Understanding The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

Understanding the Fundamentals of NAV

Net Asset Value (NAV) represents the net worth of an ETF's holdings. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, it's calculated by taking the total market value of all the underlying assets (primarily global equities mirroring the MSCI World index) minus any liabilities (such as expenses). This figure is then divided by the number of outstanding ETF shares, resulting in the NAV per share.

Crucially, the NAV differs from the ETF's market price. The market price fluctuates throughout the trading day based on supply and demand, while the NAV is calculated at the end of the trading day, reflecting the actual value of the underlying assets. This difference can sometimes create arbitrage opportunities for sophisticated traders.

Several factors influence an ETF's NAV:

-

Market Fluctuations: Changes in the prices of the underlying stocks directly impact the NAV. A rising market generally leads to a higher NAV, and vice versa.

-

Currency Exchange Rates: The "USD Hedged" aspect of the Amundi MSCI World II UCITS ETF is significant. This hedging strategy aims to minimize the impact of currency fluctuations between the underlying assets' currencies and the US dollar. However, the effectiveness of this hedging influences the NAV calculation daily.

-

Dividends Received: Dividends paid by the underlying companies are reinvested, increasing the total assets and subsequently impacting the NAV.

-

Expense Ratios: The ETF's expense ratio (management fees) deducts from the total assets, thus affecting the NAV calculation.

-

NAV is calculated daily, usually after the market closes.

-

The published NAV represents the closing value of the ETF's assets.

-

Differences between the NAV and market price can present short-term arbitrage opportunities for experienced investors.

NAV and the Amundi MSCI World II UCITS ETF USD Hedged Dist Specifically

The Amundi MSCI World II UCITS ETF USD Hedged Dist (often identified by its ticker symbol – you should check the provider's website for the exact ticker) tracks the MSCI World Index, offering broad exposure to global equities. Its USD Hedged feature is designed to mitigate the risk of losses stemming from currency fluctuations between the underlying assets (likely in various currencies) and the US dollar. This hedging involves using financial derivatives to offset potential currency losses.

Understanding the NAV of this specific ETF is critical for several reasons:

- Performance Monitoring: Tracking NAV changes over time allows investors to assess the ETF's performance.

- Benchmarking: Comparing the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist to other similar ETFs helps in making informed decisions.

- Investment Decisions: The NAV provides a clear picture of the intrinsic value of the ETF, guiding buy/sell decisions.

The USD Hedged component influences the daily NAV calculations. The hedging strategy aims to maintain relative stability, but its effectiveness varies depending on market conditions. This means that while the hedge protects against significant currency swings, there will still be some daily fluctuation in NAV attributable to currency movements.

- Check the official Amundi ETF fact sheet or website ([insert link here if available]) for detailed information on NAV calculation methodology.

- The ETF's expense ratio directly impacts the NAV, reducing the overall value over time. Consider the expense ratio when comparing this ETF to alternatives.

Using NAV to Make Informed Investment Decisions

Investors can leverage NAV data to effectively analyze the Amundi MSCI World II UCITS ETF USD Hedged Dist's performance. By comparing the NAV to the market price, investors can identify potential discrepancies and assess buying or selling opportunities. However, it's important to remember that short-term fluctuations are normal and should not be the sole basis for investment decisions.

Comparing the NAV of this ETF to similar ETFs helps determine which one provides better value for the investment. Factors like expense ratios, risk profiles, and overall investment goals should also be considered alongside the NAV.

- Interpret NAV changes over time by examining trends (e.g., using charts and graphs). Look for sustained upward trends to assess long-term growth potential.

- Short-term NAV fluctuations are common and are not necessarily a cause for concern.

- Focus on long-term NAV performance for a better understanding of the ETF's overall value creation.

Mastering the Net Asset Value (NAV) of Your Amundi MSCI World II UCITS ETF USD Hedged Dist Investment

Understanding the Net Asset Value (NAV) is paramount for successfully managing your investment in the Amundi MSCI World II UCITS ETF USD Hedged Dist. By tracking the NAV and understanding its interplay with market conditions, currency hedging, and expense ratios, you gain valuable insights into your portfolio's performance and can make more informed investment decisions. Regularly monitoring the NAV allows you to react effectively to market changes and optimize your investment strategy.

Start monitoring your Amundi MSCI World II UCITS ETF USD Hedged Dist NAV now! Learn more about Amundi MSCI World II UCITS ETF USD Hedged Dist NAV and investment strategies today!

Featured Posts

-

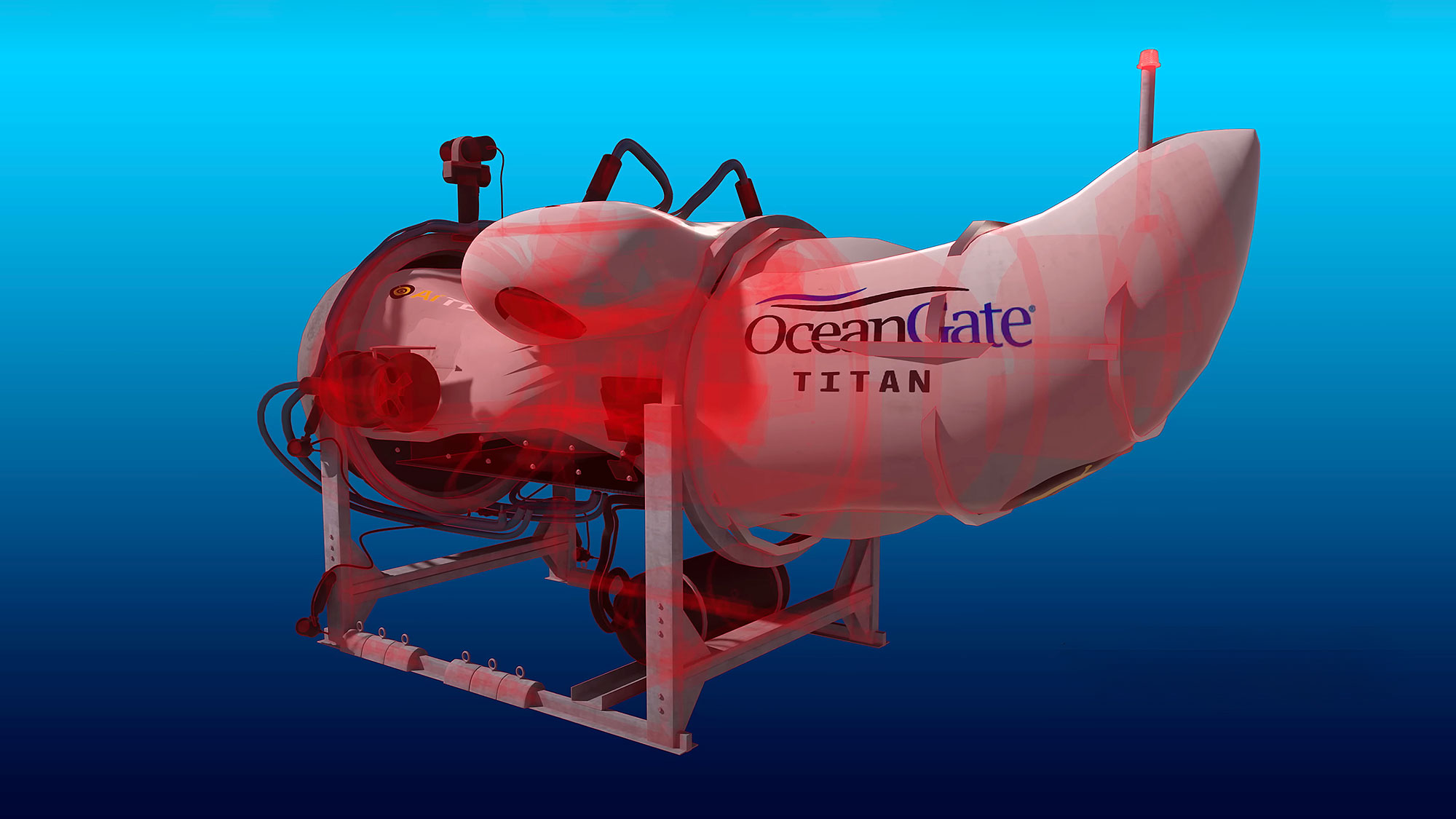

The Bang Heard Around The World Underwater Footage Of Titan Sub Implosion

May 25, 2025

The Bang Heard Around The World Underwater Footage Of Titan Sub Implosion

May 25, 2025 -

Amundi Msci World Ii Ucits Etf A Guide To Net Asset Value Nav

May 25, 2025

Amundi Msci World Ii Ucits Etf A Guide To Net Asset Value Nav

May 25, 2025 -

A Realistic Escape To The Country What To Expect

May 25, 2025

A Realistic Escape To The Country What To Expect

May 25, 2025 -

Whats On Tonight Top 10 Tv And Streaming Picks For Thursday

May 25, 2025

Whats On Tonight Top 10 Tv And Streaming Picks For Thursday

May 25, 2025 -

2 Fall On Amsterdam Stock Exchange Following Trumps Tariff Announcement

May 25, 2025

2 Fall On Amsterdam Stock Exchange Following Trumps Tariff Announcement

May 25, 2025