Hudson's Bay Offloads Key Assets To Canadian Tire: A $30 Million Deal

Table of Contents

The Assets Involved in the Hudson's Bay to Canadian Tire Transaction

This significant HBC property sale includes a portfolio of key retail locations and real estate holdings. Canadian Tire's acquisition represents a strategic expansion for the company.

Detailed Description of the Specific Assets

While the exact list of properties remains partially undisclosed, reports suggest the sale includes prime real estate locations strategically situated across Canada. These assets likely encompass a mix of both freestanding retail buildings and land parcels with high development potential. Specific details, including exact addresses and square footage, are expected to be released as part of the official closing statements.

- Location details: While precise locations are currently limited, reports suggest a focus on key metropolitan areas across several provinces, including Ontario and British Columbia.

- Size and type of property: The properties likely vary in size and type, ranging from large-scale retail spaces to smaller, strategically located parcels. Further details regarding the specific square footage and building types will be disclosed following the transaction's official closure.

- Past performance and revenue generated: The assets sold represent historically profitable locations for HBC. The financial reports for these properties should be publicly available soon. Canadian Tire's due diligence would have carefully evaluated past performance metrics.

- Strategic importance for both companies: For HBC, the sale allows for strategic portfolio realignment, focusing on core business operations. For Canadian Tire, the acquisition expands its retail footprint and strengthens its market position.

Financial Implications of the $30 Million Hudson's Bay Deal

The $30 million price tag raises questions about the market value of the assets and the potential return on investment for both parties involved in this HBC asset sale.

Analysis of the Sale Price

The $30 million figure represents a significant investment for Canadian Tire and potentially marks a strategic divestment for HBC. A detailed breakdown of the costs involved is not yet public. Independent analysts will analyze the deal's financial aspects in more detail once all information is available.

- Breakdown of the $30 million: While not publicly disclosed, the sum likely includes the purchase price of the assets, plus any associated legal and closing costs.

- Impact on HBC's financial statements: The sale is expected to positively impact HBC's balance sheet, potentially reducing debt and improving its financial outlook.

- Canadian Tire's strategic investment rationale: This acquisition aligns with Canadian Tire's growth strategy, expanding its retail presence and diversifying its portfolio.

- Potential ROI for Canadian Tire: The potential return on investment for Canadian Tire depends on the future performance of the acquired assets and their integration into Canadian Tire's existing operations. This acquisition appears to be a calculated move that would provide a strong ROI in the coming years.

Strategic Rationale Behind the Hudson's Bay Asset Sale

This HBC strategic realignment reflects a larger shift in the company's business strategy. The "Hudson's Bay offloads key assets" move is not just a single transaction, but a part of a wider corporate strategy.

HBC's Business Strategy

The decision to sell these assets reflects HBC's ongoing efforts to streamline operations and focus on its core business objectives.

- Focus on core business activities: HBC may be prioritizing its core retail operations, reducing its exposure to non-core real estate holdings.

- Debt reduction or financial restructuring: The sale could be part of a broader financial restructuring strategy aimed at reducing debt and improving the company's financial health.

- Strategic realignment of the company's portfolio: The sale signifies a strategic shift, focusing the company’s resources on its most profitable and promising ventures.

- Potential for future growth and expansion in other sectors: The proceeds from the sale could be reinvested in other areas of the business or used to fund future growth initiatives.

Impact on the Canadian Retail Landscape

The Canadian Tire investment changes the retail dynamics, significantly affecting the Canadian retail market. This "Hudson's Bay offloads key assets" deal is a major event that will likely reshape the retail industry.

Canadian Tire's Expansion Strategy

This acquisition represents a substantial expansion for Canadian Tire, strengthening its market presence and competitive positioning.

- Increased market share for Canadian Tire: The addition of these new retail locations will increase Canadian Tire's market share, giving them a competitive edge.

- Competition analysis with other major retailers: The deal will intensify competition in the Canadian retail landscape, particularly impacting rivals in the same geographical locations.

- Potential impact on consumers and prices: The long-term impact on consumers could involve changes in product offerings or pricing strategies.

- Geographic expansion of Canadian Tire's footprint: The acquisition strategically expands Canadian Tire's reach, adding new locations in key markets across Canada.

Conclusion: Understanding the Hudson's Bay Company and Canadian Tire Transaction

The $30 million deal between HBC and Canadian Tire represents a significant transaction in the Canadian retail landscape. The sale of key assets by HBC, as part of a broader strategic realignment, and their acquisition by Canadian Tire signifies a potential shift in market dynamics. The implications of this "Hudson's Bay offloads key assets" deal are far-reaching, affecting both companies' financial standing and their competitive positions within the Canadian market. This transaction will certainly be a case study of strategic realignment and acquisition in the Canadian retail sector for years to come. Stay informed about future developments by following reputable business news sources and subscribing to relevant industry newsletters to understand the ongoing impact of this significant deal on the Canadian retail sector. Understanding the long-term effects of the Hudson's Bay asset sale is crucial for anyone involved in, or interested in, the Canadian retail market.

Featured Posts

-

Eminem And The Wnbas Return To Detroit A Viable Partnership

May 17, 2025

Eminem And The Wnbas Return To Detroit A Viable Partnership

May 17, 2025 -

Jalen Brunsons Reported Discontent Could Mean Missing Next Weeks Raw

May 17, 2025

Jalen Brunsons Reported Discontent Could Mean Missing Next Weeks Raw

May 17, 2025 -

10 Great Tv Shows Cancelled Too Soon A Tragic List

May 17, 2025

10 Great Tv Shows Cancelled Too Soon A Tragic List

May 17, 2025 -

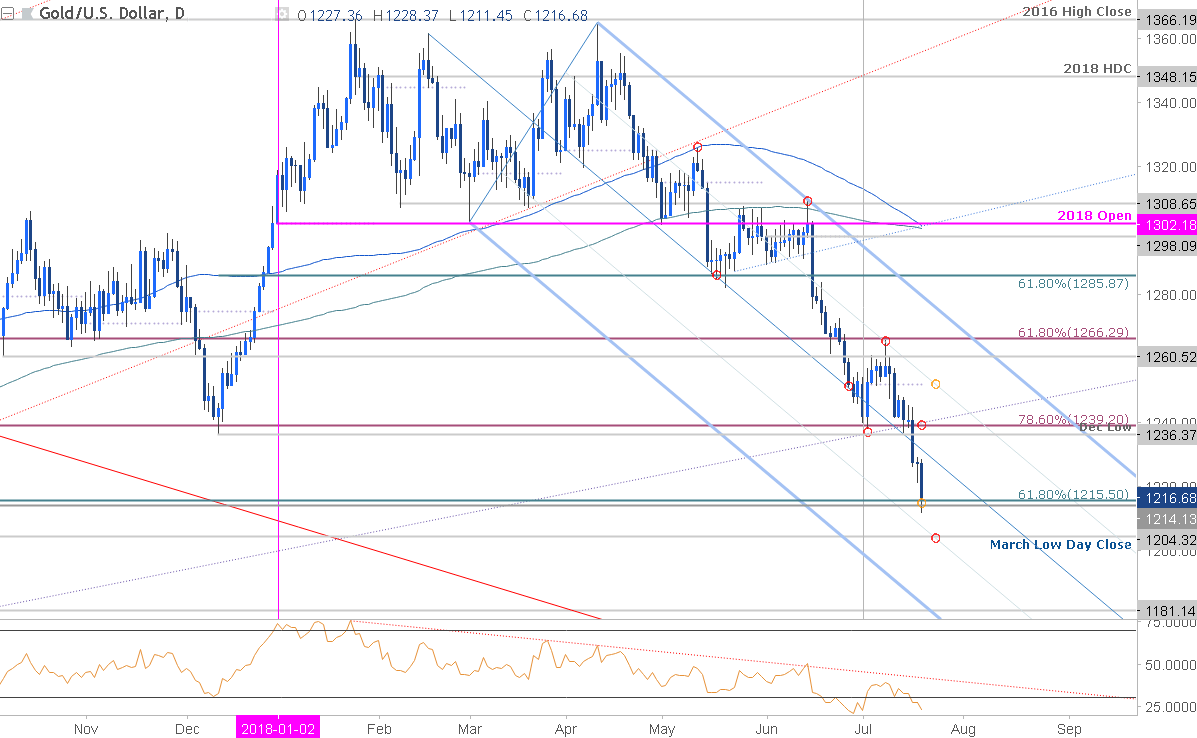

Xauusd Gold Finds Support As Weaker Us Data Hints At Rate Cuts

May 17, 2025

Xauusd Gold Finds Support As Weaker Us Data Hints At Rate Cuts

May 17, 2025 -

Kino Pavasaris 2024 Daugiau Nei 70 000 Ziurovu Populiariausi Filmai

May 17, 2025

Kino Pavasaris 2024 Daugiau Nei 70 000 Ziurovu Populiariausi Filmai

May 17, 2025