Canadian Housing Crisis: Posthaste Down Payments Price Many Out

Table of Contents

The Soaring Cost of Canadian Housing & Down Payments

Escalating Home Prices

Canadian real estate has seen dramatic price increases in recent years, pushing homeownership further out of reach for many. Major cities like Toronto and Vancouver have witnessed particularly sharp rises.

- Toronto: Average home prices have increased by X% in the past Y years, reaching an average of Z dollars.

- Vancouver: Similar increases have been observed in Vancouver, with average home prices exceeding W dollars.

- Other Cities: Significant price hikes are also evident in Calgary, Montreal, and other major Canadian urban centers.

Several factors contribute to these escalating home prices: high demand fueled by population growth and immigration, limited housing supply due to restrictive zoning regulations and slow construction rates, and low interest rates that have historically fueled bidding wars. This perfect storm has created a highly competitive market, making it exceedingly difficult for average Canadians to afford a home. The Canadian real estate market is increasingly characterized by unaffordability, impacting all aspects of housing affordability and home prices Canada.

The Down Payment Hurdle

The minimum down payment required to secure a mortgage significantly impacts affordability. In Canada, the minimum down payment is 5% for homes priced under $500,000, increasing to 10% for homes between $500,000 and $1 million, and reaching 20% for homes over $1 million.

- $500,000 Home: Requires a down payment of $25,000.

- $750,000 Home: Requires a down payment of $75,000.

- $1,200,000 Home: Requires a down payment of $240,000.

These figures illustrate the substantial financial barrier presented by down payment Canada requirements. Saving such large sums is a major challenge for many prospective first-time home buyers, particularly those with existing financial obligations. Securing a Canadian mortgage becomes significantly harder, as it is primarily dependent on a sizeable mortgage down payment.

Impact on First-Time Home Buyers

Financial Strain

Saving for a substantial down payment presents a considerable financial strain for first-time home buyers in Canada. Many potential homeowners struggle to balance competing financial priorities, including:

- Student loan repayments

- Car payments

- Rent

- Everyday living expenses

This financial burden often delays or prevents homeownership, significantly impacting their ability to build wealth and establish long-term financial security. Statistics show a declining rate of first-time home buyers, with the average time to save for a down payment increasing significantly, illustrating the difficulty of navigating the Canadian mortgage rates and overall financial landscape.

Generational Inequality

The Canadian Housing Crisis disproportionately impacts younger generations, widening the generational wealth gap. Millennials and Gen Z face significantly lower homeownership rates compared to previous generations, largely due to the escalating cost of housing and increased down payment requirements.

- Lower homeownership rates among Millennials homeownership compared to previous generations.

- Significant challenges for Gen Z housing affordability.

- Increased reliance on intergenerational wealth transfer to afford homes.

This creates a significant barrier to entry for younger generations, potentially perpetuating cycles of economic inequality. The disparity highlights the urgent need to address the Canadian Housing Crisis and its implications on generational wealth transfer.

Potential Solutions to the Crisis

Government Intervention

Addressing the Canadian Housing Crisis requires significant government intervention. Potential policies include:

- Increased funding for affordable housing initiatives.

- Adjustments to down payment requirements, such as offering lower down payment options for first-time homebuyers or adjusting the percentage thresholds based on income.

- Tax incentives to encourage homeownership and investment in affordable housing development.

- Review of existing Canadian housing policy.

These measures, along with exploring successful government housing initiatives from other countries, could provide crucial support to potential homebuyers. The implementation of effective affordable housing Canada strategies is paramount.

Increased Housing Supply

Increasing the supply of housing is crucial in alleviating the crisis. This requires:

- Zoning reform to allow for higher-density development.

- Streamlining the development approval process to reduce delays and costs.

- Incentivizing the construction of affordable housing units.

Addressing challenges such as land scarcity and environmental concerns is paramount to achieving significant increases in housing supply Canada. Effective urban planning strategies are key to building sustainable and affordable communities.

Conclusion

High down payment requirements are significantly exacerbating the Canadian Housing Crisis, pricing many out of the market and creating substantial challenges for first-time homebuyers and younger generations. The escalating cost of housing, coupled with the financial strain of saving for substantial down payments, is widening the wealth gap and hindering economic mobility. Understanding the complexities of the Canadian Housing Crisis, especially concerning posthaste down payments, is crucial. Stay informed, advocate for change, and explore alternative housing options. Let's work together to make homeownership a reality for all Canadians. We need innovative solutions to address the challenges in the Canadian real estate market and ensure housing affordability for all.

Featured Posts

-

Stock Market Live Sensex Nifty Rally Detailed Market Analysis

May 09, 2025

Stock Market Live Sensex Nifty Rally Detailed Market Analysis

May 09, 2025 -

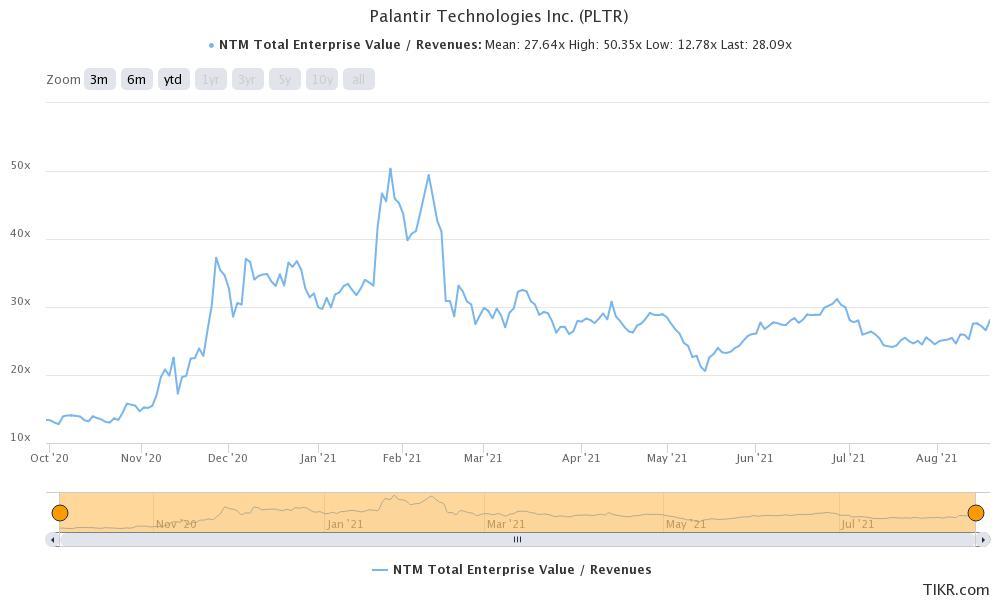

Evaluating Palantir Stock A Current Market Perspective

May 09, 2025

Evaluating Palantir Stock A Current Market Perspective

May 09, 2025 -

Elections Municipales Dijon 2026 Ambitions Ecologistes

May 09, 2025

Elections Municipales Dijon 2026 Ambitions Ecologistes

May 09, 2025 -

Once Rejected Now The Heartbeat Of Europes Best Team

May 09, 2025

Once Rejected Now The Heartbeat Of Europes Best Team

May 09, 2025 -

Draisaitls Hart Trophy Finalist Status Highlights Exceptional Edmonton Oilers Season

May 09, 2025

Draisaitls Hart Trophy Finalist Status Highlights Exceptional Edmonton Oilers Season

May 09, 2025

Latest Posts

-

The Continued Relevance Of High Potential An 11 Year Assessment

May 10, 2025

The Continued Relevance Of High Potential An 11 Year Assessment

May 10, 2025 -

High Potential Episode Count And Season 2 Renewal Is It Coming Back

May 10, 2025

High Potential Episode Count And Season 2 Renewal Is It Coming Back

May 10, 2025 -

High Potential Episode 13 Davids Actor And The Unexpected Irony

May 10, 2025

High Potential Episode 13 Davids Actor And The Unexpected Irony

May 10, 2025 -

High Potential An 11 Year Retrospective On Psych Spiritual Impact

May 10, 2025

High Potential An 11 Year Retrospective On Psych Spiritual Impact

May 10, 2025 -

West Bengal Board Madhyamik Result 2025 Official Merit List

May 10, 2025

West Bengal Board Madhyamik Result 2025 Official Merit List

May 10, 2025