Cantor, Tether, And SoftBank: A $3 Billion Crypto SPAC On The Horizon?

Table of Contents

The Players: Cantor, Tether, and SoftBank – A Powerhouse Trio?

The potential success of this $3 billion crypto SPAC hinges on the synergy and expertise of its key players. Let's examine each:

Cantor Fitzgerald's Role:

Cantor Fitzgerald, a prominent player in global financial markets, brings substantial experience in SPACs and capital markets to the table. Their established network of investors and history of successful SPAC launches could significantly enhance the deal's prospects. Their involvement could provide a crucial bridge between traditional finance and the burgeoning crypto world.

- Experience in capital markets: Decades of experience navigating complex financial transactions.

- Established network of investors: Access to a vast pool of potential investors for the SPAC.

- History of successful SPACs: Proven track record in identifying and successfully merging with target companies.

- Potential strategic advantage in the crypto space: Leveraging their expertise to navigate the regulatory landscape and attract high-quality crypto projects.

Tether's Involvement: A Stablecoin Giant's Ambitions:

Tether, the largest stablecoin by market capitalization, plays a crucial role in facilitating cryptocurrency transactions. Its participation could attract significant investment and lend further legitimacy to the SPAC in the eyes of both institutional and retail investors. However, its involvement also brings regulatory scrutiny and potential conflicts of interest into the equation.

- Market capitalization of Tether: Provides significant financial backing and credibility.

- Importance in facilitating crypto transactions: Deep involvement in the crypto ecosystem enhances the SPAC's appeal.

- Potential conflicts of interest: Requires careful management to maintain transparency and investor confidence.

- Regulatory scrutiny: Navigating the evolving regulatory landscape surrounding stablecoins is crucial.

SoftBank's Strategic Investment:

SoftBank, known for its significant investments in technology and fintech, brings a strategic perspective and substantial financial resources to the potential partnership. Their participation signals a growing acceptance of cryptocurrencies among major institutional investors.

- Previous investments in the crypto space: Demonstrates a commitment to the long-term potential of the digital asset market.

- Risk appetite: Willingness to invest in high-growth, high-risk ventures.

- Potential return on investment: Attracted by the significant potential returns offered by the crypto market.

- Diversification strategy: Expanding their portfolio into the burgeoning crypto sector.

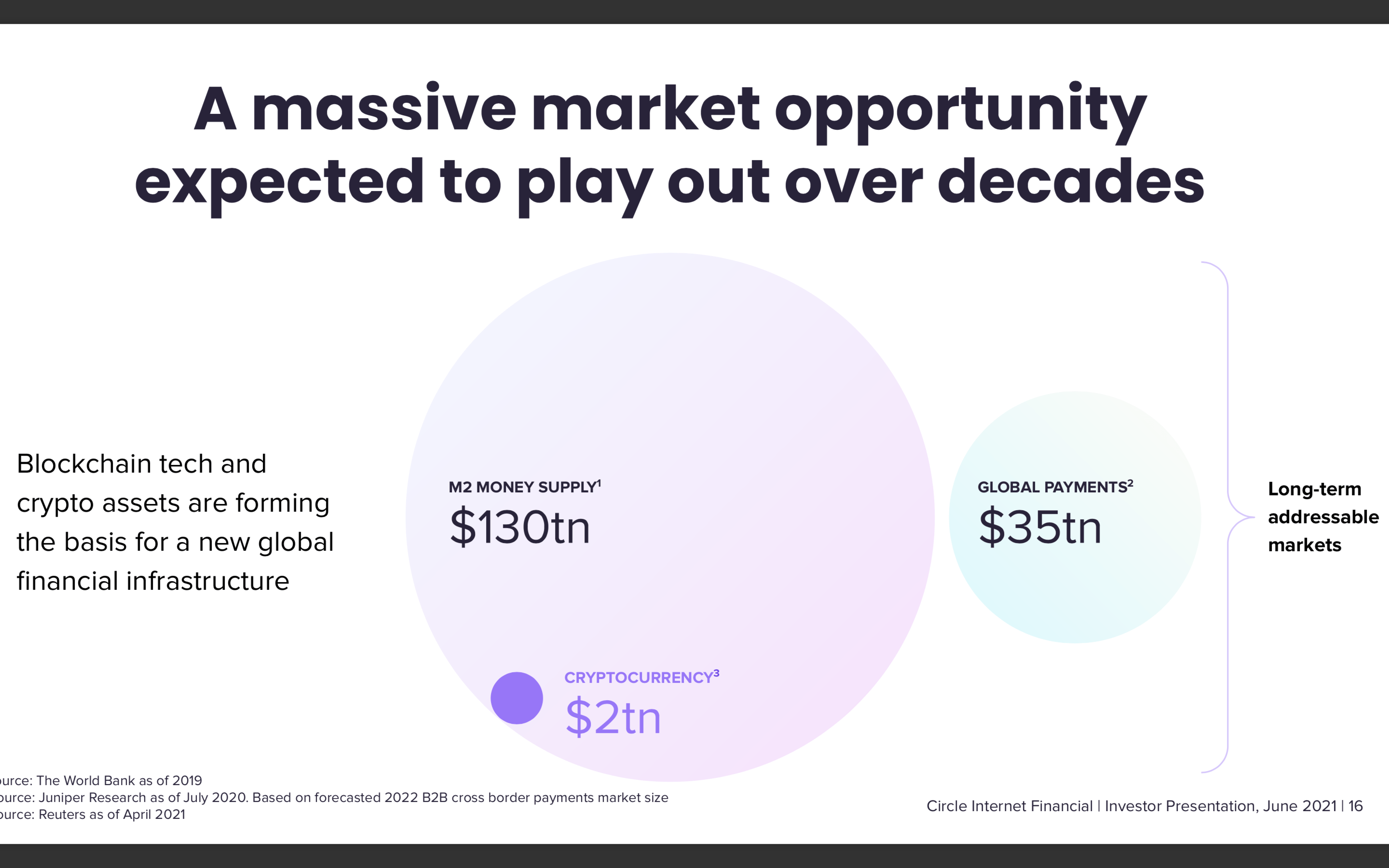

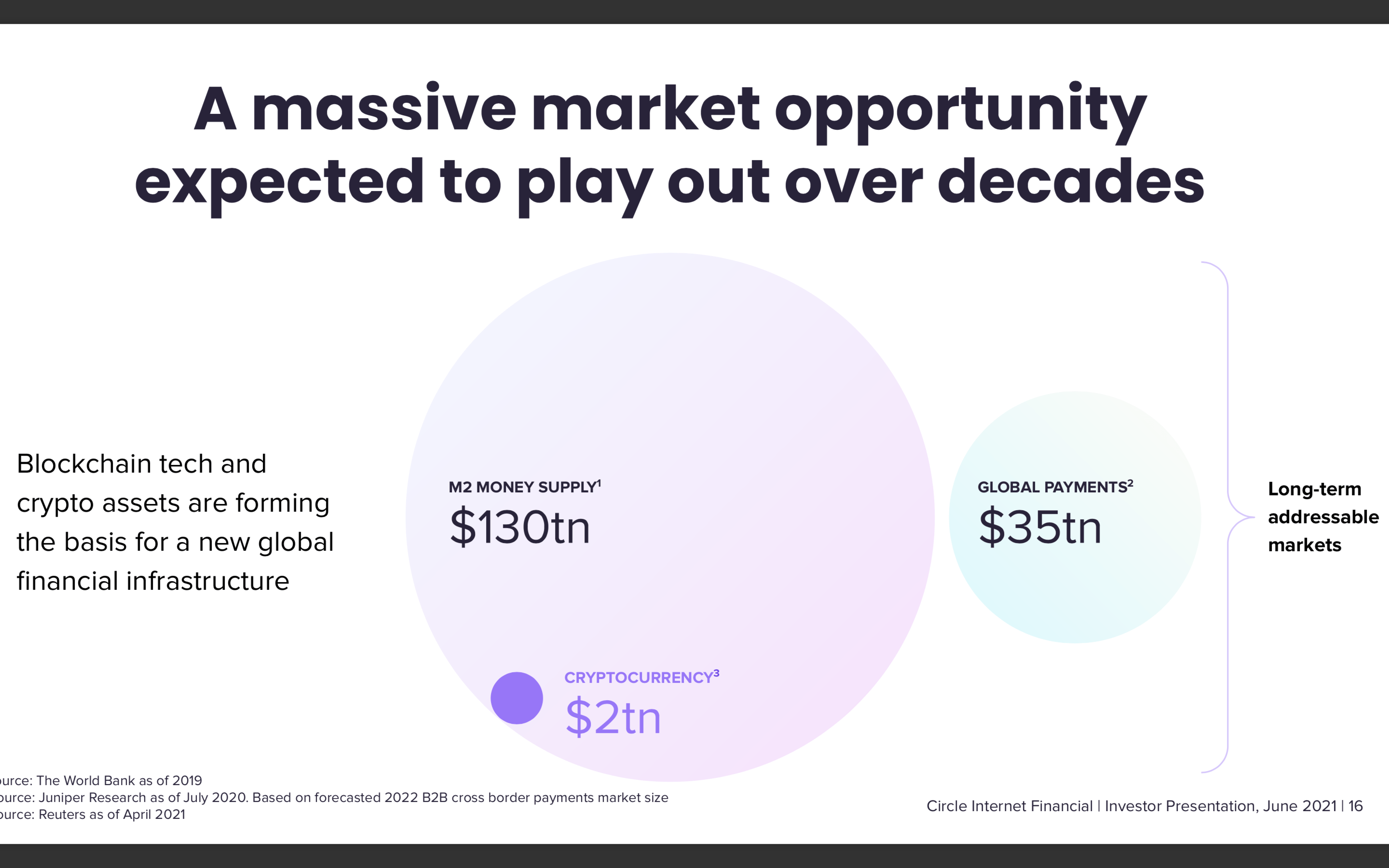

The Potential Benefits: A $3 Billion Catalyst for Crypto Adoption?

A successful $3 billion crypto SPAC could be a game-changer for the cryptocurrency industry, offering several significant benefits:

Increased Liquidity and Investment in Crypto:

The injection of significant capital through this SPAC could significantly increase liquidity in the crypto market. This would provide funding for promising crypto projects, fostering innovation and driving market expansion.

- Attracting institutional investors: Increased participation from institutional investors would enhance market stability.

- Funding for promising crypto projects: Providing much-needed capital for development and growth.

- Potential for market expansion: Driving wider adoption and mainstream acceptance of cryptocurrencies.

Legitimization and Mainstream Adoption:

The involvement of established financial institutions like Cantor Fitzgerald and SoftBank could significantly boost the legitimacy of the crypto space, encouraging wider adoption among mainstream investors and users.

- Reducing risk perception for institutional investors: Providing comfort and confidence in the investment.

- Enhancing public trust: Building confidence in the security and stability of the cryptocurrency market.

- Improving regulatory clarity: Facilitating the development of clearer regulatory frameworks.

Synergies and Cross-Industry Collaboration:

This partnership presents an opportunity for synergies between traditional finance and the innovative blockchain technology driving the cryptocurrency market.

- Integration of traditional finance and blockchain technology: Creating new financial products and services.

- Leveraging existing infrastructure: Streamlining processes and reducing costs.

- Fostering innovation: Accelerating the development of new crypto technologies and applications.

The Challenges and Risks: Navigating Regulatory Hurdles and Market Volatility

Despite the considerable potential, the proposed $3 billion crypto SPAC faces several challenges:

Regulatory Uncertainty:

The cryptocurrency industry remains largely unregulated, posing significant regulatory risks to the SPAC. Varying regulations across different jurisdictions could create legal and compliance challenges, potentially impacting investor confidence.

- Varying regulations across jurisdictions: Navigating differing legal and regulatory landscapes.

- Potential legal and compliance risks: Ensuring compliance with all relevant regulations.

- Impact on investor confidence: Uncertainty can deter investors and hinder the SPAC's success.

Market Volatility and Risk Management:

Cryptocurrency markets are inherently volatile. Effectively managing these risks is crucial for the success of the SPAC.

- Protecting investor capital: Implementing robust risk management strategies.

- Hedging strategies: Mitigating potential losses from market fluctuations.

- Diversification: Reducing risk exposure through diversification of investments.

Competition and Market Saturation:

The SPAC market is competitive. The partnership needs a strong strategy to secure desirable acquisition targets and differentiate itself from competing SPACs.

- Attracting target companies: Identifying and securing high-quality crypto projects for acquisition.

- Competing with other SPACs: Standing out in a crowded market.

- Finding suitable acquisition targets: Identifying companies with strong growth potential and alignment with the SPAC’s strategy.

Conclusion:

The potential $3 billion crypto SPAC involving Cantor Fitzgerald, Tether, and SoftBank represents a significant moment for the cryptocurrency market. While the deal offers considerable opportunities for growth, innovation, and increased legitimacy, navigating the regulatory and market risks will be crucial. The success of this venture will depend on careful planning, robust risk management, and a clear strategy for navigating the complexities of the crypto landscape. Stay tuned for further developments in this exciting story of a potential game-changer in the world of crypto SPACs. Keep following for updates on this potentially groundbreaking $3 billion crypto SPAC and its impact on the future of digital assets.

Featured Posts

-

John Travoltas Shocking Rotten Tomatoes Record A Deep Dive

Apr 24, 2025

John Travoltas Shocking Rotten Tomatoes Record A Deep Dive

Apr 24, 2025 -

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025 -

Trump On Powell No Intention To Remove Fed Chair

Apr 24, 2025

Trump On Powell No Intention To Remove Fed Chair

Apr 24, 2025 -

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025 -

Toxic Chemicals From Ohio Train Derailment Months Long Building Contamination

Apr 24, 2025

Toxic Chemicals From Ohio Train Derailment Months Long Building Contamination

Apr 24, 2025