to its Apple investment will likely be shaped by these considerations. Apple's current ESG performance will be a significant factor.

- Apple's current ESG performance: How does Apple stack up against its competitors in terms of environmental sustainability, social responsibility, and corporate governance?

- Potential impact of ESG ratings on investor sentiment: Increasingly, investors are considering ESG ratings when making investment choices.

- How ESG considerations might shape future investment decisions regarding Apple: A poor ESG rating could lead Berkshire Hathaway to reconsider its investment.

Conclusion

This article examined the potential ramifications of Warren Buffett's retirement on Berkshire Hathaway's substantial Apple investment. We explored the legacy of Buffett's investment strategy, the implications of succession planning, the influence of future market conditions, and the growing importance of ESG considerations. The future of this crucial investment remains uncertain, but careful analysis suggests a variety of potential scenarios.

Call to Action: Understanding the intricacies of Buffett's Apple investment is critical for any investor interested in Berkshire Hathaway's future. Stay informed about developments in Berkshire Hathaway's leadership and its approach to its substantial Apple holdings. Continue to research and monitor Buffett's Apple investment for a comprehensive understanding of its future trajectory.

Featured Posts

-

Porsche 911 S T Pts Riviera Blue Now Available

May 24, 2025

Porsche 911 S T Pts Riviera Blue Now Available

May 24, 2025 -

Financing Your Escape To The Country Mortgages And Rural Property

May 24, 2025

Financing Your Escape To The Country Mortgages And Rural Property

May 24, 2025 -

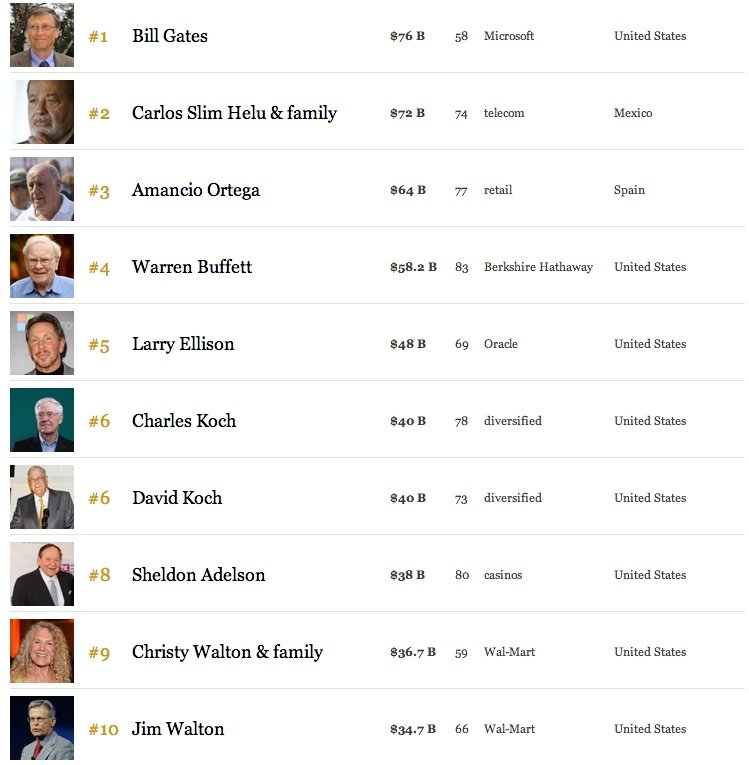

Musk In Vetta La Classifica Forbes Degli Uomini Piu Ricchi Del 2025

May 24, 2025

Musk In Vetta La Classifica Forbes Degli Uomini Piu Ricchi Del 2025

May 24, 2025 -

Real Estate Agent Accuses La Landlords Of Exploiting Fire Victims

May 24, 2025

Real Estate Agent Accuses La Landlords Of Exploiting Fire Victims

May 24, 2025 -

La Fire Victims Face Price Gouging A Growing Concern

May 24, 2025

La Fire Victims Face Price Gouging A Growing Concern

May 24, 2025

Latest Posts

-

Execs Office365 Accounts Breached Millions Made Feds Say

May 24, 2025

Execs Office365 Accounts Breached Millions Made Feds Say

May 24, 2025 -

Covid 19 Pandemic Lab Owners Guilty Plea For False Test Results

May 24, 2025

Covid 19 Pandemic Lab Owners Guilty Plea For False Test Results

May 24, 2025 -

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025 -

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025