Canada's Near-Zero Tariffs On US Goods: A Comprehensive Overview Of Exemptions

Table of Contents

Understanding the Canada-US Trade Relationship and its Tariff Structure

The Canada-US trade relationship boasts a long and rich history, significantly shaped by successive free trade agreements. The current cornerstone is the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA and further solidified the commitment to streamlined trade between the three nations. The term "near-zero tariffs," within the context of Canada's near-zero tariffs on US goods, refers to the exceptionally low tariff rates applied to most goods imported from the US. In practice, this means minimal added costs for many products entering the Canadian market.

However, it's crucial to understand that the reality is slightly more nuanced. While the general rule is near-zero tariffs, exceptions and exemptions do exist, impacting specific product categories. These exceptions are governed by a complex system of regulations and trade agreements.

Key aspects of this tariff structure include:

- Most-favored-nation (MFN) tariff treatment: This principle, enshrined in WTO agreements, ensures that Canada offers the same favorable tariff rates to all its trading partners, unless otherwise specified by a trade agreement like USMCA.

- Tariff rates for various goods categories: Tariff rates aren't uniform across all goods. While most goods from the US benefit from near-zero tariffs, some sectors, like agriculture, may have different rates or quotas.

- The role of the Customs Tariff: The Canadian Customs Tariff is the official document outlining the tariff rates and classifications for all imported goods. Understanding this document is paramount for accurate tariff calculations.

Key Exemptions and Exceptions to Near-Zero Tariffs on US Goods

Several exemptions and exceptions can affect the application of Canada's near-zero tariffs on US goods. Understanding these is critical for businesses involved in cross-border trade. These exemptions are typically governed by specific circumstances and often involve:

- Countervailing and anti-dumping duties: If Canadian authorities determine that US goods are being subsidized or dumped (sold below fair market value) in Canada, countervailing or anti-dumping duties may be imposed, significantly increasing the import costs beyond near-zero tariffs.

- Safeguard measures: In cases of import surges causing serious injury to Canadian industries, safeguard measures, like temporary tariffs, may be implemented, overriding the near-zero tariff provision.

- Agricultural products: Agricultural products often face more complex tariff structures, with specific quotas, tariffs, and seasonal variations influencing the final cost. These deviate significantly from the general near-zero tariff principle.

- Provincial and regional regulations: Certain goods may be subject to provincial or regional regulations that impose additional fees, restrictions, or taxes, impacting the overall import cost.

Navigating the Canadian Customs Tariff and Regulations

Understanding the Canadian Customs Tariff is paramount for businesses importing goods from the US. The tariff classifies goods and outlines their corresponding duty rates. This information is crucial for accurate cost estimations and compliance with Canadian import regulations.

- Resources: The Canada Border Services Agency (CBSA) website () offers detailed information on tariffs, regulations, and import procedures.

- Tariff Schedules: The CBSA website provides access to searchable tariff schedules, allowing importers to find the specific tariff classification and duty rate for their goods.

- Non-Compliance: Non-compliance with Canadian customs regulations can lead to penalties, fines, and delays, potentially harming a business's bottom line.

Practical Implications for Businesses Importing Goods from the US

Accurate classification of goods is crucial for determining the applicable tariff. Misclassification can lead to unexpected costs and penalties. Businesses should:

- Conduct thorough due diligence: Carefully research the correct tariff classification for your goods before importing.

- Seek professional advice: Customs brokers and trade consultants can provide expert guidance and ensure compliance with all regulations.

- Maintain accurate records: Keep detailed records of all import transactions, including invoices, customs declarations, and payment receipts. This is essential for auditing purposes.

By proactively managing these aspects, businesses can minimize tariff costs and avoid penalties.

- CBSA Rulings: Businesses can request binding rulings from the CBSA for clarification on specific tariff classifications or regulations.

- Customs Brokers: Engaging a customs broker can streamline the import process, reducing the risk of errors and delays.

Conclusion: Leveraging Canada's Near-Zero Tariffs on US Goods for Business Success

Understanding the exceptions and exemptions to Canada's near-zero tariffs on US goods is crucial for businesses seeking to optimize their import strategies. By thoroughly researching tariff classifications, complying with regulations, and seeking professional advice when needed, businesses can effectively leverage the benefits of the Canada-US trade relationship and minimize import costs. The Canadian Customs Tariff and related regulations should be carefully reviewed to ensure successful trade.

To learn more about navigating Canada's near-zero tariffs on US goods and optimizing your import strategy, consult our comprehensive guide [link to a relevant resource] or contact a customs broker today.

Featured Posts

-

10 Excellent Tv Shows That Ended Prematurely

May 17, 2025

10 Excellent Tv Shows That Ended Prematurely

May 17, 2025 -

Fan Claims To Have Found Jim Morrison A New York Maintenance Man

May 17, 2025

Fan Claims To Have Found Jim Morrison A New York Maintenance Man

May 17, 2025 -

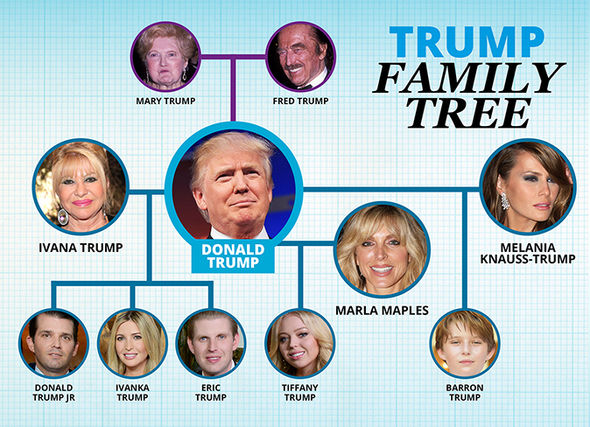

Exploring The Trump Family Tree From Donald Trumps Parents To Grandchildren

May 17, 2025

Exploring The Trump Family Tree From Donald Trumps Parents To Grandchildren

May 17, 2025 -

Hudsons Bay Offloads Key Assets To Canadian Tire A 30 Million Deal

May 17, 2025

Hudsons Bay Offloads Key Assets To Canadian Tire A 30 Million Deal

May 17, 2025 -

Novace I Dokovic Prica O Uspehu I Prijateljstvu

May 17, 2025

Novace I Dokovic Prica O Uspehu I Prijateljstvu

May 17, 2025