CAC 40: Weekly Close In Negative Territory, Despite Overall Stability (March 7, 2025)

Table of Contents

Factors Contributing to the CAC 40's Negative Weekly Performance

The negative weekly performance of the CAC 40 can be attributed to a confluence of factors, highlighting the intricate nature of the stock market and the sensitivity of the French stock market to global events.

Impact of Global Economic Uncertainty

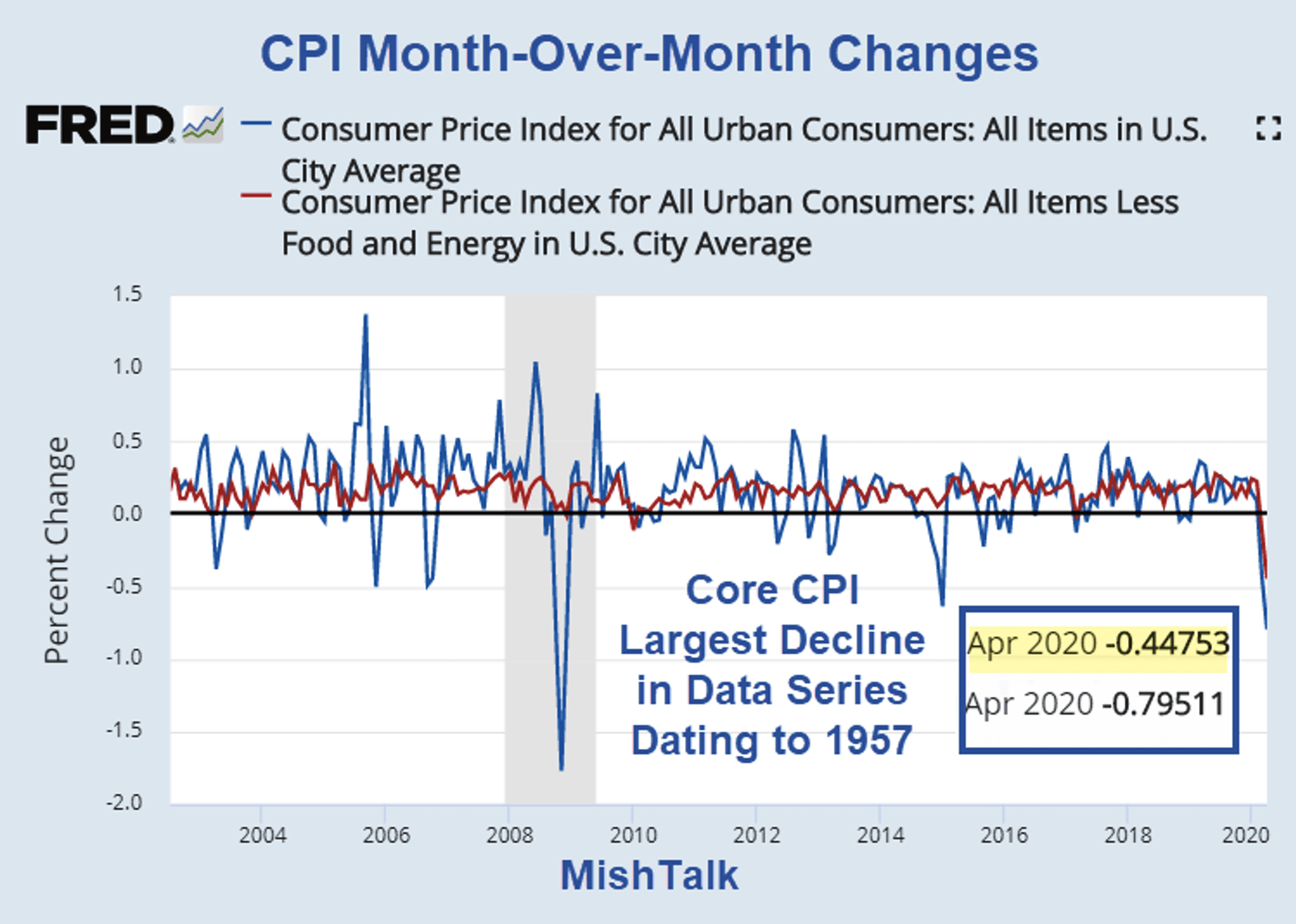

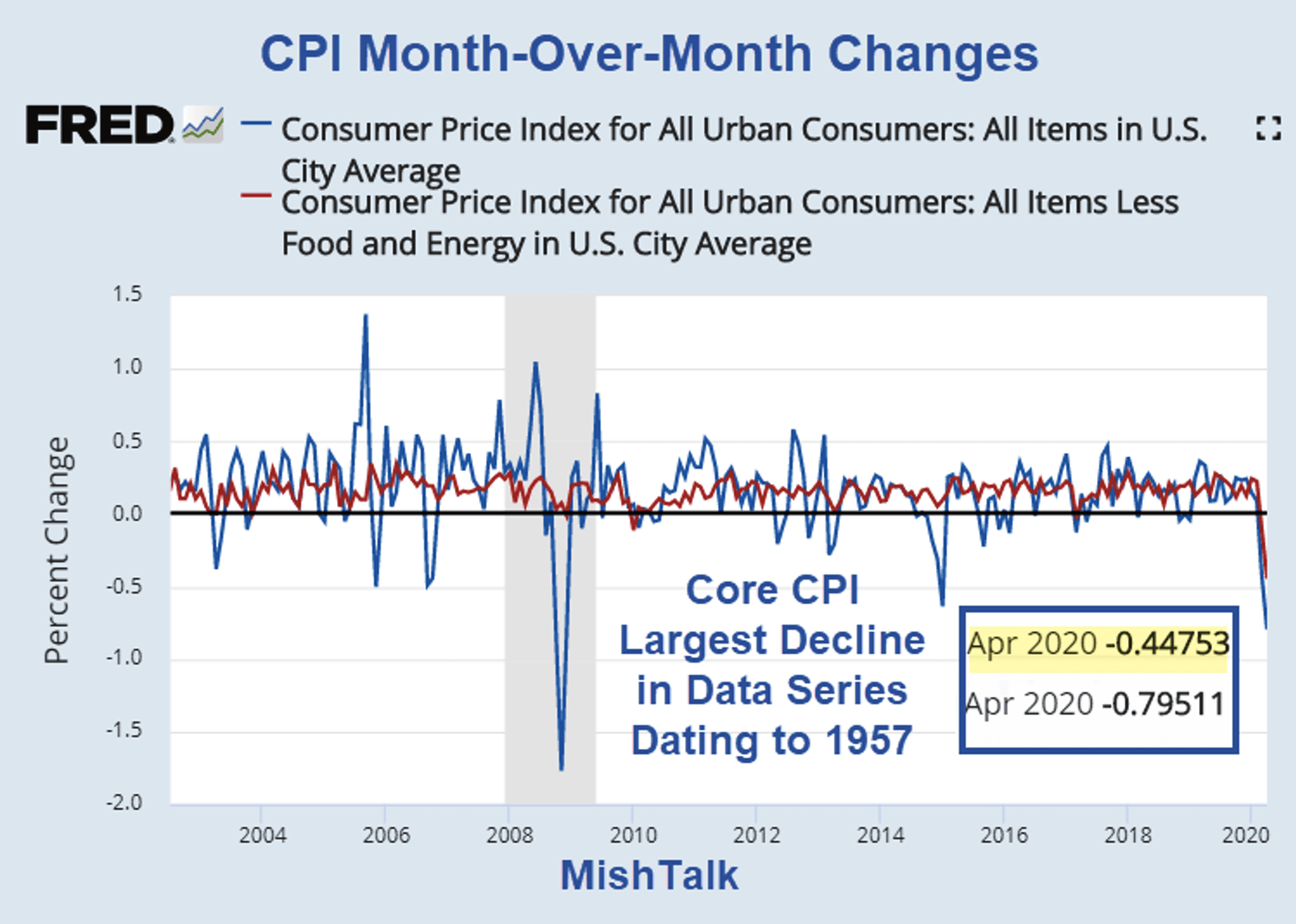

Global economic uncertainty played a significant role in the CAC 40's negative close. Persistent inflation concerns, coupled with ongoing interest rate hikes by major central banks, created a climate of investor apprehension. Geopolitical tensions, particularly those stemming from [mention a specific geopolitical event, e.g., the ongoing conflict in Ukraine], further fueled this uncertainty.

- Inflationary pressures: High inflation erodes purchasing power and increases the cost of doing business, impacting corporate profits and investor confidence.

- Interest rate hikes: Increased interest rates make borrowing more expensive, potentially slowing economic growth and dampening investment.

- Geopolitical risks: Geopolitical instability introduces uncertainty and can disrupt supply chains, leading to market volatility and risk aversion. These factors contribute to a negative investor sentiment, resulting in a sell-off in various markets, including the CAC 40.

Sector-Specific Performance

The negative weekly close wasn't uniform across all sectors within the CAC 40. Certain sectors underperformed significantly, dragging down the overall index.

- Energy sector underperformance: [Explain why, e.g., fluctuations in oil prices or concerns about renewable energy transitions].

- Technology sector downturn: [Explain why, e.g., concerns about rising interest rates impacting tech valuations].

- Financial sector volatility: [Explain why, e.g., concerns about potential loan defaults or regulatory changes].

Analyzing the specific performance of these key CAC 40 components provides a clearer picture of the market's internal dynamics. Understanding which stock market sectors are underperforming is crucial for informed investment decisions.

Influence of Key Company Earnings Reports

The release of key company earnings reports during the week also played a role in shaping the CAC 40's negative trajectory. Disappointing earnings from several major CAC 40 components, particularly in [mention specific sectors], contributed to the overall negative sentiment. Unexpected profit warnings or revisions of growth forecasts can cause significant market reactions, impacting the overall stock market index. Monitoring corporate earnings is therefore crucial for accurately tracking CAC 40 performance.

Analyzing the Overall Market Stability Despite the CAC 40 Decline

Despite the CAC 40's decline, other major indices showed relative stability. Understanding this discrepancy is crucial for a comprehensive market analysis.

Contrasting CAC 40 Performance with Other Major Indices

While the CAC 40 experienced a negative weekly close, other major European and global indices, such as the DAX (Germany), FTSE 100 (UK), and S&P 500 (US), demonstrated more resilience. This discrepancy might indicate that the CAC 40's underperformance was largely driven by factors specific to the French economy or its constituent companies, rather than a broad market correction. Comparing index performance allows for a nuanced understanding of market trends and their impact on different economies.

Potential Short-Term and Long-Term Implications

The negative weekly close raises concerns about the short-term outlook for investors. However, the long-term implications are more nuanced.

- Short-term implications: Increased market volatility and potential for further short-term losses. Short-term traders may need to adjust their strategies.

- Long-term implications: The long-term outlook depends on the resolution of global economic uncertainties and the performance of individual CAC 40 components. A long-term investment strategy might still see opportunities within the index.

This necessitates a careful consideration of both short-term trading and long-term investment strategies in light of the current market conditions and economic forecasts.

Conclusion: Understanding the CAC 40's Weekly Performance and Future Outlook

The CAC 40's negative weekly close on March 7th, 2025, resulted from a combination of global economic uncertainty, sector-specific underperformance, and disappointing earnings reports from key companies. While the broader market exhibited relative stability, the French stock market displayed vulnerability to these specific factors. Understanding these intricacies is crucial for investors looking to navigate the complexities of the French stock market. To make informed decisions, monitor the CAC 40 closely, track CAC 40 performance, and stay updated on CAC 40 news and analysis. By regularly checking for updates and engaging with market analysis, you can better understand and adapt to the ever-changing dynamics of the CAC 40 and the broader European market.

Featured Posts

-

Porsche 956 Nin Havada Asili Goeruenuemue Teknik Aciklamalar

May 25, 2025

Porsche 956 Nin Havada Asili Goeruenuemue Teknik Aciklamalar

May 25, 2025 -

Growth Opportunities A Map Of The Countrys Emerging Business Markets

May 25, 2025

Growth Opportunities A Map Of The Countrys Emerging Business Markets

May 25, 2025 -

Understanding The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 25, 2025

Understanding The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 25, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc Daily Nav And Its Importance

May 25, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Daily Nav And Its Importance

May 25, 2025 -

Martin Compstons Thriller Reimagining Glasgow As A Cinematic Los Angeles

May 25, 2025

Martin Compstons Thriller Reimagining Glasgow As A Cinematic Los Angeles

May 25, 2025